The Best Offshore Havens for Bank Secrecy

July 10, 2023

Last updated November 14, 2020

Bank secrecy has long been a target of international groups opposed to offshore tax havens. The argument goes that if governments don’t know who owns the account, they can’t effectively tax it.

Scores of tax-loving do-gooders have devoted their life’s work to eliminating bank secrecy under the guise of things like “terrorism” (stooges like Barack Obama didn’t mind spreading the phony message of “tax evaders”, either.)

Despite the fact that things like numbered bank accounts are long gone, groups such as the Tax Justice Network continue their efforts to eliminate privacy around the world.

Today, we live in an environment of transparency.

And that’s fine. It is what it is. There are still ways to enjoy greater freedom, prosperity, and growth by going offshore. You don’t need to hide money to have any of that.

In fact, as the goodie-two-shoes of the offshore industry, I strongly advise that you not go looking for ways to hide your money from the government.

If you’re a US citizen — or a citizen of any number of other Western countries — your citizenship compels you to comply with numerous offshore bank account reporting requirements that negate any offshore bank secrecy the banking jurisdiction may offer.

As distasteful as things like FATCA, FBAR, and CRS may be, I don’t recommend skirting the law. As businessmen and investors, we must be pragmatists. Comply with the laws and find ways to go where you’re treated best, legally.

Now, when I originally wrote this article way back in 2013, European nations such as Liechtenstein were rolling back their bank secrecy programs, which inspired me to compile a list of the most secretive offshore banking countries, which you can find below.

The original ranking was based only on the amount of secrecy offered and not on the significance of the jurisdiction or whether you should actually bank there.

All five countries have now joined the CRS – the Common Reporting Standard – and freely share financial information with almost every other country in the world.

Bank secrecy is dead.

However, there are still a few ways that you can obtain greater bank secrecy and do so legally and for legitimate reasons.

In this article, I’ll explain those reasons and methods, take a look at the original list of the five best countries for bank secrecy, and then present you with the new era of bank secrecy havens.

GET OUT OF WESTERN COUNTRIES

One tactic to gain greater bank secrecy involves legally giving up your taxpayer status in your home country and going to live in a country where they don’t care about your banking details.

If you are a US citizen or permanent resident, the only way to do this is to renounce your US citizenship. Because, up until you renounce (and even for a period of time after), the IRS and Treasury Department want to know where your money is.

But if you are a citizen of another Western country, all you need to do is make sure that you are a tax nonresident in your home country. That doesn’t mean just leaving and hoping you don’t have to pay, you need to go through the legal process to become tax non-resident. Once you do, you can move to a country that doesn’t care about your financial information.

As of 2020, there are thirteen non-CRS countries that we would recommend for banking. They are:

- Armenia

- Cambodia

- Georgia

- Dominican Republic

- Guatemala

- Kazahkstan

- Macedonia

- Montenegro

- Paraguay

- Philippines

- Serbia

- Ukraine

- United States

Let’s take Georgia as an example.

Georgia has a territorial tax system, if you earn money in the correct way, you can live in Georgia and not pay tax on your foreign earned income.

Georgia is also not a part of the CRS, the Common Reporting Standard. (Though they are a part of FATCA, which is where the US comes into play.) That means that if you’re banking in Singapore, Singapore may ask you where you pay tax, but Georgia won’t really care.

So, if you can leave a system where they care about your banking information and join a system where they don’t care, that is one way to obtain greater bank secrecy.

We’ll get to the second method in a minute. But first, here are the five countries where bank secrecy was holding strong just seven years ago… all stark reminders of just how quickly things can change in the offshore world.

5T. ST. LUCIA – 84/100

Tied for fifth place on the list is the tiny island of St. Lucia which, interestingly enough, now offers fast-track citizenship by investment as well.

Back in the day, tax justice folks declared that St. Lucia must “make major progress in offering satisfactory financial transparency.”

Even in 2020, IBCs incorporated on the island are not required to file accounting records, supply financial statements, or face audits. Shareholders’ and directors’ names are not included in the public records either.

But bank secrecy? That died with the signing of CRS agreements.

Even in 2013, St. Lucia was trying to becoming more “compliant” and already had forty-six tax-sharing agreements in place and was taking steps to ratify international treaties relating to financial transparency.

Its record on cooperating with other jurisdictions, however, is still spotty.

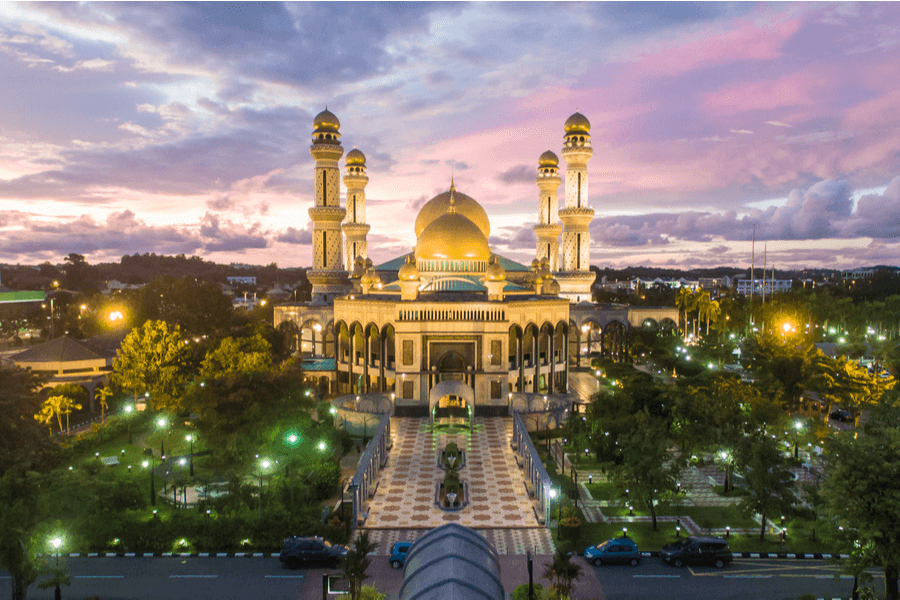

5T. BRUNEI-DARUSSALAM – 84/100

I personally don’t understand why anyone would keep their money in a country ruled by an authoritarian Sultan who spends his country’s money with wanton abandon, especially with so many better options in the region. Although Brunei’s formerly high level of bank secrecy was perhaps an attractive lure for those willing to skirt their home country’s tax reporting laws.

Brunei is a small player in the offshore space but was one of concern to international regulators… until CRS came along. In 2017, Brunei signed MAC. In 2019, it signed the MCAA. And the government has also signed the Tax Information Exchange Agreement (TIEA).

They have quickly fallen into rank.

Before the advent of the CRS, Brunei had been singled out for its lax approach to fighting money laundering, as well as its failure to disclose owners of companies domiciled there.

It’s hard, if not impossible, for foreigners to open a retail bank account in Brunei; but if you had big money, you might have been able to have an exception made for you. But that doesn’t matter anymore.

Not in this day and age.

3. SEYCHELLES – 85/100

We don’t recommend Seychelles much anymore as an offshore offshore jurisdiction – for banking or company formation. Yes, Seychelles is a haven for bank secrecy, but from an operational standpoint, it’s better to go onshore.

That said, this island nation located in the Indian Ocean has a long-standing policy of secrecy with offshore corporations and does not maintain information on a company’s beneficial owner.

Seychelles also has a lax policy on reporting interest income to overseas tax authorities.

Additionally, critics claim Seychelles does not prohibit “harmful” offshore structures nor assist in combating money laundering.

Seychelles does, however, have forty-six tax treaties that comply with OECD standards… and signed onto the CRS information sharing laws just a few years ago.

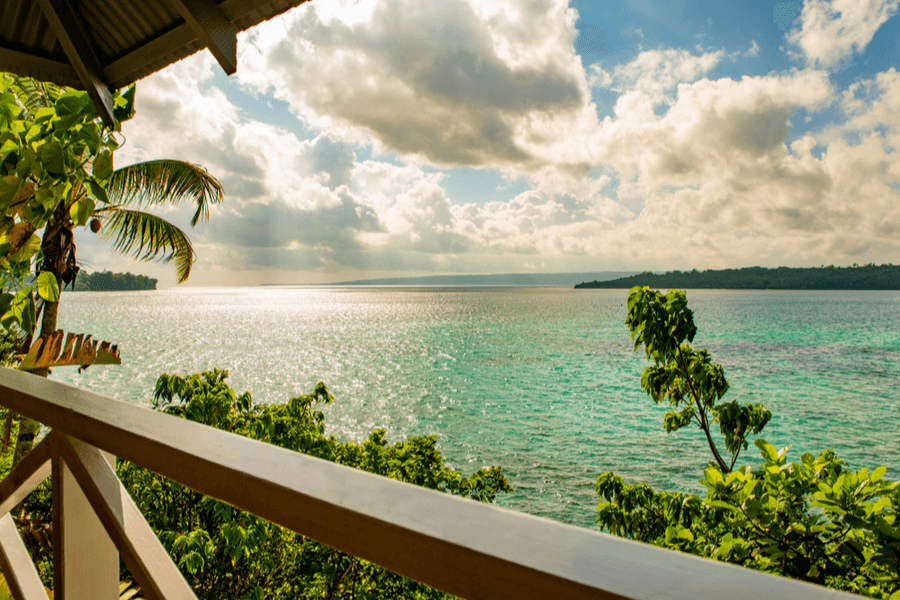

2. VANUATU – 87/100

Despite having an interesting name, few people actually know where Vanuatu is located. However, this island chain off the eastern coast of Australia is well-known to many of the world’s monied elite as an offshore banking jurisdiction since its 1971 offshore legislation.

While it’s still a tiny player in the offshore market, Vanuatu used to be among the most secretive. But they have now signed the CRS agreements as well.

However, Vanuatu offers many other benefits, including no personal or corporate income taxes, no estate or capital gains taxes, no exchange controls, and no reporting requirements. In fact, other than VAT, customs fees, and stamp duties, Vanuatu has no taxes at all.

While it has toned down its reputation as a “tax haven,” Vanuatu still earns poor marks from the anti-privacy crowd, which can only cite Vanuatu’s assistance in fighting money laundering as a mark against its strict bank secrecy.

Vanuatu does offer a one-year temporary second residency to those who invest $89,000 in the country, as well as citizenship by investment for a slightly higher donation.

1. SAMOA – 88/100

Topping the 2013 Financial Secrecy Index’s most secretive banking jurisdictions was Samoa. As with some of the other offshore bank jurisdictions on this list, Samoa is a tiny player in the offshore world, accounting for less than one percent of the global market.

Complaints against Samoa include its lack of cooperation with other countries on money laundering and criminal issues, as well as its failure to exchange tax details with other governments. But that is all changing now that Samoa has signed the CRS agreements.

However, Samoa does offer some corporate privacy as it does not require corporation data to be listed online for public consumption.

Bank Secrecy in the Modern World

These jurisdictions are likely not the best options for individual depositors or businesses. I have been saying for years that onshore is the new offshore. The days of secrecy and hiding your money are over.

Offshore banking is ultimately about international diversification and NOT law-breaking.

But the desire for secrecy does not a criminal make, nor does transparency prevent criminality. Which brings us to the second method for gaining greater bank secrecy in our modern world.

In some countries – particularly in South America, South Africa, Russia, and other post-Soviet states – bank secrecy is not about hiding money from the taxman but about avoiding trouble with criminals.

I had someone come to me recently who had been running a business in Mexico who purposefully kept the balance in his Mexican bank accounts low because the drug cartels (he says) regularly give bankers money in exchange for information on who has the money so that they can go shake them down.

This has become less of an issue over the years in many countries, but it is still an issue for some people, whether real or perceived.

Diversifying your banking and taking your money offshore can give you bank secrecy for these kinds of situations.

For example, let’s say you open an account in Switzerland. The compliance compartment is going to know your information and your banker will know your information, but it’s not going to be shared with everyone else.

The criminals won’t know.

Family members who think they deserve your money and are coming after you won’t know.

Basically, anyone else who is outside the government who might want to have a claim to your money won’t have access to it or any information about it.

In that way, fewer people knowing about your financial information could be helpful.

Twenty-First Century Bank Secrecy Havens

If this is the kind of bank secrecy you’re looking for, then I would suggest that you go to the wealth hubs.

Singapore and Switzerland are the two most common wealth hubs that we talk about here. Singapore is the twenty-first-century wealth hub that we regularly recommend because it has created a tremendous wealth hub that attracts foreign capital.

They have been able to do this, in part, because countries like Switzerland dropped the mantel after too many people were hiding their money in Swiss banks. But if you’re looking for that old school wealth hub and protection from the unknowns, then Switzerland might be worth considering as well.

Of course, the Financial Secrecy Index lists none other than the United States — the chief proponent of ending tax havens — as the second-largest tax haven by “global weight” (secrecy multiplied by its role in the global marketplace).

Somewhere out there is a large pot waiting to meet a kettle.

You can check out the 2020 Financial Secrecy Index here to learn more about the current bank secrecy havens, but here’s a quick look at the top 15. You may be surprised at who made the list.

- Cayman Islands

- USA

- Switzerland

- Hong Kong

- Singapore

- Luxembourg

- Japan

- Netherlands

- The British Virgin Islands

- United Arab Emirates

- Guernsey

- United Kingdom

- Taiwan

- Germany

- Panama

With the advent of the Common Reporting Standard, the countries on this list are best for the second type of bank secrecy. We would not give a blanket recommendation for any of these jurisdictions, as what will work best for you depends on, well, you.

That’s why we help people create personalized, holistic offshore plans to find where they will be treated best.

But this is the one key takeaway that does apply to everyone: bank secrecy the way that you’ve thought about it is dead.

Hiding your money from the government is no longer going to work.

Not in the twenty-first century.

What are your thoughts on these bank secrecy countries? Leave your thoughts in the comments below.

The Best Countries for Investing in the Middle East 2025

The global investment landscape has changed dramatically. Gone are the days when opportunities were limited by geography or confined to traditional stocks and bonds sold only through standardised, rigid and often cumbersome channels. Back then, going ‘global’ might have just meant adding a few European equities to a US-based portfolio. Today, everything has changed. Barriers […]

Read more

Best Gulf Country for Company Formation and Business Setup

For ambitious entrepreneurs, the Gulf region offers a powerful blend of top-tier banking systems and business-friendly laws that streamline company formation and make the process remarkably efficient. Countries like Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the United Arab Emirates (UAE) are actively competing to attract the world’s brightest business minds – and it’s working. […]

Read more

Top Offshore Tax Havens in the Caribbean

When people hear the term ‘tax haven’, it often conjures up images of shadowy offshore bank accounts and shady financial dealings. The reality is far more practical and much less sinister. Caribbean tax havens aren’t just for billionaires or corporations with armies of lawyers. In fact, many everyday entrepreneurs and investors take advantage of the […]

Read more