Last Updated: June 17, 2021. Dateline: Mexico City, Mexico

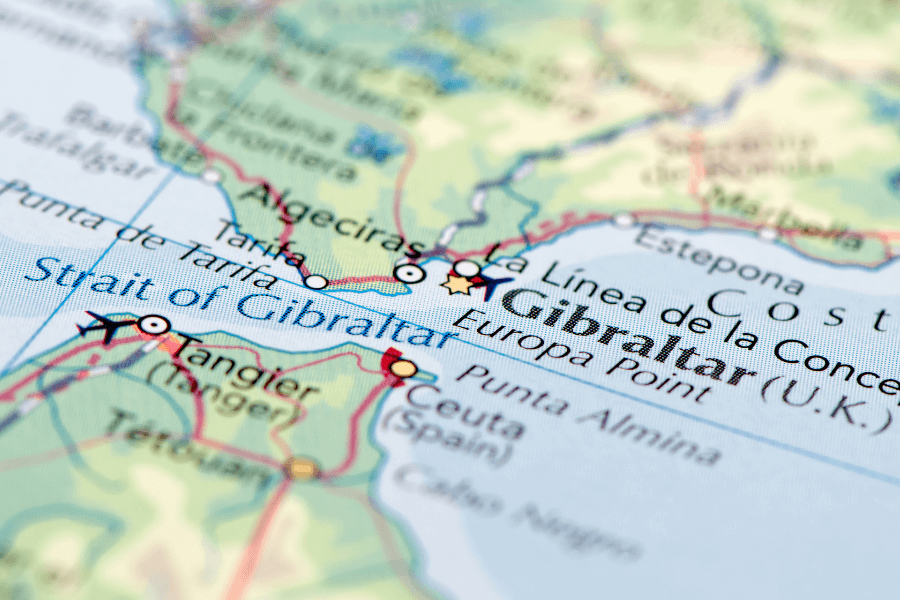

Throughout Spain, the feeling about the economy is grim. This beautiful country, full of amazing culture and cuisine, has fallen to its knees with no solutions for getting up. Yet, on its tip lies a tiny territory many have heard of, but few can find on a map- one of the best places to get a second residency. The territory of Gibraltar — home to the internationally recognized Rock of Gibraltar — is a world removed from many of the issues plaguing Spain, to which its peninsula is attached. At 2.6 square miles, Gibraltar is only about four times the size of Monaco. The territory takes full advantage of its small size to operate a lean government — even Bloomberg agreed that its size allowed it to be nimble and attract new businesses. And wealthy investors are flocking to Gibraltar as an asset haven. Excited by the seemingly recession-resistant diversified economy and relatively hands-off government, people are voting with their feet and going where they’re treated best. There are many easy second residency programs you can apply for but Gibraltar is one of our top recommendations! If you have the assets, you can join them there and gain a second residence. As a British Overseas Territory, Gibraltar retains powers of self-government with its own parliament and currency, though defense and foreign relations are managed by the United Kingdom (UK). Again, size plays a key role here — it’s nice to see governments outsourcing the expensive parts of their operation. Gibraltar is the only UK territory of its classification to be a member — but not a member state — of the European Union, having joined the precursor European Economic Community under the UK in 1973. They operate their own currency, pegged to the British pound. And the 6% gross domestic product (GDP) growth they’ve experienced lately isn’t enough for them. They’re shooting for even more growth in the coming years. Though, what’s amazing about Gibraltar is how they’re using those 2.6 square miles. They have a deep port for worldwide shipping. And they attract seven million tourists every year, many from cruise ships and day trips from Spain. Plus, they’re becoming among the top jurisdictions for online gaming companies. Gibraltar, like so many other small countries, gets it. And what Gibraltar offers for wealthy investors is worth considering. So in this article, we’ll discuss the various options for obtaining Gibraltar residency and any associated taxes.

HOW TO QUALIFY FOR GIBRALTAR RESIDENCY

For those looking to get a second residence in Europe, Gibraltar offers a compelling case. In fact, there are two ways in which you can apply for Gibraltar residency – the Qualifying Individuals (Category 2) residence status or the High Executive Possessing Specialist Skills (HEPSS) residence status.

QUALIFYING INDIVIDUAL’S RESIDENCE STATUS

Investors with £2 million (about US$2.2 million) in net assets can qualify for the prestigious Category 2 immigration status, allowing them to come and go as they please and only pay a maximum capped tax of £27,560 on income. Category 2 residents are able to claim indefinite permanent residence in Gibraltar, as long as they can prove their qualifications remain intact every three years. In exchange, they are subject to no minimum stay requirements in the territory. To qualify for a Category 2 Gibraltar residence, you cannot have been resident in Gibraltar during the 5 years prior to your application. This previous residency translates to 183 days in any given year during the past 5 years. During the year of assessment of your application, you will also need to purchase or rent an “approved” property in the territory. This property will then need to be used for you and your family’s exclusive use. Once you have applied, paid the application fee of £1,000 to the Gibraltar Finance Centre Director, and undergone the assessment, you will receive a certificate that you have obtained Category 2 status. At that point you can acquire your residence permit, which is initially granted for one year, but can basically be renewed for life. And while you can’t use your Category 2 status to go and get a job in Gibraltar, you can use your residency to operate an offshore business. Gibraltar allows residents to set up companies in its jurisdiction. However, with this option you’ll have to pay a 10% corporate tax on any company income derived in Gibraltar. Just be aware that if you decide to go with a crypto-based company, you should be prepared for an even more rigorous application process — though the tax incentives will be worth it. But as I mentioned before, the best news of all is that no matter how much you make, your tax burden will be extremely low with such a second residency in Gibraltar. Based on a certain tax election, your maximum annual income tax in Gibraltar is just £27,560. This isn’t exactly chump change, but if you have the required assets to get in, along with a decent income, it could be a drop in the bucket compared to what you’d pay back home. Though, it’s important to note that there is also a minimum tax of £22,000 per year. What’s more, Gibraltar is among the tax-free countries in Europe as it has no capital gains tax, inheritance tax, wealth tax, or sales tax. This, along with its 300 days of sunshine and proximity to other European countries, makes it an attractive low-tax location for individuals.

HIGH EXECUTIVE POSSESSING SPECIALIST SKILLS RESIDENCE STATUS

The High Executive Possessing Specialist Skills (HEPSS) status is another way to gain a second residency in Gibraltar. Under this program, those who wish to contribute to business activities in Gibraltar at an executive level can be granted this status. However, there are some qualifying conditions. For example, you must possess skills that are not readily available in and are of economic value to Gibraltar. Additionally, you will need to be able to produce two references, a passport, and a curriculum vitae (CV). Like the Category 2 status, you must rent or own a property for the year that your application is being assessed. And you cannot have been a resident in Gibraltar for the three years preceding your application. Otherwise, you just need to demonstrate that you make more than £120,000 per year. Though you will have to pay taxes on that income, Gibraltar will only tax you on the first £120,000, which amounts to approximately £32,050 per year.

SUMMARY: GIBRALTAR RESIDENCY

If you’ve dreamt of having a second residence in Europe, then getting Gibraltar residency just might help that become a reality. With great tax incentives for high-net-worth individuals, Gibraltar offers residency options that can last a lifetime. And even if you don’t have millions of dollars lying around, Gibraltar is an option to consider for a second residence. Taxes on even £500,000 in annual income are about 25%, and certain deductions could make that even lower if you elect to use them. It’s also a jurisdiction worth considering for your offshore bank account. Some may find the connection with the UK a bit nerve-wracking. While British Overseas Territories do govern their own affairs with minimal interaction with London, there is that connection. The British did intercede in the Turks and Caicos government a few years back, then handed the country back over once they “straightened them out.” Gibraltar, however, has cut back its trade with the UK, as well as its reliance. Nevertheless, it’s nice that there are still places that accept businesses and productive people with open arms. Knowing where your bread is buttered is a key step in good governance. If you are interested in Gibraltar residency, apply here for a consultation with the Nomad Capitalist team.