Time Value of Money Explained with Examples

July 3, 2023

The Time Value of Money idea is why interest rates exist and why investing early is advisable, based on the principle that money is more valuable now than it is in the future.

Whether you are an investor, or entrepreneur, you need to understand the time value of money, as it enable you to calculate how much a company or investment opportunity is worth.

The past year demonstrates the importance of the time value of money with escalating living expenses due to inflation. Leaving out the time value of money in the budgeting or financial decision making process can lead to significant losses or missed opportunities. Keep reading for a greater understanding of the time value of money with some examples.

Become a Nomad Capitalist client today, and we will work as the architects and general contracts of your international investment strategy, helping you gain higher yields, better asset protection, and greater risk diversification.

What Is The Time Value Of Money?

The time value of money is an idea that suggests acquiring money now is better than getting the same amount of money later.

Whether they realize it or not, it’s a factor people think about when deciding whether to spend or save money. This is why interest is paid or earned. Interest repays the person lending or depositing money for the time they could have been doing something else with their money.

People only choose not to spend their money now if they believe they’ll make more money in the future. This is called the required rate of return and takes into account the value of money changing over time due to inflation.

If given the option, most individuals would opt to receive $100,000 immediately rather than wait for years. The logic is simple: waiting is usually not an instinctive financial choice.

Fundamentally, this signifies that, given money time value, all other things equal, it is preferable to have money in the present rather than later, and this is what the concept of money time value demonstrates.

However, the question arises: doesn’t a $50 bill today still have the same value as a $50 bill one year later? As has been demonstrated clearly over the past year, the answer is no.

Also, while the bill itself remains the same, having the money now provides you with a better opportunity to earn more interest over time.

In the above example, by receiving $100,000 now, you are in a better situation to grow its future value by investing it and gaining interest.

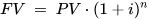

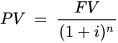

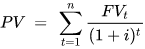

Time Value of Money Formula

Values meaning:

- FV =future value of money

- PV =present value of money

- i =interest rate

- n =number of compounding periods per year

- t =number of years

Future value of a present sum

Present value of a future sum

Compound value of a future sum

You can figure out the total value of future cash flow by adding up all the amounts of cash you expect to receive at different times or compounding periods, represented as FVt.

These are the fundamental formula examples of the time value of money, and formulas may vary slightly depending on the circumstances.

Using the standard TVM formula above, here is a simple example of how it works:

Let’s say you want to invest $100,000 (present value) for one year at a 10% annual interest would equal $110,000.

Future Value = $100,000 (Present value) [1 + (10% / 1] ^ (1 1) = $110,000.

If you also need to take into account compounding periods generated from the initial principal and accumulating amounts.

Quarterly compound interest — i.e., 4.0x per year:

Future Value = $100,000 (Present value) * [1 + (10% / 4)] ^(4 x 1) = $146,410

Example of Time Value of Money

Here’s how TVM can be applied with an example. Consider selling a property today for $250,000 and investing that amount in Certificates of Deposit (CDs) with a 2% annual yield, compounded monthly. If you want to determine the value of that investment after two years, you can use the following formula:

Future Value = $250,000 x (1+(0.2/12))(12×2)=$260,194.03

This means that your investment will be worth $260,194.03 after two years. Delaying the property and receiving the payment in two years would result in missing out on the $10,194.03in interest that could have been earned during that time. This missed opportunity cost could potentially be greater with investments or savings accounts that yield higher returns.

Time Value of Money and Inflation

With the changing value of money over time, there are multiple variables that can influence it. Amongst them, one of the most significant is inflation, the gradual surge in prices of goods and services, which has an adverse impact on the future worth of money.

Essentially, when prices increase, the value of your money depreciates, and even a minor rise in prices can result in a drop in purchasing power. In 2022, inflation in the US surged to over 9%.

Venezuela is the most impactful illustration of this in modern times. Since 2016, because of the ongoing crisis in the country, Venezuela has experienced staggering hyperinflation, and by 2018, it was over 1,000,000%. It was reported that during the inflation crisis, basic supplies like flour and pasta cost the equivalent of a month’s pay. Since 2019, the Venezuelan government started changing some of its economic policies, which has helped slow down inflation.

Although the TVM formula may not be used frequently to compute future value manually, it provides an understanding of the significance of the time value of money and how it can impact financial decision-making. For instance, it’s crucial to consider the time value of money when budgeting, given that annual expenses, often increase due to inflation. Failure to do so may result in underbudgeting, as seen with the recent surge in goods, services, and grocery prices.

Why the Time Value of Money Matters

The significance of the time value of money lies in its relevance to managing personal finances and investment strategies. As discussed above, inflation plays a critical role.

Making the right investments now can be an effective means to counteract inflation’s adverse effects.

TVM can assist in keeping pace with, or even surpassing, inflation rates through compounding returns on interest or investments.

For example, if a savings account with a 5% yield generates a $5 return on a $100 deposit, the interest earned on the $5 becomes reinvested, resulting in a $5.25 return the next year.

This principle applies to investing too. If a $100,000 investment increases by 10% in the first year, earning a $10,000 portfolio gain, a 10% return on the new $110,000 balance will yield a $11,000 gain in the second year.

Although initially minor, compounding can have a significant impact over time.

Discounted cash flow (DCF) analysis, a widely used method for assessing investment opportunities, hinges on the principle of the time value of money. Financial planning and risk management also utilize the time value of money as a key component.

Nomad Capitalist has helped 1,500+ high-net-worth clients from around the world, creating holistic strategies for investments, legal international tax planning, second citizenship, and global relocation. Work with us to create your own bespoke plan for living and investing offshore, to make the most of your wealth.

Understanding the concept of the time value of money is crucial for making sound financial decisions. The value of money changes over time, and TVM helps gauge that change. As a business, it can be used to evaluate future projects, while as an investor, it helps in identifying investment opportunities.

Therefore, knowing what TVM is and how to calculate it can help individuals make informed decisions about spending, saving, and investing.

Are you looking for solutions for living, investing, and doing business around the world? The Nomad Capitalist book is now available as an audiobook, so you can listen to it anywhere, anytime. Download the Audiobook Now.

Does Puerto Rico Pay Taxes to the US?

It’s a common question and one that often fuels confusion, debate, and a fair share of misinformation – Do residents of Puerto Rico actually pay US federal taxes? When most people think of US tax obligations, they naturally assume they apply uniformly across all US citizens. But when it comes to Puerto Rico, things are […]

Read more

Zug Canton Taxes: The Ultimate Destination for Wealth Management in Switzerland

Switzerland’s global reputation is built not just on stunning views of Alpine peaks and serene lakes but also on a foundation of exceptional quality of life, world-class infrastructure and investor-friendly tax policies. The results speak for themselves: efficient public transport seamlessly links cities and villages; the standard of living regularly ranks among the highest in […]

Read more

How Smart Investors Use Venture Capital to Build Wealth

Big companies like Google, Amazon, Facebook and Apple all started out as bold ideas backed by venture capital. Decades later, the same firms are household names, as familiar to most people as electricity, the internet, or the telephone. But hindsight is a fickle friend. The truth is, it wasn’t always so obvious they’d succeed. These […]

Read more