The Best Countries for Offshore Gold Storage

December 27, 2024

The price of gold grew by more than 20% in 2024 alone, and its value continues to climb steadily, continuing a bullish trend that has seen its price double over the last ten years.

In fact, at the end of 2024, gold prices hit record highs of over US$2,600 per ounce. Experts predict this trend will continue in the longer term.

In a time of global economic uncertainty, US fiscal deficit concerns, an ever-changing geopolitical landscape and rising interest rates, gold is a safe haven that offers tangible reassurance.

Like every commodity, gold’s value may fluctuate, though its long-term resilience makes it the perfect safeguard against both short-term market shocks and prolonged periods of economic uncertainty.

It should come as no surprise that more and more governments, particularly China, have begun stockpiling it in greater amounts, further adding to its value. Given its advantages as part of a diversified wealth portfolio, buying gold is often a sensible choice.

The question is, where and how do you store it?

In this in-depth guide, the Nomad Capitalist team explores the best countries for offshore gold storage and what to look out for to ensure your gold remains safe.

Don’t waste time worrying about tomorrow, take control of your future with a shock-proof Action Plan from Nomad Capitalist. You can find out more here.

Offshore Gold Storage – Top Wealth Havens for Precious Metals

We’ve long been fans of Singapore. Over a decade of doing business in Singapore, our team has studied and met key players from two markets: banking and precious metals.

Back in the early 2010s, Singapore decided to eliminate Goods and Services Tax (GST) – basically a form of sales tax – from the purchase of precious metals. It also decided to make it easier for anyone to trade and hold precious metals in the city-state.

As a result of those policies, Singapore has gone from relative obscurity to becoming one of the top wealth havens in the world for precious metals investors.

But is it the best place to store your gold offshore?

Considering the history of gold confiscation, wealth taxes, and other political grabs of precious metals and wealth in general, it’s important to have a safe haven for your gold, no matter what happens where you live.

At Nomad Capitalist, we believe that storing gold offshore is an important step toward financial diversification.

As a bonus, precious metals vaulted offshore and held outside the banking system are legally non-reportable for taxpayers in the United States and a number of other countries.

We’re not talking about storing your gold in a bank safety deposit box. We’re talking about private vaults with high-level security and experience of dealing with high-net-worth individuals.

To understand offshore gold storage, we first cover our checklist for selecting the best country to store gold. Then, we examine some of the common countries for storing gold and silver in offshore vaults and which of them is our top recommendation.

What to Know Before You Store Gold – Gold Storage Checklist

Here are our top criteria for the best and safest places to store gold:

1. Go for Offshore Gold Storage

Your gold should be stored outside of your home country to provide asset protection from your own government. One reason for buying gold is to detach yourself from a single country and its monetary system.

Keeping some gold coins or silver bars in a safe at home makes sense, but not your entire holding.

2. Store Gold in a Wealth Haven

Your gold should be stored in a safe jurisdiction with an excellent record as a wealth haven.

While we often encourage our clients to consider second passports and even offshore bank accounts in emerging world countries, your stack of gold bars isn’t an area where you want to fool around with countries that have untested safe-haven status.

That means we don’t consider countries like India or Thailand, which are either unpredictable or too new as wealth havens.

3. Go for Countries with the Right Alliances

Avoid countries with ‘unholy alliances’ to the extent they are a risk for holding your assets.

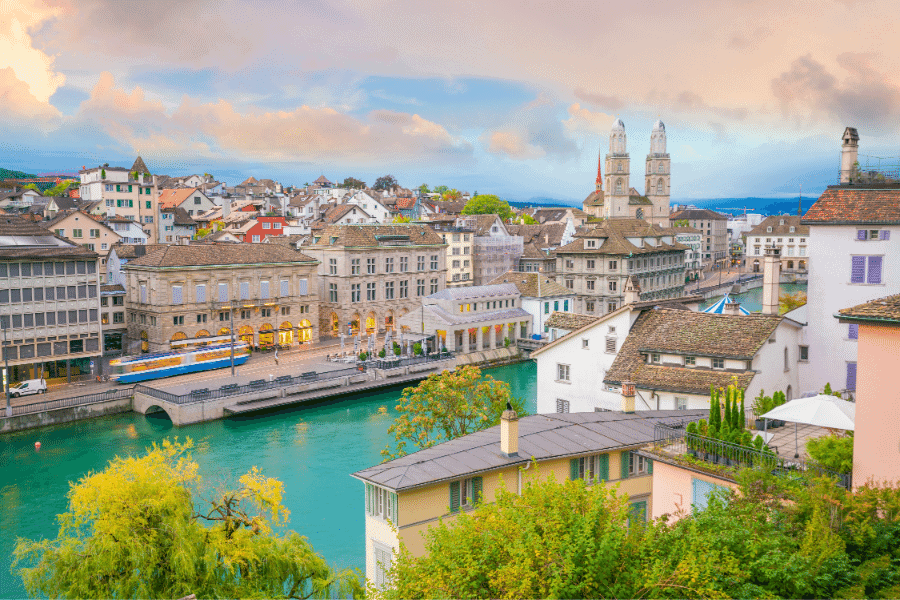

Storing gold in London is more interesting post-Brexit, as is gold storage in Switzerland.

As much as we like Ireland as a country, its membership in the European Union scares us, so we tend to avoid places like Dublin, Amsterdam or Frankfurt as a first choice.

The European Union is unlikely to issue a gold confiscation and these places may be good as a secondary vault location, but they wouldn’t be our top choice.

4. Avoid Countries under Pressure

Always try to avoid vault storage in countries that are under pressure from larger powers.

While Canada is a neutral country without any explicitly negative alliances, it remains best friends with the United States. If you’re a US citizen or have exposure to the US, we wouldn’t necessarily trust Canada for gold storage.

In the same way, we wouldn’t trust a place like Belize that’s under the thumb of the US government.

Canada, however, could work for non-Americans and non-Canadians.

While Canada certainly has rule of law and you wouldn’t expect any issues, it wouldn’t be our top pick for this reason.

5. Choose Countries without Pressure

Similarly, we may (or may not) choose to favour countries that aren’t under pressure from any other powers.

For this reason, storing gold in Hong Kong or even Shanghai could be an interesting ‘put option’ in the Western world.

As many issues as Hong Kong has had, it’s still part of China and that may actually increase your asset protection. No one is going to mess with China.

6. You Need Highly Secure Vaults

Avoid gold storage in countries that don’t have highly secure physical gold storage vaults.

While Panama is a neutral country conveniently located between both North and South America, we have not been impressed by its gold vault facilities.

Your gold and silver should be held under the strictest of security measures. There are plenty of offshore vaults fit for a James Bond movie, so don’t settle for those with shoddy security.

7. Store Gold in Professional, Well-Managed Jurisdictions

Your gold and silver should be stored in a place with proper professionals who can sell, store, buy back gold and wire your funds to anywhere in the world.

You could store your gold in Tehran as the ultimate protection against the West, but who would you call when you wanted to sell it? How would you communicate? And how would they actually get the money back to you?

Choose a respected jurisdiction with good banking infrastructure and qualified professionals who have experience in the precious metals business.

By applying those criteria, we can safely rule out many countries and many private gold storage facilities.

Here’s what Nomad Capitalist founder, Andrew Henderson, has to say about his offshore gold storage choices:

‘As a former US citizen, I would not choose to store my gold in the United States, nor do I recommend Americans or anyone with a connection to the United States do so. The US government sticks its nose in way too many people’s businesses to be trusted with an asset class that they previously confiscated.

I would also eliminate Canada, the United Kingdom, Australia and European Union countries. While places like Austria and Germany still have some modicum of bank secrecy, these countries have too many regulations and practice too much moral outrage to be my first choice.’

Three Best Countries to Store Gold Offshore

These days, buying gold is easy. In many places, gold dealers will sell and ship directly to your door. And just about anywhere you go, gold shops are a common sight. The hard part is knowing what to do with your gold and silver once you have it.

While some people are content to hide their gold in a coffee tin or bury it in their backyard, smart investors know they need to place their gold and silver in a safer place.

For the internationally-minded, this means moving your bullion offshore.

But where offshore?

The world is a big place and not every country is made alike, especially when it comes to offshore gold storage.

The following are our top picks for the best countries for offshore gold storage.

Singapore

Singapore is our top choice for gold storage. The city-state has long been the Switzerland of Asia; it’s modern, efficient and responsive. Corruption and crime are about as close to zero as you can get anywhere.

Singapore’s private gold storage facilities are more modern than in countries like Switzerland, and some vaults offer online access and even photos of your gold.

There is a well-oiled ecosystem to buy, sell, swap and even borrow against your gold and silver, all at reasonable spreads.

Other companies outside Singapore also maintain space in vaults like Le Freeport – the vault we visited there is ready for a super spy.

The vaults in Singapore truly are the best in the world.

The island country also has the benefit of independence and security. For instance, the Malaysians aren’t going to invade Singapore. It’s on the level of New Zealand in terms of geographic advantages but with much better services.

In fact, we’d go as far as to say that Singapore has the greatest innovation in the gold storage industry.

While old-school European wealth and its management is all about parking your money and leaving it there without doing a lot of transactions, Singapore is all about buying one silver coin and starting an account.

While you can always buy more, both Singapore Precious Metals Exchange SGPMX and BullionStar allow you to start storing by spending as little as US$20 on gold. And if you already have gold and silver that you want to move to Singapore, they also cover that.

In addition to that, Singapore loves transactions. Asian banks, in general, love transactions. If you’re not doing enough transactions, they’ll ask you why.

Conversely, European banks don’t want you to transact money at all and prefer you just leave it there.

The same goes for gold. In an era when Europe is becoming more unpredictable, Singapore is becoming the new wealth hub.

Because of the growing storage industry, a lot of companies are now loaning money against gold.

While we don’t advocate debt, if you have gold, you can borrow against it. It’s also possible to buy gold with no spread in Singapore.

You can buy gold from SGPMX and exchange it with another client. There’s a lot of innovation there that’s constantly making things easier.

In fact, when we spoke with Victor Foo, Founder and CEO of SGPMX, he told us about a new, even more innovative product that they were rolling out: gold-backed debit cards.

You can now sell your gold or silver and have that money put onto a debit card that they issue you. You can then use that card in five different currencies anywhere in the world.

With this setup, you no longer have to wire your money out of your gold account back into the banking system. You can just use the debit card.

No doubt, there is a lot of innovation going on in Singapore.

That is why it takes the number one spot on this list, not necessarily because it’s hands down the best place to store gold – although an argument certainly could be made for that – but because it’s dominating the industry in terms of innovation.

If you’re looking for a recommendation, Le Freeport by the Singapore airport is the best storage facility in our opinion. Our team has been there multiple times and we can honestly say it’s the safest, most impressive facility in the world.

Interested? Follow our full guide to offshore gold storage in Singapore for more details.

New Zealand

While New Zealand is regrettably part of the Five Eyes government spying program, it is undeniably a wealth haven that has remained rather neutral.

In fact, we would argue that storing gold in New Zealand is a government play. It’s not a low-tax government, but it’s a very wealth-friendly government. We don’t see the government going in and confiscating gold — that’s not necessarily its top priority.

We also like New Zealand because it’s far away from the chaos of the world’s problems. Plus, thanks to its location in the southern hemisphere, you don’t have any kind of threats, whether it’s weather or any of the political drama that goes on elsewhere.

And despite its isolation, New Zealand has a developed economy, a solid global reputation and professionals who can help with your offshore gold storage, purchases and sales.

It’s also a convenient choice simply because New Zealand is a common law and English-speaking country.

People who are storing money in London will likely find New Zealand has the benefits of storing on an island without the consequences of all the political entanglements of the UK. If we were to recommend storing on an island, we’d rather it be New Zealand than the UK.

If diversifying and storing gold and other assets around the world is on your agenda, then New Zealand deserves a place on your list.

Switzerland

When it comes to offshore gold storage, Switzerland is the old-school choice.

If you asked the average person about offshore gold storage, Switzerland would probably be the one place that they could think of. And they’d definitely be justified in this because Switzerland remains a good place to store gold.

In fact, it has the world’s largest reserves of gold per capita.

However, you’re going to see people moving their money out of Switzerland in the coming years.

We know people who have already started moving their gold to Hong Kong or Singapore from Switzerland. Fees in Switzerland are high and the service just isn’t as good.

Switzerland is not very favourable to transactions and wants to keep your money under management.

But, while the Swiss government destroyed bank privacy and secrecy many years ago, there are still plenty of gold vaults, and every online gold seller worth their salt offers vault storage in Switzerland.

Switzerland makes a good secondary vault location if you have an extensive portfolio, only because wealth is moving eastward and Singapore is coming out the clear winner.

Switzerland is not keeping up with the pace, but as an old-school jurisdiction, it doesn’t necessarily need a lot of advanced options.

It doesn’t offer leverage or loan provisions or even allow you to take the gold out yourself with an impromptu visit, but it’s still a very good place to store.

There are a million services there with excellent options to store precious metals and many facilities to choose from.

Switzerland is also a great place because it doesn’t have currency restrictions. While the rest of Europe is engaging in the ‘War on Cash’, Switzerland is a breath of fresh air.

So, while Switzerland is no longer the best place to store gold offshore, it still earns a place on this list. Neutral, developed and respected, it has served as a safe haven for the world’s wealthy for centuries.

Other Offshore Gold Storage Countries to Mention

While the countries above are our top three recommendations, here are three alternative options you might want to consider.

Israel

The wild card on our list is a country you may not have thought about, yet Tel Aviv is worth considering for international gold storage.

Numerous precious metals and logistics companies have a base in Tel Aviv and are well-versed in handling your precious metals.

While the country isn’t as well-located as others and conflict there remains an ever-present consideration, we wouldn’t have many concerns about the security of vaulted precious metals there.

Israel is relatively neutral from a Western vantage point – friends with the United States but also with Russia, for instance – and worth considering.

The Cayman Islands

The Cayman Islands is a relatively new gold storage jurisdiction. Some people like it for its proximity to the US and Canada. Still, it’s a very upscale jurisdiction in that whole Caribbean offshore area.

It’s a premium jurisdiction, but it’s three or four times the price of other places that have become just as competitive.

In fact, we’d say that other jurisdictions are competitive enough that it doesn’t often make sense to set up shop there because the banks require very high minimums.

Nevertheless, for people who are looking to get access to it, we’ve come across offers where you can get your first six months of storage in the Cayman Islands for free. As we’ve said, it is a very high-end jurisdiction and is realising that it should get involved in this space.

The only potential concern is that the Cayman Islands is a British Overseas Territory. Short of that, it pretty much has its own management.

There is a small chance the UK could interfere and shut it down as it did to Turks and Caicos a few years ago, but we don’t see it as a real threat right now. Plus, now that the UK has exited the EU, there’s even less of a threat.

Overall, the Cayman Islands is a pretty solid jurisdiction and it’s definitely a lot better than Panama (which we’ve been very underwhelmed by for gold storage) and you’ll be treated much better. If you’re considering Panama, the Caymans is a far safer option.

Austria

While the Swiss have given up on secrecy, Austria is the one country left in the EU that still values bank secrecy and financial privacy. It’s one of the only places in the world where you can store gold anonymously.

There are two or three different vaults — including Das Safe in Vienna — where you can rent a box and store gold anonymously. It’s not cheap, but it does give you privacy.

Quite frankly, the vaults in Austria aren’t as impressive as Singapore. You give up the impressiveness and James Bond quality security of a place like Singapore, but you gain financial privacy, the ability to be anonymous and pretty decent facilities.

Das Safe is the one everyone talks about, but it’s not necessarily the number one option — particularly because it’s so expensive since all the small boxes are gone.

The other benefit of storing gold in Austria is that it’s in Europe. If you want to have access to Europe, Austria is your best option in the EU. If the location of your gold storage matters to you, Austria allows you access to lots of other places.

Singapore is our favourite place to store gold, but it’s on a tiny island in the middle of Southeast Asia with limited access. So, Austria does have the benefit of giving you more geographical options.

Offshore Gold Storage: FAQs

From our experience, the best countries to store gold are Singapore, Switzerland and New Zealand. Singapore offers innovative facilities, low taxes and top-notch security. Switzerland is an old-school choice with a strong reputation, while New Zealand provides geographical safety and a stable legal environment.

To store gold offshore, choose a country with secure private vaults, favourable tax policies and political stability, such as Singapore or Switzerland. You’ll need to work with professional vault storage services that specialise in precious metals and ensure the facility meets high security and transparency standards.

We recommend Singapore as the best country to store gold offshore due to its modern facilities, low costs and innovation in gold storage services, such as gold-backed debit cards. Its independence and strong asset protection laws further enhance its appeal.

Offshore gold storage companies secure and manage your precious metals in private vaults outside the banking system. They offer services like online account access, insurance and the ability to sell or transfer gold directly through their networks.

In Europe, Switzerland’s private vaults are renowned for their security and neutrality. Austria, particularly facilities like Das Safe in Vienna, offers anonymous storage options with solid financial privacy.

Start Storing Your Gold Offshore

Here at Nomad Capitalist, we are strong proponents of including gold in your offshore asset allocation strategy and storing that gold in a private gold storage facility.

If you’re just getting started, we have dozens of resources to help you learn everything you need to know, from how to buy gold to how you can get paid in bullion.

Here are just a few of the topics that we’ve covered in detail:

- Offshore Gold Storage

- How to Get Offshore Gold Storage in Singapore

- The Cheapest Place to Buy Gold

- Getting Paid in Gold

- Gold Confiscation

- How to Buy Gold

- Where to Hide Gold and Silver

- How to Get a Gold-Backed Debit Card

And, if you’re interested in starting small with offshore gold storage, visit our partners in Singapore, who will sell you as little as one gram of gold or silver with segregated, allocated storage in their private vault.

If you’re interested in moving or investing US$100,000 or more in gold or other bullion for help with your plans, feel free to contact us.

Does Puerto Rico Pay Taxes to the US?

It’s a common question and one that often fuels confusion, debate, and a fair share of misinformation – Do residents of Puerto Rico actually pay US federal taxes? When most people think of US tax obligations, they naturally assume they apply uniformly across all US citizens. But when it comes to Puerto Rico, things are […]

Read more

Zug Canton Taxes: The Ultimate Destination for Wealth Management in Switzerland

Switzerland’s global reputation is built not just on stunning views of Alpine peaks and serene lakes but also on a foundation of exceptional quality of life, world-class infrastructure and investor-friendly tax policies. The results speak for themselves: efficient public transport seamlessly links cities and villages; the standard of living regularly ranks among the highest in […]

Read more

How Smart Investors Use Venture Capital to Build Wealth

Big companies like Google, Amazon, Facebook and Apple all started out as bold ideas backed by venture capital. Decades later, the same firms are household names, as familiar to most people as electricity, the internet, or the telephone. But hindsight is a fickle friend. The truth is, it wasn’t always so obvious they’d succeed. These […]

Read more