12 Crypto Tax-Free Countries That Don’t Tax Bitcoin Capital Gains

October 18, 2024

If you’re not already familiar with cryptocurrency, don’t worry. You can get a quick Crypto 101 crash course before you read through the rest of this guide on crypto-tax free countries (and why it’s important to look for countries with no Bitcoin capital gains if you’re a crypto investor).

To make a long, technical story short: cryptocurrency has come a long way since it emerged back in 2008. Instead of just being thought of as an alternative currency, it has now become a sought-after investment. In fact, some argue that crypto is the future.

While physical, printed cash is still the medium that most countries use, many are adopting digital forms of currency.

But not so fast, in some countries, that adoption comes laden with regulations. Yet, you may be able to escape those regulations by adding digital assets to your wealth portfolio.

Whether you want to diversify your assets by investing in cryptocurrency, discover crypto- friendly countries or expand your passport portfolio, Nomad Capitalist can help you.

We’ve helped many crypto-investors go where they’re treated best, and we can help you do the same. Get in touch with us today to discuss your Action Plan. Then, keep scrolling through to learn where to go if you want to live in one of the most popular tax-free crypto countries in the world.

Which Countries Are Crypto Tax-Free?

While many countries may follow suit with the US and start taxing capital gains on Bitcoin, there are still several countries that don’t. Here are 12 for your consideration that don’t tax Bitcoin capital gains.

Belarus

In 2018, Belarus created a ground-breaking law that legalized cryptocurrency. The law stated that until at least 2023, individuals and businesses that mine for or invest in cryptocurrencies are exempt from paying taxes on them. This year, the law may be subject to review. However, currently, in Bulgaria, crypto is considered a personal investment, so you can mine, buy, or sell cryptocurrencies here freely.

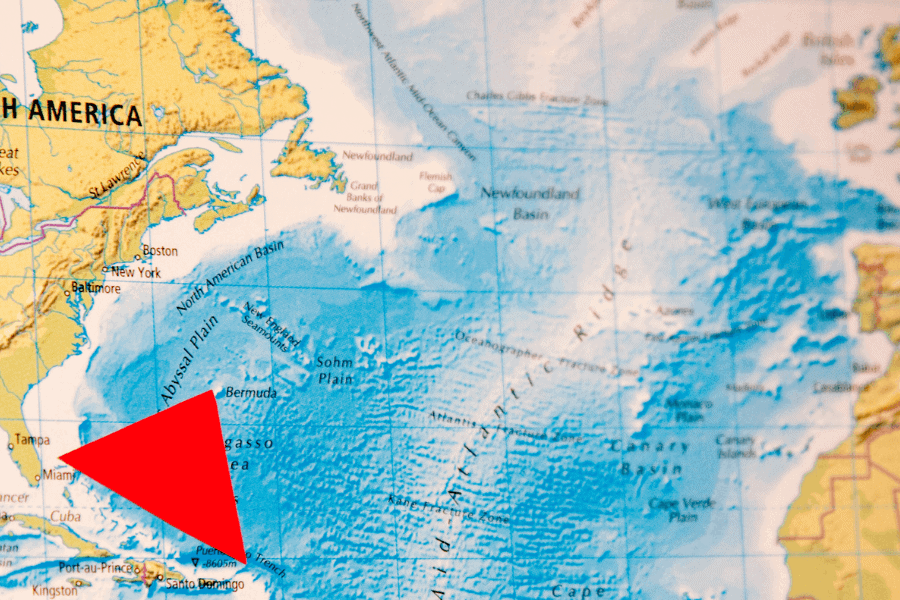

Bermuda

Bermuda does not impose taxes on digital assets or their transactions. That includes no income tax, capital gains, withholding, or other taxes. And as of 2019, any taxes that you do incur there can be paid with USD Coin, another digital coin.

Want to incorporate Bermuda in your offshore Plan? Read our ultimate guides about opening an offshore bank account and establishing residency in Bermuda.

British Virgin Islands

This tax haven is neutral when it comes to capital gains, corporate income, or withholding taxes. And for the time being, that includes cryptocurrency as well. This means that there are no specific taxes imposed against cryptocurrencies in the British Virgin Islands.

To bank or run a business in BVI, read our ultimate guide about BVI incorporation and BVI banking.

Cayman Islands

Like the British Virgin Islands, the Cayman Islands are already a tax haven. This means that the processes of issuing, holding, or transferring digital assets will not be subject to taxes here either.

Relocating to the Cayman Islands can drastically reduce your taxes. However, the Cayman Islands has put a high price on its residency, and it’s almost impossible to bank there as a non-resident.

Germany

Germany can be excellent for long-term crypto holders. In Germany, cryptocurrencies are considered to be private money. As such, they are exempt from taxes. However, you must hold said cryptocurrencies for over a year to be entitled to this perk. And if you sell any assets that have not been held for at least a year, the tax won’t accrue if the sale is less than 600 euros. Unfortunately, businesses in Germany are not as lucky and must pay corporate income taxes on any cryptocurrency gains.

Gibraltar

Already famous for low taxation, Gibraltar does not subject cryptocurrency investments to capital gains taxes. However, there is a fixed 10% corporate tax rate that is applied to crypto-trading.

Hong Kong

In Hong Kong, as long as individual cryptocurrency activities are for investment purposes, there is no capital gains tax. But for corporations, when digital assets are traded as a normal part of business, they are then subject to an income tax.

Malaysia

While you might see it on many lists of tax-free crypto countries, you will want to be careful in Malaysia.

Currently, if you make cryptocurrency transactions as an individual investor infrequently, then you will not be subject to taxes. However, if you are an “active trader,” your virtual assets can incur a capital gains tax.

Malta has an excellent long-term residency program – MM2H – for people looking to relocate to Malaysia.

Malta

Malta is known as ‘Blockchain Island’ and is one of the most crypto-friendly countries. Here, you will not have to worry about capital gains tax for any long-held cryptocurrencies.

However, if you make same-day trades, you will be subject to income tax as you would with day- trading stocks. The country may also subject crypto trades to an income tax.

Moreover, The Maltese Exceptional Investor Naturalisation (MEIN) is one of the best routes to a second passport in the EU.

Singapore

Capital gains tax doesn’t exist in Singapore. Therefore, individuals and businesses that hold cryptocurrencies are not subject to such a tax. However, businesses are liable to pay income tax on any gains.

Slovenia

As with many of these countries, Slovenia applies a different tax law to individuals and to businesses. Here, an individual will not incur a capital gains tax on any cryptocurrency that they sell. However, they will be subject to income tax on their profits, and corporations will be liable to pay income tax at the corporate rate.

Note, however, that the crypto-tax policies may change in Slovenia due to a piece of legislation that’s currently pending.

Switzerland

Considered a crypto-haven and one of the best crypto-tax free countries in Europe, Switzerland also has a few tax breaks for cryptocurrency traders. Individuals that buy, sell, or hold cryptocurrencies will not have to pay a capital gains tax.

However, this country considers cryptocurrency mining as self-employment, so an income tax will be applied to any resulting income from this activity. For professional cryptocurrency traders, a business income tax will be applied. It is also important to note that Switzerland has other wealth and cantonal taxes that may apply.

Additionally, there are other countries that are extremely crypto-friendly that you might want to keep your eye on. Though, they may not have the tax incentives that you’re hoping for.

Should You Move to a Tax-Free Crypto Country?

As the allure of crypto tax-free countries continues to grow, the question arises: should you move to a tax-free crypto country just because they won’t tax your Bitcoin capital gains?

It depends.

Embracing tax-free living by relocating to one of these havens can significantly boost your financial freedom, especially regarding Bitcoin capital gains. Such a move, especially if you’re a high-net-worth individual, requires careful planning and a well-crafted offshore strategy, though.

If you’re a seven- or eight-figure entrepreneur who wants to move your assets to a country where you won’t lose half of your wealth in taxes, contact the Nomad Capitalist team. We’re ready to help you create an offshore strategy for your digital assets.

Top Countries for Crypto and Bitcoin Citizenship and Residency in 2025

If you’re a successful entrepreneur living abroad, you already know that crypto is rewriting the rules of global freedom. It’s not just about finance anymore. Bitcoin and blockchain are reshaping how forward-thinking people like you live and earn around the world. In 2025, Bitcoin is no longer just another investment – it’s a passport to […]

Read more

Top Crypto Tax Free Countries in 2025

Crypto has come a long way. It may have started out on the fringes of finance, but in 2025, it’s firmly in the mainstream. Institutional adoption is widespread, crypto funds are regulated in major markets, and digital assets now sit alongside equities and real estate in diversified portfolios. But while the asset class may have […]

Read more

Understanding the Legal Framework for CBDCs

Central bank digital currency (CBDC) is a digital form of fiat currency which is pegged to the sovereign currency of the issuing nation. Although governments recognize that legal considerations are critical to the development of digital currencies, they’re just starting to come to terms with regulatory design. As such, there is still a gap in […]

Read more