10 Tips for Buying Gold in 2025

January 8, 2025

Central banks worldwide are buying up more gold, with China and Russia leading the charge. In 2022, the demand for gold, the purchase of gold by central banks was the highest since the 70s.

Leading governments are looking to gold as the underlying asset to stabilize the economy.

With more economic uncertainty on the horizon, gold reserves provide insurance against de-dollarization and exposure to market volatility. But before you go running off on your own personal gold rush, it’s important to invest wisely and get expert advice.

If you’re looking for a way to safeguard your wealth and diversify your asset portfolio while also legally reducing your taxes, contact Nomad Capitalist today about becoming a client. We create bespoke nomad strategies using our unique, tried, and true methods.

Previously, we shared three basic mistakes in getting a second passport. One of those mistakes was simply not letting the experts be the experts. It always pays to go to the experts and pay them for the true value of their knowledge and services.

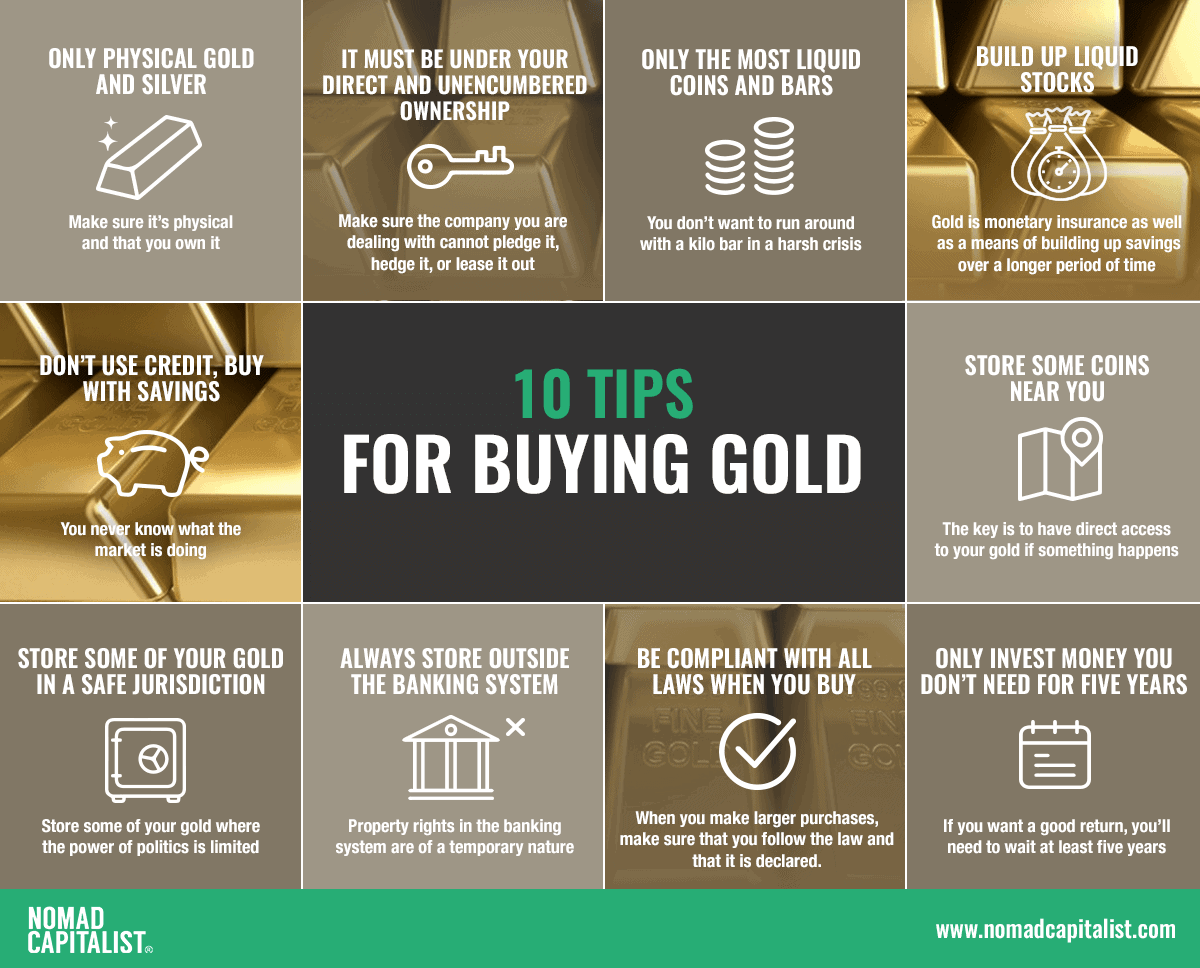

Based on the valuable insights we gained from our precious metal experts, J. Rotbart & Co., here are our 10 tips for buying gold in 2025.

1. Buy Physical Gold and Silver

Anyone investing in gold and silver needs to understand that its basic function is money.

Gold has been used as money for 5000 years. It was only in 1971, when Nixon went off the gold standard, that the whole world began to transition into the fiat system using paper money that is not backed by gold. Before that, all paper money was backed up by gold.

In the gold industry and among gold investors, there is a lot of discussion on the manipulation of gold prices, the paper market, and its effect on the price of gold.

Paper gold can be future contracts you can trade, such as electronically traded ETFs.

Banks may off you the option to buy gold, but when you read the contract, you understand that, in fact, you are actually purchasing an investment product, paper gold, that follows the price of gold, but you are not buying tangible gold.

Although they promote this as gold, you are buying a product that follows the price of gold. So that’s not the same.

What type of precious metal you want to buy depends on the incentive for the investment. If you are interested in short-term trading, then maybe paper gold is good enough. Keep in mind that paper gold products expose you to counterparty risk and someone not delivering on their promise.

This type of paper financial product is also subject to government control, and they can access them easily. Central financial instruments are all reported through CRS and FATCA.

And when it comes time that everyone wants to claim their share of that money, they will quickly find out that there is not enough available. That’s why we say always buy physical gold and silver.

2. It Must Be Under Your Direct and Unencumbered Ownership

There is an old saying, “If you cannot hold your gold, you don’t own it.”

If you are a high net-worth individual and want to allocate a percentage of your wealth into physical gold, then it makes sense to go into jurisdictions that have strong private property rights.

The best jurisdictions you can find these days are Switzerland, Liechtenstein, and Singapore, especially when it comes to physical precious metals stored outside the traditional banking system.

We strongly recommend against buying unallocated holdings or sharing commingled, meaning companies that don’t sell you the physical unit of gold.

Make sure that whenever you select a gold storage company, you know that you are the owner of the gold, that the gold belongs to you directly, and that the company you are dealing with cannot pledge it, hedge it, or lease it out. That is vital.

One thing to be vigilant of is that you are buying a London Bullion Market Association (LBMA) product.

3. Only the Most Liquid Gold Coins and Gold Bars

You want to get as much pure gold for your cash as possible. This means you should invest in legal tender minted coins such as the Maple Leaf, the Austrian Philharmonic, or the Australian Nugget.

When you buy, the price of the physical ounce of gold should be as close as possible to the paper spot price of gold. That is always the underlying way you calculate the value of an ounce of gold.

Luckily, gold pricing is very transparent. You can check prices on Reuters, Bloomberg, and other major financial websites. It’s usually priced in US dollars per ounce, but not actually a regular ounce. Interestingly, it’s a Roman (Troy) ounce, slightly heavier than the standard one.

Whether you buy a gold coin like the Maple Leaf, the Austrian Philharmonic, or the Australian Nugget, if you can buy them directly in a shop or an online store, ensure you don’t pay more than 5-6%.

We don’t advise jewelry stores or online retailers, which are often overly expensive. Don’t judge gold by whether it’s cheap or not cheap. You need security. You need a good relationship manager that will take care of your interest in the long term and a stable company. Cheap is not best.

We recommend especially high-net-worth individuals to go to dealers who deal with higher transaction values. When you go to companies that deal mostly with a larger volume, then you get better pricing.

One warning: Don’t buy on eBay. If you can buy below the spot price of gold, it’s probably too good to be true.

What about numismatic coins? Anyone wanting to buy rare coins needs to fully understand the numismatic business before making any big decisions. Numismatics can have a substantial up price, but if you don’t understand what you’re buying, then don’t do it.

4. Build Up Liquid Gold Stocks

Gold is extremely liquid because there’s always demand for it.

Gold is a type of monetary insurance as well as a means of building wealth over a longer period of time. The value of an ounce of gold has risen more than 5,000% since the 1970s. Although there have been drops throughout the years – gold’s value has increased steadily over time, particularly during economic uncertainty.

The value of gold rose following the 1979 oil crisis and the Black Monday crash of 1987. It also rose after 9/11, the crash of 2008, and the 2020 pandemic. There’s a clear pattern – investors and governments flock to gold when things get tough.

Don’t look at gold as a short-term trading vehicle but rather as a long-term insurance policy.

Today, according to the World Economic Forum, we are currently looking at just under 300 trillion in debt, with America’s debt hitting record highs.

Everything has an end, and this debt orgy that we have been witnessing for the last 50 years will also end.

You want to have access to your gold in a crisis, and you will want it to be liquid as possible.

A lesson from the past: During the Weimar Republic in Germany, when inflation ran rampant, an ounce of gold could purchase a house, and a silver ounce could pay the farmer to have chicken for the next four or five weeks. If a similar situation arises today, you will be able to use gold for bigger opportunities and silver to finance smaller things.

5. Don’t Use Credit. Buy with Savings

Anyone who wants to buy gold must save first before they invest. That is the backbone of a healthy economy.

The current system relies on debt, credit, and consumption – the exact opposite of a healthy economy. Don’t use the bad habits that have created this system to purchase the antidote to the system.

If you buy gold, use your savings, put it on the side, and make sure that it is entirely yours. Don’t take out credit or speculate to buy gold. You never know what the market is doing, and you may have to pay back your credit before the price of gold rises.

6. Diversify Your Gold

So and the common not say wisdom is anything between 5% to 15% of a portfolio should be held in gold. Depending on your motivation, you could put up to 25% of your wealth in gold.

It’s not just about asset diversification but also where you store your gold, and that’s where getting a second residence and choosing the ideal storage location comes in.

You should always have quick access to some gold. The key is to have direct access to your gold if something happens.

However, you shouldn’t store all of your gold nearby or in one place. You should have your insurance outside the country.

The United States, for example, confiscated gold back in 1933 under Franklin Roosevelt. The same happened under Mussolini in Italy, under Hitler in Germany, and under Stalin in the Soviet Union.

On the other hand, Switzerland was the last currency to go off the gold standard. They have always had a currency — even during wartime — that could be exchanged for physical gold. And the politicians don’t have the power to confiscate gold there.

7. Store Some of Your Gold in a Safe Jurisdiction

As already mentioned above, you should store some of your gold in a safe jurisdiction where the power of politics is limited.

Switzerland is one of the safest jurisdictions because they have seven presidents and a decentralized political system. This means that the states and the municipalities generally have more power to make the rules on their own levels.

A centralized system with one president, such as in America, on the other hand, can make the rules from the top and ignore the people because they have the power. In Switzerland, people have the last say and would never allow for confiscation. This is a unique system that you don’t find in many other countries.

Liechtenstein is similar, but they have a monarch figure – Prince Hans-Adam II – who has veto power. However, he is a strong supporter of gold. He was involved with the Center for Austrian Economics. He wrote the book, The State in the Third Millennium, where he promotes secession rights down to the municipality level and sound money principles such as gold and silver.

He is a classic liberal and is very much in favor of gold and silver. For that reason, Liechtenstein also makes sense as a jurisdiction for storing gold.

Our go-to gold expert, Joshua Rotbart, the founder and managing partner of J. Rotbart & Co, is based out of Singapore and Hong Kong.

In recent years, clients have been moving their assets to Asia, especially to Singapore and Hong Kong. Singapore, for example, has turned itself into the “Asian Switzerland” and attracts international “gold bugs.”

8. Always Store Outside the Banking System

Physical gold is the antidote to the current system. The current banking system is based on credit, paper, and computer digits. The crisis that we are expecting and already seeing the sign of — is the reason so many people are buying gold to protect themselves — will be a massive banking crisis.

Therefore, if you decide to purchase physical gold, it’s only logical to store it outside of that banking system.

Banks in the past have confiscated physical gold and cash, and there is always the possibility of a bail-in where all assets will undoubtedly be confiscated.

Some argue that you could have a safe deposit box, but most of the time, those are not insured. Besides, during harsh crises in the past, the bank was either closed or didn’t have the amount of gold it claimed to have.

This problem started back in the 1980s when banks brought mathematicians into the system who argued that they didn’t need all the gold on hand. They surmised that banks only needed 25% on hand. So, banks began to lien out or even sell 75% of their gold. Some invested it into government bonds, where they received a guaranteed return on the investment. Little by little, much of the gold in the banking system disappeared.

The bottom line: don’t put your gold in the banks. You don’t want to take that risk.

9. Be Compliant with All Laws When Buying Gold

The average gold investor should buy a few coins or bars whenever the possibility arises. If you buy a few coins per year, you can buy them privately.

When you buy small denominations, you can buy anonymously – you don’t have to identify yourself or disclose any personal information. And it is entirely legal. Purchasing small amounts at a time gives you even more security and privacy. So, the average buyer is at an advantage when buying small.

There are laws, however, for those who want to invest in more significant amounts of physical gold. If you are in a position to make larger purchases, make sure that you follow the law and that it is declared.

You need to have the right motivation to go into physical gold. If you want to buy gold to hide something because you believe that gold might be the last possibility and that the government will never find out, that’s the wrong motivation.

If you believe in gold, you have to play by the rules. You have to be compliant. But once you are compliant, it is possible to continue to play by the rules of the game and protect your wealth from potential confiscation.

This is possible if you store your gold in a jurisdiction like Singapore, Switzerland, or Liechtenstein. Especially if it’s stored under Swiss and Liechtenstein law, it’s safe.

10. Only Invest Money You Don’t Need for Five Years

We don’t know when the system is going to crash. Only invest money that you don’t need for the next five years. And in 2020, we’ve learned that anything can happen in even five short months.

Practically all financial assets and other tangible assets, such as real estate, dropped in value during the Pandemic. However, gold rose 20%, and silver prices rose 45%.

So, while it is very likely that the price of gold will be higher in five years than today, it’s harder to know what will happen in the short term.

Don’t use money that you will need in three, six, or even nine months because we don’t know where the price is going in the short term.

Gold, on average, appreciates 10% per annum, and it has historically been valuable to us as a civilization for 5,000 years.

An ounce of gold is always an ounce of gold, but the price of the fiat is what fluctuates. No matter what, there is a very high probability that, after five years, you will be really happy with your investment.

Gold offers stability and beats inflation every day of the week. It beats holding cash and performs on par with the American Stock Exchange.

Bonus Tip: Use the LBMA Ecosystem

One final tip from J. Rotbart & Co. is only to procure bullion that was refined by members of the London Bullion Market Association (“LBMA”) or the London Platinum and Palladium Market (“LPPM”).

Look for providers that only ship and store goods with secure logistics companies that are members of the associations. This provides peace of mind as to the authenticity of the goods, as well as reassurance that the security standards are on par with the market.

When it is time to liquidate your assets, gold bullion procured via the LBMA will take less time to liquidate, and the whole process will cost you less. Items that were removed from the LBMA/LPPM ecosystem will need to be tested or assayed before being deposited back into the system.

The Growing Trend for Buying Gold

The system as we know it is breaking down, which means that gold makes perfect sense.

Demand for physical precious metals has increased since the financial crisis 2008, and more clients have chosen to invest in gold bullion as a future wealth protection strategy.

Clients are moving their assets from bank vaults to privately held vaults. There are a few reasons for that:

- better access to their assets

- out of reach of governments and regulators

- better service

- better value for money

We also see a trend when it comes to jurisdictions: individual clients are moving many assets to the “new frontier” of Asia. Investors are also looking into gold mining stocks or gold mutual funds in any of the gold mining companies in the lucrative gold industry.

Another trend that we are seeing is that clients are moving funds between precious metals and cryptocurrencies. We are stepping towards decentralization, and, in this regard, there are similarities between cryptos and gold, as both assets are de facto global decentralized currencies.

This is why clients move funds between the two assets. Either taking profits from crypto and reinvesting them in gold funds or they are liquidating their metals holdings in order to invest the proceeds in cryptos. Our gold partners offer add-on services, allowing clients to securely convert their assets to crypto and vice versa.

Another movement that we see is that clients are taking loans against their physical holdings in order to make other investments. The difference in this trend is that the loans do not come from banks but from reputable private lenders.

If your motivation and interest is a wealth protection and preservation strategy, we advise staying away from paper gold products, and buying physical gold is key and works as an insurance policy for your asset.

Are you ready to start buying gold or investing larger sums? Do you already own gold and want to secure your wealth by offshoring? Become a Nomad Capitalist client today, and we will help you create your holistic strategy to legally reduce your tax bills, diversify and protect your assets, including your precious metals, and maximize your freedom.

Does Puerto Rico Pay Taxes to the US?

It’s a common question and one that often fuels confusion, debate, and a fair share of misinformation – Do residents of Puerto Rico actually pay US federal taxes? When most people think of US tax obligations, they naturally assume they apply uniformly across all US citizens. But when it comes to Puerto Rico, things are […]

Read more

Zug Canton Taxes: The Ultimate Destination for Wealth Management in Switzerland

Switzerland’s global reputation is built not just on stunning views of Alpine peaks and serene lakes but also on a foundation of exceptional quality of life, world-class infrastructure and investor-friendly tax policies. The results speak for themselves: efficient public transport seamlessly links cities and villages; the standard of living regularly ranks among the highest in […]

Read more

How Smart Investors Use Venture Capital to Build Wealth

Big companies like Google, Amazon, Facebook and Apple all started out as bold ideas backed by venture capital. Decades later, the same firms are household names, as familiar to most people as electricity, the internet, or the telephone. But hindsight is a fickle friend. The truth is, it wasn’t always so obvious they’d succeed. These […]

Read more