Establishing Tax Residence in Turks And Caicos Islands

June 8, 2023

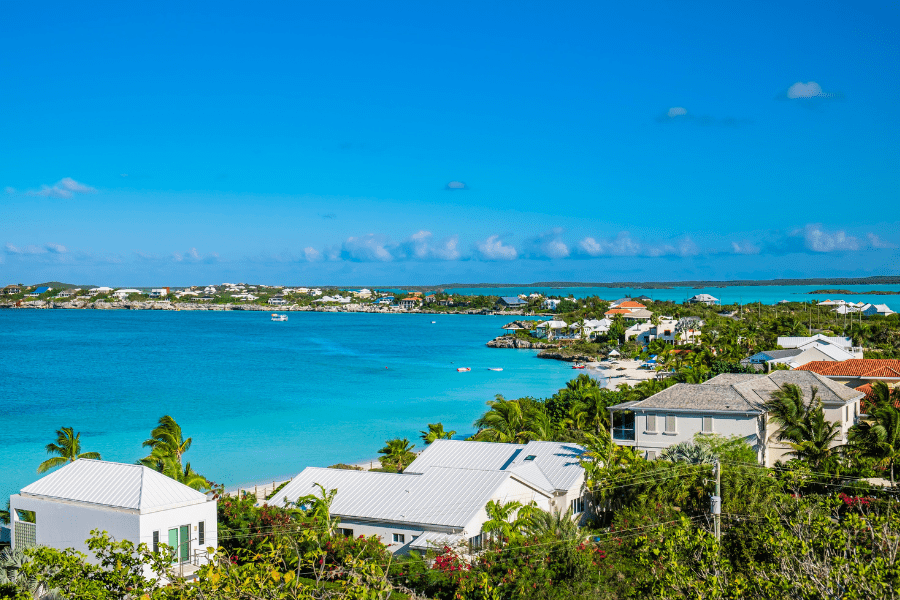

Turks and Caicos is a beautiful island country in the Caribbean, where the weather is tropical all year round and home to one of the largest coral reefs in the northern hemisphere. The beautiful beaches and tranquil environment make it a hot spot for tourists and retirees looking to escape.

Turks and Caicos also have a lot to offer foreign investors hoping to escape oppressive taxes overseas. If you’re wondering whether Turks and Caicos are right for you, then you’re in the right place.This article will explain how and why you may want to obtain a tax residency in Turks and Caicos.

Are you considering moving abroad and want to qualify for tax residency? Become a Nomad Capitalist client today, and we will help you optimize your taxes and maximize your investments.

Why Turks and Caicos?

Turks and Caicos is considered a relatively safe place to live. Even with the slight increase in crime over the past year, the overseas territory maintains its status as one of the safest spots.

As an overseas territory of the United Kingdom, Turks, and Caicos experienced the protection and assistance of the British government. However, don’t use the British pound, but the US dollar. The islands have their own form of government and legal code separate from the UK.

Turks and Caicos has an expanding economy thanks to its appeal to foreign investors and expats. The island nation’s government is always seeking new ways to develop its economy, which is why they incentivize investments and building projects.

The tourism industry is one of the primary economic industries in the country. This makes real estate and other land investments some of the most secure and likely to succeed.

As a no tax nation, Turks and Caicos can grant you the liberation you’ve been seeking from oppressive regulations and tax schemes. The country has zero income and corporate taxes, meaning you can invest in a wealthy tourism-based economy and keep most, if not all, of your wealth.

Becoming a Tax Resident in Turks and Caicos Islands

Becoming a tax resident in Turks and Caicos Islands is one of the most beneficial tax residencies. The islands have several tax benefits, including no income tax, corporate tax, or capital gains tax.

It is possible to obtain temporary residence in Turks and Caicos by making a qualifying investment in a home or business. A temporary residence permit for the Islands costs $1,500 and needs to be renewed each year.

To acquire permanent residence in Turks and Caicos, there are four options:

- investment in a property

- investment in a business

- investment in a specified public sector project

- ten Years continuous legal residence

The minimum investment needed is around $300,000 – $1,500,000, depending on the preferred option.

Individuals holding a permanent residence permit can claim tax residency status in the country if their primary residence is located there, which means spending more than half of the year (183 days) in the country or having a closer connection to Turks and Caicos.

The only applicable taxes or levies are government tax on rental income at a rate, stamp duty or transfer tax, and import duty on the value of a car being imported.

Benefits of a Turks and Caicos Taxation Residency

The main appeal for citizenship or tax residency in Turks and Caicos is their tax code. Turks and Caicos doesn’t have the following taxes, which are prevalent in other countries:

- Zero income tax

- Zero corporate tax

- Zero property tax

- Zero capital gains tax

- Zero inheritance tax

Whether you choose to gain tax residency through investment, descent, or 10-year residency, the benefits are clear. Paying little to no taxes is one of the best benefits afforded by gaining a tax residency in Turks and Caicos.

A Permanent Residence Certificate (PRC) lets you live on the islands for as long as you want, without any residence (stay) requirements, which allows you to travel abroad without worrying about losing your status.

The islands also offer outstanding business opportunities. Investing in a tourism-rich economy gives you the chance to monetize your investment in real estate.

Conclusion

Turks and Caicos has a lot to offer you, whether you plan on living there permanently or solely gaining a tax residency. The tax perks are obvious, as well as the general beauty of the lovely islands. Are you still unsure which residence option is right for you?

The process of acquiring a tax residency can be confusing and overwhelming. Become a Nomad Capitalist client, and we will work as the architect and general contractor for your international tax planning, citizenship, and asset protection. Contact us now to get started.

Turks and Caicos Tax Residency FAQS

Yes, Turks and Caicos is a haven from excessive taxes abroad. They do not have income, corporate, or other taxes that are common overseas.

The term “tax haven” sometimes has a negative connotation since it brings to mind images of hiding your wealth overseas.

However, Turks and Caicos offer investors a completely legal and fair tax opportunity.

Turks and Caicos use the U.S. dollar. Most tourist-based attractions also take major credit cards and traveler’s checks.

Yes, foreigners can purchase and own land in Turks and Caicos. The country is more open and willing to engage in investments abroad than some other countries.

Does Puerto Rico Pay Taxes to the US?

It’s a common question and one that often fuels confusion, debate, and a fair share of misinformation – Do residents of Puerto Rico actually pay US federal taxes? When most people think of US tax obligations, they naturally assume they apply uniformly across all US citizens. But when it comes to Puerto Rico, things are […]

Read more

How to Eliminate US Expat Taxes (by Renouncing)

A common myth persists among many Americans that they can’t benefit from the same tax-saving opportunities as other expats when moving overseas. That misconception is rooted in the United States’ insistence on implementing citizenship-based taxation, requiring their citizens to report and pay tax on their worldwide income – regardless of where they live. As a […]

Read more

How to Pay Zero Tax in Latin America

Latin America has a reputation among many investors as a ‘tax hell’, and its headline tax rates seem to bear out this theory. Colombia taxes top earners at 39%, Ecuador at 37%, and Chile climbs to 35.5%. Those aren’t tax rates to sniff at – they’d make a freedom-sized hole in any annual tax return. […]

Read more