Best Countries for Offshore Companies in 2025

February 11, 2025

Lowering taxes, growing a business faster, protecting assets from litigation, gaining access to new markets, new investment opportunities and estate planning – offshore company formation has many benefits.

But is it legal?

That’s a question we often hear from investors and entrepreneurs.

The biggest problem with incorporating offshore isn’t the procedures involved or even dealing with foreign authorities – it’s dispelling the myths surrounding it.

Our team at Nomad Capitalist knows with absolute certainty that setting up an offshore company is completely legal when done by the book.

That’s because many offshore jurisdictions have strict and streamlined regulations to support offshore company formation.

Moreover, the privacy benefits and, in some cases, more lenient reporting requirements can do a lot to create the ideal business-friendly environment for your company to flourish.

If you want to establish an offshore company but don’t know where to start, set up a call with us today.

What is an Offshore Company?

Before we get into the list of the best countries to set one up in, let’s briefly discuss what an offshore company is.

The truth is there are too many myths out there that steer entrepreneurs away from this exceptional tool for business growth.

However, an offshore company is simply a legal entity that you set up in another country. For example, if you live in Canada and set up a Limited Liability Company (LLC) in the US to do business there, it’s an offshore company.

Nothing scary, nothing complicated and definitely nothing illegal.

Many large multinationals, such as Apple, Google and Samsung, use offshore companies to optimise their corporate structure, reduce or eliminate taxes, house intellectual property, redistribute assets and ultimately generate more profit.

What is an International Business Company (IBC)?

An IBC is a company that doesn’t conduct business activities in its country of incorporation.

It’s also known as a non-resident company. That said, not all offshore companies are IBCs.

An IBC doesn’t publicly disclose shareholders’ information. Moreover, the assets of an IBC’s shareholders are legally separated from the company’s assets.

Although, if the company has a bank account, it’s mandatory to disclose the corporation’s shareholders’ information to the bank.

Best Countries to Set Up Offshore Companies

We’ve all heard of famous offshore jurisdictions or tax havens like Vanuatu, Cayman Islands, and Belize.

Although these countries offer clear tax advantages, you may want to avoid traditional tax havens.

There’s nothing illegal going on in them – the problem is that you could have trouble finding a bank that wants to deal with foreign companies incorporated in traditional tax havens.

Even if they do let you open a corporate bank account, you’ll need to complete lengthy due diligence and additional forms just because you’re running a business from a tax haven.

Simply setting up a company in a tax-free jurisdiction is not the end of your business and tax challenges.

If you truly want to reap the benefits of offshore company formation, you need to think holistically. That’s the message we always give our clients.

A Nomad Capitalist holistic Action Plan can help you with that. Contact us today to go where you’re treated best.

Now, let’s look at some of the best countries to set up an offshore business.

British Virgin Islands

Let’s start with the ultimate offshore jurisdiction – the British Virgin Islands (BVI).

The British Virgin Islands is a British Overseas Territory in the Eastern Caribbean Sea comprising four larger and upwards of 50 smaller islands.

The island nation is famous for its natural beauty and thriving offshore financial services industry, which after tourism is its most prominent sector.

In 1984, BVI introduced the International Business Companies Act to regulate the formation of offshore companies and attract foreign investment.

Today, BVI has the largest number of registered offshore companies among all offshore jurisdictions, thanks to its strict compliance with international tax and corporate regulations.

In 2005, the country eliminated all differences between an IBC and a local company, meaning both have the same rights and tax advantages.

Here’s how you’ll benefit from setting up a company in BVI:

Ease of Company Formation: A BVI company must have at least one director, shareholder and owner – all of whom can be one person (or a legal entity) of any nationality. No minimum capital requirement exists. Moreover, offshore company registration in BVI is fast and affordable.

Minimal Reporting Requirements: A BVI company isn’t required to prepare or file financial accounts. No auditing requirements exist either. However, the company must keep a detailed record of its financial transactions and liabilities.

Privacy Protection: Information regarding a BVI company’s shareholders, directors and beneficial owners remains confidential since the Register of Directors is not publicly available.

Tax Advantages: BVI companies don’t pay income or capital gains tax. The same goes for dividends, interest, rent and royalties.

Cyprus

If you’re surprised to see a European Union (EU) jurisdiction on our list, don’t be.

You can’t simply look at the headline tax rate of a country to decide whether you want an offshore company set up there.

Many countries, including quite a few in Europe, have special tax regimes for foreign investors and entrepreneurs looking to incorporate there.

Cyprus is an island nation in the eastern Mediterranean and is an excellent jurisdiction for people looking for a modern financial services sector and access to international markets through a network of trade agreements.

Here’s how you’ll benefit from setting up a company in Cyprus:

Tax Advantages: One of the most significant advantages of setting up a company in Cyprus is its corporate tax rate of 12.5% – one of the lowest in the EU.

The country also does not tax dividends, revenues from securities trading and all profits from real estate sales abroad. Cyprus has also signed over 60 favourable double taxation avoidance agreements.

Ease of Company Formation: A Cyprus company must have at least one director, shareholder and secretary. The directors of a Cyprus Company can be a natural person or legal entity. Most companies use nominee services for privacy protection.

Stable EU Jurisdiction: With a company in Cyprus, you’ll get all the benefits of an EU jurisdiction, like sound banking options, investment opportunities and access to the world’s largest single market area and its consumers.

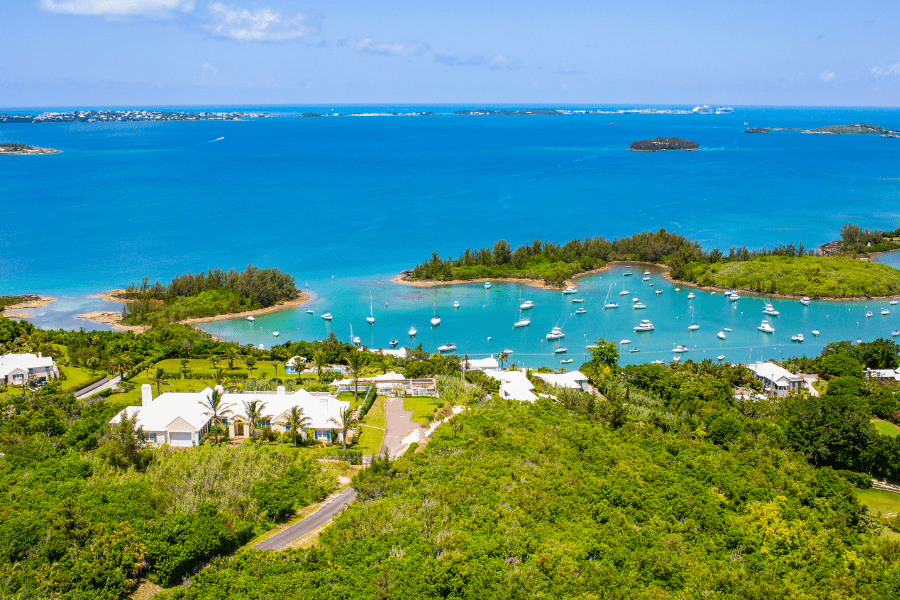

Bermuda

Bermuda is a self-governing British Overseas Territory in the North Atlantic Ocean. People flock to Bermuda for its pink sand beaches and ideal climate.

Of course, many entrepreneurs come to form their own companies.

The country has long been a popular offshore company jurisdiction thanks to its 0% corporate tax rate. However, as of January 2025, Bermuda will introduce a new 15% corporate income tax rate.

While this is still a relatively low rate, it does take some of the appeal out of forming a company in Bermuda.

Tax increase aside, there are still a few reasons why you’ll benefit from setting up a company in Bermuda:

Gateway to Residency: If you want to set up a company in Bermuda and work toward permanent residence, you should consider the Economic Investment Certificate (EIC) program.

Purchasing Bermudian real estate, investing in an existing Bermuda-based business or setting up a new business there can all qualify you for Bermudian residence.

You’d have to invest US$2.5 million in one of the several government-approved routes. After five years, you are eligible to become a permanent resident of Bermuda, enabling you and your family the right to live and work there indefinitely.

Tax Advantages: Currently, the country has no income or capital gains taxes.

Ease of Adapting: Bermuda is a particularly favourable jurisdiction for Westerners since its official language is English and the Bermudian Dollar is pegged to the US Dollar.

Antigua and Barbuda

Antigua and Barbuda is among the wealthiest countries in the Eastern Caribbean region, thanks to its steady influx of tourists and its growing popularity as an offshore banking jurisdiction.

But the country is also well-known for its tax-friendly policies, so setting up an IBC in Antigua and Barbuda can be advantageous for many reasons:

Ease of Company Formation: An Antigua IBC must have at least one director and one shareholder, both of whom can be the same person (or a legal entity) of any nationality. No minimum capital requirement exists. Moreover, all shareholders can be foreigners. An Antiguan IBC can be formed and registered within one day, and opening an offshore bank account there is straightforward.

Tax Advantages: IBCs in Antigua and Barbuda pay no taxes, making the country an excellent corporate jurisdiction. A fifty-year tax exemption exists for Antigua IBCs on most forms of income, dividends, interest and royalties paid by and to foreigners.

Privacy and Asset Protection: The names and assets of beneficial owners and shareholders of an Antiguan IBC are never included in any public records.

No Reporting Requirements: While no annual audit or reporting requirement exists, an IBC must keep financial records that accurately reflect the company’s financial position.

Georgia

One of the most unheralded Eastern European countries, Georgia is an increasingly popular jurisdiction in which to set up a company.

Aside from its appeal as a tax-friendly European corporate base, the country boasts delicious wines, ancient monasteries and breathtaking mountains. The capital, Tbilisi, is also one of the most charming Eastern European capitals.

Here’s how you’ll benefit from setting up a company in Georgia:

Strategic Location: Thanks to its location at the intersection of Asia and Europe, Georgia is an ideal base for serving existing markets and expanding into new ones, starting a business and opening an offshore bank account.

Ease of Doing Business: Georgia ranks 7th among 190 countries in the latest World Bank’s Doing Business Index.

Tax Advantages: The corporate income tax rate in Georgia is 15%. However, the country offers several tax-friendly programs to foreign investors and entrepreneurs. You can entirely eliminate your tax liabilities in Georgia by registering as a micro business or pay as little as 1% by registering as a small business.

Panama

Panama is one of the safest countries in South America. It’s also one of the top retirement destinations with an extensive community of American expat retirees.

International Business Companies (Sociedad Anónima) in Panama are world-renowned for privacy and asset protection.

Alternatively, a Panama Limited Liability Company (LLC) may work for those looking to establish a business there with less complexity. A Panama LLC can carry out business activities in Panama or abroad.

Here’s how you’ll benefit from setting up an IBC company in Panama:

Ease of Company Formation: A Panama IBC must have at least three board members – all of whom can be of any nationality. An authorised capital requirement of US$10,000 exists, but you’re not required to pay it upfront.

Asset Protection: Your personal assets are protected from the corporation’s liabilities.

Tax Advantages: No income, capital gains, estate or gift taxes exist for Panama IBCs.

United Arab Emirates (UAE)

The UAE government has done an excellent job of attracting foreign investors and entrepreneurs.

The UAE offers several business structures and tax advantages to foreigners looking to incorporate there. You can set up an offshore, free zone or onshore company in the UAE.

See our guide to UAE residence by investment for more details on how to establish a base in the country.

Here’s how you’ll benefit from setting up a company in the UAE:

Tax Advantages: The UAE has long been a world-renowned tax-free jurisdiction. Not anymore, though. The country announced a 9% corporation tax in 2023. However, certain types of business income are still tax-free.

Gateway to Residency: The UAE offers investors and entrepreneurs a chance to qualify for residence if they establish a company there worth at least AED 10 million (around US$2.72 million), or partner in an existing or new company with a share value of at least AED 10 million.

Diverse Community: Few countries can boast diversity like the UAE. Over 80% of the population are expats, with a skilled workforce from all over the world.

The Bahamas

The Bahamas is made up of around 700 islands. With award-winning beaches, one of the strongest economies in the region and almost no taxes, the island nation has plenty to offer.

One of the best company structures to set up in the Bahamas is an IBC. Here’s how you’ll benefit from setting up a company in the Bahamas:

Tax Advantages: No personal income, corporate income, capital gains, sales, withholding, gift or inheritance taxes exist. If legal tax reduction is your goal, a Bahamas company can help you significantly.

Easy-to-Adapt: The official language of the Bahamas is English, and the Bahamian dollar is pegged to the US dollar. The nation is a convenient location for English-speaking foreign investors, entrepreneurs and retirees.

Hong Kong

Hong Kong is an excellent jurisdiction for a diverse range of larger-scale corporations looking to reduce their taxes legally.

A Hong Kong offshore company is a shell company with no bank accounts, accounting, transactions, operations, directors or shareholders in Hong Kong.

A Hong Kong onshore company has its main base and whole structure in Hong Kong. The corporate tax rate for an onshore company is 16.5%. However, the tax rate on the first HKD2 million is 8.25%.

Here’s how you’ll benefit from setting up a company in Hong Kong:

Foreign Ownership: Unlike some other Asian jurisdictions, Hong Kong allows 100% foreign ownership of companies.

Highly Reputable: Hong Kong is a global financial services and trade hub with an enviable global reputation.

Ease of Doing Business: Hong Kong ranks 3rd in the World Bank’s Ease of Doing Business Index for its simple business formation process, ease of securing construction permits and power connections at corporate locations and straightforward tax system.

The Cayman Islands

The Cayman Islands, a British Overseas Territory in the western Caribbean Sea, is one of the most popular jurisdictions for setting up an offshore hedge fund.

It’s a dependable offshore banking location that houses over 70% of the world’s offshore hedge funds with over 200 banks, including international financial institutions.

Here’s how you’ll benefit from setting up a company in the Cayman Islands:

Tax Advantages: The Cayman Islands has no income, withholding, property, corporate, wealth or inheritance taxes.

Stable Environment: The Cayman Islands’ currency is stronger than the US dollar, and the country has a very stable political and economic landscape, resulting in an excellent quality of life overall.

Gateway to Residence: By actively managing and investing US$1,200,000 in a Cayman Islands-based business and hiring some local employees, you may qualify for Cayman residence.

Countries that May Work Depending on Your Business

Different jurisdictions work better for certain types of offshore companies. It’s important to understand the type of company that will work best in a chosen country.

Traditional Companies

A traditional trading business that sells physical goods will benefit hugely from being located in a stable jurisdiction with a well-respected banking system and favourable tax regulations, such as Singapore or Hong Kong.

Alternatively, if you have a pure service-based business, you should consider onshore alternatives with high banking, accountability and reporting standards, like Estonia or Georgia.

Location-Independent Companies

It’s highly recommended that online businesses form offshore corporations since they can operate anywhere.

Forming different kinds of offshore companies can help you process payments in one country, host your website in another, keep accounting records in a third and pay low taxes in a fourth.

Any offshore jurisdiction with tax advantages for tech-based businesses, innovative start-ups or location-independent structures will work for an online business.

Patent and Trademark Holding

Soft asset companies with intellectual property (IP), such as trademarks, patents and copyrights, are booming.

Multinationals like Apple and Microsoft use offshore holding companies to house their intellectual properties, but the benefits are not limited to the big players.

With a patent and trademark holding, you can incorporate in a country with stringent IP protection regulations and a favourable tax regime.

Some of the tried-and-tested countries for holding IP are Cyprus, Bermuda, and Luxembourg, for example.

Best Countries for Offshore Companies: FAQs

An offshore company is a company that you own in a jurisdiction where you are not living or residing. Contrary to what is so often portrayed in the media, offshore companies are neither illegal nor incredibly complex.

In general, offshore jurisdictions offer benefits which include substantial tax benefits, reduced compliance obligations, fewer related costs and enhanced banking privacy. They also permit the flexible creation of various company types and accessible options to protect wealth and assets.

No single jurisdiction is the best. Instead, you should only consider those with economic and political stability and sound judicial structures and corporate laws, as well as lower taxes.

Despite being asked by the Organisation for Economic Cooperation and Development (OECD) to sign up for a 15% global corporate tax, some countries have refused to fall in line. As a result, these non-compliant countries have been blacklisted and face a range of potential sanctions. They may also carry reputational risk.

It can do, but, generally speaking, will not do so in isolation. You also have to factor in where you live and pay taxes, where your company is moving from and to and the tax regime of the new jurisdiction. You also have to consider what other types of assets you hold, where you hold them and how they are structured.

The costs vary depending on the jurisdiction. Some are more cost-effective than others. In general, however, you should budget for incorporation fees, registered agent fees, government license fees, legal fees and the cost of premises and hiring. However, the cost also depends on the type of company, the services required and the service provider chosen.

To form an offshore company, you must choose a jurisdiction, register the company with local authorities and fulfil the legal requirements such as appointing directors and shareholders. You’ll also need to open a corporate bank account and comply with any reporting and tax obligations in the jurisdiction.

Entrepreneurs, investors and businesses that want to reduce their taxes, protect their assets or expand into new markets can benefit from an offshore company. Those with intellectual property or location-independent operations might find offshore structures especially beneficial.

Find the Best Country for Offshore Company Formation

Here at Nomad Capitalist, we work tirelessly to understand which countries are the best to establish an offshore company, because the offshore world is always prone to change.

Depending on their business, income and lifestyle goals, people will have different reasons for setting up an offshore company. That’s why there’s no one-size-fits-all answer or solution to this problem.

What works for one person or business may not work for another.

You may want to move to the Caribbean or Middle East for lower taxes without realising that you could pay less close to home in the EU.

But no consultant who gets paid to sell you one location will tell you that.

Nomad Capitalist provides tax, investment and lifestyle solutions in over 100 countries backed by our global team and network of legal and tax professionals.

We have an in-depth understanding of how to match your vision with a holistic plan that covers all your needs.

To go where you’re treated best, set up a call with us today.

The Best Countries for Investing in the Middle East 2025

The global investment landscape has changed dramatically. Gone are the days when opportunities were limited by geography or confined to traditional stocks and bonds sold only through standardised, rigid and often cumbersome channels. Back then, going ‘global’ might have just meant adding a few European equities to a US-based portfolio. Today, everything has changed. Barriers […]

Read more

Best Gulf Country for Company Formation and Business Setup

For ambitious entrepreneurs, the Gulf region offers a powerful blend of top-tier banking systems and business-friendly laws that streamline company formation and make the process remarkably efficient. Countries like Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the United Arab Emirates (UAE) are actively competing to attract the world’s brightest business minds – and it’s working. […]

Read more

Top Offshore Tax Havens in the Caribbean

When people hear the term ‘tax haven’, it often conjures up images of shadowy offshore bank accounts and shady financial dealings. The reality is far more practical and much less sinister. Caribbean tax havens aren’t just for billionaires or corporations with armies of lawyers. In fact, many everyday entrepreneurs and investors take advantage of the […]

Read more