- Home

- Articles

- Global Citizen

- A Concise Guide to Portugal’s Wealth Tax

A Concise Guide to Portugal’s Wealth Tax

November 26, 2025

For high-net-worth individuals, the tax environment of their country of residence is among the most important considerations. If you plan on relocating, it should be to a country that won’t cause wealth deterioration through heavy taxation.

Fortunately, Portugal is among such countries. The taxation system is favorable for expats, including those with significant wealth.

In this guide, we’ll focus on the Portugal “wealth tax” specifically and discuss:

- Whether Portugal has a wealth tax

- Which assets are subject to taxation

- How to optimize your tax liabilities in Portugal

Does Portugal Have a Wealth Tax?

Portugal does not impose a broad annual tax on an individual’s net worth or international assets. There is no traditional wealth tax, which is in stark contrast to other European countries like Spain and Switzerland and can be a deciding factor when determining where to relocate.

Still, Portugal does levy an additional property tax on high-value real estate, known as AIMI (Adicional ao Imposto Municipal sobre Imóveis). It’s often colloquially referred to as a wealth tax because it targets high-value property, but it doesn’t qualify as such due to several reasons:

- It only focuses on real estate and doesn’t encompass additional assets

- It doesn’t account for an individual’s net worth

- It only targets Portuguese real estate (whereas a wealth tax may encompass worldwide property)

Due to AIMI’s narrow scope, high-net-worth individuals can rest assured that their international assets won’t be subject to any wealth tax. Still, it’s worth understanding AIMI to optimize your tax position after relocating to Portugal.

How Does AIMI Work?

AIMI replaces the previously imposed 1% stamp duty on luxury homes with a progressive tax structure defined by the value thresholds of residential properties and building plots in Portugal. It must be paid if you own a qualifying property, regardless of whether you’re a Portuguese tax resident or a foreign citizen.

While AIMI is sometimes mistakenly referred to as a property tax, a more accurate description would be a luxury property tax. Portugal has a separate municipal property tax (Imposto Municipal sobre Imóveis or IMI), which is paid alongside AIMI and differs from it in three crucial aspects:

| Aspect | AIMI | IMI |

| Purpose | Levying tax on urban residential and building properties to fund Portugal’s social security system | Implementing a standard annual property tax to fund local services like education and infrastructure |

| Scope | Imposes tax on the combined total value of a taxpayer’s eligible properties (to prevent individuals from spreading wealth across multiple assets) | Levies tax on the value of each individual property |

| Affected assets | Mainly targets urban residential buildings and land designated for construction | Includes all types of real estate, including rural and commercial properties |

AIMI Tax Rates and Property Value Thresholds

AIMI’s progressive rates come into effect when the official taxable value (Valor Patrimonial Tributário or VPT) of all eligible Portuguese real estate you own surpasses the exemption threshold.

The threshold is €600,000, after which properties are taxed at the following rates:

| Property Value | AIMI Rate |

| €600,000+ up to €1,000,000 | 0.7% |

| €1,000,000+ up to €2,000,000 | 1.0% |

| €2,000,000+ | 1.5% |

These thresholds apply to individuals. Couples can leverage a joint assessment to double the exemption threshold, which would be €1.2 million in this case. Any property valued above this threshold is taxed at the same progressive rates regardless of joint assessment.

Companies and other legal entities that own property pay a flat tax rate of 0.4% and are not eligible for the €600,000 exemption.

Still, this rule has narrow practical implications because it only affects companies or funds that own real estate or land for investment purposes. If a property is being used for commercial, agricultural, or industrial purposes, it’s exempt from AIMI.

For investment-driven buildings held by entities in tax havens, AIMI is 7.5%. This may be a notable consideration for those who own offshore funds that hold such buildings.

All the exemption thresholds and rates are applicable to residents and non-residents alike. Your expat status will not impact your AIMI obligations, so account for them when determining if relocation to Portugal makes financial sense.

When Is AIMI Paid?

AIMI must be paid annually by September of each calendar year. The complete AIMI timeline is as follows:

- December 31: The Portuguese Tax Authority assesses the taxable value (VPT) of all your properties in the country

- January 1: The Tax Authority begins calculating AIMI on eligible properties

- June 1–31: Calculations are completed, and you get your AIMI bill for the year

- September 30: You must pay your AIMI by this date

AIMI is paid in a single installment, in contrast to IMI, which may be paid in 1–3 installments, depending on the amount of tax due.

Considering that property ownership is determined on January 1 of the current year, you should plan your ownership and financing strategy according to this date. For instance, you may want to sell one of your properties by the end of the year to minimize AIMI or even drop below the exemption threshold.

If you live abroad and own AIMA-qualifying property, you can pay any tax due through an international bank transfer or online using the Portuguese Tax Authority’s platform. Still, it’s important to have a fiscal representative or a system to receive Portuguese tax notices so that you don’t miss the AIMI bill and the related deadlines.

How Is AIMI Determined?

AIMI is calculated based on the VPT of all properties you own on January 1 of the current year. VPT is different from the property’s market value, as it’s an official valuation determined by the tax authorities. It accounts for various factors of your property, including:

- Size

- Location

- Age

- Amenities

The good news is that VPT is often lower than a property’s market value, which can reduce your tax burden. Still, this is only a rule of thumb, so you shouldn’t explicitly count on the VPT being lower than the property’s appraisal.

If your property has a mortgage or another form of secured loan, any outstanding debt is deducted from its value for AIMI purposes. This means that AIMI is applied to your property’s net equity, which enables you to lower your tax obligations by holding a mortgage.

After the property’s VPT is calculated, the Tax Authority determines which bracket it falls under and applies the corresponding rate.

Which Properties Are Exempt From AIMI?

AIMI primarily targets luxury housing and land, so it focuses specifically on high-value residential properties and building plots for development. By contrast, various property types are exempt from it, including:

- Commercial and industrial properties

- Rural and agricultural properties

- State-owned properties

- Social housing or controlled-cost housing properties

These exemptions can be valuable if you are an investor and wish to grow your wealth through different economic activities that involve real estate. For example, investing in a farm or buying office space in Portugal to expand your business should not expose you to AIMI.

On the other hand, Portugal doesn’t allow any exemptions for primary residence. All qualifying properties will be taxed regardless of whether you live in them.

There are also no concessions for expats like there are with other tax types. For example, while only 50% of non-residents’ capital gains are taxable, AIMI must be paid in full.

How To Reduce Your AIMI Exposure

If your wealth is (or will be) considerably made up of Portuguese property, you can leverage various strategies to minimize the AIMI burden. Joint ownership is among the most popular methods, and it can take two common forms:

- Owning real estate as a married couple: Including both spouses as owners of a property can expand the AIMI threshold to €1.2 million

- Splitting ownership between multiple parties: AIMI is determined based on individual property ownership, so spreading real estate holdings among several parties can ensure that no single owner exceeds the €600k threshold

You may also want to consider owning high-value property through a Portuguese company. While doing so does not exempt you from AIMI, it lets you circumvent progressive taxation and fix the rate at 0.4%.

The downside to this strategy is that companies are subject to various additional taxes, which may complicate your tax position. You should consult a tax expert to determine if minimizing AIMI through company ownership is financially feasible.

Finally, it might be sensible to finance any future property purchases with mortgages. Doing so may considerably decrease your property’s VPT, especially during the first years of relocation, as the outstanding debt amount may be significant.

Additional Property Tax Considerations for High-Net-Worth Expats

AIMI is not the only tax you should consider if you plan on relocating to Portugal with significant wealth. You should familiarize yourself with other obligations and allowances to plan your finances accordingly.

Besides a lack of a traditional wealth tax, Portugal doesn’t impose any estate tax on inheritances to close family members. If you plan on transferring real estate to your spouse or children, you should only expect a 0.8% stamp duty on Portuguese real estate.

This doesn’t apply to distant heirs or gifts to non-family; such transfers are taxed at a flat rate of 10%, which may be substantial for high-value property.

Other property tax considerations to make before relocating to Portugal include:

- IMI: As mentioned, IMI encompasses all real estate, so you’ll pay it annually regardless of the property’s value. IMI can range between 0.3% and 0.45% for urban properties, mainly depending on the intended use, size, and location

- Rental income tax: Proceeds from renting out a property are subject to a flat tax rate of 28% for non-residents, which is withheld at source

- Capital gains tax: When you sell a property, 50% of the gains will count toward your taxable income, which is taxed at progressive rates that range from 12.5% to 48%. High-net-worth individuals in the top brackets may also be subject to a 2.5%–5% solidarity surcharge

With adequate wealth structuring and management, you can leverage various deductions and exemptions to retain as much of your income as possible during your time in Portugal. To get assistance in developing an effective strategy, seek expert support from Nomad Capitalist.

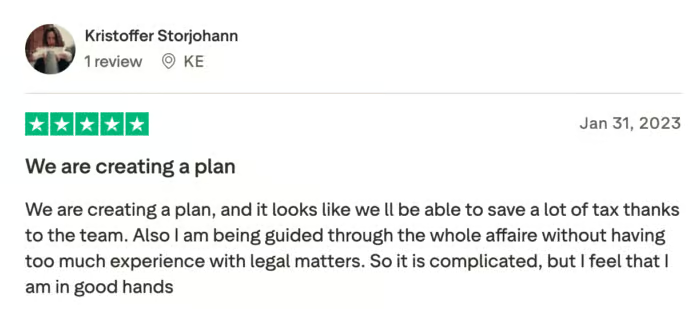

Ensure Tax-Efficient Relocation With Nomad Capitalist

For over a decade, Nomad Capitalist has been developing successful strategies for high-net-worth individuals who wish to seamlessly relocate to another country while preserving or growing their wealth.

We do this through a 360-degree Action Plan—a personalized, structured strategy that enables:

- Simplified procedures for obtaining residence or citizenship in foreign countries

- Exploration of new investment opportunities

- Fully compliant tax optimization and reduction plans

To get your Action Plan, you only need to complete a simple questionnaire to determine whether you’re a good fit. If so, we will:

- Schedule an onboarding call to fully understand your current situation and goals

- Create a granular plan based on your circumstances

- Present and implement the Action Plan over a 12-month period

As a part of the Action Plan implementation, we’ll take over all the processes that might be time-consuming if you do them yourself, from opening bank accounts to facilitating citizenship applications. We’ll then provide ongoing support to help you optimize your tax obligations and retain your wealth.

Should you decide to make any personal or business changes with financial implications, you can rely on your lifelong support. We can advise you on any significant steps and modify the Action Plan as needed.

Panama Residency Requirements: A Guide for Investors, Retirees, and Workers

Panama’s immigration system allows investors, retirees, and individuals seeking to live abroad multiple pathways to acquire residency and, over time, pursue Panamanian citizenship. The residency visa system has several attractive options, each with its own set of requirements. In this article, we’ll explore Panama’s residency requirements, discussing topics such as: Benefits of Panama Residency Several […]

Read more

Panama Real Estate Investment: What International Buyers Need To Know

Panama is a popular destination for foreign investors seeking to diversify assets, generate rental income, or acquire a second citizenship in a stable country with a dollar-based market. In this article, we’ll explore the key aspects of a Panama real estate investment. We’ll take a look at the real estate market, examine foreign investors’ rights […]

Read more

Can You Get Panama Citizenship by Investment? Answer and Alternatives

Panama’s status as Latin America’s main financial hub, favorable tax policies for income earned abroad, and an affordable, high-quality lifestyle make it one of the premier destinations for high-net-worth individuals. While the country offers multiple residency-by-investment programs, a common question is whether there’s a direct way to invest and become a citizen. In this article, […]

Read more