The Most (and Least) Crypto-Friendly Countries in the World

July 4, 2025

What do a nomad and a cryptocurrency have in common? Both are location-independent.

A nomad can move around the globe as they please, while a cryptocurrency is completely virtual and devoid of any central regulating authority, making it the perfect asset for a digital nomad.

The ever-increasing popularity of crypto and the global shift toward remote work after the pandemic has given rise to a popular question for crypto investors: What are the most crypto-friendly countries in the world?

Crypto investors, entrepreneurs, digital nomads, and more people every day want to invest in cryptocurrency.

Cryptocurrency is seen as a safe, liquidated currency that shouldn’t be controlled or regulated by their government or any government for that matter.

Here at Nomad Capitalist, nomads are our favourites (naturally) because they are people who are not hesitant to go where they are treated the best.

Nomads appreciate decentralised digital assets like crypto because they truly reflect their values, goals, and lifestyle far better than regular money.

Crypto has been around for so long now that most countries have developed regulations related to it, friendly or not.

In this article, we will discuss everything you need to know about crypto-friendly countries and countries you should stay away from.

What Makes a Crypto-Friendly Country?

There are more layers than one would think.

Crypto friendliness may mean different things to different people, and rightfully so, since no two countries seem to have the same crypto regulation in place.

But at the same time, governments across the world have come a long way since crypto came to life in 2009.

Many countries have softened their previously rigid stance on crypto to adapt to the shifting global dynamics and profit from it.

Some countries are doing everything in their power to be considered among the world’s most crypto-friendly countries.

However, don’t be surprised when the country with the most attractive crypto tax incentives is a country you know nothing about– that’s the whole point.

Small countries are also trying to create more foreign investment opportunities and generate higher revenue through their minimal (and sometimes non-existent) crypto taxes.

A win-win for all the parties included. The country becomes a top choice for crypto holders around the world and the crypto investors get to save their hard-earned money.

It is also worth noting that just because a country has a large number of crypto users, it doesn’t necessarily mean that the country is actually crypto-friendly.

Generally, a crypto-friendly country should have one or more of the following:

- Zero (or minimal) crypto capital gains taxes

- Zero (or minimal) crypto income tax

- Zero (or minimal) tax on crypto exchanges like crypto trading or spending

Now that we know that taxing crypto is the biggest indicator of a country’s stance on cryptocurrency, let’s dive into the types of crypto taxes most countries impose.

The crypto activities taxed by (most) governments are:

- Crypto Exchanges: including trading crypto for another cryptocurrency or selling it for your national (or any fiat) currency.

- Crypto Transactions: Spending crypto to purchase products or services (Crypto Payments)

- Any income from crypto

Now that you know the basics, let’s look at the most crypto-friendly countries in the world.

The Most Crypto-Friendly Countries in The World

1. Germany

You might be surprised to see one of the highest-tax countries in the world on a list of countries that are crypto-friendly, but Germany’s relationship with crypto taxes is definitely very interesting.

Although it’s far from being a tax-free crypto country, Germany’s population has over 16% crypto users, and a staggering 44% of the population is motivated to invest in cryptocurrency.

The spiked interest in cryptocurrency might invoke the misconception that the country must be very crypto-friendly, but that is not necessarily the case.

Germany crypto tax is applicable if you:

- Get paid in crypto or earn through mining or staking crypto

- Sell crypto used in staking within one year

- Sell crypto within one year and gain more than €600 (capital gains tax).

Germany has regulated cryptocurrency as private money – so you are exempted from paying taxes on your crypto gains if:

- You’ve held your crypto assets for more than a year

- You’ve sold your crypto within one year but gained less than €600.

Some nomads and crypto enthusiasts have their eye on Germany for how easy it is to get the German Freelance Visa if you meet the requirements. However, the country, at large, discourages volatile crypto transactions and aims to create a more stable crypto environment for domestic and foreign crypto investors and users.

2. Switzerland

Another European country on our list is Switzerland, which is known for its banking and finance industry.

Considering its history, it’s no surprise that it is also home to the ‘Crypto Valley’ – a crypto hub in the low-tax canton, Zug.

Zug was one of the first places to truly embrace cryptocurrencies by recognising its potential, and that is why plenty of crypto companies decided to set up exchanges there.

The Ethereum Foundation is headquartered in Zug. Many other Swiss cities like Lugano are also following suit to become crypto-friendly.

Still, if you are looking for terms like ‘zero taxes’ or ‘tax-free’, you may want to skip Switzerland.

Taxes in Switzerland are not discouraging crypto enthusiasts from going to the country, although their crypto assets are still taxed.

Switzerland classifies cryptocurrency as a private wealth asset – meaning that private investors are exempted from paying capital gains taxes on crypto.

Your crypto income and the total value of your crypto assets are still subjected to taxation, even if you are a private investor.

Unfortunately, for businesses, the Swiss crypto tax laws are pretty much the same as the laws on legal tender or fiat currency.

3. El Salvador

No list of the world’s most crypto-friendly countries is complete without the mention of El Salvador.

In recent years, this small country has passed back-to-back pro-crypto regulations to establish itself as a forerunner among crypto-friendly countries.

In September 2021, it became the first country to adopt Bitcoin as legal tender, making it a crypto tax haven and a huge magnet for crypto companies and investors alike.

El Salvador’s president Nayib Bukele also plans to build a ‘Bitcoin City’ near the Conchagua volcano.

The city will be powered by geothermal energy and will have no income tax, no property tax and no capital gains tax.

The only El Salvador crypto tax you have to pay is a 10% value-added tax (VAT) to fund the construction and services of the city.

To encourage foreign investments, the government of El Salvador has also exempted foreign crypto investors from paying income tax and capital gains tax on Bitcoin.

To further solidify its position as one of the world’s most cryptocurrency-friendly countries, the country has announced the El Salvador Golden Visa program.

According to this, immediate permanent residency, not citizenship, will be granted to crypto investors after they meet the minimum investment requirement made in crypto.

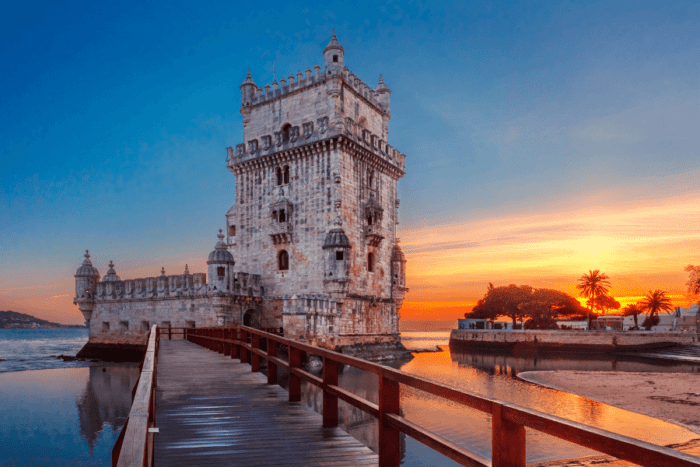

4. Portugal

The Great Recession hit Portugal hard in 2008, and since then, it’s been trying to get back on its feet through its popular Portugal Golden Visa program and tax-friendly regulations.

All these policies have done a wonderful job of attracting foreign crypto investments and those looking for a tax-free way of life in Portugal, making it one of the top crypto-friendly countries.

For the majority of investors, there is no Portuguese crypto tax on crypto trading, income and long-term capital gains. Businesses still have to pay corporate income tax and VAT.

Although Portugal is still crypto-friendly for long-term holdings and gains from crypto, the government introduced a new crypto tax regime in 2023, imposing taxes on short-term crypto holdings.

5. Malta

Ever since the Maltese law on blockchain technology and cryptocurrency passed in 2018, the European island nation has cemented its position as a crypto tax haven, earning it the title of ‘Blockchain Island’.

The Maltese government classifies crypto as a ‘unit of account, medium of exchange or a store of value’. But what does that mean?

It means that:

- No crypto tax in Malta will be subjected to long-term capital gains

- Crypto trading will be subjected to 0-35% of business income tax, based on your income status and tax bracket.

Crypto trading is taxed in Malta because the government views crypto trades and day trading stocks similarly.

The nation’s tax-friendly laws make it a huge attraction for people who want to move to Malta through one of several programs for Malta residency.

As you will have noticed, there is no one-fits-all solution when it comes to ‘picking’ the perfect crypto tax-free country – governments vary, and with them, crypto regulations.

That is why, here at Nomad Capitalist, we offer a comprehensive, holistic strategy to take you where you are treated best.

One of the best pieces of advice we give to our clients is to always keep your options open and consider more than one locality to gain the best tax-friendly experience while enjoying nomad freedom.

Despite its increasing popularity, not all countries share the same approach to cryptocurrencies.

Some are even downright hostile and want nothing to do with crypto. It’s important to know about these countries to steer clear of them or be aware in case they ever decide to soften their stance.

Let’s explore some of the worst countries for everything crypto.

The Least Crypto-Friendly Countries in the World

1. China

Let’s start with China – the country that seems to be at the forefront of innovative technology and mass manufacturing of, well, everything.

In September 2021, the People’s Bank of China banned all crypto transactions and crypto payments.

According to the government of China, the decision to ban crypto was taken amid concerns about crypto mining’s effect on the environment.

The government was also highly concerned about the misuse of digital currencies for fraud and money laundering.

Currently, the future of crypto in China seems to be pretty bleak, with no optimistic turn in the near future, so it’s best to be wary of this region, in particular, if you are a crypto enthusiast.

Other countries that share China’s complete crypto-ban stance are Bangladesh, Tunisia, Egypt, Morocco, Iraq, Oma, Qatar and Algeria.

Before the crypto ban, China had been a leader in crypto mining.

2. The Netherlands

In the Netherlands, cryptocurrencies are classified as assets and are subjected to the same tax rate as regular assets.

An income tax, a wealth tax, and a gift tax (above a certain figure) will be applied to your crypto assets as per the Dutch tax laws.

The Netherlands is on our list of non-crypto-friendly countries because crypto taxes in the Netherlands are levied on unrealised or fictitious gains at 36%.

3. Japan

In Japan, crypto assets are subject to Miscellaneous Income Tax ranging from 15% to 55% on profits.

There’s also a municipal tax of 10% that has to be added at any rate, which ultimately leads to a maximum tax rate of 55%.

You will be required to pay the Miscellaneous Income Tax on exchanges or transactions that usually come under capital gains tax.

Why is it bad? Because, in Japan, income tax rates are relatively higher than capital gains tax. Japan is also one of the countries that have a comparatively higher income tax rate.

4. India

In its 2022 budget, the government of India decided to levy a 30% tax on income from crypto and all other virtual assets with no deductions or exemptions.

While most crypto users are disappointed by the government’s decision, others have voiced support for the official regulation of cryptocurrency in the country.

While it is true that the high Indian crypto tax rate will probably discourage many newcomers from joining the crypto industry in India, veteran Indian crypto users are hopeful that the government may soften its crypto regulation in future.

Especially when it sees the revenue opportunities it can bring.

5. Albania

A recent Albanian crypto tax decision forced private investors to pay taxes on profit from crypto trading since 2023.

Profits gained from crypto businesses will be taxed per the country’s business tax rate – but that’s not all.

Private investors will also have to pay 15% of their annual earnings to the government.

Crypto-Friendly Countries: FAQs

● Germany: Zero capital gains tax on assets held for over a year

● Switzerland: Private Investors pay zero crypto capital gains tax

● El Salvador: The first country to adopt Bitcoin as legal tender

● Portugal: Majority of investors don’t have to pay income tax and capital gains

● Malta: Dubbed Bitcoin Island

● China: Complete crypto-ban

● The Netherlands: 31% tax on fictitious gains

● Japan:Ccrypto assets taxed up to 55%

● India: 30% tax on crypto income

● Albania: 15% taxes on crypto profits starting 2023

Switzerland stands out as the most crypto-friendly country in Europe, thanks to its supportive regulatory framework, particularly in the Canton of Zug, known as ‘Crypto Valley’.

Yes, several Caribbean countries are crypto-friendly, with St. Kitts Nevis, Antigua, St. Vincent and the Grenadines, Dominica and St. Lucia having adopted crypto-friendly laws between 2020 and 2022, fostering a supportive environment for digital currencies.

Mauritius is considered a crypto-friendly country in Africa, offering a regulatory environment that

supports blockchain and fintech innovations.

Countries often cited as crypto-friendly include Malta, Switzerland, Portugal, Singapore, and Estonia, which are known for their progressive regulatory environments and embrace blockchain technology. Malta, often referred to as ‘Blockchain Island,’ has implemented comprehensive regulations supporting cryptocurrencies and blockchain businesses.

Several countries, including China, Algeria, Bangladesh, Egypt, Morocco and Nepal, have banned or heavily restricted cryptocurrency. Some of these countries have implemented strict bans on cryptocurrencies, prohibiting their use, trading or mining.

Many service providers accept Bitcoin, particularly in the tech and freelancing sectors. These include web hosting services, VPN providers, and freelance platforms that support crypto payments. Websites and apps like CoinMap can help you locate businesses and services in your area that accept Bitcoin as payment.

Go Where You Are Treated Best

Nomad Capitalist encourages a life of freedom and better financial choices – for many of our clients, that includes digital assets like cryptocurrency.

Any list of the top crypto-friendly countries is not set in stone. The global dynamics for crypto payments, transactions, selling and trading change all the time.

But, what hasn’t changed over the years is how people adapt to these changes by taking action.

In 2019 alone, over US$50 billion worth of cryptocurrency was moved from Chinese virtual wallets to other parts of the world.

Rather than searching by yourself for a list of crypto-friendly countries to invest in, it’s always best to consult experienced professionals who have done it all before.

If you plan on investing in crypto and you’re overwhelmed by ever-changing global dynamics, then it’s time for you to reach out to our team.

Our global entrepreneurial team will devise a perfectly tailored ‘made-for-you’ holistic strategy.

We’ve done so for more than 1,500 high-net-worth individuals so they can multiply and protect their wealth. Get started today.

Does Puerto Rico Pay Taxes to the US?

It’s a common question and one that often fuels confusion, debate, and a fair share of misinformation – Do residents of Puerto Rico actually pay US federal taxes? When most people think of US tax obligations, they naturally assume they apply uniformly across all US citizens. But when it comes to Puerto Rico, things are […]

Read more

Zug Canton Taxes: The Ultimate Destination for Wealth Management in Switzerland

Switzerland’s global reputation is built not just on stunning views of Alpine peaks and serene lakes but also on a foundation of exceptional quality of life, world-class infrastructure and investor-friendly tax policies. The results speak for themselves: efficient public transport seamlessly links cities and villages; the standard of living regularly ranks among the highest in […]

Read more

How Smart Investors Use Venture Capital to Build Wealth

Big companies like Google, Amazon, Facebook and Apple all started out as bold ideas backed by venture capital. Decades later, the same firms are household names, as familiar to most people as electricity, the internet, or the telephone. But hindsight is a fickle friend. The truth is, it wasn’t always so obvious they’d succeed. These […]

Read more