Uruguay is well worth considering for those who want an affordable, relaxed lifestyle in a low-tax environment within the Americas. Uruguay is a politically stable...

Founder of Nomad Capitalist and the world’s most sought-after expert on global citizenship.

What we’re all about

Meet our global team

We’re here to serve you

Read our testimonials

Get free email updates

Create your own bespoke global citizenship plan

Claim a second passport based on familial connections

Click here to see all our products and services

Discover the world’s best passports to have in an ever-changing world

Explore the citizenship options using our interactive citizenship map

Explore the tax details for countries using our interactive tax map

Click here to see all of our research and interactive tools

Learn from a curated “Who’s Who” of business speakers from around the world, get our latest R&D updates, and rub shoulders with successful people from all corners of the world.

Andrew Henderson wrote the #1 best-selling book that redefines life as a diversified,

global citizen in the 21st century… and how you can join the movement.

Uruguay is well worth considering for those who want an affordable, relaxed lifestyle in a low-tax environment within the Americas. Uruguay is a politically stable...

Georgia's attractive visa policy, low tax rates, and high quality of life make it an excellent option to live, work, and invest in. This article explores the tax and...

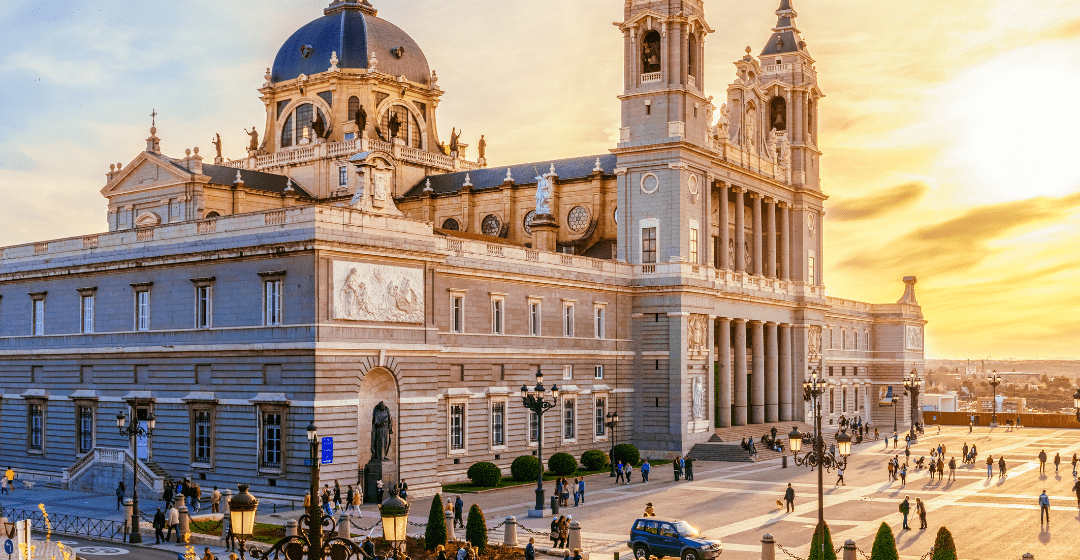

The Special Regime for Displaced Workers, or Beckham Law, as it has become known, was introduced by Spain in 2004 to attract talent and qualified workers from overseas. The...

Europe is not known for low taxes. However, certain countries provide regimes that can help alleviate your tax burden. Malta is one of the best options when considering EU...

There are plenty of good reasons to move to Ireland. It's a vibrant and friendly country and, in recent times, one of the most economically successful in the world. If...

You would be wrong to think that you must move to a country with a headline 0% tax rate, such as the UAE or Vanuatu, to minimise your taxes. The truth is that many other...

Lowering your taxes or eliminating them entirely is something that many of us aspire to, especially if we live and work in the West. Aggressive high-tax policies and burdensome...

With its favourable tax regime and extremely low presence requirement, Cyprus is an excellent choice for anyone who wants to spend at least part of the year on a friendly,...

UNLOCK A TAX FREE FUTURE WITH YOUR CRYPTO WEALTHReduce Taxes on Your Crypto Gains by Up to 100%Bitcoin and crypto investors need a Global Citizenship Plan to reduce their taxes...

The United States has a bad rep with many non-US residents when it comes to setting up a business there, with many entrepreneurs criticising what they see as heavy tax burdens...

In this article, we look at a little-known Greek tax loophole that potentially allows you to pay single-digit tax rates. More importantly, this method is 100% legal – the Greek...

Is Malta a tax haven? The question often crops up during any discussion of jurisdictions with tax-friendly systems. As an EU member state , Malta is renowned not only for its...

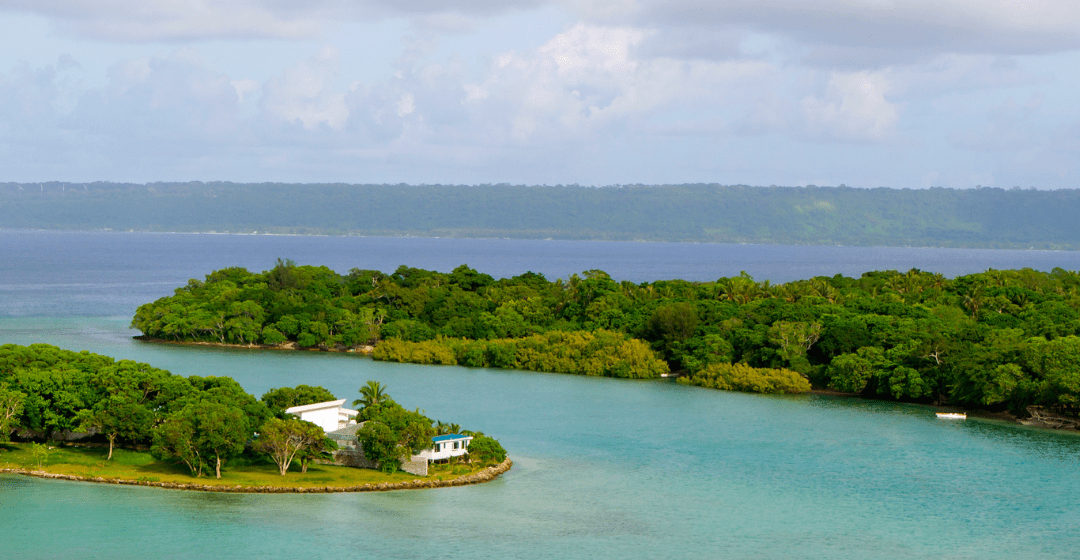

Vanuatu is primarily known for its island paradise appearance and favorable tax code. The national tax code is extremely limited with most wealth and profits are non-taxable. If...

In a perfect world, non-residents of any country would not incur any tax liability in that jurisdiction. In our imperfect world, being a non-resident in one country and a tax...

According to the latest World Happiness Report, the Netherlands is the sixth happiest country in the world. A significant reason for that is its excellent social security system....

This article discusses Montenegro's tax-friendly regime, its tax code, and how establishing tax residency in Montenegro can help you reduce your taxes drastically. Montenegro is...

This article looks at the tax benefits in Mauritius. If tax reduction is your goal, Mauritius may not be the first country that comes to mind, but with a low corporate tax rate,...

Why would anyone want to become a tax resident of Malaysia? As it turns out, that's a pretty easy question to answer. Along with the promise of low taxes, foreigner-friendly...

France is renowned for many things. Unfortunately, this includes high taxes. Most Western European countries fall into the same high-tax category, and that’s why people have...

Antigua and Barbuda is more than just a postcard-perfect Caribbean getaway; it’s also a smart choice for those looking to optimise their tax strategy. With personal income...

Subscribe to our Weekly Rundown and stay ahead with instant alerts on key global changes.