7 Tax-Friendly Countries with High Life Expectancy

November 5, 2024

You want yourself and your family to live comfortably for as long as possible, right? Well, living in countries with high life expectancy helps ensure this. Living in high life expectancy countries also means that you can make the most of the opportunities provided to you.

Unfortunately, some of us don’t live in countries with high life expectancy, which can be a cause for concern for many. Therefore, to secure your and your family’s future, at some point, you will have to consider your options abroad.

But how will you do it?

And more importantly, where will you go?

Moving overseas isn’t the easiest thing to do. Even if the financial side of things is taken care of, there’s the aspect of leaving behind everything you’re accustomed to.

This can make things even more difficult, but for most people, the trade-off is worth it.

To most people, the trade-off is worth it.

With that in mind, we’ve prepared a list of countries with high life expectancy and tax-friendliness. Now, you must be thinking to yourself: do such countries even exist?

Historically, there is a relationship between high taxation and a higher standard of living. These two factors, in turn, affect government services and life expectancy.

So the answer to your question is yes.

Many countries provide a better life expectancy and ways of paying lower taxes and increasing your wealth.

Why Move to Countries with High Life Expectancy?

Before we move to the list of countries with high life expectancy, let’s take a look at the reasons why people move abroad . You must know what to expect because uprooting your entire life isn’t easy.

It isn’t something you do simply for the sake of it or to follow the latest trend. You need to move to make life better for you and your family.

If you’re still unsure, here are some of the main reasons why you should move to one of the countries with high life expectancy.

A Better Life Awaits You

Western countries aren’t simply giving back as much as they used to. In the past few decades, most of the world wanted to move west.

There were several reasons behind this, from stronger second passports to better benefits, work opportunities and more. To most people, the Western world was a beacon of hope for a better life.

However, even the strongest economies collapse, and that beacon is diminished. Today, almost every major Western country is facing problems of its own in this regard. The writing is on the wall: the benefits that once existed simply don’t anymore.

So, what do you do about it?

Unfortunately, there’s not much you can do. Only a select few Western countries can provide you with the benefits that were once common.

Apart from that, Asia is becoming an important business hub with increasing standards of living . Maybe it’s time to venture east?

Governments Offer Better Incentives and Tax Advantages

Chances are, you probably live in a country where there is little to no tax advantage allotted to you.

For example, in the United States, it’s becoming extremely difficult to operate a tax-friendly business due to the sheer amount of money that needs to be paid.

It can be highly demotivating for many individuals to be taxed so much, especially if there’s little or no benefit to it. So, what do you do?

Well, you move to a country where the government recognises what you bring to the table. There are many countries where governments bend over backward to help high-net-worth individuals with their business ventures.

To make the most of your wealth and expand it legally, you need a government willing to put you first.

7 Countries with High Life Expectancy You Should Move To

Now, without further ado, you will find the best countries with high life expectancy and low taxes below. You’ll see a mix of countries in Asia and Europe , where living in them can help elevate your life.

Hong Kong

The first country on our list is Hong Kong.

Of course, many people consider Hong Kong a bit controversial, but there’s no way to deny the facts. Hong Kong tops the pile in the list of tax-friendly countries with high life expectancy.

With women living up to eighty-four years and men living up to eighty-two, no country in the world is higher than this.

Now, we’ll admit that many people have pulled out of Asia, particularly over the last year. However, you’ll be happy to know that the economic situation in the country has improved.

There are plenty of tax-friendly options available to high-net-worth individuals interested in moving here. As a major Asian financial hub, it even has some of the highest living standards in the continent.

If you’re a young entrepreneur or someone interested in expanding their business, Hong Kong is perfect for you.

It’s also great for families. The healthcare system is well set up. There are plenty of quality schools that teach in English. It even has some of the best universities in the world. So, if you’re looking for new talent, you’ll find that here in abundance.

The government is quite encouraging when it comes to moving and registering your business. Overall, it’s a great place to move to.

Singapore

Next on our list is Singapore.

Another major Asian financial hub, Singapore, boasts high living standards and high life expectancy.

The life expectancy for women is eighty-six years and for men, it’s eighty-two.

Singapore is perfect for investors and young entrepreneurs. It’s an exciting country, so even if you don’t have a family yet, there’s plenty to enjoy.

Singapore has particularly tax-friendly laws for your business and investments. So, you won’t feel restricted in the way you do things. Due to the low regulations, there’s a significant amount of economic freedom here too.

The Singaporean economy is doing well, so it’s a good place to lay down roots. For families, there are plenty of good schools and universities. It’s safe. There’s minimal corruption, and the business prospects are immensely exciting.

Even if you don’t want to live in Singapore all year round, it’s a great place to get a residency and set up a base for your business. Its tax-friendly policies are bound to help you in such a situation.

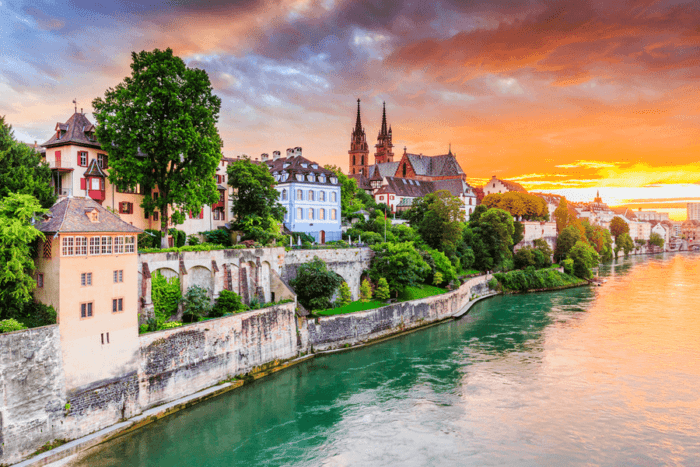

Switzerland

Now, Switzerland’s the first European country on the list, and there is a reason.

Many people don’t consider Switzerland to be one of the most tax-friendly countries. After all, it’s famous for having some of the most strict tax laws globally. It has a strong banking sector, and the government is very particular about all things tax and finance.

But the good news for seven and eight-figure investors and entrepreneurs is that the high taxes don’t apply to them. There’s a lump sum tax for high-net-worth individuals you need to pay in Switzerland, and then you’re free to make as much money as you want.

It’s quite straightforward. You’re essentially paying the Swiss government upfront, and then they won’t interfere with your business at all.

It’s a fair bargain considering how Switzerland is one of the few European countries with high life expectancy and quality of life.

On average, women live up to eighty-five, and men live up to eighty-two.

As mentioned before, Switzerland has a great banking sector and amazing healthcare.

It’s perfect for those looking to move to Europe, but want a high life expectancy. In recent years, we’ve seen that the life expectancy in some Western countries has gone down.

So, it’s impressive that Switzerland has managed to maintain its economy and high life expectancy in the face of so much change everywhere else.

Malta

Now, if you want to live in a country with great Mediterranean weather and a high life expectancy, then Malta is where you should be.

Women live up to eighty-four years, and men live up to eighty-one. Malta is a country for those who like the local, small island lifestyle. It’s very popular among Europeans. Most people prefer retiring to Malta, but it’s an ideal place for working individuals as well.

If you don’t live in Malta, you don’t have to worry about filling out any tax applications. But if you do plan on living there, there are programs available to legally help you reduce your taxes. And there are plenty of tax incentives available for you here too.

Malta is a secluded place with a unique vibe and appealing way of life. If you want to get away from the big city and move somewhere exciting and different, this is the place. It’s part of the European Union to boot.

So, if you opt for the citizenship by investment program and get your second passport , you can even travel all around Europe. As you can see, there’s a world of opportunities opening up to you in this country.

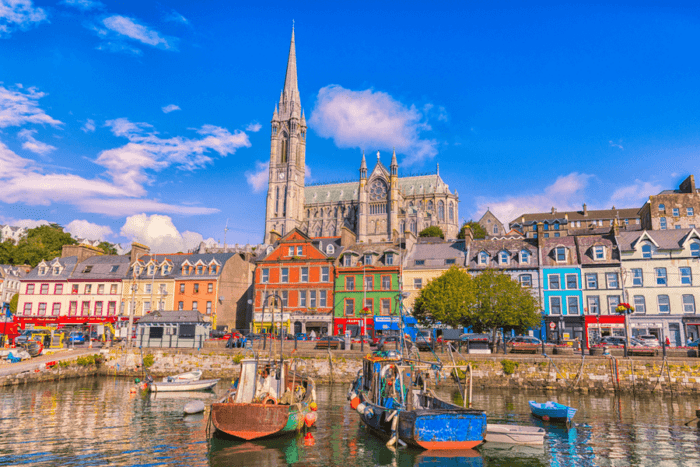

Ireland

The average life expectancy in Ireland is eighty-two years, with women living up to eighty-four and men living up to eighty years. It’s the third European country on this list.

If you’re Irish, there are quite a few tax-friendly plans available to you. If you’re a foreigner coming in for a residency, there are many options to choose from.

Unfortunately, the residency by investment program has been cancelled. However, you can obtain residence through the country’s Zero Stamp and Highly Skilled Worker programs . There are also residency options for entrepreneurs.

If you’re coming from another country in the European Union, all you have to do is register your company. You can then begin to benefit from the tax incentives.

Ireland has a great life expectancy compared to most other European countries, and you can also take advantage of the healthcare system.

There’s an option to get Irish citizenship by descent as well. So, if you have Irish ancestry, there’s a way to go about obtaining citizenship. If you manage to do this, you’re opening yourself up to a completely new culture as well.

This will make settling in Ireland a lot easier. It’s next door to the United Kingdom, sharing a border with it in Northern Ireland. So, if you’ve got business there, you can easily settle in Ireland and save on your taxes.

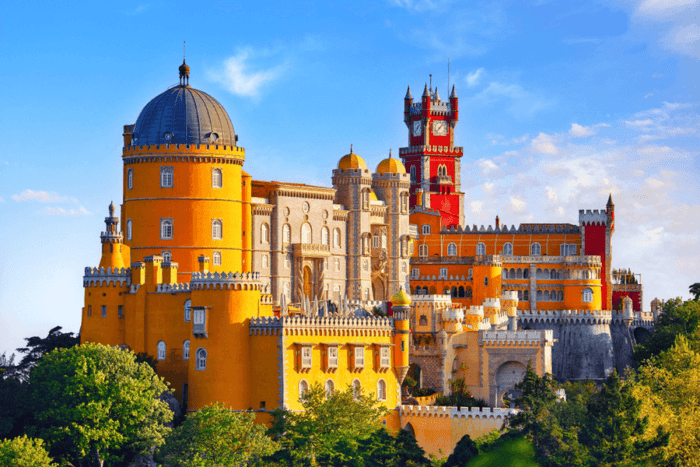

Portugal

Another European country to make the list of countries with high life expectancy is Portugal. In the last few years, we’ve seen many European countries struggle economically.

Portugal’s government has done everything to ensure that it doesn’t end up like Spain or Greece. This includes making its tax policies easier for high-net-worth individuals looking to move there.

Some of the tax incentives include almost no tax for those who stay there for ten years. There’s a Golden Visa program available if you want to invest in residency.

If you’re someone who heavily invests in cryptocurrency, then you’ll be happy to know that there’s no tax on those either.

As for life expectancy, women in Portugal live up to eighty-four, whereas men live up to seventy- eight.

It’s a lovely country and has a negative tax policy for certain foreigners. The weather’s excellent as well, and the government essentially wants people to come and live in Portugal.

Since it’s in Western Europe, and part of the European Union, there are many benefits that come with life in Portugal.

Andorra

The last country on this list is Andorra.

With an average life expectancy of eighty-three years, it’s a low-tax country where you can buy a property or have the government hold your money. Taxes are particularly low, in the single digits.

There’s not much government regulation either. So if you’re worried about governments ruling your life, you’ll be relieved to live here.

It’s a small country, of course. But recently, we’ve seen a trend of people moving to these smaller countries with attractive tax policies and ways to get almost immediate tax residency or citizenship.

Andorra is a fantastic country to live in if you take its culture and economy into account. Plus, it has a good healthcare system too.

Overall, Andorra offers everything a health-conscious individual would look for, with great tax policies being the cherry on top of the cake.

7 Tax-Friendly Countries with High Life Expectancy: FAQs

Spain is recognised for having one of the highest life expectancies in Europe and the world, currently around 84 years old. This is thanks largely to the exceptional standard of living in the country.

The average life expectancy in Europe is approximately 81 years, varying slightly between different countries and regions across the continent. Countries like Monaco, Switzerland, Spain and Italy are among those with the highest life expectancies, often exceeding 83 years, due to their healthcare systems and healthy lifestyle factors.

Algeria, Capo Verde, Tunisia, Morocco, Mauritius and the Seychelles rank among the highest in terms of life expectancy in Africa, typically reaching into the mid-to-high 70s. Higher socioeconomic status generally correlates with better access to healthcare, education and improved living conditions, thereby contributing to longer life expectancy.

On average, humans live about 28,000 to 30,000 days, which equates to approximately 76 to 82 years, though this varies significantly between different regions and countries.

The current life expectancy in England is approximately 81 years overall, with women having a higher life expectancy of about 83 years and men around 79 years. Interestingly, life expectancy in England is generally higher than in other parts of the United Kingdom, such as Scotland and Northern Ireland.

Learn More About Countries with High Life Expectancy Today

These countries are fantastic places for individuals looking for a better life. All countries on our list are either already tax-friendly or have up-and-coming economies that will benefit your business.

These countries are extremely expat-friendly. So, not only do you get the benefit of a better life, but you also get to explore and immerse yourself in the local culture.

After all, that’s what being a global nomad’s all about, isn’t it?

We think it’s vital to ensure that you’re living the best life possible. As a high-net-worth individual, you must go where you can expand your wealth.

Most countries with high life expectancy offer all kinds of tax-related benefits, and you should take advantage of this.

So, the next step is to take advantage of these benefits by getting in touch with our team.

Nomad Capitalist is dedicated to providing financial services to seven and eight-figure entrepreneurs and business people. If you’re thinking about moving away from your home country and obtaining a residency or second passport, you’re in the right place.

We bring decades of personal and professional experience to the table. Work with our team and develop a tax and lifestyle strategy, that includes second residency and citizenship, which will help you and your family in the long run.

Why Dual Citizenship Is The New American Dream

The American dream that once fueled immigration is dying. Many Americans now believe that other countries can offer them better opportunities. A lack of freedom, affordable housing and economic challenges have sparked a growing interest in US dual citizenship. This trend in dual citizenship extends beyond the United States, as individuals around the world seek […]

Read more

Visa-Free Countries for US Visa and Green Card Holders

For high-net-worth entrepreneurs, global mobility is more than a luxury; it’s a necessity. As a US visa or Green Card holder, you enjoy the privilege of being able to travel to numerous countries without the hassle of securing additional visas. Imagine the convenience: jetting off for business deals, scouting new investment opportunities, or sneaking in […]

Read more

10 Easiest Countries to Immigrate to: Passports for Investors and Professionals

The freedoms we enjoy in our so-called ‘borderless’ world are being steadily dismantled. In its place, a complex web of shifting regulations and political anxieties has taken root, affecting long-term planning for global citizens. As established pathways close and new hurdles appear, the definition of an ‘easy’ country to immigrate to is subject to change. […]

Read more