In this article, we look at a little-known Greek tax loophole that potentially allows you to pay single-digit tax rates. More importantly, this method is 100% legal – the Greek...

Founder of Nomad Capitalist and the world’s most sought-after expert on global citizenship.

What we’re all about

Meet our global team

We’re here to serve you

Read our testimonials

Get free email updates

Create your own bespoke global citizenship plan

Claim a second passport based on familial connections

Click here to see all our products and services

Discover the world’s best passports to have in an ever-changing world

Explore the citizenship options using our interactive citizenship map

Explore the tax details for countries using our interactive tax map

Click here to see all of our research and interactive tools

Learn from a curated “Who’s Who” of business speakers from around the world, get our latest R&D updates, and rub shoulders with successful people from all corners of the world.

Andrew Henderson wrote the #1 best-selling book that redefines life as a diversified,

global citizen in the 21st century… and how you can join the movement.

In this article, we look at a little-known Greek tax loophole that potentially allows you to pay single-digit tax rates. More importantly, this method is 100% legal – the Greek...

So you’ve decided to go where you’re treated best. You’re leaving your high-tax country and looking forward to earning business income, capital gains and dividends with zero or...

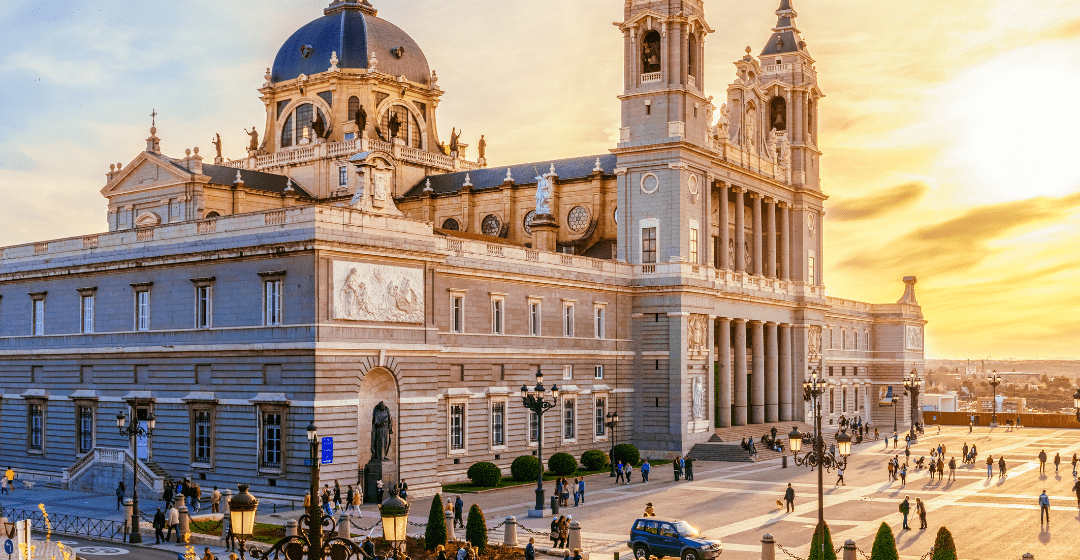

Is Malta a tax haven? The question often crops up during any discussion of jurisdictions with tax-friendly systems. As an EU member state , Malta is renowned not only for its...

When most people think of California, capital gains tax rates don’t automatically spring to mind. Usually, people picture sunshine, beaches and that famously easy-going...

Searching for a tax-friendly residency that works in your favour?Cyprus offers one of the most attractive non-dom tax regimes in Europe, with low tax rates and generous...

In this ultimate guide on how to get Swiss residence, we'll go over everything from the requirements for a Swiss residence permit to the advantages of having Swiss permanent...

To attract more foreign investment to the country, Uruguay has made it easier to become a tax resident there. If tax reduction is your objective, the favorable tax rates offered...

As a non-resident of the UK, what tax incentives do you qualify for? Is tax reduction a goal? You can lower your taxes as a non-UK resident. Read on to get an overview of the tax...

If you're a UK non-domiciled resident with a permanent home outside the jurisdiction, you will pay tax differently than a standard resident. You can achieve a tax reduction which...

Turks and Caicos Islands is a tranquil chain of islands in the Caribbean. The islands have some of the best opportunities for savings on annual taxes through a permanent...

For many, Turkey isn’t just a great place to visit on holiday — it’s the ideal location to build a new future. Whether you’re drawn by the rich history, the investment...

Thailand is a popular Asian travel destination for global investors, offering an abundance of opportunities for those seeking residency in this captivating country. This article...

In a perfect world, non-residents of any country would not incur any tax liability in that jurisdiction. In our imperfect world, being a non-resident in one country and a tax...

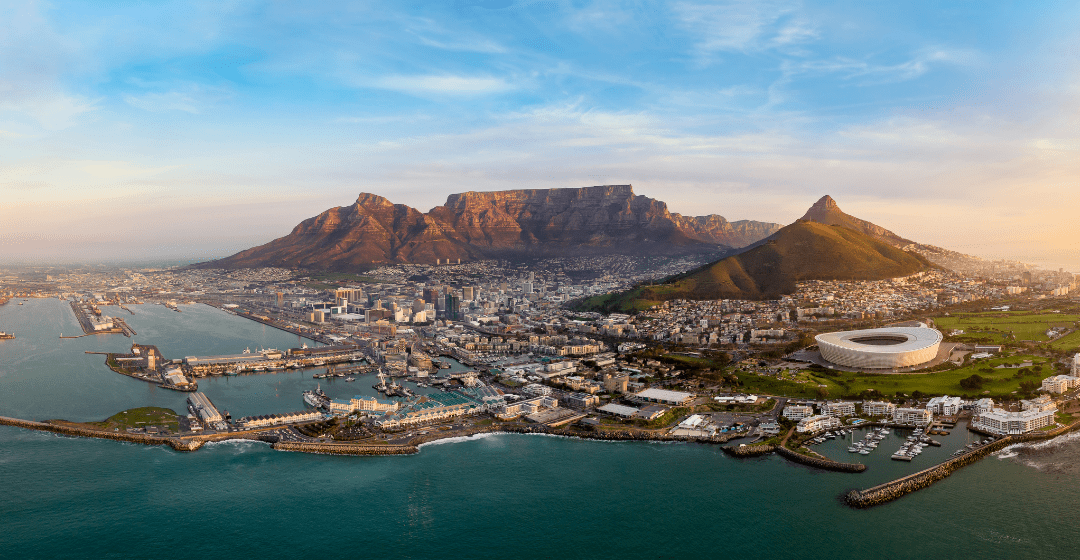

South Africa is a residence‐based tax system. If tax reduction is an objective, you can reduce your tax liability as a non‐resident. Our comprehensive South African tax guide...

This article discusses how to get Serbian residence, with information on the different types of residence permits in Serbia available, the pros and cons of each plus details on...

Establishing residence in Romania gives you all the perks of an EU residence. Moreover, many Romanian residency options lead to citizenship, qualifying you for an excellent EU...

Relocation to Portugal can change your tax circumstances significantly if you decide to become the country’s resident. Familiarizing yourself with the rights and obligations of...

Welcome to the ultimate guide on how to get a second residence in Paraguay. This comprehensive guide allows you to explore the finest travel and international investment...

LEGALLY REDUCE YOUR TAXES TO 15% OR LESSThese days, you can run your business from just about anywhere. So why are you still doing it from a country that charges you more and...

Do you want to reduce taxes and grow your business faster? Would you like to establish a tax residence in this Central America to give your freedom and options? Learn all about...

Subscribe to our Weekly Rundown and stay ahead with instant alerts on key global changes.