Gold has grown by more than 5% in 2023 alone, continuing a bullish trend that has seen its price double over the last 10 years.

In fact, earlier this year, the price of gold came close to hitting record highs at over $2,000 per ounce. Experts predict it will continue to grow steadily in the longer term. In a time of global economic uncertainty and rising interest rates, gold is a safe haven that offers tangible reassurance.

Like every commodity, its value may fluctuate, though its long-term resilience makes it the perfect safeguard against both short-term market shocks and prolonged periods of economic or geopolitical uncertainty.

It should come as no surprise to hear that more and more governments, particularly China, have begun stockpiling it in greater amounts, further adding to its value. Given its advantages as part of a diversified wealth portfolio, buying gold is usually a sensible choice, the only question is where and how you store it.

So, in this article we look at the best countries for offshore gold storage and what you need to look out for to ensure your gold remains safe.

Don’t just sit there worrying about tomorrow, take control of your future with a shock-proof Action Plan from Nomad Capitalist. You can find out more here.

Top Wealth Havens For Precious Metals

I’ve been coming to Singapore for business for nearly a decade now. During that entire time, I’ve been studying and meeting with players from two markets: banking and precious metals.

Back in the early 2010s, Singapore decided to eliminate GST – basically a form of sales tax – from the purchase of precious metals. They also decided to make it easier for anyone to trade in and hold precious metals in the city-state.

As a result of those policies, Singapore has come from relative obscurity to become one of the top wealth havens in the world for precious metals investors. But is it the best place to store your gold offshore?

Considering the history of gold confiscation, wealth taxes, and other political grabs for precious metals and wealth in general, it’s important to have a safe haven for your gold no matter what happens where you live. We at Nomad Capitalist believe that storing gold offshore, outside of your home country, is an important step toward financial diversification.

As a bonus, precious metals vaulted offshore and outside of the banking system are legally non-reportable for taxpayers in the United States and a number of other countries.

We are NOT talking about storing your gold in a bank safety deposit box or some storefront; we’re talking about private vaults with high-level security and experience with ultra-high-net-worth individuals and institutions.

We’ll first look at my gold storage checklist for selecting the best country to store gold and then we’ll examine some of the most common countries for storing gold and silver in offshore vaults and which ones win our top recommendations.

My Gold Storage Checklist

Let’s discuss my criteria for the best and safest place to store gold:

1. Your gold should be stored outside of your home country to provide asset protection from your own government. One reason for buying gold is to detach yourself from a single country and its monetary system.

Keeping some gold coins or silver bars in a safe at home makes sense, but not your entire holdings.

2. Your gold should be stored in a safe haven jurisdiction with an excellent record as a wealth haven. While I often encourage our clients to consider second passports and even offshore bank accounts in emerging world countries to create international diversification, your stack of gold bars isn’t an area where you want to fool around with countries that have an untested status as a safe haven.

That means no countries like India (bad) or Thailand (too new as Asia’s “new wealth haven.”)

3. Avoid countries with “unholy alliances” to the extent they are a risk. Storing gold in London is more interesting post-Brexit, as is gold storage in Switzerland. As much as I like Ireland as a country, their membership in the European Union scares me, so I would tend to avoid places like Dublin, Amsterdam, or Frankfurt as my first choice.

The European Union likely won’t issue a full-stop gold confiscation and these places may be good as a secondary vault location, but they wouldn’t be my first choice.

4. Avoid vault storage in countries that are under pressure from larger powers. While Canada is a neutral country without any real “unholy alliances”, they are best friends with the United States. If you’re an American or have exposure to the United States, I wouldn’t necessarily trust Canada.

In the same way, I wouldn’t trust a place like Belize that’s under the thumb of the US government. (Canada, however, could work for non-Americans and non-Canadians.) While Canada certainly has rule of law and you wouldn’t expect any issues, it wouldn’t be my top pick for this reason.

5. Similarly, I may (or may not) choose to favor countries that are NOT under pressure from any other powers. For this reason, storing gold in Hong Kong or even Shanghai could be an interesting “put option” in the western world. For as many issues as Hong Kong has had, it’s still part of China and that may actually increase your asset protection. No one is going to mess with China.

6. Avoid gold storage in countries that don’t have highly secure physical gold storage vaults. While Panama is a neutral country conveniently located between both North and South America, I’ve been there and have not been impressed by their gold vault facilities.

Your gold and silver should be held under the strictest of security measures. There are plenty of offshore vaults fit for a James Bond movie; don’t settle for those with rinky-dink security.

7. Your gold and silver should be stored in a place with proper professionals who can sell, store, buy back gold, and wire your funds anywhere in the world. You could store your gold in Tehran as the ultimate protection against the West, but who would you call when you wanted to sell it? How would you communicate? And how would they actually get the money back to you?

Choose a respected jurisdiction with good banking infrastructure and qualified professionals who have experience in the precious metals business.

By applying those criteria, we can safely rule out many countries and many private gold storage facilities.

As a former US citizen, I would not choose to store my gold in the United States, nor do I recommend any Americans or anyone with a connection to the United States to do so. The US government sticks its nose in way too many peoples’ business to be trusted with an asset class that they previously confiscated.

I would also eliminate Canada, the United Kingdom, Australia, and European Union countries. While places like Austria and Germany still have some modicum of bank secrecy laws, these countries have too many regulations and practice too much moral outrage to be my first choice.

The Best Places to Store Gold Offshore

These days, buying gold is easy. In many places, gold dealers will sell and ship directly to your door. And about anywhere you go, gold shops are a common sight. The hard part is knowing what to do with your gold and silver once you have it.

While some people are content to hide their gold in a coffee can or bury it in their backyard, smart investors know they need to place their gold and silver in a safer place. For the internationally-minded, this means moving your bullion offshore.

But where offshore?

The world is a big place and not every country is made alike, especially when it comes to offshore gold storage. The following are our top picks here at Nomad Capitalist for the best countries for offshore gold storage.

Singapore

Singapore is my #1 choice for gold storage. The city-state has long been the Switzerland of Asia; it is modern, efficient, and responsive. And corruption and crime are about as close to zero as you can get anywhere.

Singapore’s private gold storage facilities are more modern than in countries like Switzerland, and some vaults offer online access and even photos of your gold. There is an entire well-oiled ecosystem to buy, sell, swap, and even borrow against your gold and silver, all at reasonable spreads.

Other companies outside of Singapore also maintain space in vaults like Le Freeport, the vault I visited there that’s ready for a super spy. The vaults in Singapore truly are the best in the world.

The island country also has the benefit of independence and security. For instance, the Malaysians aren’t going to invade Singapore. It’s on the level of New Zealand in terms of geographic advantages, but with much better services.

In fact, I’d go so far as to say that Singapore has the greatest innovation in the gold storage industry.

While old school European wealth and management is all about parking your money and leaving it there without doing a lot of transactions, Singapore is all about you buying one silver coin and starting an account.

While you can always buy more, both SGPMX and BullionStar allow you to start storing by spending as little as USD$20 on gold. And if you already have gold and silver that you want to move to Singapore, they cover that as well.

On top of all that, they also love transactions. Asian banks, in general, love transactions. If you’re not doing enough transactions in an Asian bank, they’ll ask you why. Conversely, European banks don’t want you to transact money at all and prefer you just leave it there.

The same goes for gold. In an era when Europe is becoming more tumultuous, Singapore is becoming the new wealth hub.

Because of the growing storage industry, there are also a lot of companies there that are now loaning money against gold. While I don’t do debt, if you have gold, you can borrow against it. It’s also possible to buy gold with no spread in Singapore. You can buy gold from SGPMX and exchange it with another client. There’s a lot of innovation there that’s constantly making things easier.

In fact, when I originally spoke with Victor Foo from SGPMX, he told me about a new, even more innovative product that they were rolling out: gold-backed debit cards.

You can now sell your gold or silver and then have that money put onto a debit card that they issue you. You can then use that card in five different currencies anywhere in the world. With this setup, you no longer have to wire your money out of your gold account back into the banking system. You can just use the debit card.

No doubt, there is a lot of innovation going on in Singapore.

That is why it takes the number one spot on this list, not necessarily because it’s hands down the best place to store gold – although an argument certainly could be made for that – but because they’ve dominated the industry in terms of innovation.

If you’re looking for a recommendation, Le Freeport by the Singapore airport is the best storage facility in my opinion. I’ve been there multiple times and I can honestly say it’s the safest, most impressive facility in the world.

New Zealand

While New Zealand is regrettably part of the Five Eyes government spying program, they are undeniably a wealth haven that has remained rather neutral.

In fact, I would argue that storing gold in New Zealand is a government play. It’s not a low-tax government, but it’s a very wealth-friendly government. I don’t see the government going in and confiscating gold — that’s not necessarily their top priority.

I also like New Zealand because it is far away from the chaos of the world’s problems. Plus, thanks to its location in the southern hemisphere, you don’t have any kind of threats, whether it’s weather or any of the political drama that goes on elsewhere.

And despite its isolation, New Zealand has a developed economy, a solid global reputation, and professionals who can help with your offshore gold storage, purchases, and sales.

It is also a convenient choice simply because New Zealand is a common law and English speaking country.

People who are storing money in London will likely find New Zealand has the benefits of storing on an island without the consequences of all the political entanglements of the UK. If I were to store on an island, I’d rather it be New Zealand than the UK.

If diversifying and storing gold and other assets around the world, New Zealand does deserve a place on your list.

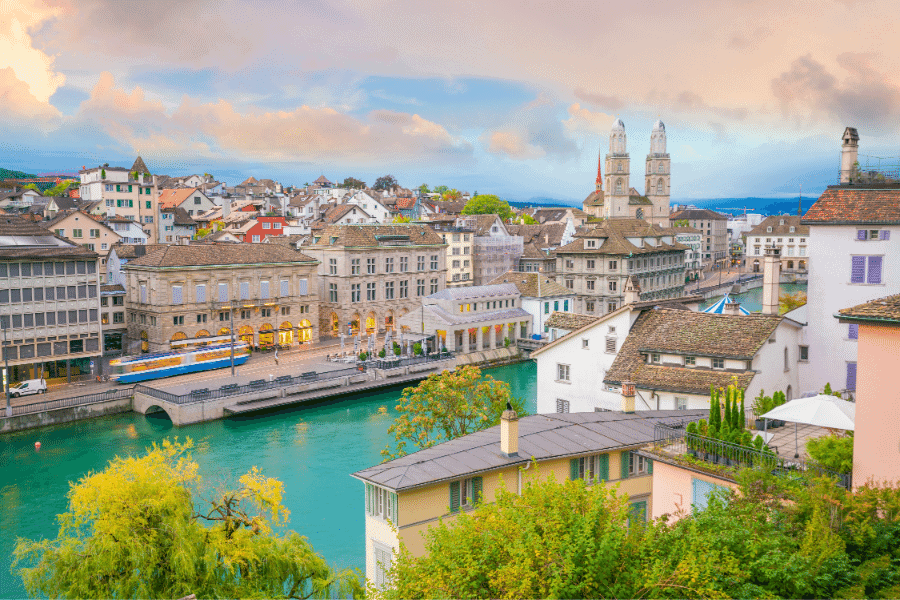

Switzerland

Switzerland is the old-school choice. If you asked the average person about offshore gold storage, Switzerland would probably be the only place that they could think of. And they’re definitely justified in their assumption because Switzerland remains a good place to store gold.

In fact, it has the world’s largest reserves of gold per capita.

However, you’re going to see people moving their money out of Switzerland in the coming years. I know people who have already started moving their gold to Hong Kong or Singapore from Switzerland. Fees in Switzerland are high and the service just isn’t as good.

They are not very favorable to transactions and want to keep your money under management.

But while the Swiss government destroyed bank privacy and bank secrecy many years ago, there are still plenty of gold vaults, and every online gold seller worth his salt offers vault storage in Switzerland.

Switzerland makes a good secondary vault location if you have an extensive portfolio, only because wealth is moving eastward and Singapore is coming out the clear winner.

Switzerland is not keeping up the pace, but as an old school jurisdiction, they don’t necessarily need a lot of advanced options. They don’t offer leverage or loan provisions or even allow you to take the gold out yourself with an impromptu visit, but it’s still a very good place to store.

There are a million services there with very good ways to store metals and many facilities to choose from.

Switzerland is also a great place because they don’t have currency restrictions. If you’re flying from Switzerland to Hong Kong, there’s really not much to report in terms of cash and precious metals. In essence, while the rest of Europe is engaging in the War on Cash, Switzerland is a breath of fresh air.

So, while Switzerland is no longer the best place to store gold offshore, it still earns a place on this list. Neutral, developed, and respected, it has served as a safe haven for the world’s wealthy for centuries.

Other Gold Storage Countries To Mention

Israel

The wild card on my list is a country you may not have thought about, yet Tel Aviv is worth considering for international gold storage. Numerous precious metals and logistics companies have a base in Tel Aviv and are well-versed in handling your precious metals.

While the country isn’t as well-located as others, I wouldn’t have many concerns about the security of vaulted precious metals there. Israel is neutral from a western vantage point – friends with the United States but also with Russia, for instance – and worth considering.

The Cayman Islands

The Cayman Islands is a relatively new jurisdiction. Some people like it for its proximity to the US and Canada, but it’s actually a bit harder to get there. Still, it’s a very upscale jurisdiction in that whole offshore area.

It’s a premium jurisdiction and that can be a good thing, but it’s three or four times the price of other places that have become just as competitive.

In fact, I’d say that other jurisdictions are competitive enough that it doesn’t often make sense to set up shop there because the banks require very high minimums.

Nevertheless, for people who are looking to get access to it, a colleague of mine at Byzantium has an offer where you can get your first six months of storage in the Cayman Islands for free. As I said, it is a very high-end jurisdiction and they’re realizing that they should get involved in this space.

The only potential concern is that the Cayman Islands is a British Overseas Territory. Short of that, they pretty much have their own management.

There is a small chance the UK could interfere and shut them down like they did to Turks and Caicos a few years ago, but I don’t see it as a real threat right now. Plus, now that the UK has exited the EU, there’s even less of a threat.

Overall, The Cayman Islands is a pretty solid jurisdiction and it’s definitely a lot better than Panama (which I’ve been very underwhelmed by) and you’ll be treated much better. If you’re considering Panama, the Caymans are a much safer option.

Austria

While the Swiss have given up on secrecy, Austria is the one country left in the EU that still values bank secrecy and financial privacy. It’s one of the only places in the world where you can store anonymously.

There are two or three different vaults — including Das Safe in Vienna — where you can rent a box and store gold anonymously. It’s not cheap, but it does give you anonymity.

Quite frankly, the vaults in Austria aren’t as impressive as Singapore. You give up the impressiveness and James Bond quality security of a place like Singapore, but you gain financial privacy and the ability to be anonymous for pretty decent facilities.

Das Safe is the one everyone talks about, but it’s not necessarily the number one option in my opinion — particularly because it’s so expensive since all the small boxes are gone.

The other benefit of storing gold in Austria is that it’s in Europe. If you want to have access to Europe, Austria is your best option in the EU. If the location of your gold storage matters to you, Austria allows you access to lots of other places.

Singapore is one of my favorite places to store gold, but is on a tiny island in the middle of Southeast Asia with limited access to very few places where you probably don’t want to go, so Austria does have the benefit of giving you more geographical options.

Start Storing Your Gold Offshore

Here at Nomad Capitalist, we are strong proponents of including gold in your offshore asset allocation strategy and storing that gold in a private gold storage facility.

If you are just getting started, we have dozens of resources that can teach you everything you need to know, from how to buy gold to how you can get paid in bullion. Here are just a few of the topics you can find on our site:

- Offshore Gold Storage

- How to Get Offshore Gold Storage in Singapore

- The Cheapest Place to Buy Gold

- Getting Paid in Gold

- Gold Confiscation

- How to Buy Gold

- Why You Need Offshore Gold Storage

- Where to Hide Gold and Silver

- How to Get a Gold-Backed Debit Card

And if you’re interested in starting small with offshore gold storage, visit our partners in Singapore, who will sell you as little as one gram of gold or silver with segregated, allocated storage in their private vault.

If you’re interested in moving or investing $100,000 or more in gold or other bullion, feel free to contact us for help with your plans.