The Best Countries to Buy Gold in 2025: The Ultimate Guide

January 7, 2025

In 2024, savvy investors are turning their attention to gold as central banks worldwide, led by China, ramp up their gold reserves.

Since 2015, the Red Dragon has been on a gold-buying spree, solidifying its position as a major player in the global gold market.

But China isn’t alone in the pursuit of gold. For millennia, the precious metal has been a trusted safeguard against political and economic turbulence, hyperinflation and even bizarre state regulation.

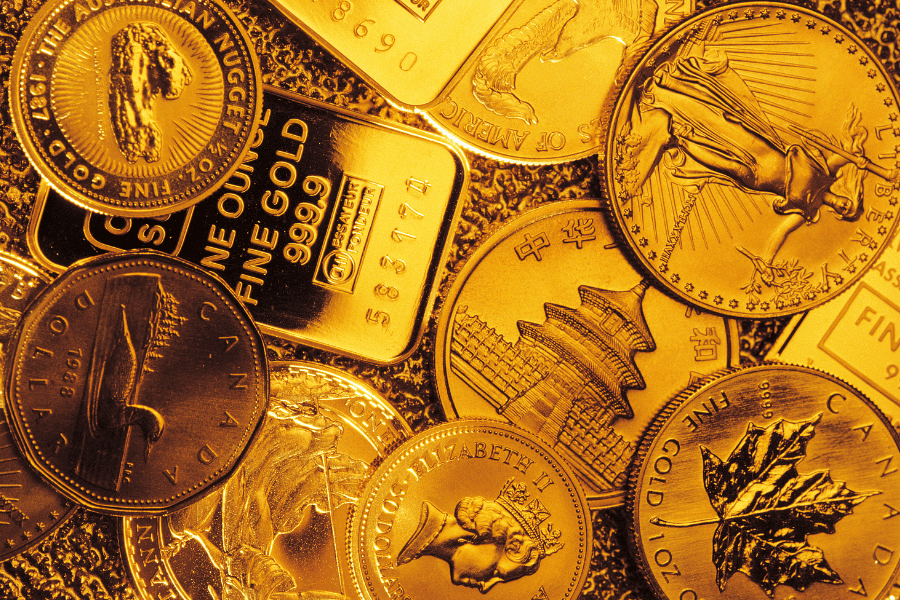

Today, it remains a beacon and reliable hedge in uncertain times. So, whether you’re considering purchasing investment-grade gold bullion, coins or even jewellery, remember that precious metals in any form can be a valuable addition to diversify and strengthen your investment portfolio.

You’ll find many articles on our Nomad Capitalist website regarding gold, silver and other precious metals. However, if you plan on investing in gold, you’ll need information tailored to address your investment portfolio’s needs. That’s where we come in.

At Nomad Capitalist, we’ve helped many clients understand the gaps in their portfolios and how to fill them with asset classes that will award them the highest return on investment. If you want expert guidance, get in touch with us today.

Best Country to Buy Gold

Hong Kong

One of Asia’s second biggest financial hubs after Singapore, Hong Kong’s banks are some of the best places to buy gold. They have no shortage of capital or gold reserves, making them excellent offshore banking options.

Hong Kong banks usually offer lower premiums when purchasing gold. So, if you want to buy the cheapest gold, Hong Kong may work in your favour. You can also purchase gold coins, bars and other presentations in Hong Kong through online dealers. However, you’ll usually get the best deals on buying gold (or selling gold) by physically visiting a Hong Kong bank.

Best Countries to Buy Gold

United Arab Emirates

Given its profile on the international stage, it’s natural to include the UAE when discussing company formation and investment opportunities. In fact, Dubai is one of the best places to buy gold in the world.

In the UAE, you’ll find plenty of gold dealers, jewellers and banks selling gold. Whether you want gold bars or coins, pure gold, investment grade bullion or otherwise, you’ll find the country brimming with options for people looking to trade gold.

Online gold dealers in the UAE sell gold slightly cheaper than other sources. They also have a variety of options. However, you should keep in mind the markup associated with online purchases.

Switzerland

You may have noticed the pattern by now. Countries with the most stable and safe banking options are usually the best to buy gold. You can purchase gold in Switzerland through a Swiss bank, dealer or jeweller. However, you must first research and compare gold prices to get the best deal.

Austria

Austria is another excellent country to buy gold from. Just like in Hong Kong, you can expect low premium rates on gold purchases from an Austrian bank. They won’t be anywhere near Hong Kong rates, but they’re still attractive. Purchasing gold from reputable sources like a trusted precious metals firm or a well-known bank is crucial.

Saudi Arabia

Just like the UAE, Saudi Arabia has no shortage of gold jewellers, online dealers or banks. However, a Saudi jeweller may be able to offer you the best deal on your gold purchase. Though, this isn’t always the case.

As with any investment, especially on a large scale, do your due diligence and compare prices and markups before making the purchase.

India

Surprised to see India on the list? India may not match the jurisdictions mentioned above in terms of stability or offshore banking options, but it has plenty of options for purchasing gold. Indians hold around 9-11% of all the physical gold in the world, and no, that doesn’t include only the wealthy. Jewellery is the most common form of gold purchased by Indians.

Throughout the country, you’ll find numerous dealers, jewellers, gold firms and banks selling gold at varying prices.

Things to Keep in Mind Before Buying Gold

Many new investors tend to favour investing in gold or other metals because they think it’s easy. Of course, walking into a bank or jeweller and buying a bucket full of gold may seem simple, but there’s a lot more to it.

So, here are some things to keep in mind before buying gold:

- Buy Physical Gold: Owning gold on paper is never equal to owning physical gold – especially in a monetary crisis. Many banks have cash settlement clauses, meaning that the bank can pay you out in cash instead of physical metals in a financial crisis or war. If you want to invest in gold and put it aside as long-term insurance, ensure it’s physical metal and that you own it. Also, ensure you receive an itemised list of everything you own, including gold bar numbers, hallmarks and any other forms of gold you have.

- Buying Liquid Gold Coins or Bars: It’s better to buy pure gold in small quantities than buy partially pure gold in large amounts. Invest in legal tender coins such as the Maple Leaf, the Austrian Philharmonic or the Australian Nugget. You should also ensure they have a low fabrication fee (the fee the dealer pays to the mint to get the gold physically produced).

- Consider Offshore Gold Storage: Can you trust the banks of your country with your gold in times of monetary crisis? Are you sure that they’ll even let you take it out? If you are even slightly concerned about this, investing in offshore gold storage destinations like Singapore, Hong Kong and Switzerland makes sense. Not only will it diversify your portfolio, but it will also add a layer of protection to your asset portfolio.

Best Countries to Buy Gold: FAQs

Precious metals have historically been one of the most invested asset classes. They provide a hedge against rising inflation, political instability and financial crisis.

Owning gold on paper is never equal to owning physical gold. If you want to invest in gold and put it aside as long-term insurance, ensure it’s physical and that you own it.

When it comes to gold storage, we recommend offshore vaults. While vaults are appearing in a number of offshore jurisdictions, places like Singapore and Austria offer privacy, affordability and security. Switzerland is one of the safest jurisdictions, but you will have to pay more there.

We recommend against buying unallocated shared commingled holdings where you don’t receive the physical unit of gold. Whenever you select a gold storage company, make sure that the company you choose cannot pledge it, hedge it or lease it out. Also, make sure you are buying a London Bullion Market Association (LBMA) product.

The gold standard, which linked the value of a country’s currency directly to gold, was formally abandoned in 1971. We now have a fiat system with paper money that is not backed by gold. However, having historically been used as money for thousands of years, gold is a stable store of value.

It is not typically recommended because it is often more expensive. In any case, even if an online seller offers a good price, cheap is not always best. Ideally, you should have a relationship manager to take care of your long-term interests. At Nomad Capitalist, we advise high-net-worth individuals to go to dealers who deal with higher transaction values as they offer better rates.

Get a Plan B Today

Individuals and countries are stocking up on gold to prepare themselves for an inevitable financial crisis. Several US banks have crashed in recent years, and many others are struggling to keep afloat. The US national debt is at a record high, and inflation is high.

In the midst of such uncertainty, investing in historically proven asset classes like precious metals (procured from a trusted precious metals firm or a bank) is always a great idea to protect yourself from the side effects of poor government policies.

However, what if we tell you that you don’t need to prepare for a crisis? That you can take one step forward and thrive, but only if you are brave enough to go where you’re treated best.

Countries out there are competing for your investment. In exchange for your capital, they offer you stable banking options, passports with exceptional travel freedom and residencies that open the door to an array of personal and corporate opportunities.

So what are you waiting for? Get in touch with us today and get the ultimate insurance against your government.

Is Land Investment Safer?

When American humorist and writer Mark Twain said, ’Buy land, they’re not making it anymore,’ he was definitely on to something. Land is finite, and that scarcity gives it lasting appeal. Yet, despite its obvious logic, land remains one of the most misunderstood investments. Many people are put off by its perceived complexity, potential legal […]

Read more

Top Emerging Market Economies for US Investors in 2025

If you’re still parking all your capital in overvalued US real estate or clinging to tech stocks in the S&P 500, you’re playing an old game while rivals are redesigning the board. The world has move on. Smart investors know that the biggest returns aren’t coming from Wall Street anymore – they’re coming from below-the-radar […]

Read more

Monaco Real Estate Guide: Market Trends and Opportunities

When it comes to luxury real estate, nowhere does things quite like Monaco. This tiny but ultra-exclusive principality isn’t just a place to live – it’s a global symbol of wealth, prestige and financial freedom. In 2025, Monaco remains the world’s most expensive real estate market, with average property prices soaring beyond €51,000 per square metre […]

Read more