How to Set Up a Luxembourg Trust in 2025: The Ultimate Guide

January 8, 2025

This ultimate guide will discuss how to set up a Luxembourg trust. We’ll also take an in-depth look into the benefits of a Luxembourg trust.

A Luxembourg trust is an excellent asset protection tool for individuals who don’t trust or want to associate themselves with offshore trust jurisdictions like the Bahamas or the Cook Islands.

A highly-developed Western European country like Luxembourg ticks all the boxes for fair play and safe investment.

Want to set up a trust in Luxembourg to protect your corporate or personal assets? Get in touch today, and we’ll create a tailored strategy for you that assesses the type of your assets and offers you the best option regarding privacy and protection.

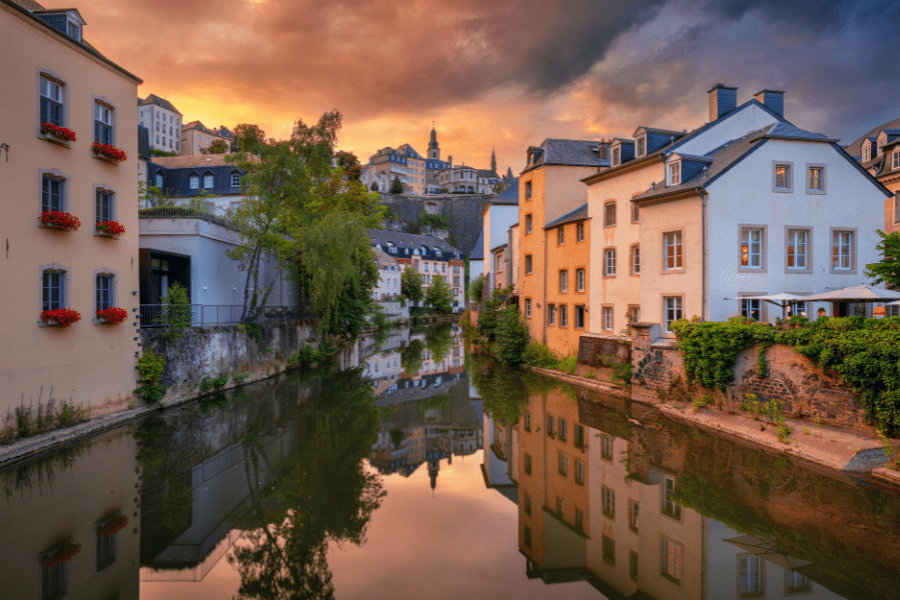

Luxembourg – Country Overview

Situated in northwestern Europe, Luxembourg is a landlocked country bordered by France, Germany, and Belgium. The current population of Luxembourg is 654,912.

The Duchy of Luxembourg is one of the world’s smallest yet most prosperous countries, with roots stretching back to the 10th century.

The country’s history, public interests, culture, and languages are closely intertwined with its neighbors, especially Germany.

Luxembourgish, French, and German are the administrative languages. The capital and largest city is Luxembourg City.

Luxembourg – Global Importance

Luxembourg City is one of the four institutional seats of the European Union. It is also the seat of several other notable EU institutions like the Court of Justice of the European Union.

Luxembourg is also a founding member of the European Union (EU), OECD, the United Nations (UN), NATO, and the Benelux Economic Union.

Luxembourg – Passport

Luxembourg has maintained its place at the top of the Nomad Passport Index for five years in a row. Luxembourgish citizens can enjoy visa-free or visa-on-arrival access to 174 countries.

The country offers its citizens high levels of freedom, and fortunately for expats, it has recently made its naturalization process easier.

Luxembourg – Economy

Luxembourg has a stable, high-income, and one of the most prosperous economies in the world. According to the IMF, Luxembourg has the largest economy by GDP per capita.

Luxembourg has a market economy previously dominated by the industrial sector (primarily the steel industry). Since the turn of the century, the country has been renowned for its financial sector, which brings in most of its revenue.

Luxembourg is the largest investment fund center in Europe and the second largest in the world after the U.S. It is also the largest global distribution center for investment funds and the most important private banking center in the Eurozone.

Setting up a Trust in Luxembourg in 2023

Thanks to its reputation as Europe’s most powerful investment management center, Luxembourg is a premium jurisdiction for setting up foreign trusts, favored by wealthy individuals and families.

In 2003, the country introduced the Trust Law, which provided the foundation for international trust for foreigners.

A Luxembourg international trust is an excellent tool for estate planning, setting up investment funds, wealth management, and other forms of asset protection.

Under the Trust Law (of 27 July 2003 on Trust and Fiduciary Contracts), foreign citizens can act as settlors, beneficiaries, trustees, and even fiduciary agents for Luxembourg international trusts.

Trust Structure in Luxembourg

A Luxembourg international trust structure is not much different than any other offshore trust.

It’s important to note that a Luxembourg trust can’t be established until all the trust parties and their roles are not clearly defined in the trust agreement.

The following are the significant parties in a Luxembourg international trust:

The settlor: A settlor is a person who establishes the conditions under which the trust is set up. The settlor chooses the trustee, beneficial owners, and the assets to be held in the trust.

Trustee: A trustee can be a natural person or a trustee company offering asset management services. A trustee’s duties and extent of authority are limited to what’s written in the trust deed and nothing more. A trustee can’t be a beneficiary.

Beneficiary: A beneficiary is any person who will benefit from the trust assets.

Benefits of Setting up a Luxembourg Trust

Foreigner-Friendly Jurisdiction

Luxembourg has a global perception of a country that bothers no one. It’s super foreigner-friendly, and this attribute reflects in its Trust Law.

The Luxembourg International Trust allows foreigners full rights to act as settlors, trustees, beneficiaries, or other fiduciary agents in a trust.

Tax Exemptions

Luxembourg isn’t a low-tax country. However, non-resident beneficiaries of a Luxembourg trust are generally exempt from paying taxes there if all the trust assets are located outside Luxembourg. Still, individuals paying taxes on worldwide income must report all the benefits received to their government and tax authorities.

Trust Privacy

Transparency is the norm now. Gone are the days when you could keep your financial details to yourself and go about your day. However, some countries still manage to offer you some degree of privacy – Luxembourg is one of those.

Tax Justice Network’s Financial Secrecy Index ranks Luxembourg in fifth place. With an index listing 144 countries, that’s a pretty good spot for people who like their privacy.

Luxembourg has a trust register, but the information within is not accessible to the public.

How to Set up a Luxembourg Trust

Setting up a Luxembourg trust is similar to setting up trusts in other renowned trust jurisdictions. Generally, the process goes as follows:

- Consult a team of professionals to handle your trust establishment (like Nomad Capitalist)

- Choose a Trustee

- Identify all trust participants and their roles (settlor, trustee, beneficiaries, etc.)

- Collect Necessary Documents

- Draft the Trust Deed

- Transfer Assets

- Register the Trust

The last point is notable. Let’s discuss it in detail.

Trust Registration in Luxembourg

In July 2020, Luxembourg published a law introducing the ‘Fiduciary and Trust Register‘ (LTR). LTR applies to express trusts and other arrangements comprising;

- Luxembourg trustee(s), or

- Trustees outside Luxembourg, entering into a business relationship in Luxembourg (or acquiring real estate) on behalf of the trust. Trustees forming multiple business relationships on behalf of the trust in different Member States must also be registered.

LTR requires the following information:

- identity details and certain information of beneficial owners (settlors, trustees, beneficiaries, any individual or a legal entity exercising effective control over the trust.)

- Certain information (name, registration number, etc.) on the trust deed or fiduciary contract.

Should You Set up a Trust in Luxembourg?

There are usually tons of benefits to setting up trusts in well-known European jurisdictions that are not considered traditional tax havens.

For starters, you don’t have to deal with all the additional paperwork and frowns associated with traditional offshore tax havens.

The highly regulated Luxembourg law on trusts, its stable tax administration, and the global importance and perception of the country offer you ease in many ways.

However, if you don’t mind stepping outside the EU, jurisdictions like the Cook Islands (a pioneer in offshore trusts) and the Bahamas may offer you more benefits from a tax perspective.

Wherever you see your best life, Nomad Capitalist can make it possible for you. All you have to do is reach out to us.

How to Set Up a Luxembourg Trust in 2025: The Ultimate Guide FAQ

Non-resident beneficiaries of international trusts are generally exempt from all taxes as long as the trust assets are located outside of Luxembourg. Some key exceptions are mentioned below:

Non-residents are subjected to income tax only on Luxembourg-earned income and their property in Luxembourg.

Non-residents are subject to capital gains tax only if they dispose of shares or other assets subject to capital gains taxes within six months of acquisition.

Inheritance tax is due depending on the degree of kinship between the beneficiary and the settlor.

Assets transferred to a Luxembourg trust must be registered in LTR through a €12 registration tax.

Luxembourg trusts are excellent wealth management tools for wealthy individuals looking to protect their assets (liquid assets, legal entities, etc.). Such individuals can also establish private family offices in Luxembourg to protect their estates.

The Best Countries for Investing in the Middle East 2025

The global investment landscape has changed dramatically. Gone are the days when opportunities were limited by geography or confined to traditional stocks and bonds sold only through standardised, rigid and often cumbersome channels. Back then, going ‘global’ might have just meant adding a few European equities to a US-based portfolio. Today, everything has changed. Barriers […]

Read more

Best Gulf Country for Company Formation and Business Setup

For ambitious entrepreneurs, the Gulf region offers a powerful blend of top-tier banking systems and business-friendly laws that streamline company formation and make the process remarkably efficient. Countries like Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the United Arab Emirates (UAE) are actively competing to attract the world’s brightest business minds – and it’s working. […]

Read more

Top Offshore Tax Havens in the Caribbean

When people hear the term ‘tax haven’, it often conjures up images of shadowy offshore bank accounts and shady financial dealings. The reality is far more practical and much less sinister. Caribbean tax havens aren’t just for billionaires or corporations with armies of lawyers. In fact, many everyday entrepreneurs and investors take advantage of the […]

Read more