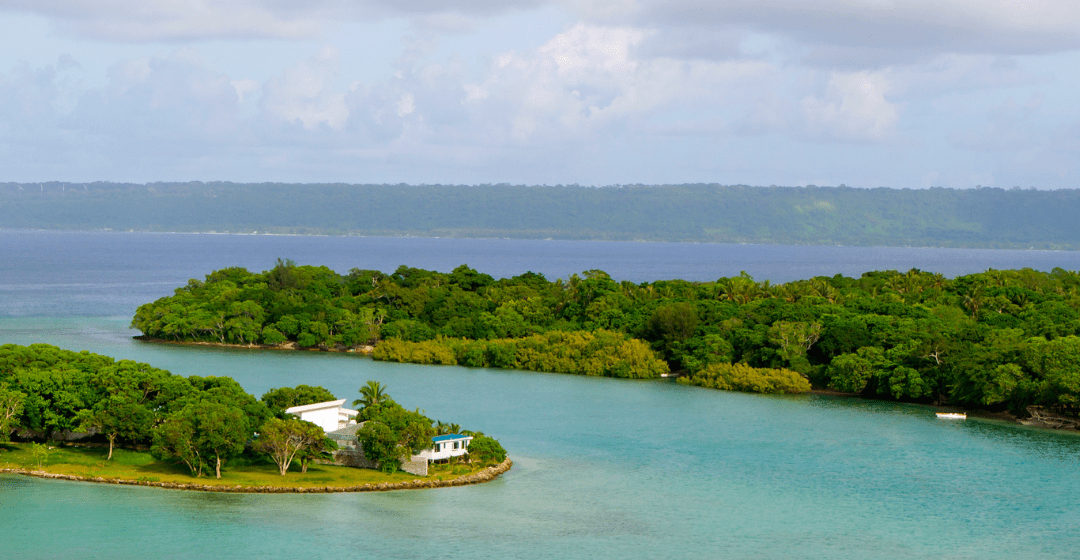

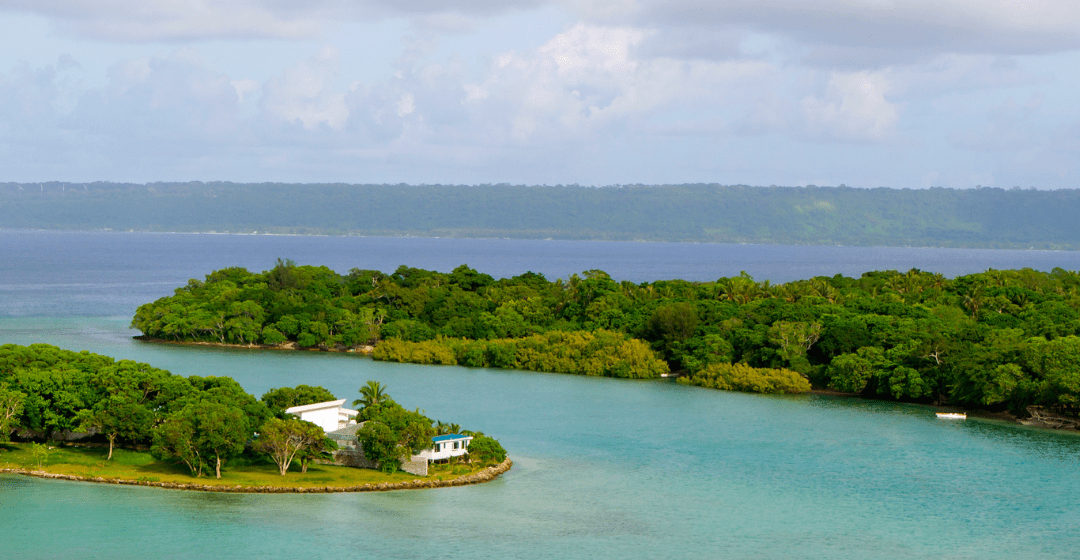

Vanuatu is primarily known for its island paradise appearance and favorable tax code. The national tax code is extremely limited with most wealth and profits are non-taxable. If...

Founder of Nomad Capitalist and the world’s most sought-after expert on global citizenship.

What we’re all about

Meet our 95+ global team

We’re here to serve you

Read our testimonials

Get free email updates

Create your own bespoke global citizenship plan

Claim a second passport based on familial connections

Click here to see all our products and services

Discover the world’s best passports to have in an ever-changing world

Explore the citizenship options using our interactive citizenship map

Explore the tax details for countries using our interactive tax map

Click here to see all of our research and interactive tools

Learn from a curated “Who’s Who” of business speakers from around the world, get our latest R&D updates, and rub shoulders with successful people from all corners of the world.

Andrew Henderson wrote the #1 best-selling book that redefines life as a diversified,

global citizen in the 21st century… and how you can join the movement.

Vanuatu is primarily known for its island paradise appearance and favorable tax code. The national tax code is extremely limited with most wealth and profits are non-taxable. If...

Turks and Caicos is a beautiful island country in the Caribbean, where the weather is tropical all year round and home to one of the largest coral reefs in the northern...

This article looks at ways of establishing Thai tax residence and provides information on taxes in Thailand. Thailand is a Southeast Asian country on the Indochinese peninsula....

As a discerning high-net-worth individual, you’re likely continuously seeking jurisdictions that offer unrivalled tax and lifestyle advantages for you and your wealth. The...

Singapore is a small island nation just south of the Malay peninsula. It’s a place of eternal spring, without snow or cold weather, thanks to its place at the equator. It...

Portugal has long been one of the best European Union (EU) countries to establish tax residence thanks to its lucrative tax schemes and business-friendly environment. Moreover,...

This article discusses how to establish Panama tax residence with information on the benefits of tax residence in Panama, plus other information related to the Panamanian tax...

This article looks at how to establish tax residence in Barbados along with information on the different taxes in Barbados and how they are levied. It's important to note...

Dateline: Dublin, Ireland The Nomad Capitalist lifestyle is all about "going where you're treated best" and planting flags in different countries that serve you better than any...

Over one million Australian citizens live and work outside of Australia. Over two-thirds of that number has relocated to accept jobs offshore. With the rapid growth of the Asian...

Subscribe to our Weekly Rundown and stay ahead with instant alerts on key global changes.