Taxes are confusing - we can all agree on that. All the asset reporting, consulting with CPAs, filling the never-ending paperwork, and trying to make sense of tax raises each...

Founder of Nomad Capitalist and the world’s most sought-after expert on global citizenship.

What we’re all about

Meet our global team

We’re here to serve you

Read our testimonials

Get free email updates

Create your own bespoke global citizenship plan

Claim a second passport based on familial connections

Click here to see all our products and services

Discover the world’s best passports to have in an ever-changing world

Explore the citizenship options using our interactive citizenship map

Explore the tax details for countries using our interactive tax map

Click here to see all of our research and interactive tools

Learn from a curated “Who’s Who” of business speakers from around the world, get our latest R&D updates, and rub shoulders with successful people from all corners of the world.

Andrew Henderson wrote the #1 best-selling book that redefines life as a diversified,

global citizen in the 21st century… and how you can join the movement.

Taxes are confusing - we can all agree on that. All the asset reporting, consulting with CPAs, filling the never-ending paperwork, and trying to make sense of tax raises each...

Working remotely became the norm rather than a privilege for many professionals after the pandemic as countries starved of tourist money started rolling out digital nomad visas...

The digital nomad movement gathered pace during the pandemic. Many countries rolled out their version of the digital nomad and remote work visas to attract the ever-increasing...

Curious about how to obtain EU citizenship and unlock the benefits that come with it? This guide covers everything you need to know - from the different paths to citizenship, to...

Our founder, Andrew Henderson, is a big fan of Dave Ramsey's book EntreLeadership. It is a guide to building and leading successful businesses based on simple...

In this article, we look at how dividend stock investors can double or even potentially triple their yields. All it takes is a change in strategy. Sure, it might take some...

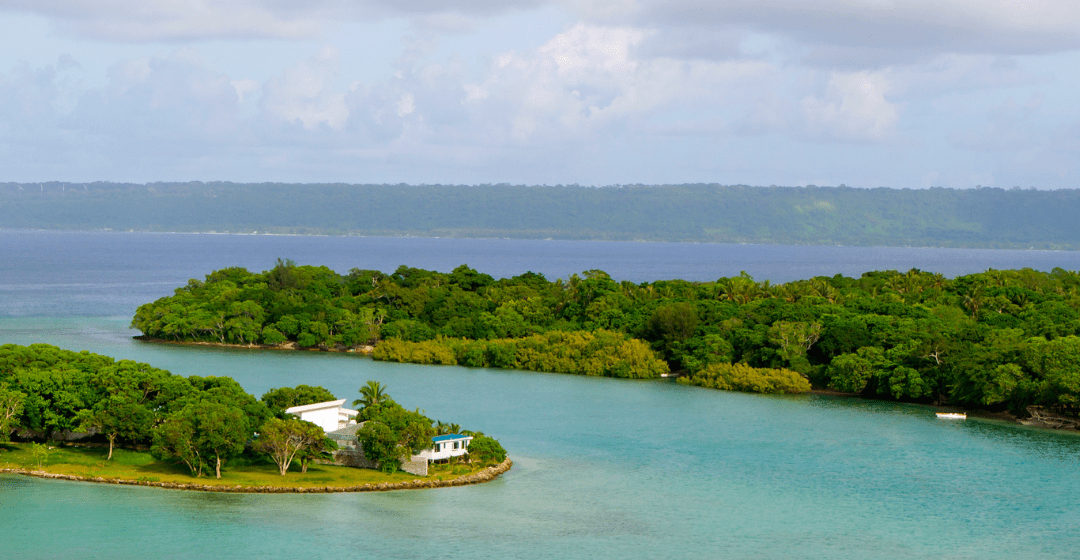

Vanuatu is primarily known for its island paradise appearance and favorable tax code. The national tax code is extremely limited with most wealth and profits are non-taxable. If...

Searching for a tax-friendly residency that works in your favour?Cyprus offers one of the most attractive non-dom tax regimes in Europe, with low tax rates and generous...

This article looks at banking in the UAE. We start with an overview of the country, its economy, and its banking sector. We then look at the different types of banks in the UAE,...

As a discerning high-net-worth individual, you’re likely continuously seeking jurisdictions that offer unrivalled tax and lifestyle advantages for you and your wealth. The...

In a perfect world, non-residents of any country would not incur any tax liability in that jurisdiction. In our imperfect world, being a non-resident in one country and a tax...

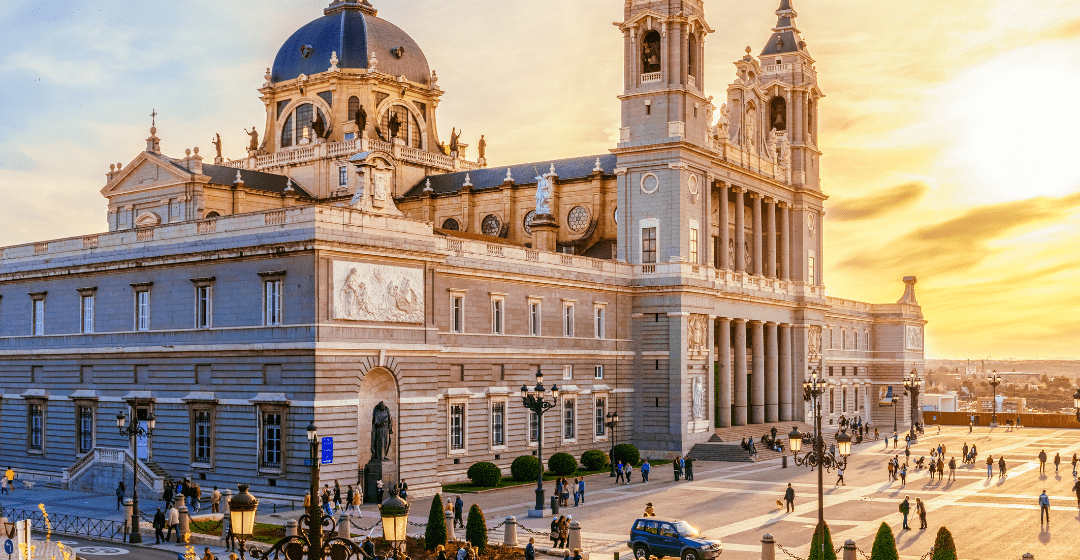

Want to move to Spain so you can bend your tax payments like Beckham? Well, the good news is you don’t have to be a superstar athlete to benefit from Spain’s special expat...

This article discusses Serbian citizenship by descent, its eligibility criteria, benefits, and how to acquire it in 2025. Serbia is among the best countries in Eastern Europe for...

Relocation to Portugal can change your tax circumstances significantly if you decide to become the country’s resident. Familiarizing yourself with the rights and obligations of...

Thinking of setting up a bank account in Portugal? It’s a rite of passage for any expat moving to the Iberian country and one that often causes the biggest...

This article looks at company formation in North Macedonia, the business environment in the country, the types of companies you can form, the one type we recommend to clients,...

Is tax applicable to non-residents in New Zealand? Unfortunately, yes. The increasing number of departures from New Zealand is largely down to individuals seeking freedom from...

According to the latest World Happiness Report, the Netherlands is the sixth happiest country in the world. A significant reason for that is its excellent social security system....

This article discusses Montenegro's tax-friendly regime, its tax code, and how establishing tax residency in Montenegro can help you reduce your taxes drastically. Montenegro is...

This article looks at the tax benefits in Mauritius. If tax reduction is your goal, Mauritius may not be the first country that comes to mind, but with a low corporate tax rate,...

Subscribe to our Weekly Rundown and stay ahead with instant alerts on key global changes.