Top 14 English-Speaking Countries for Expats

November 4, 2024

Have you dreamed of living and working abroad but have concerns about whether you’ll be understood and be able to communicate with the locals? In other words, you’re monolingual.

‘Do you speak English?’ – asking this over and over again and continually fumbling for the right words in your new country has little appeal.

While some look forward to the challenge of learning a new language, to others it’s a chore and something that can be difficult to master.

And that’s why you may keep putting off moving abroad and, in the process, the opportunity to enhance your lifestyle and potentially even lessen your tax burden.

It can certainly feel isolating not knowing the language that the majority of people speak.

Sure, you can get by with English in tourist spots and hire a local to help you navigate finding a property and the bureaucracy, but it’s not quite the same as connecting with a place on a more personal level.

If not being able to speak a second language is stopping you from living overseas and gaining tax advantages, don’t let it.

Are you someone who wants to leave your home country and either settle in one place or have multiple bases while maintaining a tax-friendly lifestyle? Become a Nomad Capitalist client, and we will combine all your needs in a single holistic tax, immigration, asset protection and investment strategy.

What’s in a Language, Anyway?

Before moving to a new place, the number one fear expats face is the language barrier.

It comes before the fear of being too far away from friends and family and before things like culture shock or concerns over healthcare and infrastructure standards.

The team at Nomad Capitalist knows this all too well, having lived and worked in many different countries.

There is nothing like the feeling of isolation that comes with being unable to understand the news, the shop vendor or the taxi driver.

A smile and a hand gesture go a long way, but that’s not really a fulfilled life, is it?

There is so much value in these micro-interactions that it’s little wonder that people who don’t speak a second language hesitate to move abroad.

But with so much to gain, both personally and financially, don’t let it become the reason you’re missing out on a new life.

The good news is that you can reduce your tax burden and move to a new place without having to compromise on your quality of life.

Expat English-Speaking Countries (That Make Sense Tax-Wise)

We’ve pulled together the ultimate list of expat-friendly countries where you can get by with English perfectly fine. Not just get by but adapt to a new culture without speaking a foreign language, build relationships with expats and locals and thrive.

Here are the best English-speaking countries to move to if you want the tax advantages of living abroad without having to learn a new language.

1. The Bahamas

Obtaining a residence permit for the Bahamas is easy, and once you do, living there is tax-free.

With millions of tourists heading there each year, the Bahamas is everything you would expect of a sun-soaked, tropical Caribbean island chain. Beyond its beaches, another attraction is that 87% of Bahamians speak English well.

So, if island life appeals to you and you’re unphased by the potential for tropical storms, it could be a good choice. And if you want to do business in the Bahamas, it’s a recognised tax haven with favourable laws that welcome foreign investment and company formation.

2. Belize

If you want to enjoy the beach or explore Mayan ruins, all while speaking English with the locals, head to Belize. It’s a beautiful paradise along the coast of the Caribbean Sea, where you can go snorkelling, fishing, sailing and caving.

Since the EU removed Belize from its tax haven blacklist in 2019, it’s now an even better place to consider for offshore banking.

The country’s official language is English, with around 63% of the population speaking it.

There are pockets where Belizean Creole or Spanish are used more often, but English will be enough to help you conduct your affairs and social life.

3. Bermuda

You’ll easily find native English speakers as you enjoy the stunning beaches and sunsets in Bermuda. Of course, it makes sense that Bermuda, a British Overseas Territory, would make our list of countries where English is spoken fluently.

Bermuda is one of the most livable countries with no income tax, although it can be expensive. Finding a property will also be a tall order as it’s in short supply and relatively expensive.

Yet, if you have the cash and want to live on a highly developed island with good travel connections to the United States, Bermuda may be for you.

4. Dominica

You can get fast-track citizenship of this tropical paradise for as little as a US$100,000 donation to the Dominican government.

It’s worth remembering that the island of Dominica and the Dominican Republic are two separate countries.

As home to one of the world’s most affordable citizenship by investment programs, Dominica isn’t just a place to get a second passport; it’s also a Caribbean paradise where over 2,000 US expats live. These are mostly retirees so if you’re after an upbeat lifestyle, Dominica is possibly not for you.

Unlike Saint Kitts and Nevis, where English is also widely spoken, Dominica imposes income tax at progressive rates from 15% to 35%, so you may want to consider other options if you’re planning to live somewhere full- time.

5. Gibraltar

If you want the beauty of Spain’s south coast in an English-speaking country, Gibraltar gives you just that, Plus, an attractive tax regime.

Gibraltar is one of the few English-speaking countries in Europe and has long been a tax haven. It’s the perfect place to incorporate a business (no capital gains tax) and even become a tax resident (maximum effective tax rate of 25% with the possibility for a lump-sum tax incentive).

Being a British Overseas Territory, Gibraltar’s official language is English, so you will have no problem conversing with the locals.

Gibraltar residence permits are relatively easy to come by, and overall, it’s a place that welcomes expats. Plus, if you feel bored, you can always pop over to Andalusia for the wines, cured meats and flamenco dancing.

6. Ireland

Ireland is undoubtedly one of the friendliest English-speaking countries in the world, and although Gaelic is recognised as the official language, just 5% of the population speak it regularly.

While it’s not exactly a recognised income tax haven, it is a tax-friendly offshore jurisdiction, it actually has one of the lowest corporate tax rates in Europe.

Multinational companies such as Apple, Microsoft and Google have long recognised this and have established operations there – with the 12.5% corporate tax rate and skilled workforce being the main appeal.

While the accent will take some getting used to, Ireland ticks many boxes:

- A highly reputable country on the international scene

- Member of the EU, it’s very close to the continent

- Modern infrastructure, high standard of health care and education

- A great quality of life.

Personal income tax ranges from 20% to 40%, but with some smart planning, lower corporate taxes could compensate for the relatively high-income tax.

And if you don’t qualify for citizenship by descent in Ireland, you could get a residence through the country’s Zero Stamp and Highly Skilled Worker programs.

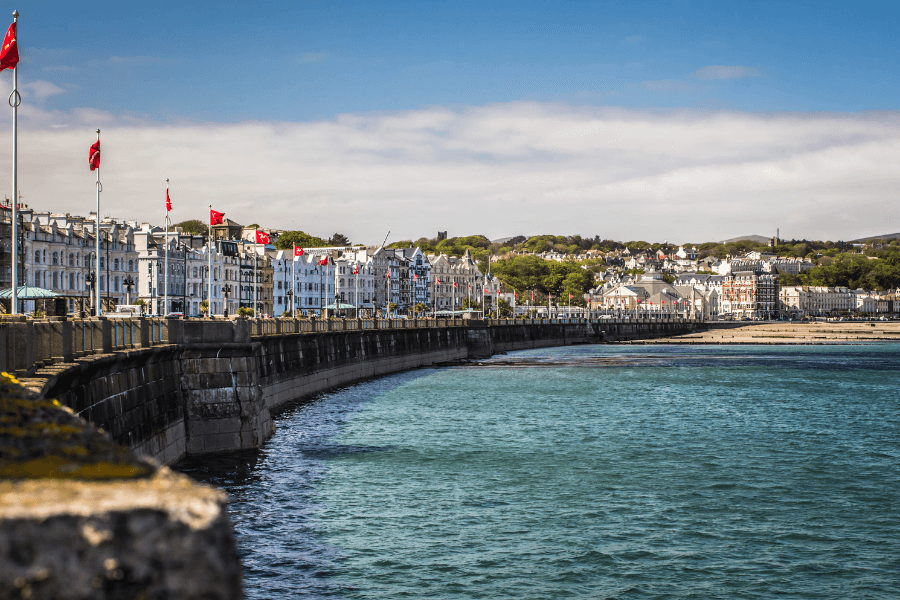

7. Isle of Man

If you don’t mind paying a little tax, this English-speaking country is just a short flight from London.

A small island between Ireland and the United Kingdom, the Isle of Man is well-connected to both the UK and Europe.

It’s a self-governing territory of the British Crown, with sleepy fishing towns, medieval castles and rural landscapes.

Needless to say, everyone there speaks English, so if you’re after an island that’s a bit closer to home then the Isle of Man could be a good choice, with London, Dublin and Edinburgh a quick plane ride away.

Income tax operates in two bands of either 10% or 20%, so it’s not too high in exchange for an English-speaking country with all the amenities a low-key island life could require.

8. Jersey

Don’t be fooled by the place names on Jersey – St Helier, St Ouen and La Pulente all sound suspiciously French. However, Jersey has two official languages, and one of those is English.

Located between the UK and France, it’s a so-called ‘channel island’ that offers, a relatively high quality of life and a booming finance sector.

Jersey has no capital gains tax, and the income tax rate is a flat 20%. However, you can opt to pay a lump-sum tax which may make it more worthwhile.

9. Malaysia

Given past British involvement in this Southeast Asian paradise, you can get by there speaking English.

If you have a base in Malaysia, learning Malay does not necessarily need to be a high priority.

In Kuala Lumpur, practically everyone speaks English to some degree, and if you stay in the city, you don’t need to learn Bahasa Malay because English is the de facto official language.

There are also some islands where you can immerse yourself fully in the local culture and speak only English, for example, Langkawi and Penang – and both offer a great quality of life.

Malaysia also has a reputation for being tax-friendly and is an attractive English-speaking destination for entrepreneurs, businesses and retirees alike.

10. Malta

While it is closer to Italy than it is to Britain, English is the language of choice in Malta.

Malta may well be one of the best places to live in Europe when it comes to countries that speak English. And it certainly helps that it’s tax-friendly, allowing offshore companies domiciled there to claim a credit on taxes they pay with an effective corporate tax rate as low as 5%.

Setting up a company in Malta also allows non-EU citizens to obtain residency there. Plus, its territorial tax system means that foreign income will not be taxed unless it is remitted to Malta, at which time it will be taxed at a rate of just 15%.

You’ll also have access to all of Europe without having to worry about resetting your visa every time you want to move country.

On top of Malta’s benefit as an offshore hub for easy banking, low taxes and openness to industries like gambling, 89% of Maltese people speak English.

11. Mauritius

This African island nation has a lot to offer, including being an English-speaking country with tax and offshore company benefits, and advantages for crypto investors.

This small Indian Ocean island is an English-speaking country in Africa that packs a punch.

Its ease of doing business, favourable tax laws and growing banking system allow you to incorporate your offshore company in Mauritius easily.

Income tax rates stand at 10-15%, and only income remitted to Mauritius is taxed there. In other words, the majority of your worldwide income will not be taxed there.

In 2018 Mauritius became the very first country in the world to introduce custodian services to digital assets such as Bitcoin.

12. The Philippines

You’ll have a better chance of running into English speakers in the Philippines in larger cities like Manila.

Because of historical ties, English has been the unofficial language of the Philippines for decades. It is widely taught in schools, although you should stick to mainly urban areas to experience the benefit of the 64% of the people who speak English in the country.

As a bonus – only income derived from sources within the Philippines is taxed there, so if you have foreign income, it is not taxed.

Retirees love the Philippines for its relatively low cost of living, relaxed island lifestyle and welcoming locals.

13. Singapore

Nowhere exudes opulence and luxury like Singapore. The fact that it’s a tax-friendly, English-speaking country is the icing on the cake.

Singapore is a place where so many nationalities and cultures intermingle that it’s difficult to imagine that English is widely spoken.

But forget the preconceptions – most Singaporeans are bilingual Chinese and English speakers. However, English is the de facto language of business and is widely used in banking and legal circles.

With one in five of the expats in Singapore a millionaire; it’s an extremely pricey place to live, and you’ll need some capital behind you to make the move.

14. Vanuatu

It is possible to get residence or citizenship in Vanuatu and enjoy tax-free living in this English-speaking country.

It will make particular sense for New Zealanders or Australians to move there because it’s relatively close to them. Perhaps less so for everyone else because it is so remote.

However, if you want to take the plunge and give Vanuatu a chance, you’ll be glad to know that 62% of the population speaks English. It’s also one of the easiest places on earth to pay zero income tax and get a second passport in a matter of months.

Other English-First Scenarios

If you’re not so concerned about lessening your tax burden and are simply looking for the best English-speaking countries to live in for a part of the year (thus not becoming a tax resident as per Nomad Capitalist’s Trifecta Strategy), here are some more options.

1. Scandinavia – Norway, Sweden and Denmark

If you’re just looking for an English-speaking country to visit, consider the Scandinavian countries. Just don’t stick around long enough to pay taxes.

These Viking lands are economic powerhouses, where the adopted common language is English. So, while it might not be an obvious choice, Norway, Sweden and Denmark are rated as some of the happiest places on earth, so you know that the quality of life there is attractive.

What they are not, however, are tax havens. With some of the highest rates of income tax in the world, it won’t suit everyone to move there permanently.

However, if you plan it carefully and don’t become a tax resident, Scandinavia is an amazing place to live. High-quality public services and unspoiled nature could be all yours, and you’d get to enjoy it in English too.

2. The Netherlands

The Netherlands has a large population that speaks English as a second language, and they do it very well.

The Dutch were named the most adept at speaking English as a second language in the world.

Amsterdam, the Hague and other Dutch cities are some of the biggest English-speaking destinations in Europe.

If you have ever dreamed of strolling the romantic canals of Amsterdam, you’ll be happy to know that over 90% of Dutch speak English.

While becoming a permanent resident of the Netherlands may not be the best move for tax purposes, Western citizens can easily spend half their year in Europe’s Schengen area, giving you plenty of time to enjoy a second home in Amsterdam.

The Netherlands also has favourable corporate arrangements in place, thanks to its copious tax treaties and tax participation exemptions (including, dividends and capital gains realised are exempt from corporate tax).

It’s a highly stable country with access to Europe and extremely modern health, transport and educational facilities. What’s not to like? The income tax is a potential issue, so be careful not to overstay your non-resident welcome.

3. The Balkans – Serbia, Croatia and Bulgaria

You may be surprised by how many English speakers you can find in Eastern Europe.

Depending on where you are in the Balkans, you might have some luck with Italian or German. However, the main second language of the younger generation is English.

Many of the older generations might still be monolingual or speak Russian as their only foreign language, but in cities like Zagreb, Sofia or Belgrade, you shouldn’t encounter problems as an English speaker.

Some Balkan countries have favourable tax regimes with flat income tax rates and are extremely grateful for foreign capital by way of business incorporation or investment.

So, if you are looking for an English-speaking country that’s expat-friendly and below the radar, the Balkans could be a good choice.

4. The Baltics – Lithuania, Latvia and Estonia

You may not have guessed you would find Lithuania on our list of English-speaking countries, but you are sure to find plenty here and in neighbouring Estonia and Latvia.

People often disregard the Baltics in favour of places with a richer cultural history, better food or a milder climate.

And if you think this way, too, you’re not doing yourself any favours.

The region has experienced some of the fastest growth rates in the EU over the last few years. There’s loads of investment potential here, with some generous tax-friendly exemptions for foreign capital.

With growing foreign investment and tourism, the Baltics can provide a comfortable life at a fraction of the cost of Scandinavia but with many of the same amenities.

In Vilnius, Riga and Tallinn, you can work towards lower tax rates and fully immerse yourself in life there while speaking English.

The Best English-Speaking Country for Expats

We’ve given you plenty of food for thought as to the countries you can call home and go about your daily life in English.

As we always say at Nomad Capitalist, however, it’s about ‘going where you’re treated best’.

The choice to live, work or invest in one of these English-speaking countries will only make sense if you have planned it properly.

That’s where Nomad Capitalist comes in.

We help seven- and eight-figure entrepreneurs and investors create a bespoke strategy using our uniquely successful methods. You’ll keep more of your own money, create new wealth faster and be protected from whatever happens in just three steps. Discover how we do things here.

Is Grenada Safe for Visitors, Residents and Families?

Evaluating a nation for tourism, relocation or investment begins with a single, non-negotiable factor – safety. Security, from both a personal and financial point of view, is the foundation upon which all other considerations rest. And while it’s easy to assume that stability is a given in the developed world, recent challenges in countries like […]

Read more

Is Antigua Safe for Tourists, Families and New Residents?

Security is a cornerstone of any serious investment migration strategy. For high-net-worth individuals (HWNIs) and globally mobile families, it ranks alongside tax efficiency, political stability, and quality of life as a key driver in deciding where to live, invest or acquire a second passport. Too often, safety is assumed to align with economic development. Countries […]

Read more

Is St Kitts and Nevis Safe? Tips for Tourists and Residents

Safety is a non-negotiable factor for anyone considering whether a country is right for travel, relocation or investment. Overlooking such a vital consideration carries serious consequences, and the stark truth is that assumptions based on a country’s global image often fall short of reality. Cases in point include the following countries: The takeaway is clear: […]

Read more