The Best Digital Nomad Visa to Get in 2025

June 2, 2025

The entrepreneurial landscape has drastically changed over the past few years. as tThe Covid pandemic highlighted the need for a more borderless way of doing business.

And as more and more professionals realise they don’t need to stay in one place to work or run their businesses, countries are clamouring to attract them to their shores through digital nomad visas.

If you’re interested in running your business from all over the world, a digital nomad visa could be a great way to do it.

Here’s what you need to know about these visas and where to get one.

What is a Digital Nomad Visa?

As the name implies, digital nomad visas specifically target remote workers.

Countries with digital nomad visas usually offer flexible terms ranging from a couple of months to a year of stay. They provide multiple entries and can sometimes be renewed for an extension.

Digital nomad visa countries also offer minimal tax liabilities. Depending on which country you’re applying for, you’ll often find that they do not tax your income.

To qualify, most only require you to provide proof that you are a remote worker and have a sufficient amount of monthly income.

The application process is often quick and user-friendly, with some countries implementing entirely online applications.

The aim of these programs is to attract foreigners to work, invest and contribute to the economy.

However, there are usually restrictions to prevent competition with the local job market. Digital nomads are generally prohibited from taking employment with local companies or engaging in activities that displace local workers.

And as we move into 2025, new programs continue to emerge.

The Best Countries With Digital Nomad Visas 2024

In total, there are more than 60 digital nomad visas available in 2024.

However, not all of them are good choices for young professionals, which is why we only focus on countries that are affordable, highly sought-after, relatively easy to access and have the infrastructure in place to help nurture a digital nomad during their stay.

Spain Digital Nomad Visa

After many years of anticipation, Spain has finally jumped on the digital nomad bandwagon.

While it has long had a golden visa program, it recently introduced a new visa specifically for digital nomads as part of its Startup Law.

Spain’s digital nomad visa aims to create a globally competitive hub for digital nomads and business startups. And unlike the golden visa, it does not require an investment.

This visa allows digital nomads to live in Spain while working remotely for companies outside the country without needing a full work visa. Some other benefits include:

- A streamlined, one-stop hub for all startup requirements

- Non-resident income and corporate tax are reduced from 48% to 24% for five years

- A reduction in interest and deposit-free deferral of tax debt payments

- Deferred, interest and deposit-free payments for corporate tax and non-resident income tax for 12 and 6 months, respectively

- Corporate and non-resident income tax payment installments are waived for the first two years. The date starts when taxable income is first recorded

- Significant increase in tax exemptions on stock options for startups from €12,000 to €50,000 per year.

To meet the requirements for a Spain digital nomad visa, you must be either:

- An investor creating an innovative startup

- A digital nomad working for a foreign company

- Or a freelancer doing remote work for a client outside Spain.

The visa is initially granted for one year. You can then renew it for two-year periods until you reach a total of five years in Spain. After five years, you can apply for permanent residency.

Portugal Digital Nomad Visa

Portugal is a favourite destination for digital nomads. The country’s perfect weather, vibrant culture and affordable living attract international interest.

Besides offering one of the most sought-after golden visas, Portugal is ramping up its digital nomad visa game by offering the Portuguese D8 Visa.

The key points for anyone considering the Portugal D8 Visa are:

- The initial validity of the visa is four months, after which you can apply for a residence permit that’s good for two years, with the option to extend it for another three years

- Once you hold residency for five years, you can apply for citizenship

- The minimum income requirement is €3,280 per month.

Other essential requirements to qualify include proof of an employment contract or service contract with an entity based outside Portugal.

You must have comprehensive health insurance, pass a criminal background check and meet the minimum stay requirement of 183 days per year.

Costa Rica Digital Nomad Visa

Another digital nomad visa that launched in 2022 was the one in Costa Rica.

A favourite destination among tourists and expats, Costa Rica boasts relaxed beaches and pulsating nightlife. The new Costa Rica Nomad Visa has removed the hassle of border runs, making it much easier for nomads to stay.

Previously, remote workers would have only been able to stay for 90 days and then leave, get a new visa and come back.

Significant aspects of the Costa Rica Nomad Visa include:

- One-year validity and can be extended to another year. Provided you stay in the country for at least 180 days in the first year

- Proof of stable income of at least US$3,000 per month or US$4,000 if you are a couple or family applying together

- Foreign-earned income is not taxable. Import taxes on work equipment are also waived

- Permits you to drive using your home country’s driver’s license, which is otherwise not allowed for tourists and resident’s visas

- Has banking privileges that let you open a local bank account.

There are no exemptions to who can apply for a Digital Nomad Visa as long as you meet the requirements.

You’ll also need comprehensive insurance that is valid throughout your stay.

Croatia Digital Nomad Visa

Croatia’s version of a digital nomad visa is not a visa per se but a temporary residence permit.

However, the requirements work just the same way because applicants are required to have remote income.

Key features include:

- Stay and work legally in Croatia for six months up to a year. After that, the temporary residency is not extendable

- You must leave the country once your residence permit expires and reapply after 90 days

- Income tax exemption

- A minimum monthly income of about €2,870 from a foreign source.

The Croatia Temporary Residence Permit does not restrict how you earn your monthly income. Thus, your income can come from retirement, investment, etc., as long as it is earned outside Croatia.

Some requirements to apply for a Croatian Digital Nomad Visa will vary depending on your nationality.

So, it’s best to check with the Ministry of Foreign Affairs to ensure that you have all the necessary paperwork in place.

Estonia Digital Nomad Visa

Estonia is another country that is fully embracing the nomadic lifestyle wave. Besides its E-residency program, it also offers a Digital Nomad Visa.

The Estonian Digital Nomad Visa provides two options: the C-visa valid for 90 days, which is best for a short-term stay, or the D-visa, which is valid for up to 12 months.

They both offer:

- No restrictions on nationality. Everyone can apply as long as they fulfil eligibility requirements

- Valid for up to one year, including 90-day travel across the Schengen Area with the option to renew within Estonia

- Minimum income requirement of €4,500 per month

- No income tax for C-visa. But if you apply for a D-visa, your income is taxable if you stay for more than 183 days.

To qualify for the Estonia Digital Nomad Visa, you must prove that you are either:

- A digital nomad working for a foreign employer or company

- A shareholder of a company registered outside Estonia

- Or you offer freelance service and have established contracts with clients abroad.

You also must provide proof that you have met the monthly income threshold for the past six months.

The Digital Nomad Visa is not a pathway to residency or citizenship but a permit for a temporary stay. stay.

Greece Digital Nomad Visa

In 2021, Greece’s Digital Nomad Visa Law 4825/2021 was passed to create a visa that caters to remote workers.

It suits foreigners who want to enjoy what the country has to offer, but do not wish to commit for the long-term.

Some of the visa’s main features include:

- Validity is for up to one year and can be extended for another year at the most

- A Greek digital nomad visa is extendable to other family members

- The minimum monthly income requirement is €3,500. An additional 20% is required if applying with a spouse and or 15% for each child.

Greece is an ideal location for most digital nomads because it has a well-developed infrastructure to support all types of nomadic professions.

The country has excellent coworking hubs, a stable internet connection, digital and mobile banking, a well-run transport system and a vibrant community of expats with which to connect.

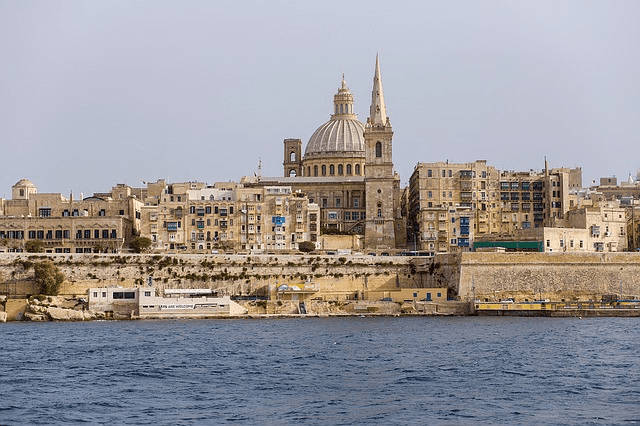

Malta Digital Nomad Visa

Malta’s Nomad Residence Permit (NRP) is ideal for digital nomads who do not wish to be a full-on tax resident.

On top of that, Malta is another favourite destination among digital nomads and travellers.

The country’s sunny weather, beaches and relaxed lifestyle are ideal for those who want to take a leisurely approach to life.

Though the government already has a Global Residence Programme (GRP), it also introduced a digital nomad visa program called Nomad Residence Permit (NRP).

Some provisions of the program include:

- Digital infrastructure in place for telecommuting work

- Zero income tax liability for one year even if you spend over 183 days in Malta, provided you have a tax residency in your home country

- The minimum monthly income threshold is pegged at €3,500

- No physical stay requirements

- Freedom to travel and stay in Schengen visa countries for 90 out of any 180 days.

One crucial requirement for getting a Malta Digital Nomad Visa is proof of tax residence.

If you are no longer paying taxes in your home country, then the NRP might not be a good fit for you.

Brazil Digital Nomad Visa

The Brazil Digital Nomad Visa program was launched in 2022. With it, Brazil aims to attract foreigners to work remotely in the country without needing local employer sponsorship.

Brazil’s version has since propelled the country as an up-and-coming hotspot for remote workers who want a vibrant culture and diverse landscapes.

Some features and benefits include:

- One-year validity with an option to renew for another year

- A minimum monthly income requirement of US$1,500 or maintaining a balance of US$18,000 in your bank account

- No income tax liability provided you do not exceed your stay of 183 days within a one-year period.

Because the Brazil Digital Nomad Visa was only launched in 2022, there are still some grey areas, like the tax obligations of digital nomads and their foreign employers.

In addition, the in-person application can also be a turn-off to those who enjoy the convenience of filling out applications online.

If you prefer a more long-term approach, you could opt to get Brazilian citizenship by marriage or residence by investment.

Digital Nomad Visa Advantages

What makes digital nomad visas attractive to remote workers is the relatively easy application process and easy requirements (for most countries, at least).

There are also minimal visa fees and tax exemptions.

If you are a constant traveller who fully embraces the nomadic lifestyle, then this is one way to explore the world.

As long as you follow the general requirements of earning your living outside the country you are visiting, meet the minimum monthly threshold, have comprehensive insurance and pass a thorough background check, you can fully embrace the life of a global citizen.

Digital Nomad Visa Disadvantages

On the other hand, because some countries are just warming up to the idea, there are vague areas of implementation.

For instance, Brazil Digital Nomad Visa is unclear if it can be extended to other family members.

In addition, some countries have unclear guidelines regarding tax. For example, Malta’s one-year tax exemption does not apply to everyone.

Tax regulations for Nomads in Greece are still vague, while Estonia’s zero income tax, although promising in theory, is difficult to achieve in actuality.

These can make you vulnerable to double taxation and other tax risks.

Another issue is that there are already other visas in place that cater to a nomadic lifestyle, such as golden visas, residency permits and freelancer visas that are more established.

Most importantly, there is also the question of maximising the benefits. Do you need a digital nomad visa, or will a tourist visa be enough to travel and work legally?

Digital Nomad Visa 2024: FAQs

Whether you need a visa for Costa Rica depends on your nationality. Citizens of certain countries, such as the United States, Canada and most European Union countries, do not need a visa for short tourist visits, typically up to 90 days.

Countries offering digital nomad visas include:

Estonia

Portugal

Croatia

Spain

Malta

Bali (Indonesia)

Dubai (UAE)

Barbados

the Cayman Islands

Mauritius

Costa Rica

Brazil.

A digital nomad visa is a type of visa that allows individuals to live in a foreign country while working remotely for a company or clients outside that country. Digital nomad visas are designed for remote workers who want to reside in a destination for an extended period without becoming permanent residents.

The Italy Digital Nomad Visa was introduced in 2024, allowing non-EU citizens to live and work remotely in the country. Like other digital nomad visas, it’s targeted toward freelancers, remote employees and self-employed individuals who are citizens of countries outside the European Union.

Yes, as of 2024, the Japan digital nomad visa was introduced, allowing remote workers to live and work legally in the country for up to six months. Requirements typically include a valid passport, proof of remote work, sufficient income and health insurance.

Yes, Thailand offers a visa called the ‘Destination Thailand’ visa, which is the country’s digital nomad visa. It’s a multiple-entry visa valid for five years.

The Best Digital Nomad Visas for You

Which visa is best for you to apply for as a digital nomad?

It all boils down to a lifestyle fit. What works for most may not be the right choice for you. Always opt for a custom-tailored, holistic strategy that considers your lifestyle preferences, future plans and financial goals.

If you want to know more about how you can go where you’re treated best and be a global citizen, apply here.

How to Get UAE Citizenship – The Complete Guide

Sovereignty – both national and personal – shapes ambition, secures wealth, and defines status in a shifting global order. For the high-achieving global citizen, acquiring a second or even third passport is more than a lifestyle upgrade; it’s a strategic move in long-term financial and geopolitical positioning. But not all citizenships are created equal – […]

Read more

A Gateway to Central Asia: New Kazakhstan Golden Visa Program for 2025

Central Asia just raised the stakes in the golden visa game. In May 2025, Kazakhstan officially launched a 10-year Golden Visa program in an ambitious move to position the country as a serious contender in the global investor migration space. At a time when other international regions are rolling back their citizenship and residency options, […]

Read more

Top Countries Offering Golden Visas in 2025

Residency is no longer about lifestyle – it’s about leverage In an increasingly unpredictable world, Golden Visas offer something most governments can’t: certainty in exchange for capital. They are more than migration tools; they are strategic safeguards offering residence rights, future citizenship, global mobility, and access to tax-friendly jurisdictions. For investors, entrepreneurs and globally minded […]

Read more