How to legally reduce ՚s taxes

With a bespoke Plan from Nomad Capitalist, most citizens of reduce their tax bill by . The personalized report below will show you how.

POSSIBLE OPTIONS

We specialize in helping clients reduce taxes legally through international tax planning. Our team of experts will analyze your unique situation and create a tailor-made plan to optimize your tax obligations.

International Tax Residency

Relocation & Income Sourcing

Offshore Structuring

Tax Treaties & Agreements

Tax-Efficient Investments

POTENTIAL TAX SAVINGS FOR CITIZENS OF

STOP WASTING $ IN TAXES

CREATE YOUR BESPOKE TAX REDUCTION PLAN WITH NOMAD CAPITALIST

INTERESTED IN SAVING TAXES AND BUILDING WEALTH OFFSHORE?

Join Nomad Capitalist Live, and learn about cheap second passports, offshore banks, the best places to live, and the latest tax incentives to pay as little as 0%, even in Europe. Connect with like-minded freedom seekers and visionaries while benefiting from priceless information and access to experts.

WHY NOMAD CAPITALIST

When it comes to global reach, direct experience, and detailed knowledge in legally reducing the tax rates for citizens of , Nomad Capitalist is hard to beat. Unlike other firms, we live the Nomad Capitalist lifestyle. We appreciate how valuable your time is, so let us handle the small details while you focus on what matters.

Over 1,500 clients, including from have trusted us to get results – and our track record results speak for themselves.

31

TAX FRIENDLY COUNTRIES CLIENTS MOVED TO

28

48

38

WHAT OUR CLIENTS ARE SAYING ABOUT US

WARNING

For most business owners and investors, legal offshore tax reduction requires you to relocate overseas for the majority of the year. You can keep your current citizenship but will generally be required to establish a home base overseas. This report is not intended to be tax advice and any offshore tax planning requires substantial effort.

Through our global and trusted network of highly qualified tax, investment, and other vendors, we are dedicated to providing tailored solutions to help you optimize your offshore tax planning. Feel free to contact Nomad Capitalist using the form on this website to learn how we can help you.

STILL RESEARCHING HOW TO REDUCE YOUR TAXES?

JOIN OUR LIVE EVENT

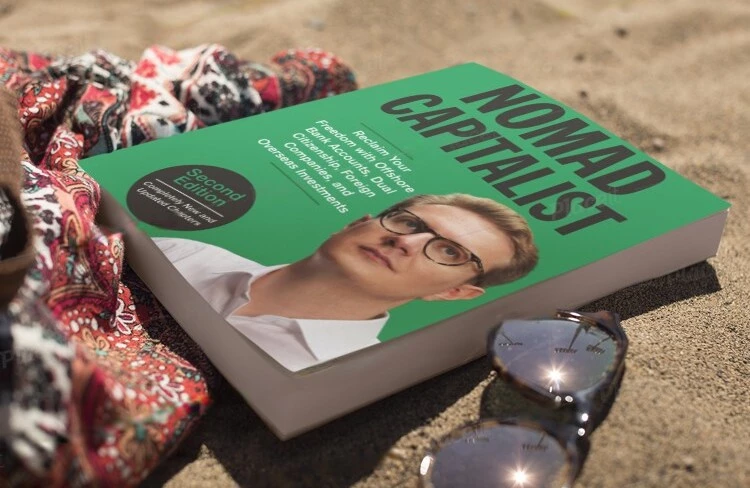

READ OUR BOOK

Read our founder’s adventures from more than a decade of real-world, on-the-ground offshore experience, from how he reduced his tax bill to 1% to how he obtained multiple second citizenships to offer him total freedom.