Last Updated February 3, 2022

Dateline: Singapore

Having a second citizenship is an important part of international diversification, but having a backup passport alone does not end your tax obligations if that is your goal.

US citizens can have as many passports as they want (I know one guy who has eight), but they will be liable to the IRS so long as they carry a US passport.

Citizens of countries like Australia, the UK, Canada, Norway, and others may similarly have a lot of hoops to jump through if they want to stop paying taxes in their home country, even after leaving.

While only US citizens must renounce their citizenship to fully escape their government’s tax net, there are other countries where becoming tax non-resident is hardly a walk in the park.

These days, every government agency you deal with wants to know which country you’re a resident of. For that reason, it is important to establish a tax residence in a tax-free country that won’t try to get its hands on the money you earn anywhere else.

Going to tax-free countries and obtaining a second residence can go a long way in getting your high-tax home country off your back while saving you thousands (if not hundreds of thousands) of dollars in taxes every year.

It’s all about “going where you’re treated best” in a world where many residents of high-tax countries are on the hook to pay income taxes on their worldwide income.

No matter what your situation may be, having a second residence in a tax-free country gives you a lot of freedom.

In this article, we’ll address the different types of tax-free countries that you can use as part of your offshore strategy before diving into the specific countries where you can obtain a second residence to enjoy a tax-free life.

What Is a Tax-Free Country?

If you’re a regular reader of our blog or viewer on our YouTube channel, you may have noticed that people tend to make one of two mistakes when going offshore:

Either they think it’s too easy, OR they think it’s too difficult.

Those who think it’s too difficult often believe that the only way to live tax-free is to move themselves to a country with no personal income tax whatsoever. To go where they’re treated best, they have to uproot their entire life and move to a tax haven.

But this isn’t always the case.

The ones who think that it’s too easy to believe that they can just incorporate an offshore company and then continue to live where they are and somehow avoid paying taxes.

It doesn’t work this way, either.

If you want the benefits of going offshore, you need to go offshore.

Still, others think that they can just live the life of a perpetual nomad and avoid taxes by not living anywhere permanently. Unfortunately, this approach doesn’t work for most citizenships anymore.

Many countries have cracked down on the different tests and requirements that their citizens must pass to prove that they are no longer tax residents of their home country. They want to know what country you call home now.

So… you need someplace new to call home.

By finding a new tax home, you can create a strategy that allows you to structure your lifestyle and business to go where you want to go while paying what you want to pay. And this doesn’t have to involve you running off to live in a small, zero-tax country like Monaco.

Now, if you did just want to live in Monaco, you could create a fairly straightforward plan and live tax-free. But every situation is incredibly different and zero-tax countries are not your only option.

There are various ways to live tax-free (and there is often more to it than just getting a second residence or citizenship). Each approach involves different countries and unique strategies, but in general, your options for tax-free second residencies are as follows:

- Zero-Tax Countries: Become a tax resident of a zero-tax country that does not impose income taxes or capital gains taxes,

- Territorial Tax Countries: Become a resident of a territorial tax country that only imposes taxes on the income you earn within their borders… then make sure you don’t have local source income.

- Lump-Sum Tax Countries: Become a resident of countries that will only charge an annual lump-sum tax. Technically, these are not tax-free countries, but you can basically view the flat tax as a government fee for your second residence, which then allows you to live tax-free for the rest of the year.

- Exemptions and Non-Domiciled Countries: Become a resident of a country that normally has high taxes but then apply for an exemption or special status as a non-domiciled resident that will allow you to live in the country tax-free for a set period of time.

Please note that this article is not a full list of all the zero-tax countries in the world. We’ve spoken before about countries with zero income tax, but not all of them have second residence programs or are desirable locations for lifestyle purposes.

If you would like to learn more about tax-free countries in different parts of the world, you can check out our other articles and videos:

- 15 Countries With No Income Tax

- The Best Tax-Free Countries for Americans

- The Best Tax-Free Countries in the Americas

- The Best Tax-Free Countries in Asia

- 7 Tax-Friendly Countries for High-Net-Worth Expats

- Tax-Free Countries in Europe

- Countries With No Property Taxes Where You Really Own Your Home

And if you want to learn more about the different forms of taxation, how they work, and how to legally lower your taxes overseas, you can read these articles:

- How To Pay Less Taxes: 5 Offshore Methods

- What Is Tax Residence and Why Does It Matter?

- The 4 Income Tax Systems Around the World

- Freedom Starts with Territorial Taxation

- How To Legally Lower Your Taxes

- 4 Corporate Tax Systems for Offshore Companies

- Citizenship-Based Taxation: Who’s Tried It and Why the US Can’t Quit

But if you’re here to discover the tax-free countries of the world where you can get a second residence, you’re in the right place, so read on.

Second Residence in Tax-Free Countries

The Bahamas

The Bahamas is one of the countries with no income tax, choosing to earn its money from tourism instead. Residents of the Bahamas pay zero tax on the money they earn anywhere in the world, inside or outside of the Bahamas.

You can enter The Bahamas as a visitor and then apply for either temporary or permanent residency within two months of your arrival.

A renewable annual residence permit will cost you $1,000 each year. And even though it is not officially required, it is beneficial to have a home on the island to get approved.

After 20 years of temporary residence, you can apply for a permanent residence permit, OR you can speed up the process and get your permanent resident status right off the bat by investing at least $750,000 in real estate or a business that will create at least one local job.

If you would like to fast-track your application to get a guaranteed response from the Bahamas Immigration Department within 21 days, you can increase the investment amount to $1.5 million and pay a one-time fee of $10,000.

Then, if you have chosen to purchase a home on the island, you will be issued a Home Owner’s Card on an annual basis that allows you, your spouse, and any minor children to live in the Bahamas.

The British Virgin Islands

This British overseas territory and island nation applies no income tax, capital gains tax, no corporate income tax, inheritance or gift taxes, land or housing taxes, wealth tax, sales tax, or VAT.

While getting a work permit in the BVI can be a rather bureaucratic process, obtaining a residence visa as a self-sufficient person is quite easy and can be obtained in less than a month in most cases.

You simply need to provide bank statements showing that you can afford to live there and pay a $1,000 surety bond.

Brunei

The Sultan of Brunei has so much money that he doesn’t really need investors to immigrate to his sultanate.

However, with a large enough investment, you can obtain residence or permanent resident status in this tiny country nestled in the Borneo part of Malaysia — though we wouldn’t recommend it.

Cayman Islands

The crown jewel of the Caribbean offshore world, the Cayman Islands doesn’t appeal to the middle class.

Just as Cayman financial authorities have gone to great lengths to make incorporating into their country expensive, immigrating there requires some serious cash as well.

Specifically, if you want to live in Grand Cayman, you must have an annual income of nearly $150,000, maintain roughly $500,000 in a Cayman Islands bank account, and invest $1.2 million in the country, with roughly half of the investment going to real estate.

Those requirements are significantly smaller if you want to live on one of the smaller, less flashy islands. You can learn more about the Cayman Islands’ residency program here.

Monaco

Talk about sex appeal and sophistication; Monaco oozes it.

The principality bordering France and Italy is part of the gorgeous French Riviera and is well-connected by train, airplane, and helicopter to the rest of Europe.

It’s the perfect zero-tax residency if you prefer European glamour to island living, and you’ll be in the company of some of the wealthiest people on earth.

Monaco requires that prospective residents show proof of accommodation. This may involve presenting a 12-month rental contract, holding corporate real estate as a company director, or purchasing real estate worth at least €500,000.

Applicants must also prove that they have sufficient financial resources by opening a bank account in Monaco and making a minimum deposit of €500,000. However, some banks require a minimum initial deposit of at least €1,000,000.

Turks and Caicos

The rogue of the British Overseas Territories, Turks and Caicos unveiled an economic residency program that offers quick residence permits to foreigners who either spend at least $300,000 building a new home or remodeling a distressed property, or who invest at least $750,000 in a company majority-owned by locals.

If you’re good for the investment, you can enjoy not only zero personal income tax as a resident of Turks and Caicos but also zero corporate tax rate, no capital gains tax, no property tax, and no inheritance tax.

United Arab Emirates

The UAE offers many different advantages to foreign businessmen and investors, including second residence and zero taxes. The Arab country is one of the oil and gas industry leaders in the region.

By setting up a free-zone company, you can start a 100% foreign-owned company in the UAE and get both a second residence and a tax residence certificate. This increases the foreign investment flow into the country. You will need to follow several rules and check-in at least a couple of times a year to keep your residence active.

Company formation costs are $4,800.

You will also need to have an office in the country, even if it is simply a hot desk at a local co-working space.

Another option to get a residence permit is by investing 10 million AED (over 2.7 million USD) in public investments or investing at least 5 million AED (roughly 1.36 million USD) in UAE real estate held for at least three years.

If you’re looking for an ultra-cheap residence or offshore solution, this is probably not your best option, but it may work for entrepreneurs looking for one jurisdiction that can give them zero taxes on both their business and personal taxes.

Vanuatu

Vanuatu offers a very straightforward residence program that rewards those who invest more.

Foreigners can invest about $89,000 in real estate or business and qualify for a one-year residence visa, renewable annually. Invest more and you’ll be granted a residence permit good for three, five, ten, or even fifteen years.

You will also need to get a bank in Vanuatu to certify that you are self-sufficient by proving that you have roughly $2,200 or more in monthly income – or double that if you are including your spouse or partner on the application.

Government fees for Vanuatu’s residence program are a bit higher than I’d like, but considering the low investment and the variety of interesting property investments there, it’s worth considering if you crave island life in the South Pacific.

Vanuatu is also one of the few tax-free countries where obtaining citizenship is an additional possibility. Be sure to check out our other articles to learn more about Vanuatu’s residence and citizenship by investment programs.

Residence in Territorial Tax Countries

The following countries tax the local source income of citizens and foreigners alike.

Much as we dislike tax, if it is to be done, I have to admit that territorial taxation is the fairest way of doing things. Money earned from activity in a country is taxed there, while overseas income having nothing to do with the place is not.

If you become a resident of one of these countries, you should make sure that any income you earn overseas or remit into the country isn’t taxable as local source income; consult a tax advisor.

Costa Rica

If you’re looking for countries with lowest taxes for retirees, Costa Rica has long been the second residence of choice and one of the best countries to retire for American retirees and investor expats retiring out the US.

Costa Rica is one of the tax-free retirement countries which retirees flock to seeking retirement abroad taxes-free.

The requirements have become more stringent in recent years, but anyone with $2,500 in monthly income that they bring into Costa Rica can become a resident.

Costa Rica isn’t exactly my favorite place, and it is highly bureaucratic, but if you enjoy sandy beaches or tropical jungles, it may be worth considering.

Georgia

One of the most underrated countries on earth, Georgia is fast becoming one of the world’s freest economies. The pro-business government slashed the number of taxes from 21 to 6 (and now to 5), and rates decrease each year, making it one of few “tax-free” business countries that don’t tax foreign-sourced income.

Georgia offers almost all foreigners a 360-day tourist visa, and anyone can open a Georgia company in order to qualify for residence. Buying real estate might also qualify you.

If you do invest in Georgia, taxes there usually range from a flat 5-15%.

Guatemala

If you crave the adventure of Mayan ruins and life in Central America, Guatemala is one of four countries in the region that offer territorial taxation.

Obtaining permanent residence in Guatemala is easy if you can show proof of $1,250 monthly income, although you must be willing to live there a good part of the time or they’ll cancel your permit.

You can also get temporary residence as an investor if you make an investment of at least $100,000 USD in the country, but seeing as you can get permanent residence for much less, this option isn’t that attractive.

Additionally, if you are willing to live in Guatemala full-time, it’s possible to get citizenship after five years.

Hong Kong

If you can afford it, Hong Kong is perhaps the most exciting city in Asia. While the special administrative region of China is tightening its banking and corporate policies as it applies to joining the OECD, the tax policy is still very friendly.

Hong Kong certainly isn’t a tax haven, but it’s one of the low tax countries that offer low corporate taxes to entrepreneurs who want to base their company there, and potentially zero taxation for investors or those with businesses overseas.

While the immigrant investor program was canceled in 2015, entrepreneurs can obtain a residence permit by creating or joining a start-up business in Hong Kong and proving that they will make a substantial contribution to the economy.

Macau

While often belittled as a dodgy gambling outpost in the shadow of Hong Kong, Macau is an enigmatic and fascinating place. Just one hour from Hong Kong by boat, the special administrative region of China features a few excellent banks, as well as zero tax on foreign earnings.

It used to be that investors could obtain residence in Macau with an investment of $375,000 USD, but the official residence by investment program was shut down in 2007.

Like Hong Kong, you can still get residency by starting a local company. However, there are a lot of hurdles to jump to make this program work.

You must invest MOP 500,000 ($62,700+ USD) into the business and then hire yourself as a Manager and apply for residency together with a Work Visa. The catch is that you must prove that you could not find anyone to fill the managerial position in Macau, which can be a pain.

Initial residency is temporary and is valid for seven years. If you live in Macau and become a tax resident, you will only pay taxes on income over 20,000 USD earned in Macau. After that, tax rates begin at 12% and go up.

Malaysia

Malaysia’s MM2H program is one of the most underrated second residence programs on earth, especially for entrepreneurs and investors who want to live in Asia full-time but do not prefer Singapore.

The program is extremely straightforward and doesn’t require much help from anyone to get.

If you’re under the age of 50, you’ll need to show proof of $2,400 in monthly income and deposit approximately $72,000 at today’s exchange rates into a Malaysian bank. You will also need to prove that you have about $120,000 in liquid assets.

You won’t be able to touch your money for ten years (or until you cancel the visa) unless you decide to buy real estate. If you’re over 50 years old, the bank deposit is cut in half.

You can learn more about Malaysia’s MM2H program and other visas here.

[Update: In July of 2020, the MM2H program was temporarily suspended for the second time in two years without a clear date of return.]

Nicaragua

I’ve called Nicaragua “the next Costa Rica” as it becomes more open and more affordable than its southern neighbor.

From the beaches of San Juan del Sur to the colonial charm of Grenada, Nicaragua is a great place to have a second residence… if you actually want to live there.

Obtaining Nicaraguan residence is extremely easy and only requires proof of income — generally about $750 per month — but you need to live there for six months each year or else your residence permit, and your territorial tax benefits, will expire.

Panama

Panama has some of Latin America’s strongest offshore banks and has become an open country for immigration, especially for citizens of Western countries.

For these citizens, Panama’s Friendly Nations visa program offers instant permanent residence with a low bank deposit of $5,000 and one “economic tie”, usually a Panamanian company or the title deed to real estate.

Paraguay

Paraguay is well-known as a cheap second passport program, allowing foreigners to obtain an instant permanent residence with a mere $5,200 bank deposit, and citizenship in three years.

Paraguay makes for an attractive second residence with the potential to get a passport later. Taxes on local source income are quite low at just 10%, and foreign source income is typically not taxed. Learn more about residency in Paraguay.

Singapore

Singapore is a no-tax haven for entrepreneurs; not only is a company in Singapore far more costly to start and maintain than its Hong Kong counterpart, but tax rates are 0-17% on corporate profits and a flat 20% on the high personal salary you’ll be required to take if you want residency in Singapore as part of the deal.

In short, an active business owner living in Singapore would pay at least $20-25,000 a year for the privilege.

On the other hand, investors with around $4 million to invest can move to Singapore and enjoy no tax on bank interest, capital gains, or foreign profits. Learn more about residency in Singapore.

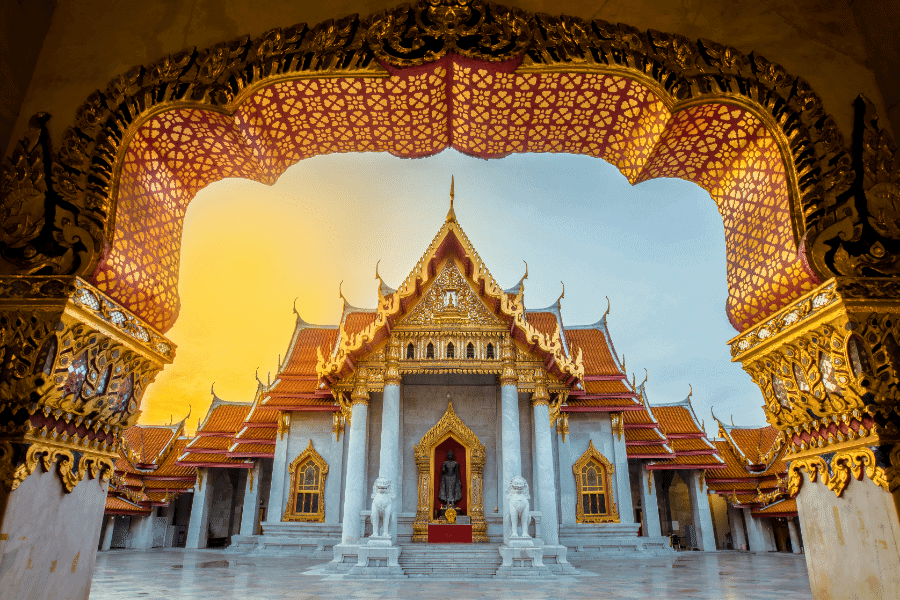

Thailand

Cards on the table, I do not prefer Thailand as a place to live, invest, or do business. But there are a lot of people who do. If you’re one of them, then you’re in luck because Thailand is not only a territorial tax country but also offers many different residency options.

Unless you are going to marry a local, the main residence programs that foreign investors and businessmen will qualify for include the business visa, investor visa, retirement visa, and Thai Elite Visa.

You can read more about each program here, and we’ll give you a deep dive into the Thai Elite Visa here. But here’s a quick summary of each program:

Business Visa: If you run a company out of Thailand, you can apply for a non-immigrant B visa that is good for 90 days and then upgrade it to a one-year visa that can be renewed. However, foreigners cannot own more than 50% of a Thai company.

Investment visa: Invest roughly $280,000 in stocks, bonds, real estate, or any other Thai investment vehicle and qualify for a temporary visa that you can renew annually as long as you maintain the investment.

Retirement Visa: If you are 50 or older, you can get a retirement visa by either showing proof of an 800,000 baht deposit (about $25,600 USD) or a monthly pension or income source of 65,000 baht or more (about 2,080 USD at 2020 exchange rates), or a combination of both.

Thai Elite Visa: Pay anywhere from $15,000 to just over $60,000 for a card that lasts 5, 10, or 20 years and comes with special benefits like government concierge and airport services and receive a temporary residence visa that is renewable every five years.

The Philippines

The Philippines offers one of the lowest age requirements for a retirement visa anywhere in the world. If you are 35 or older, you can apply for the Philippines’ Special Retiree Resident Visa (SRRV) and receive the right to permanently reside in this tropical paradise.

There are several different investment options, with the SRRV Classic being the most popular. If you are between 35-49 years old, you can qualify for the visa by depositing $50,000 in a local bank. Those over 50 who can prove a minimum monthly income of $800 (or $1000 for a couple) only need to deposit $10,000.

Following a 30-day holding period, after your visa is issued, you can convert your deposit into active investments or choose to keep the money in the bank. You must maintain your deposit or investment for the entire duration of your residency.

With the SRRV, you will have government assistance to obtain a tax identification number and establish the Philippines as your tax residence. You will also enjoy tax-free remittance of your pension and annuities.

To learn about all the benefits and different investment options of this residence program, you can read our guide to the Philippines SRRV.

Residence in Lump Sum Tax Countries

As we have seen with the programs listed above, there are different requirements and varying levels of monetary investment in any country to get a residence permit, regardless of the tax situation you’ll enjoy once you become a resident.

One way or another, there is a price of entry.

In lump-sum tax countries, the price of entry is an annual fixed tax.

For years, a number of high-tax countries have offered a special tax regime to attract high-net-worth individuals. These are not a few of tax-free countries around the world, but if you tick all the right boxes, they’ll let you pay a fixed lump-sum tax each year to qualify for a residence permit, and then you can live tax-free in the country for the remainder of the year.

It is essentially a donation for the privilege of living in the country.

You will usually need to maintain a certain standard of housing and a minimum level of wealth to qualify, as well.

The benefit of these programs is that lump-sum tax countries are often of higher quality. You may be willing to pay a little tax over zero tax in order to live in Switzerland vs. Dubai or Italy vs. Vanuatu.

Currently, you can pay a lump-sum tax in the following countries and pay zero tax on all foreign source income:

Anguilla

A British Overseas Territory in the Caribbean’s Lesser Antilles, Anguilla is a small player in the world of offshore trusts and offshore banking. Anguilla has two residence schemes that you can use to dramatically lower your taxes with proper planning.

Your first option is to become a permanent resident by making a donation ($150,000) or investing in real estate ($750,000), which will qualify you to live in the country for as long as you want while enjoying the zero income tax rates. If you live in Anguilla for at least six months a year, you will also qualify as a tax resident.

If you do not want to spend six months of the year on the tiny island, your second option is to pay a lump-sum tax of $75,000 each year. You must also purchase a home worth $400,000. This will reduce the amount of time you must spend in the country to maintain your tax resident status to 45 days a year.

Italy

Italy offers a simple plan. For 100,000 EUR a year, you can obtain an Italian residence permit and live in the country free from all other federal, local, wealth, and inheritance taxes for the years that you are enrolled in the program.

Dividends payable to you from foreign companies are excluded from tax as well, but you will be taxed on any Italian income sources.

You can take advantage of this lump-sum tax for a total of fifteen years.

If you are merely interested in residence, Italy also offers a Golden Visa program but you will have to pay the regular 23-43% tax on your worldwide income if you choose to live there.

Italy also has a self-sufficient residence scheme that would qualify you for a flat 7% tax on all foreign source income. However, there are many conditions to this program and any foreign income taxed at the 7% rate will not be eligible for a tax credit.

Overall, if you have a high income and you would like to live in Italy, the lump-sum tax is probably your best option.

Gibraltar

If you have around $3 million, you may be eligible to become a resident of Gibraltar. Residents under the territory’s investor-friendly Category 2 visa pay a maximum tax of approximately £28,360 per year in exchange for permission to reside on the tip of the Mediterranean.

Similar to London’s “non dom” program, Category 2 residents can escape Gibraltar’s progressive tax rates. While you won’t pay $0, you will have residency in a highly respected European jurisdiction for a predictable flat price.

Plus, Gibraltar is a territorial tax country, which means that any foreign source income will not be taxed either.

Greece

Greece patterned its program after Italy’s lump-sum tax regime, so it’s no surprise that they also require a €100,000 payment to gain tax resident status in this Mediterranean paradise.

Those who take advantage of this program will be protected from double taxation and exempted from reporting requirements and local taxation on their foreign source income.

Switzerland

If you are able to support yourself on savings and overseas investments, you might be able to qualify for a residence permit in Switzerland by paying a lump-sum tax of at least 400,000 Swiss francs.

To calculate your individual lump-sum tax, you will need to disclose all your assets to Swiss authorities. They will use this information to determine your annual “rent expense” and your annual tax will be seven times that amount.

It should be noted that this program is only available in non-German-speaking cantons. Other drawbacks include the high cost of living in Switzerland and the fact that you will not be exempt from inheritance tax, wealth tax, and some capital gains taxes.

For more details about these and other programs, check out our article on the six lump-sum tax countries.

Live in Zero Income Tax Countries

If you’re not as concerned about finding a new country to permanently call home and simply want to live tax-free for a few years, you can achieve just that by getting a second residence in a country offering a tax exemption or the opportunity to become a non-domiciled tax resident.

However, this can be a very complicated option with many hoops and fewer rewards. It is getting harder to become a non-domiciled resident in many countries and it does not always guarantee a zero-tax situation.

For instance, Portugal recently amended the tax laws governing its non-habitual residence program so that foreign pensions received by residents are no longer tax-free but are subject to a flat 10% rate.

Besides Portugal, you can also obtain non-domiciled status in the UK, Ireland, Cyprus, and Malta.

But your best option for a temporary tax exemption is Uruguay, which offers a multi-year exemption on certain income types.

If you can prove that you have a guaranteed monthly income, you can get a residence permit and enjoy tax-free living for a number of years in this “Switzerland of Latin America.”

Wherever you go, there will be unique circumstances and conditions that must be met to make your tax-free offshore strategy a success.

If you’re looking for a second residence and aren’t sure where to start, feel free to reach out to our team. We take every aspect of your situation into consideration as we help you design a holistic offshore plan, including residence, citizenship, taxes, business, investment, and more.