In this article, we look at a little-known Greek tax loophole that potentially allows you to pay single-digit tax rates. More importantly, this method is 100% legal – the Greek...

Founder of Nomad Capitalist and the world’s most sought-after expert on global citizenship.

What we’re all about

Meet our 95+ global team

We’re here to serve you

Read our testimonials

Get free email updates

Create your own bespoke global citizenship plan

Claim a second passport based on familial connections

Click here to see all our products and services

Discover the world’s best passports to have in an ever-changing world

Explore the citizenship options using our interactive citizenship map

Explore the tax details for countries using our interactive tax map

Click here to see all of our research and interactive tools

Learn from a curated “Who’s Who” of business speakers from around the world, get our latest R&D updates, and rub shoulders with successful people from all corners of the world.

Andrew Henderson wrote the #1 best-selling book that redefines life as a diversified,

global citizen in the 21st century… and how you can join the movement.

In this article, we look at a little-known Greek tax loophole that potentially allows you to pay single-digit tax rates. More importantly, this method is 100% legal – the Greek...

So you’ve decided to go where you’re treated best. You’re leaving your high-tax country and looking forward to earning business income, capital gains and dividends with zero or...

Is Malta a tax haven? The question often crops up during any discussion of jurisdictions with tax-friendly systems. As an EU member state , Malta is renowned not only for its...

When most people think of California, capital gains tax rates don’t automatically spring to mind. Usually, people picture sunshine, beaches and that famously easy-going...

Unless you live in a tax-free jurisdiction, you're subjected to many taxes. The US tax authority IRS, alone, has over 800 forms and schedules for taxpayers. You may be required...

International corporate income tax rates vary, with the average rate sitting comfortably around 23.45%. There are extremes. Some countries – think the Caribbean – offer 0%...

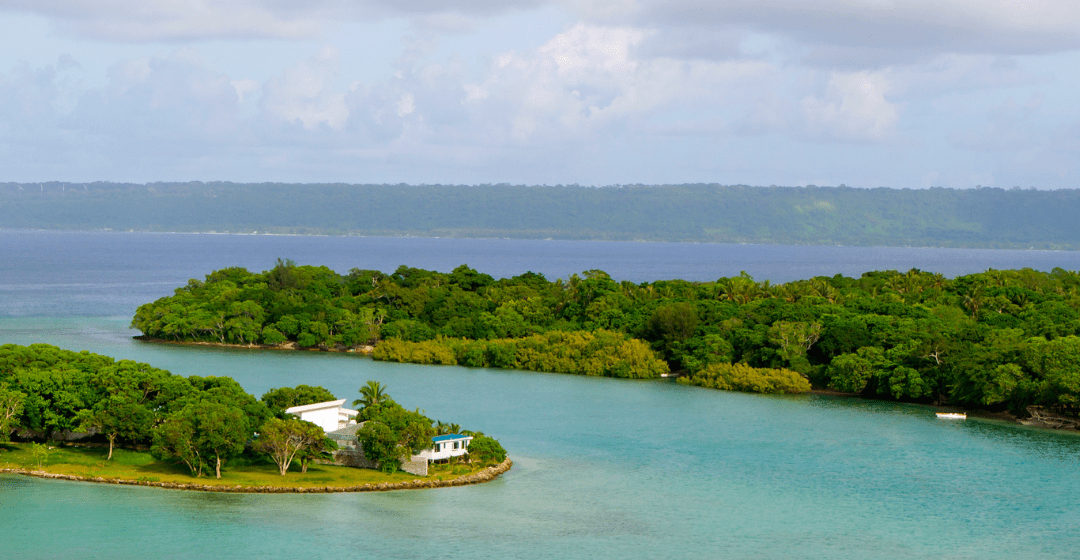

Vanuatu is primarily known for its island paradise appearance and favorable tax code. The national tax code is extremely limited with most wealth and profits are non-taxable. If...

Searching for a tax-friendly residency that works in your favour?Cyprus offers one of the most attractive non-dom tax regimes in Europe, with low tax rates and generous...

To attract more foreign investment to the country, Uruguay has made it easier to become a tax resident there. If tax reduction is your objective, the favorable tax rates offered...

As a non-resident of the UK, what tax incentives do you qualify for? Is tax reduction a goal? You can lower your taxes as a non-UK resident. Read on to get an overview of the tax...

Subscribe to our Weekly Rundown and stay ahead with instant alerts on key global changes.