10 Countries with the Safest Offshore Banks

March 11, 2025

If you’re new to the world of offshore banking, you may understandably be concerned about bank safety. After all, many people, influenced by false media reports, believe that there’s a risk their money can simply vanish if they move it overseas.

You may not know that almost every developed country has some form of deposit insurance for banking clients. You may be surprised to learn that the United States was only ranked the 40th most stable banking system at the peak of the financial crisis.

Here at Nomad Capitalist, we often discuss emerging offshore banking jurisdictions that offer higher interest rates, but anyone seeking reassurance will still want to know the safest offshore banking countries.

Each year, Global Finance Magazine publishes a report on the ‘World’s Safest Banks’. We’ve analysed the latest report and listed the countries with the safest offshore banks.

Of course, you should always do your own due diligence before opening an offshore bank account, but these countries score high in the 2024 global financial rankings.

Here is our list of the most secure, stable banks for protecting your assets abroad.

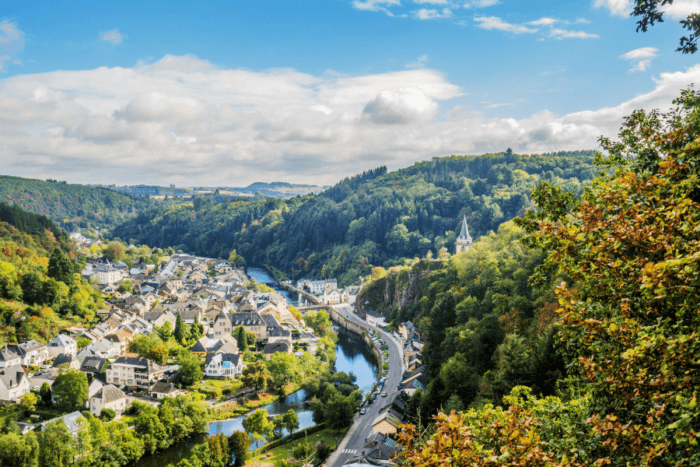

10. Luxembourg

Luxembourg, this tiny nation of just over half a million, was listed as one of the top 5 richest countries in the world per capita. Unsurprisingly, it has a solid reputation for banking security.

Unfortunately, Luxembourg may not be an option for US citizens, as few Luxembourg banks accept US persons as clients.

But if you get a chance, Banque et Caisse d’Epargne de l’Etat ranks #20 on the list of the world’s safest banks.

However, Luxembourg comes in the top 5 on our Nomad Passport Index.

Luxembourg is generally associated with stability and financial expertise and is, thus, in good context here.

9. South Korea

South Korea is not usually at the forefront of discussions for nomads and offshore experts.

However, this highly-developed Asian nation makes our list of the safest countries in Asia for Nomads and also appeared in our discussion on safe-haven currencies.

We also recently wrote about South Korean residency and citizenship in this guide for those interested in a passport that also offers visa-free access to the United States.

South Korea frequently appears on the World’s Safest Banks list, with the Korea Development Bank (#16), Export-Import Bank of Korea (#17), and Industrial Bank of Korea (#22).

These are some great banking options for entrepreneurs and investors interested in banking in Asia. Additionally, they will find a culture that respects business and finance and offers the banking infrastructure needed to support it.

8. Singapore

Singapore is undeniably our favourite place to bank here at Nomad Capitalist and is home to some of the world’s best offshore banks.

According to Global Finance, the tiny Asian financial centre is home to three of the world’s safest banks: DBS (#12), Oversea-Chinese Banking Corp. (#13), and United Overseas Bank (#14).

Singapore has built the best offshore banking centre in the world by acknowledging one simple truth: capital goes where it’s treated best.

Singapore has one of the highest numbers of ultra-wealthy people globally, making it a great place to bank. Although opening an offshore account in Singapore is becoming more complicated, it’s still possible.

And since so many wealthy Asians are ignoring Switzerland in favour of Singapore, it’s an excellent sign that it’s the place to bank.

7. Canada

For Americans, Canada might not be the first place that comes to mind when thinking of ‘offshore banking.’ Nevertheless, it has some of the world’s safest banks.

Unfortunately, those banks are often off-limits to Americans, especially those paying more aggressive interest rates.

While banks like TD Bank have made strong moves into the US market and have been forced to spend an estimated US$100 million to comply with the Foreign Account Tax Compliance Act (FATCA), smaller Canadian banks have simply shut their doors to American clients.

It’s a shame because they have some of the safest banks, including the aforementioned TD Bank (#21) and the Royal Bank of Canada (#10).

Other reputable banks include the Bank of Nova Scotia (#26), the Bank of Montreal (#27), the Canadian Imperial Bank of Commerce (#28), and the Federation des Caisses Desjardins du Québec (#33).

6. France

France is not a country we often talk about at Nomad Capitalist due to its lack of desirability from a tax-planning standpoint and bureaucratic ways.

As one of the countries in the world with the highest capital gains tax and income tax, this European Union(EU) centre of power is still ranked five times in the top 50 safest banks.

Last year, France’s top three safest banks were the Caisse des Depots et Consignations (#11), SFIL (#18), and Agence France Locale (#45).

5. Sweden

Sweden is known by many as a bastion of security, safety and order both in Europe and around the world.

The Swedish passport is rated #14 on our Nomad Passport Index. In terms of banking, the country has multiple safe banks including Swedish Export Credit Corporation (#9), Svenska Handelsbanken (#15), and SEB (#40), some of whom may be recognisable to those who have travelled in Scandinavia.

Sweden is a remarkable economic and social success, but with that comes certain drawbacks. It is also the nation with one of the highest tax rates in the world.

In terms of banking, Sweden may offer you the stability you are looking for in Northern Europe. Plus, English will be spoken competently throughout the process.

4. Norway

Norway is one of the best countries to be born in and the second happiest country in the world. If that wasn’t enough to pique your interest, it also has Kommunalbanken, rated as one of the safest banks in the world (#7). But be careful. Norway is also home to the world’s second most expensive Big Mac Burger.

However, high wages can make up for this and, while banking is possible for foreigners in Norway, there are several caveats. For example, if you’re a non-resident, you may only be able to open a savings account and most banks will require that you deposit at least US$110,000.

3. Netherlands

The good news for the Netherlands is that it is one of the safest countries in which to bank.

On paper, bank accounts in the Netherlands are protected by bank deposit insurance for up to €100,000, the EU minimum.

The country is home to three of the top 50 offshore banks, including Bank Nederlandse Gemeenten(#3), Nederlandse Waterschapsbank (#6), and Rabobank (#39).

2. Switzerland

Switzerland and banking are synonymous for most people around the world. Over several generations, this highly developed, multilingual European country has become the global standard for financial stability. Zuercher Kantonalbank continues to rank as #2 in the world’s safest banks.

Many have dreamed of having a Swiss bank account or taking advantage of the many financial benefits of this non-EU nation. However, while Switzerland was once the only tax haven, it is now increasingly inaccessible for offshore purposes.

As discussed, Switzerland is no longer the universal answer for bank secrecy. Banks there have become increasingly bureaucratic and highly regulated in recent years. At the same time, other countries have upped their game by becoming financial safe havens.

Interestingly, Switzerland has no restrictions on the amount of cash carried into or out of the country. It is also an ‘old school’ choice for offshore gold storage and remains one of the least corrupt countries in the world.

1. Germany

Germany is home to KfW (Kreditanstalt für Wiederaufbau), the #1 safest bank in the world, as reported by Global Finance. In all, Germany is home to seven of the world’s fifty safest banks, including Landwirtschaftliche Rentenbank (#4), L-Bank (#5), NRW Bank (#8), and more.

As one of Europe’s stronger economies, Germans take their banking system seriously. And while bank secrecy in Germany isn’t what it is in other German-speaking countries, such as Austria or Switzerland, Germans are concerned about issues like capital controls.

It was the Germans who convinced the European Union to issue a high-value €500 banknote so they could more easily keep the hard currency at home.

A few German banks accept foreigners, including US citizens, but the accounts offered are typically general retail accounts with low interest rates and little option for currency diversification.

Thoughts for US Citizens

Amazingly, a few US banks are still ranked among the ‘World’s Best Banks‘. However, it’s worth noting that other countries have a larger number of banks at the top of the list.

With laws like the Foreign Account Tax Compliance Act (FATCA) ready to be fully implemented, Americans, in particular, should take caution to move some of their assets into safe offshore banks before it’s too late.

The team at Nomad Capitalist is ready to help you. If you’re interested, check out our list of the best offshore banks in countries that provide safety, make it easy to open a bank account, and offer greater diversification.

We help seven- and eight-figure entrepreneurs and investors create a bespoke strategy using our uniquely successful methods. We’ll help you keep more money, create new wealth faster, and be protected from whatever happens in just three steps. Become a client today.

The Best Countries for Investing in the Middle East 2025

The global investment landscape has changed dramatically. Gone are the days when opportunities were limited by geography or confined to traditional stocks and bonds sold only through standardised, rigid and often cumbersome channels. Back then, going ‘global’ might have just meant adding a few European equities to a US-based portfolio. Today, everything has changed. Barriers […]

Read more

Best Gulf Country for Company Formation and Business Setup

For ambitious entrepreneurs, the Gulf region offers a powerful blend of top-tier banking systems and business-friendly laws that streamline company formation and make the process remarkably efficient. Countries like Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the United Arab Emirates (UAE) are actively competing to attract the world’s brightest business minds – and it’s working. […]

Read more

Top Offshore Tax Havens in the Caribbean

When people hear the term ‘tax haven’, it often conjures up images of shadowy offshore bank accounts and shady financial dealings. The reality is far more practical and much less sinister. Caribbean tax havens aren’t just for billionaires or corporations with armies of lawyers. In fact, many everyday entrepreneurs and investors take advantage of the […]

Read more