The Best Tax-Free Countries for Americans

May 8, 2025

Americans are faced with a dilemma that’s unique to their citizenship, known as global taxation.

Essentially, it means that no matter where you work or earn money from, you will always have to pay taxes to Uncle Sam. Even if you were born in another country like France, never set foot on US soil, but have a US parent, they can nail you for large sums of your money.

If that seems unfair, then it is.

The sad reality remains that aside from renouncing your US citizenship, there isn’t much you can do about it.

For globally-minded investors or expats, this leaves an even more sour taste in their mouths. It means that even if they want to set up a business or immigrate overseas to favourable tax systems, they still have to be extremely careful.

In fact, for people like this, the best option is to find a country with almost zero to no taxes at all that has double-taxation treaties with the US or one with strong enough tax benefits, as that allows them to only pay taxes on what they earn once.

Thankfully, a few of these countries exist, and when executed right, you can dramatically lower your tax burden. But this will come at a cost.

Aside from investing money to legally move to these new countries, you’ll most likely have to become a tax resident. This means actually moving there and spending significant time in the chosen country.

However, if you’ve ever considered moving from California, Illinois or Massachusetts to a state with much lower tax rates like Florida, there’s no reason not to consider going a little further.

If you can go to Florida, why not Puerto Rico? Or Panama? At the end of the day, it’s going to be less complicated than it looks and far more rewarding when it comes to reducing your tax burden.

To help you find better opportunities, here’s a breakdown of the best tax-free countries for Americans to legally reduce their taxes, generate more wealth and increase their peace of mind.

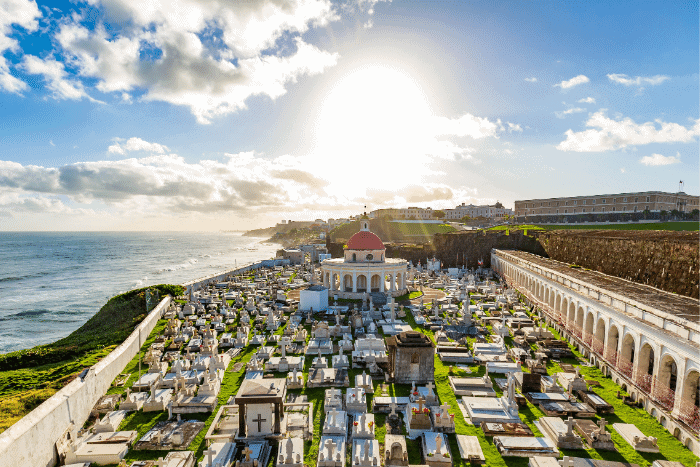

1. Puerto Rico

Puerto Rico isn’t technically a country. While Puerto Rico is a part of the United States, tax laws Act 20 and 22 have created different tax benefits that allow Americans living in Puerto Rico to legally reduce their taxes by 90%.

It’s a popular option.

However, it’s not a solution for everyone, and it requires a lot of planning to make it work. But if you’re following the rules and doing things properly, you could see some great benefits.

For example, you can’t move to Puerto Rico and sell the company you’ve owned for 20 years the very next day and get a capital gains exclusion. Simply moving to Puerto Rico is not enough to no longer pay taxes. The benefits will take a little more work, time and planning.

On the other hand, if you’re trading, Puerto Rico could be a good opportunity for your business to pay a single-digit tax rate.

But that doesn’t apply to all international businesses. If you’re running businesses all over the world, you’re going to need to rectify that with Puerto Rico.

One potential pitfall is the misconception that because Puerto Rico is part of the US, the same level of scrutiny and planning isn’t required. This is a mistake.

Meeting the requirements of Acts 20 and 22 involves passing various tests and demonstrating genuine residency. Simply spending a few months on the island won’t cut it.

All in all, Puerto Rico is a decent option for business owners who like the idea of living there. It’s also a great option for Americans who want to keep their US citizenship while engaging in more passive income strategies.

You only need to make sure you know how to make it work before you rush off and try it.

2. Panama

Some people call Panama City the Miami of Latin America. While it certainly isn’t a cheap place to live, many Americans like Panama.

If you prefer living outside of the city, there are plenty of areas around Panama City with thriving expat communities. If your goal is to find people who make you feel at home, you’ll be able to find many of them in Panama.

On the tax side of things, Panama has a residential taxation system, which means that if you’re running a business or other financial activity outside of the country, they aren’t going to tax it.

Now, with any of these so-called territorial tax countries, there are always questions about properly planning your residence strategy so that you don’t run into any problems. Are you running the business from inside the country? How does that all work?

Failing to answer these could mean that you end up paying taxes on your business there as well.

Generally speaking, Panama is a pretty tax-efficient option for Americans who want to run a business where the actual activity is happening somewhere else. Someone who, theoretically, would be able to spend the entire year in Panama could achieve significant tax benefits from living here.

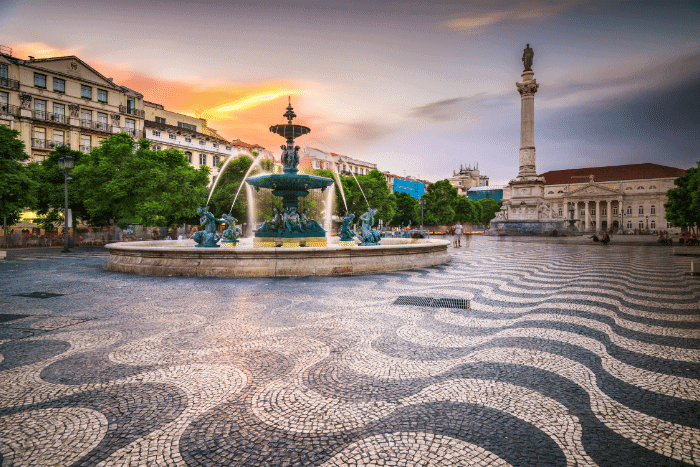

3. Portugal

Portugal is another great country for Americans to move to.

We hear from many different people who like the idea of living in Europe, especially Spain. In fact, we’re working with a few folks right now who have made Spain part of their strategy.

Portugal is the lower tax, less bureaucratic version of Spain.

Unlike Puerto Rico, Portugal had a tax exemption that only lasted for ten years. However, this regime is no longer accepting any new applicants. You won’t find an indefinite tax exemption, and you will have to create proper plans and strategies to make Portugal work. But, those who are currently under the NHR system can live there nearly tax-free.

Another great benefit is that you get to live inside of the European Union without the notoriously high taxes.

And, if you don’t want to be living the Trifecta lifestyle, bouncing around to different bases every three to four months of the year, Portugal is not a bad place to put down roots. You just have to make sure you plan it properly.

The added bonus is that there’s the possibility of getting European Union citizenship, which can open up more options for you and help you build out a passport portfolio.

4. Georgia

While some of Georgia’s immigration procedures have gotten more difficult over the years, and the boat has probably sailed as far as ‘easy residences’ go, it’s still quite possible to buy a home in Georgia relatively affordably.

This and the fact that you can literally show up and get a 365 day visa means you could legally set up tax-residence without too much hassle.

To sweeten the deal even more, Georgia has a territorial tax system and has been doing very interesting things with its economy lately. Georgian companies, for example, follow the Estonian model in a sense where you can, theoretically, pay no tax on your retained earnings in your company until you take the money out.

The challenge for Americans is that, like many other countries in the world, Georgia’s tax system doesn’t quite match up with the US tax system.

The territorial tax system isn’t quite as pure there, and you might get caught in a few bad situations if you don’t properly plan.

That said, if you live there, you can earn money in a foreign corporation, make investments overseas, do all kinds of deals, and pay essentially no tax.

And if Georgia does interest you as a place where you could be living full-time, keep in mind that the residential rental income tax is incredibly low. You could buy some cheap real estate and earn money while you’re there.

Overall, Georgia isn’t a bad place to be.

5. Malaysia

Many people like Southeast Asia, and for Americans looking to make a life there, both Malaysia and Thailand could take up the fifth spot on this list.

What puts Malaysia over Thailand for the fifth is that it appeals to a bigger audience. Thailand attracts a young crowd. Malaysia caters to everyone, including those no longer in their twenties, perhaps even with families and kids.

If this is your situation, Malaysia will give you a bit more of what you’re used to in the United States than Thailand will, and maybe even more than anywhere else in Southeast Asia.

One reason for this is the apartments you’ll be able to find. Looking through listings in Singapore, Thailand, or the Philippines, you’ll be able to find some big apartments, but the standard size will be relatively small.

Malaysia, on the other hand, has lots of wide-open apartments and homes. It’s the only country in Southeast Asia where you can have the so-called “landed property.” If you want your own home with a yard, Malaysia will be your best option.

Additionally, many Americans often feel more comfortable in Malaysia because of how widely English is spoken. In fact, going to Malaysia, and especially Kuala Lumpur, will allow you to live a very multicultural lifestyle without making sacrifices to your quality of life.

In Kuala Lumpur, you can have the Western comforts of excellent health care or get a coffee at the megamall (one of the best in the world) and still be able to go out with locals to one of our favorite Indian restaurants.

It’s like living in the US, but only the good parts.

No country is perfect, but from a tax perspective, you can live there and save. Depending on what you’re doing, you pay either zero in taxes or very little.

Tax-Free Countries for Americans: FAQs

Countries like Monaco, the Bahamas and the UAE have no personal income tax, making them tax-free havens for residents. Although, there are many other tax-free countries in the world.

Puerto Rico, Panama and the UAE are popular tax-efficient options for Americans due to their low or no taxes, especially for business owners and investors. These are also relatively easy places for US citizens to move and integrate into.

While Europe doesn’t have fully tax-free countries, places like Monaco and Andorra offer very low-tax environments for residents.

The UAE, the Bahamas and Bermuda are well-known for having no personal income taxes. These countries attract many expats looking to minimise their tax burdens.

The Cayman Islands, Bermuda and the UAE are excellent tax-free jurisdictions for businesses thanks to their zero corporate tax policies.

Countries like Puerto Rico (with its Act 20 and 22), Panama and Portugal offer favourable tax regimes and are great places for American expats looking to reduce their tax liabilities legally.

A Holistic Offshore Strategy

There you have them – our top five picks for the best countries that are tax-free for Americans.

Six, if you count Thailand, which isn’t a bad option at all.

Whether you like Central America, Asia, or Europe – there are many places where you can go as a US citizen to legally reduce your taxes.

To figure out which one is best for you, get in touch with us today.

Is Grenada Safe for Visitors, Residents and Families?

Evaluating a nation for tourism, relocation or investment begins with a single, non-negotiable factor – safety. Security, from both a personal and financial point of view, is the foundation upon which all other considerations rest. And while it’s easy to assume that stability is a given in the developed world, recent challenges in countries like […]

Read more

Is Antigua Safe for Tourists, Families and New Residents?

Security is a cornerstone of any serious investment migration strategy. For high-net-worth individuals (HWNIs) and globally mobile families, it ranks alongside tax efficiency, political stability, and quality of life as a key driver in deciding where to live, invest or acquire a second passport. Too often, safety is assumed to align with economic development. Countries […]

Read more

Is St Kitts and Nevis Safe? Tips for Tourists and Residents

Safety is a non-negotiable factor for anyone considering whether a country is right for travel, relocation or investment. Overlooking such a vital consideration carries serious consequences, and the stark truth is that assumptions based on a country’s global image often fall short of reality. Cases in point include the following countries: The takeaway is clear: […]

Read more