Six Lump Sum Tax Countries to Lower Your Tax Rate

November 30, 2022

Dateline: Kuala Lumpur, Malaysia

There are many ways to legally reduce both your personal and business tax rates by going offshore. You could move to a zero-tax country like the United Arab Emirates, Monaco, or Vanuatu. Or you could structure your business to save tax in a territorial tax country like Thailand. You could even establish tax residence in a tax haven and travel the world as a nomad.

One option that has been around for years but is not often discussed is the lump sum tax strategy. While the number of lump sum tax countries has grown in recent years, you have no doubt heard of Switzerland – arguably the original lump sum tax country – and their tax incentives years ago.

If you’re new to the idea of offshore tax reduction, I’d suggest you also read these articles:

- How to Legally Lower Your Taxes

- Offshore Company: How a Foreign Corporation Can Reduce Taxes

- How to Avoid Paying Taxes: Tax Evasion vs. Avoidance

- How to Pay Less Taxes: 5 Offshore Methods

In this article, we’ll discuss how a lump sum tax works and which countries allow you legal tax reduction options by moving there.

What is a Lump Sum Tax Country?

First things first, for the purposes of offshore tax planning, lump sum tax refers to a special tax regime created by a country to attract investors. It does not mean that the country has implemented one lump sum tax rate for everyone in the country the way some US politicians advocate as a matter of tax policy.

Lump sum taxes are offered by countries that want to attract successful entrepreneurs, investors, and high-net-worth retirees to their countries. Lump sum tax countries are generally NOT zero-tax countries, and they often don’t offer other tax incentives.

In that way, they are not tax havens. Tax havens are often subject to higher levels of scrutiny, whereas lump sum tax countries have a higher veneer to foreign tax officials and public scrutiny.

Lump sum tax countries figure that while their own local tax rates may be rather high, they would like to attract foreigners to live and spend money there. The logic goes that you wouldn’t move there if you were subject to the same tax rates as the local population, so they’re willing to lower them specifically for the type of people they would like to attract.

Unlike zero tax destinations like Dubai, lump sum tax programs are more fine-tuned. While theoretically anyone could move to Vanuatu or St. Kitts and Nevis and enjoy the benefits of zero income tax, lump sum tax programs have certain conditions to be met.

These conditions generally include that you maintain a minimum level of wealth as well as a certain standard of housing. While some high-level tax-free countries like the Cayman Islands have similar requirements, lump sum tax programs are generally reserved for high-net-worth individuals rather than those aspiring to be wealthy.

Lump Sum Tax vs. Tax-Free

It is exactly that exclusivity that makes lump sum tax countries attractive to many high-net worth and ultra-high net worth individuals.

You may be asking, “Why would I pay SOME tax if there are places I can go and pay ZERO tax?” The answer is that lump sum tax programs give you additional, and some might say higher quality, options.

Read my article on tax-free countries where you can obtain a residence permit and you’ll see a pattern: many of these countries are “off the radar”, as we say. Others are less desirable to live in.

Sure, Dubai is an amazing city with endless shopping, dining, and recreation suitable for any multimillionaire. And while the United Arab Emirates is indeed income tax-free, many of our clients take issue with the extreme weather, or the culture, or what they call the “sterility” of the place. Not everyone wants to live in Dubai.

On the opposite end of the spectrum, many people wouldn’t want to relocate to Vanuatu – an island chain in the South Pacific – no matter how much money they saved. If you’ve accumulated millions of dollars, you may expect a certain lifestyle that a country like Vanuatu, or even the more centrally located St. Kitts and Nevis or Antigua, can’t provide.

Meanwhile, territorial tax countries – those that don’t tax foreign income – increasingly require proper tax planning to ensure your businesses or investments won’t be taxed if you’re a full-time resident. Territorial tax countries also tend to be emerging; think Panama, Costa Rica, Malaysia, and Georgia.

And while Singapore is also a territorial tax country that can theoretically be structured to pay zero tax, you have to actually invest nearly US$2 million in the country which may be something you’re not willing to do on day one.

Lump sum tax programs introduce well-heeled, sophisticated countries like Switzerland, Italy, and British territories to your options list. For high-net worth individuals, these may be well worth a small premium when relocating.

Lump Sum Tax Countries for Relocation

So, just where are these lump sum tax countries? They include some of the most Tony places on the planet that go beyond the usual suspects like Monaco and Dubai.

Switzerland

Historically, each Swiss region – known as cantons – allowed foreigners to negotiate an annual lump sum tax payment with them. They would evaluate your assets and desirability and strike a deal with you. This has gone on since the nineteenth century.

Today, the process is more streamlined than before. Most Swiss cantons offer the program, except the German-speaking cantons of Zurich, Appenzell-Ausserrhoden, Schaffhausen, Basel-Stadt and Basel-Landschaft where it was removed for being unpopular. While you can’t live in Zurich, you can live in nearby Zug or Lucerne, or in the highly international Geneva.

Switzerland’s lump sum tax program is reserved for those who do not carry on professional activity in the country; it’s not for high-level employees or those seeking to run a business. You are permitted to manage your private wealth, and if you can support yourself on savings and overseas investments, you can save a lot in taxes globally.

The process involves disclosing all your assets to Swiss authorities; this data is confidential in keeping with Swiss privacy laws. They will then determine what your annual cost of living – known as your “annual rent expense” – should be, and will generally apply a 7X multiple to that.

The resulting lump sum tax should reach at least 400,000 Swiss francs at the federal levels, although some smaller cantons may reduce this. The cost of living in Switzerland isn’t exactly cheap – I’ve met Swiss millionaires who never considered hiring a maid – so hitting that threshold is not difficult.

Today, about 5,100 families live in Switzerland under the lump sum taxation program. It should be noted that Switzerland does have both inheritance tax and wealth tax, and often applies that wealth tax based on actuarial tables rather than your actual wealth. Capital gains from certain Swiss assets like real estate are also levied in addition to your lump sum taxation.

Italy

Italy recently introduced its own lump-sum tax program to attract wealthy foreigners to move to the country. Given the romance associated with living in Italy, the program may prove to be more popular than its expensive competition to the north.

Unlike Switzerland, Italy’s lump-sum tax program allows participants to live anywhere in Italy, from Rome to the island of Sardinia to Milan and Lake Como in northern Italy near the Swiss border.

Italy’s proposition is simple: move to Italy, become a resident, and then apply to pay just 100,000 euros per year as your entire tax obligation. You can add a spouse, child, or extended family member for 25,000 euros each. Considering Italy’s ordinary progressive tax rates go up to 43% on incomes over a mere 75,000 euros, you don’t need to earn that much to save… and that 43% rate is before levies and local taxes.

This lump-sum payment excludes your federal and local tax obligations, as well as wealth and inheritance taxes for the years you’re enrolled, for up to a total of fifteen years. Any income from Italian sources or blacklisted countries is taxed as usual.

If you earn 1 million euros a year, you’ll pay an effective tax rate of 10%; the same rate you’d pay in Bulgaria, which is infinitely less livable. Even better, the lump sum regime may exclude dividends payable to you from foreign companies, meaning you won’t pay tax twice as you might elsewhere in Europe.

What gives me pause about Italy’s lump-sum tax option is Italy’s membership in the European Union. While Switzerland has more latitude as an unassociated country, Italy must follow norms established in Brussels, where wealthy foreigners getting off with low tax rates is deemed unpopular. Italy is more lenient with you owning a business, but that business will need to be structured properly to avoid triggering an additional tax.

Like any EU country, tax planning in Italy is needed even when tax savings are offered by the government. However, Italy offers numerous ways to become a resident. While Italy has an overpriced “Golden Visa” program, they also have a far less expensive self-sufficient resident scheme to reduce your cash outlay.

You can learn more about Italy’s investor visa and other residence programs that would qualify you to apply for this lump-sum program here.

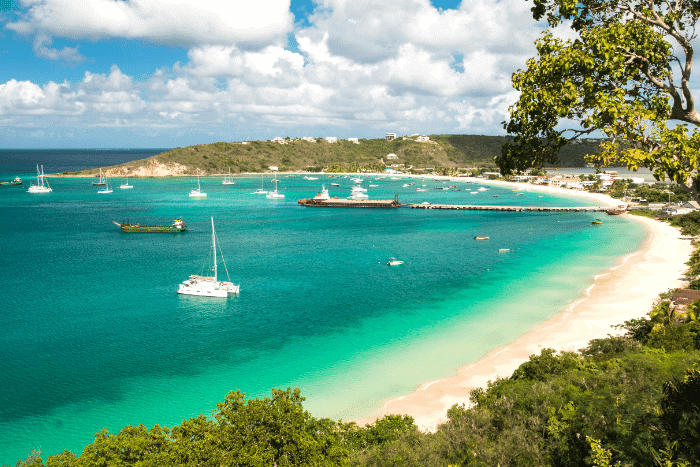

Anguilla

Anguilla is a British Overseas Territory in the Caribbean. Owing to its status as part of the Anglosphere, Anguilla does not have its own passport but does have autonomy over its affairs. The result is a relative tax haven with the high level of development you’d expect from a former British colony.

The island’s government calls it “luxurious living meets financial freedom”. The island itself is similar in quality to the tax-free Cayman Islands, and definitely a step up from the tax-free citizenship by investment countries of Antigua and St. Kitts.

Anguilla has two unrelated schemes that can be paired together: a permanent residence program and a tax residence program. The permanent residence program allows you to live in the Caribbean for as long as you like with zero income tax. The tax residence program allows you to pay a flat, lump sum tax to Anguilla each year with minimal time spent on the island.

To become a permanent resident, you’ll need to purchase qualifying real estate worth US$750,000 or more to cover up to a family of four; you won’t be allowed to sell this property for five years. Alternatively, you may donate $150,000 plus $50,000 per spouse or dependent to a capital development fund for the government.

Once you have your residence status, you can live in Anguilla without any direct taxation whatsoever, for as long as you’d like. If you spend six months in Anguilla, you’ll become an automatic tax resident and can use that to legally avoid tax in other jurisdictions.

If you prefer to pay an annual flat tax in exchange for greater freedom, you can choose to pay a fixed $75,000 per year to Anguilla’s treasury and spend a mere 45 days there. In order to establish a genuine link to the country – since foreign tax offices don’t trust “paper tax residences” – you’ll also need to purchase a home worth $400,000.

With proper planning, your global tax should be capped at the $75,000 so long as you don’t spend more than six months in any single country other than Anguilla.

Jersey

Jersey is a British crown dependency located in the Channel Islands between the United Kingdom and France. Due to its connection to the United Kingdom, the 118-square kilometer island has a definite British look and feel. Despite its tiny size, the island offers world-class education and healthcare facilities just a short flight from London.

Jersey is also home to a special tax regime for high-net-worth individuals that has attracted everyone from European entrepreneurs to Russian billionaires.

The scheme is simple: pay a minimum tax of 145,000 British pounds on your first 725,000 pounds in income, and only 1% thereafter. Your tax is effectively capped at the 145,000-pound level due to the insignificant tax on any income above that.

If you run a business or your investments can fit into a business, Jersey also offers a 0% corporate tax rate for businesses run from the island. We often discuss how your personal taxes and business taxes are separate but work together; incorporating in Jersey is an excellent way to not only cap your personal taxes, but pay zero corporate tax and have no CFC rule issues while living there.

While Jersey is not for everyone, it does offer a high quality of life for families or those looking for a slower pace than in London or other major European cities. Safety and community are aspects of the territory, which also allows long-term residents to work toward British citizenship.

Gibraltar

Gibraltar is a British Overseas Territory, a more common relationship than Jersey’s crown dependency which is not formally enshrined as Jersey was never a British colony.

Also known as “the Rock”, Gibraltar is a tiny stretch of land located at the southern tip of Spain. It’s known for its mountainous terrain and the Gibraltar monkeys that populate it.

It just so happens that Gibraltar also has two lump sum tax schemes for foreigners. While Gibraltar has a warmer climate and more Spanish influence, it allows high-net-worth individuals to enter at a far lower price than Jersey.

In fact, some investors may be able to move to Gibraltar and live absolutely tax-free.

While Gibraltar recently made nice with high-tax European countries by claiming it had abandoned its status as a tax haven to become a “low-tax country”, high-net-worth individuals can still pay an extremely low rate of tax. Gibraltar has no capital gains tax and is a crypto-friendly country, meaning everyone from stock traders to cryptocurrency investors can potentially live there and pay zero tax.

For everyone else, there are other schemes. Gibraltar’s “Category 2” allows those with foreign businesses to pay a minimum tax of 22,000 pounds per year, and a maximum tax of 27,560 pounds per year; you simply pay tax only on the first 80,000 pounds of income at ordinary rates. Certain highly skilled employees can pay taxes on only 120,000 pounds of income.

To qualify, you’ll need to rent or purchase an apartment, but you don’t need to live there. While you may stay in Gibraltar as long as you like, you only need visit a few days per year to claim your taxpayer status there.

Greece

A newcomer to the lump sum tax scene, Greece introduced a new non-domiciled tax regime for tax residents in January 2020 that retroactively takes effect beginning December 12, 2019.

With provisions protecting tax residents from double taxation via tax treaties, the legislation aims to attract high-net-worth individuals to establish their tax residence in Greece. Tax residents will also be exempt from reporting requirements and local taxation on their foreign source income, replaced by an annual lump sum tax.

According to the new tax bill, anyone who has not held the status of tax resident in seven of the last eight years can exempt all taxes on foreign income after paying a lump sum payment of €100,000. Additional family members can be added for an extra €20,000 per person each tax year.

All Greek source income is still subject to local rules and will be taxed according to Greece’s progressive tax rates that can be as high as 54%. However, any foreign-held assets are exempt from inheritance and donation tax.

Patterned after Italy’s program, this special tax status can be held for a total of fifteen years. Applications for Greek tax residence are due March 31 of each tax year.

To qualify, the individual must make a minimum investment of €500,000 in Greek real estate, business, securities, or shares. This requirement will be waived for those who already hold a Greek Golden Visa or another residence permit that requires a similar level of investment.

Second Citizenship through Lump Sum Taxation

Lump sum taxation countries are a rare, tax-advantaged way to obtain a “Tier A” second passport. While it is generally disadvantageous to move to a high-tax country like Italy, the lump sum program makes it reasonable.

If you moved to Italy or Switzerland or Jersey without the benefit of a fixed tax payment, you would pay taxes at the normal income tax rates and your tax burden could approach 50% in some cases.

As romantic as Italy may be, I’ve always wondered why a successful person would give up their entire life in one high-tax country to move to another high-tax country when so many low-tax options exist.

Through lump sum taxation, you can lock in a low tax obligation as a percentage of your income and then comfortably spend as long as you like in the country in order to qualify for citizenship. While I wouldn’t spend more than six months in Italy, nor make it my “center of life”, if you are part of this tax regime, you can.

Most developed nations require you to spend at least six months per year in their country to become a citizen; in some cases, the requirement is as much as ten months per year. Not surprisingly, these day counts are connected to the amount of time you need to become a taxpayer.

Having an Italian or British or Swiss passport gives you an incredible amount of flexibility to live, work, invest, travel, and educate and provide care for your family. If you’re willing to put the time in on the ground, lump sum taxation combined with physical presence can yield an excellent second passport without any extra expense.

How to Get Started

It’s important to understand that lump sum tax programs still require careful planning. US citizens should especially pay attention to their US tax obligations, which follow them no matter where on earth they live and don’t always “play nice” with lump sum programs.

Non-US citizens should also take care that their businesses and investments are arranged properly. If you have a business outside of the lump sum country, you’ll need to make sure you are compliant with CFC rules, PE rules, and other common tax practices, and that your companies are not incorporated in a blacklisted jurisdiction. There may be management and control issues to address as well.

It is also worth noting that having a lump sum tax obligation does not by itself eliminate taxes you may owe in other countries. If you spend 45 days per year in Anguilla and violate your pledge to limit time in any other country to less than six months, the country you spend that majority of time in may also tax you regardless of what you pay to Anguilla.

Similarly, your foreign investments may be subject to tax somewhere else. Rental property in Canada is taxed in Canada because it is Canadian source income. You may need to rely on tax treaties or foreign tax credits – or simply avoid some assets – to ensure your global tax is truly capped at the lump sum.

Offshore tax planning involves matching up all of the “puzzle pieces” in each country where you live, do business, invest, have family, or simply spend time. Nomad Capitalist has helped everyone from internet entrepreneurs, to high-level cryptocurrency traders, to billionaire founders. If you’d like our help creating the best international tax plan, click here to learn more.

Does Puerto Rico Pay Taxes to the US?

It’s a common question and one that often fuels confusion, debate, and a fair share of misinformation – Do residents of Puerto Rico actually pay US federal taxes? When most people think of US tax obligations, they naturally assume they apply uniformly across all US citizens. But when it comes to Puerto Rico, things are […]

Read more

How to Eliminate US Expat Taxes (by Renouncing)

A common myth persists among many Americans that they can’t benefit from the same tax-saving opportunities as other expats when moving overseas. That misconception is rooted in the United States’ insistence on implementing citizenship-based taxation, requiring their citizens to report and pay tax on their worldwide income – regardless of where they live. As a […]

Read more

How to Pay Zero Tax in Latin America

Latin America has a reputation among many investors as a ‘tax hell’, and its headline tax rates seem to bear out this theory. Colombia taxes top earners at 39%, Ecuador at 37%, and Chile climbs to 35.5%. Those aren’t tax rates to sniff at – they’d make a freedom-sized hole in any annual tax return. […]

Read more