7 Tax-Friendly Countries for High-Net-Worth Expats

May 13, 2025

Numerous countries make it possible for you to pay less tax legally.

Significantly less tax.

In fact, zero tax in some cases.

If this is something you’re interested in, you’re in the right place, as it’s part of a process the Nomad Capitalist team calls ‘going where you’re treated best’.

Simply put, we believe you should be able to move your life, money, investments, business and even your citizenship to a location where you will get the attention and treatment you deserve.

After all, as a high-net-worth individual, choosing a new base should be about more than just location. It’s about finding somewhere that aligns with your financial and lifestyle goals – somewhere you’re treated best.

One immediate benefit is finding the most tax-friendly countries (or even entirely tax-free places) that give you options.

So, if you’re after a tax-friendly country to live, work or invest your capital in, set up a call with us today.

How to Choose the Right Tax-Friendly Country

Choosing the right tax-friendly country requires an approach that aligns with your financial goals, lifestyle preferences and long-term plans.

Without proper planning, you could still face tax obligations.

Start by assessing the country’s tax policies, including income tax rates, corporate tax structures and wealth or inheritance taxes.

Looking beyond low-income tax, factors like residency requirements, banking stability, legal protections and ease of doing business all play a crucial role in finding the right place.

Some jurisdictions, such as Monaco or the Cayman Islands, offer outright tax-free living but come with high costs of entry. Others, like Malaysia or Singapore, provide structured tax incentives for foreign investors and entrepreneurs.

You’ll also need to consider your current home country and how it might affect your tax status.

Look into tax treaties and explore options beyond simply moving to a country with no taxes. You might find ways to vastly reduce your tax obligations without needing to move to a new country outright.

On top of this, you’ll also want to consider the country’s residency and citizenship options, as some require significant investment.

If you’re a US citizen, remember that the Internal Revenue Service follows you globally unless you renounce your citizenship, making a well-planned tax strategy essential.

7 Best Countries for Wealthy Expats

Of course, for wealthy expats, the ‘best’ country to live in is entirely subjective, but it usually won’t tax you through the roof.

If you’re looking to drastically reduce, or even eliminate, your tax burden, here are some of the best places to do it.

A few countries on this list are commonly referred to as ‘tax havens’, but we recommend caution as the term is often misleading.

1. Monaco

Right off the bat, Monaco is a famously tax-free country. This means that, for the most part, the taxman will leave you alone as long as you’re not a French citizen.

Key information:

- Income tax rate: 0%

- Corporate tax rate: 25%.

You can secure residence by depositing anything from €500,000 to €5 million in a Monaco bank. Permanent residence is available after ten years, after which you could be eligible for citizenship.

But, there’s a caveat – you can’t just have a paper residence – you actually need to spend time living there.

Even though Monaco is the second smallest state after the Vatican, with a population of roughly 39,000, it offers the highest standards of exclusivity but comes with a hefty price tag.

In Monaco, you’ll trade lower taxes for higher living costs.

In addition, to reside in Monaco, you must deposit at least €500,000 in a bank account in your name.

Realistically, banks can and do request significantly more, so anticipate having to deposit anything from €2 million to €5 million.

You’ll have to submit additional supporting documents, like proof of your bank deposit and any residencies you’ve held for the past five years.

You’ll need to complete an interview with the police department and pass a criminal background check. Then, after ten years, you will receive permanent residence and a potential route to citizenship if you wish.

Monaco is primarily aimed at the ultra-wealthy who don’t mind leaving several million on the table for the sake of convenience.

2. Jersey

Jersey is connected to the UK as a British Crown dependency, but it governs its own affairs, which allows it to have a tax-friendly regime.

Key information:

- Income tax rate: 20%, then 1% on any income above £1,250,000

- Corporate tax rate: 0%.

Is Jersey a tax haven? Again, we’re wary of using the term, but Jersey is a tax-friendly option that people don’t talk about much.

You can obtain residence as a high-net-worth individual by paying £250,000 annually in tax. After five years, you can apply for indefinite leave to remain.

Entrepreneurs and investors can run a company from Jersey and pay significantly less in both personal and business taxes.

You can also get residence as a person of means and pay a minimum of £250,000 per year in tax. Find out more about the Tax Implications of Jersey Residence.

Jersey is certainly an interesting option, particularly with its close relationship with the UK and proximity to London.

Here, you can have a manor house and beautiful gardens within close reach of France and the UK. All while enjoying the benefits of far lower taxes.

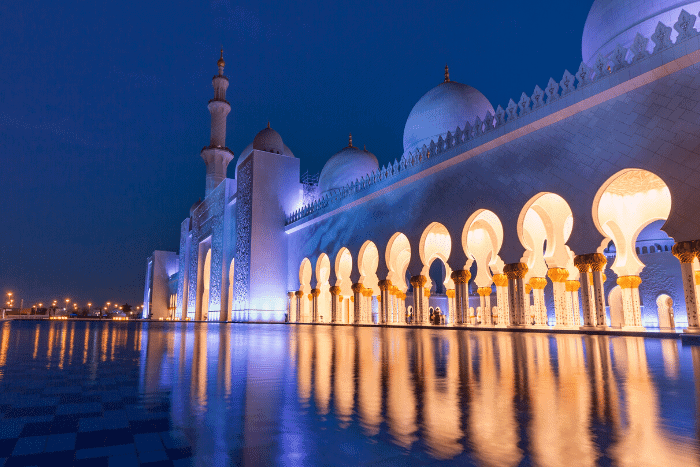

3. The United Arab Emirates (UAE)

With the introduction of 5% VAT and a new corporate tax rate of 9%, the UAE is becoming less hospitable for businesses. Unfortunately, not all free zone companies are exempt from corporate tax.

Key information:

- Income tax rate: 0% personal income tax

- Corporate tax rate: 9% (exceptions for some qualifying free zone companies).

The United Arab Emirates (UAE) is a popular choice for those who want a combination of a hassle-free residence permit and no personal income tax.

You can obtain a temporary residence with little or no fuss if you are employed, make an investment or purchase a property in the UAE.

Longer-term residence by investment is available for substantial investors and costs around US$545,000.

The two main cities of Dubai and Abu Dhabi offer luxury, entertainment and high-quality living. As you will see in our expat guide to the UAE, Dubai is more entertainment-focused, while Abu Dhabi is still glitzy but a bit less frantic.

Life is good in the UAE. You don’t need to worry about much. If anything, you can hire someone in the UAE to worry for you, as every service and product you could ever want is available there.

Some people have reservations about the Middle East, but you’ll be treated exceptionally well when you’re there.

4. Singapore

Singapore attracts the wealthy from all over the world with its tax-friendly policies. It’s home to over 333,000 millionaires and over 40 billionaires.

Key information:

- Income tax rate: Progressive, up to 24%

- Corporate tax rate: 17%.

For a path to residence and citizenship, you can invest SDG10 million (US$7.4 million) in a business or SDG25 million (USD$18.5 million) in a fund under the Global Investor Program (GIP).

Permanent residence may lead to citizenship.

In Singapore, your foreign-sourced income is tax-exempt, while income earned there is taxed at progressive rates ranging from 0% to 22%.

To learn more, see our Ultimate Guide to Establishing a Singapore Tax Residence.

Nicknamed ‘The Little Red Dot’ on the Southeast Asian Sea, this city-state and island country is small but packs a global financial punch.

If you want to live in a tax-friendly place with a stable political climate and world-class healthcare and transport, Singapore is well worth considering.

For those looking for a place that’s very well put together and where everything works, Singapore is an excellent spot with lots of investment potential.

5. Bahamas

The Bahamas is an exciting option for those seeking privacy and enjoyment without feeling trapped by having to live there for any length of time.

Under its residence-by-investment program, there’s no minimum stay requirement, and the 45-minute flight to Miami offers an easy connection to the US.

Key information:

- Income tax rate: No personal income tax

- Corporate tax rate: 15% corporate income tax for large multinationals

You can purchase property worth US$750,000+ for permanent residence or expedite this with properties valued at US$1.5 million and over.

Foreign investors may be eligible for a permanent residence permit based on a residential property purchase of at least BSD750,000, which, as it’s pegged to the dollar, is the same in USD.

If your property is worth at least US$1.5 million, you can also accelerate the bureaucratic process to be completed within a speedy 21 days.

The Bahamas is a true tax haven – there are no direct taxes such as personal income tax or wealth taxes.

The government has introduced a 15% corporate tax on the largest multinationals, but it still works if you want to incorporate a smaller company there and enjoy a business-friendly governance regime.

6. Cayman Islands

As an English-speaking British Overseas Territory, the Cayman Islands is a good choice for a luxury lifestyle on a laid-back island.

Much of the Caribbean is well-known for its tax haven status, but the Cayman Islands has long been the crown jewel.

Key information:

- Income tax rate: No personal income tax

- Corporate tax rate: No corporate income tax.

Getting a Cayman Islands residence is pretty straightforward. However, while becoming a resident isn’t too difficult, it is expensive.

For residence, you must invest US$1.2 million (US$600,000 must be in developed real estate) and at least US$2.4 million for a pathway to citizenship.

Although this is a high price to pay, the Cayman Islands offers benefits not available in other Caribbean nations. For instance, as a resident, you have the opportunity to obtain a British Overseas Territories passport.

As always, the decision to choose Cayman Islands residence will depend on your needs and circumstances. While island life is tempting, there might be better choices.idence will depend on your needs and circumstances. While island life is tempting, there might be better choices.

7. Antigua and Barbuda

Antigua and Barbuda offers one of the cheapest CBI programs for families of up to four, making it an excellent option if you’re after a second passport.

Key information:

- Income tax rate: No personal income tax for residents

- Corporate tax rate: 25%.

Citizenship by investment is available, starting at US$230,000 for a family of four.

Although it’s not tax-free, Antigua and Barbuda is a relatively tax-friendly jurisdiction.

If you want a hassle-free place to live with specific tax benefits, you may consider citizenship by investment in Antigua and Barbuda.

It’s situated in the heart of the Caribbean and offers good lifestyle benefits. Plus, you only have to spend five days a year there to maintain your citizenship.

Interested? Our guide to Antigua and Barbuda Citizenship by Investment has all the information you need.

Tax-Friendly Countries for Expats: FAQs

Monaco, the UAE, the Bahamas and the Cayman Islands are some countries with no personal income tax and very low (or no) corporate taxes.

The Bahamas and other Caribbean islands, like St Kitts and Nevis, are particularly easy for Americans due to their proximity, lack of language barrier and straightforward investment-based residence options.

The Bahamas and the UAE are both tax-free and offer relatively simple residency options through property investment.

The UAE has 0% income tax and minimal residence requirements. However, various tax-free countries exist, including Monaco, Vanuatu and tax havens in the Caribbean. There are also a number of low-tax countries where residence-by-investment is more affordable in less far-flung places.

Jersey is a tax-friendly British Crown Dependency with low personal and corporate taxes. However, it’s not a typical tax haven in that it does not offer zero taxes.

Some of the best tax-friendly countries for expats include Monaco, the UAE, the Bahamas, the Cayman Islands and Singapore. These countries offer low or zero personal income tax, making them attractive for high-net-worth individuals. However, residency requirements and living costs vary, so choosing the right country depends entirely on your financial and lifestyle goals.

The most tax-friendly countries are often located in regions like the Caribbean (Bahamas, Cayman Islands, Antigua and Barbuda, St Kitts and Nevis), the Middle East (UAE) and Europe (Monaco, Jersey). These places have either no income tax or structured tax incentives for foreign residents. Some Asian countries, like Singapore, Malaysia and Hong Kong, also offer competitive tax benefits to expats and entrepreneurs.

Go Where You’re Treated Best

In some countries, the tax-free label only applies to your personal income.

For example, in Dubai, a 9% profit tax is levied on many companies.

In the Caribbean, you need to establish permanent residence or citizenship to avail yourself of tax-free living. But it comes at a cost – you’ll be asked to pay for citizenship by buying property, making a donation or investing in a business there.

So, the process of finding tax-friendly companies is complicated. There are a lot of moving parts, which means that in order to legally reduce your taxes, you’ll have to plan carefully.

Even if you do get permanent residence or citizenship in one of these countries, you may still face a tax burden from somewhere else.

And if you’re a US citizen, there’s no way of truly escaping the IRS without renouncing your citizenship.

That’s why you need a holistic strategy that considers your lifestyle, tax residency status and other factors to ensure you can legally reduce your taxes as efficiently as possible.

At Nomad Capitalist, we help seven- and eight-figure entrepreneurs and investors create bespoke strategies using our uniquely successful methods.

This will allow you to keep more of your own money, create new wealth faster and be protected from whatever happens in just three steps.

If you want help understanding the ideal option for you, your business, and your family, feel free to reach out to our team.

Is Grenada Safe for Visitors, Residents and Families?

Evaluating a nation for tourism, relocation or investment begins with a single, non-negotiable factor – safety. Security, from both a personal and financial point of view, is the foundation upon which all other considerations rest. And while it’s easy to assume that stability is a given in the developed world, recent challenges in countries like […]

Read more

Is Antigua Safe for Tourists, Families and New Residents?

Security is a cornerstone of any serious investment migration strategy. For high-net-worth individuals (HWNIs) and globally mobile families, it ranks alongside tax efficiency, political stability, and quality of life as a key driver in deciding where to live, invest or acquire a second passport. Too often, safety is assumed to align with economic development. Countries […]

Read more

Is St Kitts and Nevis Safe? Tips for Tourists and Residents

Safety is a non-negotiable factor for anyone considering whether a country is right for travel, relocation or investment. Overlooking such a vital consideration carries serious consequences, and the stark truth is that assumptions based on a country’s global image often fall short of reality. Cases in point include the following countries: The takeaway is clear: […]

Read more