Tax in France for Non-Residents: The Ultimate Guide

November 8, 2024

France is renowned for many things. Unfortunately, this includes high taxes. Most Western European countries fall into the same high-tax category, and that’s why people have (mistakenly) associated the entire of Europe with a hefty tax bill. That’s not true, though.

Believe it or not, Europe, especially Eastern Europe, still has some hidden gems where you can enjoy the high-standard European vibe while paying a fraction of the tax you’d pay in a country like France.

Eager to know your options? Read on to learn how to establish tax non-residency in France, and get in touch with us today to kickstart your high-quality, low-tax life.

Tax Non-Residency Criteria in France

France categorises taxpayers into two categories – residents and non-residents.

You will be considered a resident in France for tax purposes if you meet at least one of the following criteria:

- Your primary residence (home) is in France

- Your primary professional activity is exercised in France

- You spend 183 days or more a year in France (consecutively or otherwise)

- The centre of your economic activity is in France.

If you don’t meet any of the criteria mentioned above, you will be considered a non-resident for tax purposes in France.

Tax System for Non-Residents in France

French Sourced Income

French tax residents are taxed on their worldwide income. In contrast, French non-residents pay taxes only on their France-sourced income. This generally includes employment income, self-employment income, property income, dividends, capital gains, and pensions (if the debtor is France-based).

PAYE System

Most French residents must file an income tax return in France. However, a few years back, the French government introduced Pay-As-You-Earn (PAYE) system. According to PAYE, taxpayers will be taxed monthly, at the source of the income, instead of filing an annual tax return. For example, an employee’s taxes will be withheld and filed by their employer.

Income subject to the PAYE system also includes retirement and rental income.

Household Taxation

In France, taxation primarily revolves around household or family units. Tax residency is determined for each household member. You can be considered a French tax resident even if your spouse or civil partner isn’t.

Below is a summary of taxes in France for non-residents.

Tax Rates in France for Non-Residents

Income Tax in France for Non-Residents

French taxes can go as high as 45%. Fortunately, non-resident tax rates are relatively lower.

Due to the PAYE system, most non-residents don’t need to file a French income tax return. The withholding tax is subjected to progressive rates of 0%, 12%, and 20%, depending on the total taxable income.

Where the withholding tax rates don’t apply, French non-residents pay an income tax rate of 20% on their French-sourced income. French-sourced income over €28,797 is subject to an income tax rate of 30%.

Capital Gains Tax in France for Non-Residents

French non-residents pay tax only on French-sourced capital gains. For French non-residents, capital gains are taxed at the same progressive rates applicable to residents.

Capital gains tax rates in France vary based on the nature of the gains. Capital gains from the sale of securities are taxed at a flat rate of 30%. The sale of shares is taxed at 34.5%, and capital gains related to real estate are taxed at 34.5%.

Wealth and Inheritance Tax in France for Non-Residents

Non-residents pay a wealth tax only on their French-located property. French wealth tax rates vary from 0.5% to 1.50%.

France also levies inheritance and gift taxes. French inheritance tax rates depend on the residence status of the deceased and the beneficiary.

Can Non-Residents Benefit from International Tax Treaties in France?

France has double taxation avoidance agreements with over 100 countries. According to the French tax system, international tax treaties executed between France and other countries precede national legislation. However, each tax treaty may establish different rules regarding tax residency, so it’s essential to refer to the relevant tax treaty.

European Countries with Tax-Friendly Regimes

Believe it or not, Europe still has some pretty amazing spots where you can live a high-standard life while paying fewer or zero taxes. You just have to look closely – or you can contact Nomad Capitalist, and we’ll do it for you.

Portugal

You may be surprised to see Portugal here. After all, taxes in Portugal can get pretty high (up to 48%, depending on the nature of income).

Although not as appealing as the former Non-Habitual Residence (NHR) tax program, there is the new International Taxation System (ITS) in place. This is also known as the NHR 2.0 and grants tax relief to active income earners involved in technical, scientific or academic roles in R&D projects, academics and start-up companies.

The main benefit of the new program is a reduced personal income tax (PIT) rate of 20% for qualifying individuals. It also offers exemptions on various foreign income sources, including:

- Capital investment income (interest or dividends)

- Royalties

- Capital gains (awaiting regulations for clarity)

- Real estate income or gains.

Portugal also has an excellent golden visa program. If you’re interested, you can read our ultimate guide on the Portugal Golden Visa for more details.

Italy

Like Portugal, Italy’s standard tax rates are pretty high (up to 43%). However, the country offers a lump sum tax program to high-net-worth individuals who can pay €100,000 per year as their entire tax obligation.

Foreigners seeking Italy’s lump sum tax program must move to Italy, become a resident and pay €100,000 annually for up to fifteen years (or the term of their enrolment).

As a result, they’re exempt from local tax obligations and inheritance, wealth or gift taxes in Italy.

The country also has an Italian Golden Visa program for people interested in acquiring EU residency through investment.

Georgia

If you’re up for moving your tax residency to an Eastern European country, Georgia should be one of your top choices. It’s a beautiful country with a straightforward and territorial tax regime, meaning that foreign income is tax-exempt for Georgian residents.

The following are the Georgian tax rates:

- Income Tax: 20%

- VAT: 18%

- Corporate Tax: 15%

- Capital Gains and Interest: 5-20%

- Property Tax: 1%

Not only is Georgia an excellent second residency option, it’s also a pretty great spot to plant a business flag, considering its foreigner-friendly laws and ease of banking.

Tax in France for Non-Residents: FAQs

Yes, income tax rates in France can go up to 45%, making it one of the countries with the highest taxes in the world.

Yes, France has a tax treaty with the US and over 100 other countries.

France’s standard VAT rate is 20%, which is in line with the average VAT rates across the European Union. There are reduced rates of 10%, 5.5% and a super-reduced rate of 2.1% for certain goods and services.

France uses a progressive income tax system with rates ranging from 0% to 45%, depending on income brackets. Capital gains tax rates depend on the asset type, with a standard rate of 30% for most financial investments, including 17.2% for social contributions.

TVA stands for ‘Taxe sur la Valeur Ajoutée’, which in English translates to Value Added Tax (VAT).

Yes, France imposes property taxes on real estate, primarily through two taxes: Taxe Foncière and Taxe d’Habitation. Taxe Foncière is a local property tax paid annually based on the property’s cadastral value.

Taxe d’Habitation is a local residence tax historically paid by occupants of a property, but it has been gradually phased out for most primary residences.

Inheritance tax in France, known as ‘droits de succession’. This is a tax on the transfer of assets from a deceased person to their heirs. The tax rate depends on the value of the inheritance and the relationship between the deceased and the heirs. Rates range from 0% to 60%.

The purpose of the US-France tax treaty is to prevent double taxation on income and capital gains by determining which country has the right to tax specific types of income.

The treaty covers various types of income, including dividends, interest, royalties, capital gains, pensions and business profits.

Go Where You’re Treated Best

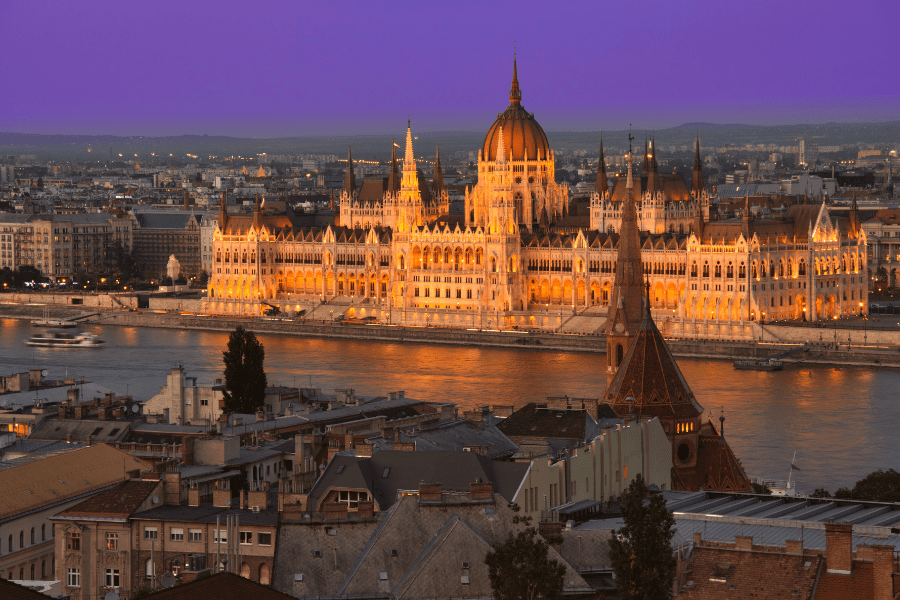

France is a wonderful country. Beautiful landscapes, breathtaking architecture, charming lifestyle, excellent wine and even better cuisine – at a glance, the country seems to be perfect.

The French social security system and the perks it offers are among the best in the EU. However, all that comes at the cost of high taxes.

Fortunately, other European countries offer the same (if not better) quality of life with friendly tax regimes. If paying nearly half of your income in taxes makes you shudder, you may want to look at those options.

For now, most European countries have residential taxation, which gives you the option to leave the tax system if you wish.

However, with more dialogue around the potential for France and other European nations to follow in the footsteps of the United States and start taxing their citizens no matter where they live, this may not be the case for long.

There could come a time when, even if you don’t live in your own country, the mantra will change, and you will have to pay no matter where you choose to reside.

Prepare now and protect yourself with a second passport.

We help seven- and eight-figure entrepreneurs and investors create a bespoke nomad strategy using our unique, tried-and-tested methods.

You’ll keep more of your own money, create wealth faster and be protected from whatever happens in just three steps. Discover how to achieve this here.

How to Get UAE Citizenship – The Complete Guide

Sovereignty – both national and personal – shapes ambition, secures wealth, and defines status in a shifting global order. For the high-achieving global citizen, acquiring a second or even third passport is more than a lifestyle upgrade; it’s a strategic move in long-term financial and geopolitical positioning. But not all citizenships are created equal – […]

Read more

A Gateway to Central Asia: New Kazakhstan Golden Visa Program for 2025

Central Asia just raised the stakes in the golden visa game. In May 2025, Kazakhstan officially launched a 10-year Golden Visa program in an ambitious move to position the country as a serious contender in the global investor migration space. At a time when other international regions are rolling back their citizenship and residency options, […]

Read more

Top Countries Offering Golden Visas in 2025

Residency is no longer about lifestyle – it’s about leverage In an increasingly unpredictable world, Golden Visas offer something most governments can’t: certainty in exchange for capital. They are more than migration tools; they are strategic safeguards offering residence rights, future citizenship, global mobility, and access to tax-friendly jurisdictions. For investors, entrepreneurs and globally minded […]

Read more