5 Dos And Don’ts When Moving Overseas

August 8, 2023

In this article, we’ll talk about the dangers of being addicted to one country, the risks associated with falling for the brand name trap, why it’s best to recognize when you’re not wanted somewhere, and how to make the best decisions about where to live when moving overseas for both lifestyle and tax reduction.

Moving overseas is one of the most important decisions of your life. It can make or break you.

That’s why it’s best to go where you’re treated best rather than one of the so-called “best” countries in the world.Ready to move offshore but don’t know where to start? Set up a call with us today to discuss your holistic offshore Action Plan.

What To Avoid When Moving Overseas

Having helped over 1,500 clients go offshore over the years, we have witnessed upfront many of the mistakes people make when moving overseas. These are the big three you will want to avoid:

1. Don’t Be Addicted To One Country

Let’s say you ant to go to Spain because everyone tells you that Spain is the best.

Here’s the problem: Spain looks great on paper – there are beaches, a colorful culture, and great food. But you know what else Spain has?

Taxes.

And there is only so much you can do about them.

If you were to move to Spain, you would almost always be subject to moderate to high tax rates. And if you pursue Spanish citizenship, you would eventually be subject to Spain’s wealth tax.

When people consider moving overseas, they often think that a holiday destination is the best country to live in the world. But then the realities begin to set in, and they realize that they were treated much better as a tourist.

Spain, much like many other popular nomad destinations, is no place to settle down and create a tax-free life. If you’re addicted to the idea of living there, you’re boxing yourself into a difficult tax situation that no amount of planning is going to completely eliminate.

2. Don’t Fall For the Brand Name Trap

Like the clients who insist on living in Spain, folks interested in moving overseas often fall into the brand name trap. The good news is that it is easy to avoid this trap by simply understanding what it is.

First, every country is a brand name. Some countries are known for their innovation, others for their low taxes, and some for their “rags to riches” opportunities.

Whether or not the country still delivers on the promises of its brand is an entirely different question. But many countries in the West now live by Spain’s saying, having gained fame for whatever positives their brand used to offer, they are now drifting off to sleep – resting on their laurels, so to speak.

The result is that many of these countries continue to market themselves as the top brand without offering their former benefits. And because people still buy into the brand name – believing that they can only get what they are looking for in that one place – these countries can get away with charging higher prices via taxes, regulations, and limited freedoms.

Look past the brand names and focus on what you really want. Do you want a specific place or just what you believe a given place has to offer?

Brand names shouldn’t be the deciding factor. Instead, start with the end in mind and work backward to arrive at a goal and the means of achieving it.

When you throw the brand names out, it is much easier to design a strategy that will help you both reduce your taxes and achieve the lifestyle you have envisioned.

3. Experiment With Your Destinations

If you are already living overseas but have not optimized your tax situation, there is a very good chance that your addiction to one country is limiting your progress.

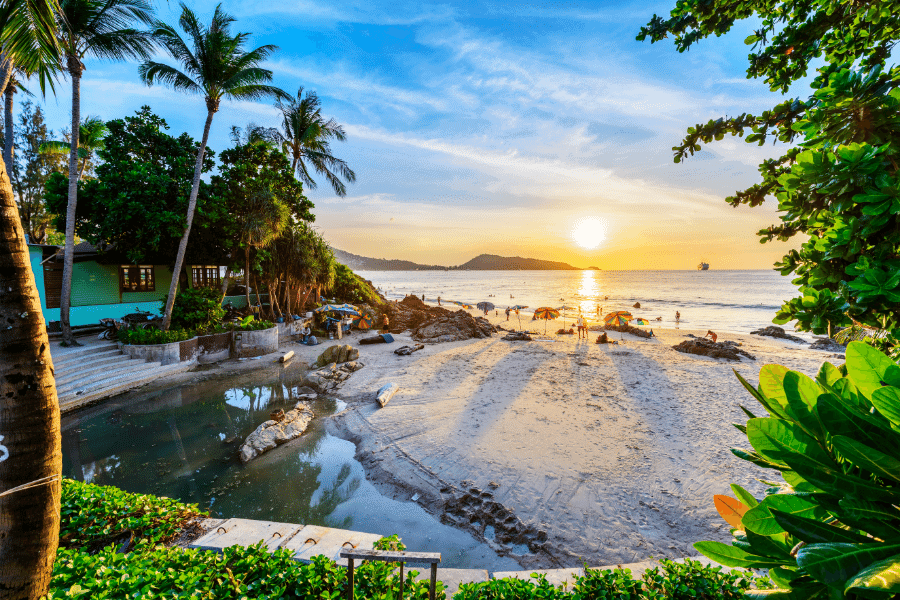

Thailand, for example, has been the digital nomad capital of the world for many years. This is partly owing to the fact that Bangkok is the most visited city in the world, with good connections to the rest of the globe and a cheap cost of living.

But the government got tired of “bag-packers” flooding their country because they didn’t necessarily contribute to the economy beyond the bare minimum, and they promoted the most noxious elements of Thai culture.

So, they began to make life more difficult for them. It used to be the case that you could do “visa runs” and simply touch another foreign country and then instantly turn back and have several more weeks of visa-free living in Thailand.

But that accidental loophole got stamped out, and digital nomads of lower means have had to get more creative to stay in the country. Now they sign up for Thai classes at a local university or sign up at a Muay Thai dojo in the hopes of receiving a student visa.

But why go to such great lengths to stay in a country that doesn’t want you?

Thailand is still open to a certain type of expat – they have a permanent residence program for investors as well as the Thai Elite Visa Program – but if you’re not investing or contributing to their economy, what do they want you for?

And if they don’t want you, why hold on like a clingy ex-lover when the relationship is obviously over? This is especially true when you have so many other choices, including Malaysia, Vietnam, and others.

It’s clear to any outside observer that the Thai government wants to keep their country from being overrun by lower-tier digital nomads. So, why do digital nomads still insist on going there?

Go where you’re wanted and where you’re treated best.

What To Consider When Moving Overseas

So. where do you go instead? If your goal is to legally reduce your tax burden, the best countries to consider when moving overseas are not the ones you will hear about from your normal social circle.

And you won’t find them by following the crowd, either.

Here at Nomad Capitalist, we’re constantly on the lookout for places that are off the radar but offer great benefits. We recommend countries like Armenia, Colombia, Montenegro, Malaysia, and Georgia instead of the usual brand names like Spain, Indonesia, Thailand, France, and Italy.

But we never blindly recommend a country to someone without considering the big picture. We are in the business of creating holistic offshore plans, and that means fitting every piece of the puzzle together to fit you individually, including where you live.

The following factors will help you understand your individual needs when moving overseas and ease the decision-making process:

4. Replicate Your Desired Lifestyle

Everybody wants something a little different. That’s why there’s really no good or bad place to go. What matters is finding what you want.

There’s an energy in each place you go, and if you’re attracted to that energy, that’s a good sign. But if one particular location has the right energy but the wrong tax rate, understand that you can often replicate what you want somewhere else.

If you have your heart set on a location, take a step back and think about what it is about that place that makes you want to live there. Whatever it is, most probably, you can find those elements somewhere else.

There are, of course, some things (like a city’s vibe) that are not always replicable, but the question is, do you want to save money?

The key is knowing what you want.

5. Incorporate Tax Planning

If you’re leaving your country because of its high taxes and you’re moving overseas to another high-tax country, you’re not really solving any problems.

In some cases, you may make things worse.

Simply leaving your country is not the only piece of the puzzle you need to fit together. Where you’re going also matters.

Places like Spain, Italy, Indonesia (for Bali), and others require a lot of tax planning.

If you don’t want high taxes, you have to be open-minded enough to consider the countries that have better tax options. Or, you need to be moving around enough to use our Trifecta method so that you do not become a tax resident in these high-tax countries.

There are countries that are tax-friendly and some that even have zero taxes, others have tax exemptions, territorial taxes that exclude your foreign income, low lump-sum taxation, or flat taxes.

Whatever the case may be, you can save tens or even hundreds of thousands of dollars – millions of dollars a year in some cases – by choosing to live in these places instead of dogmatically pursuing one high-tax country because of its brand-name appeal.

Don’t be addicted to one place. It can get in the way of your ultimate reason for moving overseas.

If you’re addicted to the idea of living in Dubai, then lowering your taxes is going to be much easier/

But if you like the idea of living in Spain, a small change can make all the difference.

If you love Spain for its beaches, Portugal is right around the corner and offers non-habitual tax residence. Or, you can head to the Southern tip of Spain and enjoy a low lump-sum tax in Gibraltar. And if beaches aren’t your thing, you can head North, and you will find the mountains and forests of Andorra.

All three countries offer most, if not all, of the benefits that Spain does, but they are far more beneficial from a tax perspective.

Start With The End In Mind

If you are considering moving overseas, the key is to start with the end in mind. From there, you can go through the process of finding the means to that end.

If you are addicted to one country, you’ll end up doing the whole process backward, jeopardizing your ability to optimize your tax situation.

If you’re moving overseas to save on taxes, focus on the options that will enable you to do exactly that. The money you will save by doing so will compound over the years, granting you the personal and financial freedom you need.

That’s what the Nomad Capitalist lifestyle is all about. The things that you think are amazing may not be quite as amazing as you believe.

Are you willing to pay the price of high taxes to learn that lesson, or are you willing to be open-minded and see what other options are available to you?

Set up a call with us today to know all your options so that you don’t have to regret later.

Is Grenada Safe for Visitors, Residents and Families?

Evaluating a nation for tourism, relocation or investment begins with a single, non-negotiable factor – safety. Security, from both a personal and financial point of view, is the foundation upon which all other considerations rest. And while it’s easy to assume that stability is a given in the developed world, recent challenges in countries like […]

Read more

Is Antigua Safe for Tourists, Families and New Residents?

Security is a cornerstone of any serious investment migration strategy. For high-net-worth individuals (HWNIs) and globally mobile families, it ranks alongside tax efficiency, political stability, and quality of life as a key driver in deciding where to live, invest or acquire a second passport. Too often, safety is assumed to align with economic development. Countries […]

Read more

Is St Kitts and Nevis Safe? Tips for Tourists and Residents

Safety is a non-negotiable factor for anyone considering whether a country is right for travel, relocation or investment. Overlooking such a vital consideration carries serious consequences, and the stark truth is that assumptions based on a country’s global image often fall short of reality. Cases in point include the following countries: The takeaway is clear: […]

Read more