Establishing a Singapore Tax Residence: The Ultimate Guide

June 6, 2023

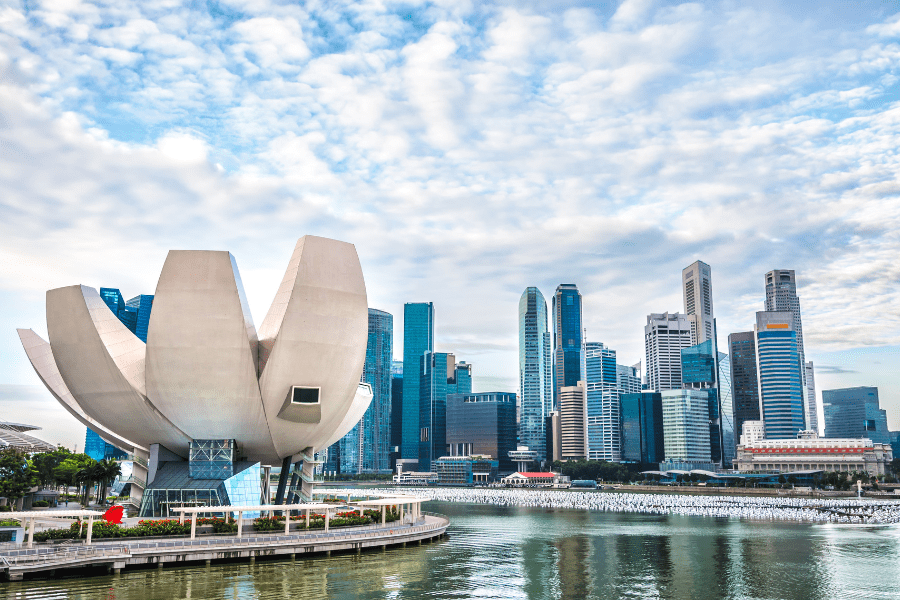

Singapore is a small island nation just south of the Malay peninsula. It’s a place of eternal spring, without snow or cold weather, thanks to its place at the equator. It comprises 64 islands, with Pulau Ujong being the largest.

Singapore has a lot to offer foreign investors. With low corporate taxes and several incentives for entrepreneurs and business owners, there’s a lot of room for growth and prosperity.

If you’re thinking about making the move to get a tax residency in Singapore, let us help you. Our team at Nomad Capitalist are experts on how and and where to go to be treated best.

Overview of Singapore

Singapore is a unique island city state located in the south pacific ocean. It was once a colony of the British empire, but has been an independent country since 1965. They have a parliamentary republican form of government, with an elected parliament and president.

The president is the head of state, who’s responsible for appointing the prime minister and other ministers of cabinet. Their government structure is similar to that of the United States, with an Executive, Legislative, and Judicial branch.

The climate is tropical, since the small island is located near the equator. Despite its small size, however, it has a growing population and excellent infrastructure.

Singapore is not a single island, but comprises 64 surrounding islands. Together these small islands make up 728.6 square kilometers. This is smaller than Rhode Island in the U.S.

Don’t let the size deceive you, though. There’s plenty of open space and wildlife preservation space. While the main island is fully developed with a bustling city life, most of the islands are undeveloped. This gives the islands a great balance between natural wonder and industrial development.

Of the 5 million inhabitants, approximately 1 in 5 are millionaires. This is because Singapore offers several tax benefits and business opportunities that appeal to wealthy foreigners and local investors.

Becoming a Tax Resident in Singapore

Before we jump into the ins-and-outs of Singapore’s tax residency, let’s briefly address the question of what is a tax residency? Tax residency is the place where you’re legally required to pay taxes.

Tax residencies differ from second residencies. Second, residencies allow foreigners to reside in a different country permanently or temporarily. Tax residencies don’t necessarily require you to reside within the national borders. Rather, you just have to pay taxes.

Getting a different tax residencies can save you thousands of dollars in taxes every year. This is especially true if you live in a nation where the tax rates are high. Moving your tax residency to a country like Singapore is a great way to pay lower tax rates.

How to Get a Tax Residency in Singapore

Getting a tax residency in Singapore is a little harder than getting one in some other tax friendly countries. But it’s far from impossible, and can be well worth the effort.

Tax residency in Singapore can be obtained on a personal or business level. Businesses are considered taxable “citizens” if they are managed and incorporated within the country’s borders. This business will be considered a taxable business within Singapore after a year.

Individual tax residency requires you to reside within the nation for three years for the majority of the year. It’s best to spend at least 183 days in the country each year for the three year period, although it’s not always necessary.

Alternatively, entrepreneurs can apply for an entre-pass into the country. This pass is essentially a business visa and allows entrepreneurs to open and manage their own business in the country.

Finally, you can apply for tax residency by participating in the global investor program. To qualify for this program you must invest a minimum of $10 million SDG in a company or $25 million SDG in an approved fund.

Benefits of Singapore Tax Residency Status

Tax-Friendly

While the Singaporean tax residency laws are somewhat complex, they include several tax exemptions and incentives for different work in Singapore. Singapore also offers greater deductions than in other developed countries.

For example, newly incorporated companies are exempt for the first three tax filing years from 75% of corporate income tax on the first S$100,000.

Favorable Tax Treatment

Singapore offers a special designation known as “not ordinarily residents.” To qualify as a NOR, making you eligible for favorable tax treatment for five years of assessment, you must have been a non-resident in Singapore for three years. A NOR taxpayer pays income tax on the employment income correlating with the number of days in a calendar year they are resident in Singapore.

Income Tax Rate

Singapore has a territorial tax system, so you will not be taxed on your worldwide income. This is true even if you live there full-time and become a tax resident. This also includes the income derived from overseas paid into a Singapore bank account.

The Income Tax Act has a few exceptions to these tax residency rules. Still, they mostly relate to overseas income accrued through Singaporean employment and income earned in Singapore through Singaporean partnerships. Foreign income from corporations and other investments is tax-exempt.

Inheritance Taxes

You will not pay tax on income earned from inheritance in Singapore if you have tax residency status.

Capital Duty Taxes

Singapore does not have capital duty taxes.

Wealth Taxes

Singapore does not levy any wealth tax on its tax residents.

Avoidance Of Double Taxation

While resident and non-resident companies are generally taxed at the same rate, a business that is a resident of Singapore avoids double taxation thanks to the DTAs Singapore has in place with other countries.

Things to Consider When Applying for Tax Residency in Singapore

Even though Singapore is a favorable tax country, it is not a tax haven. This means that by moving to Singapore you’ll save money on taxes, but you won’t be living in a zero tax country.

Singapore’s tax system is not progressive, and currently taps out at 22%. This will increase further in 2024 with a rate of 23% on income between $500,000 to $1 million SDG, and 24% on income in excess of $1 million SDG.

So if you’re looking to move your wealth to a zero-tax nation, Singapore isn’t the place for you. However, if you’re looking to move your business to a more favorable country to grow, Singapore is the best place to go.

Conclusion

Singapore is a gorgeous country with tropical weather. The balance of industrial areas and open space make it the perfect place to go to experience growth and tranquility.

We hope this article helped you better understand the nation and what it has to offer you. We recommend Singapore to any business owners wanting to move away from crippling corporate taxes.

Our team at Nomad Capitalist have helped thousands of people move to places where their businesses aren’t crippled by taxes. Please contact us today so we can help you make the best choices for your future.

Singapore Tax Residence FAQ

All people who stay within Singapore for at least 183 days are considered a tax resident. This means no matter your citizenship status or residency status if you remain in the country for 183 days per year then you must pay tax in Singapore.

Yes, Singapore taxes foreigners, but only if they qualify as tax residents. Tourists who stay in the country for less than 183 days per year are not taxed. Money from businesses incorporated outside the country may be taxed if the money is brought into the country.

Whether or not you think a Singapore tax residency is right depends on your needs and desires. While Singapore can be a beneficial move, depending on your circumstances, it’s not the first residency our team would recommend.

If you’re unsure and want professional advice, contact Nomad Capitalist and let us help.

The Best Countries for Investing in the Middle East 2025

The global investment landscape has changed dramatically. Gone are the days when opportunities were limited by geography or confined to traditional stocks and bonds sold only through standardised, rigid and often cumbersome channels. Back then, going ‘global’ might have just meant adding a few European equities to a US-based portfolio. Today, everything has changed. Barriers […]

Read more

Best Gulf Country for Company Formation and Business Setup

For ambitious entrepreneurs, the Gulf region offers a powerful blend of top-tier banking systems and business-friendly laws that streamline company formation and make the process remarkably efficient. Countries like Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the United Arab Emirates (UAE) are actively competing to attract the world’s brightest business minds – and it’s working. […]

Read more

Top Offshore Tax Havens in the Caribbean

When people hear the term ‘tax haven’, it often conjures up images of shadowy offshore bank accounts and shady financial dealings. The reality is far more practical and much less sinister. Caribbean tax havens aren’t just for billionaires or corporations with armies of lawyers. In fact, many everyday entrepreneurs and investors take advantage of the […]

Read more