- Home

- Articles

- Global Citizen

- Portugal Taxes for U.S. Expats: An In-Depth 2025 Guide

Portugal Taxes for U.S. Expats: An In-Depth 2025 Guide

November 26, 2025

As an American living in Portugal, you can enjoy the country’s favorable tax system with many incentives, but you must also balance your obligations with those in the U.S. This two-pronged tax landscape can be confusing and lead to inadequate tax planning.

To clear the air and share crucial information you should know about Portugal taxes for U.S. expats, this guide will cover:

- Your tax obligations in Portugal and the U.S.

- Criteria for tax residency in Portugal

- The specifics of income tax, capital gains tax, and other related obligations

- Provisions that prevent double taxation

- Practical steps for filing taxes in Portugal

How Are Taxes in Portugal for U.S. Citizens Determined?

Unlike the U.S., Portugal has a residence-based taxation system. If you qualify as a Portuguese tax resident based on the applicable criteria, you must pay taxes on your worldwide income.

You are considered a tax resident in Portugal if you meet either of the following conditions:

- Physical presence: Staying in Portugal for more than 183 days (consecutive or not) within any 12 months overlapping the fiscal year

- Habitual residence: Maintaining a permanent home in Portugal with the intention of keeping it as your primary residence (regardless of how many days you spend in it)

If neither of the above applies to you, you’re considered a non-resident for tax purposes and must only report income generated in Portugal, including:

- Income from domestic employment

- Business earnings

- Real estate income

Note that in some cases, you may effectively be a Portuguese resident without being considered a tax resident. For instance, Golden Visa holders only need to stay in Portugal for seven days in their first year and 14 days over the next two years to maintain residency.

If you meet these minimum criteria but don’t stay in Portugal for over 183 days within 12 months or maintain a primary residence in the country, you are not considered a tax resident.

How High Are Taxes for Expats in Portugal?

All Portuguese tax residents (regardless of citizenship) are subject to the country’s progressive tax system, which differentiates between nine tax brackets based on annual income:

| Taxable Annual Income (EUR) | Tax Rate |

| 0–8,059 | 12.5% |

| 8,059–12,160 | 16% |

| 12,160–17,233 | 21.5% |

| 17,233–22,306 | 24.4% |

| 22,306–28,400 | 31.4% |

| 28,400–41,629 | 34.9% |

| 41,629–44,987 | 43.10% |

| 44,987–83,696 | 44.6% |

| 83,696+ | 48% |

High-earning individuals are also subject to a so-called solidarity surcharge, so you might face one of the following two rates depending on your income:

- €80,000–€250,000: 2.5%

- Over €250,000: 5%

Combined with the above rates for personal income tax (known as Imposto sobre o Rendimento das Pessoas Singulares or IRS in Portugal), this means that affluent individuals might encounter a tax rate of up to 53%.

Progressive tax rates apply to most income categories, including employment, self-employment, and pensions. Specific categories are taxed at a flat rate of 28%, most notably:

- Rental income

- Dividends and interest

- Short-term capital gains (from assets held for less than 12 months)

Non-Resident Expat Taxes in Portugal

Being a non-resident for tax purposes simplifies your tax position because you must only report income generated in Portugal. Any remaining U.S. income (or global income, in general) is excluded.

Another benefit—especially for high-income individuals—is that income tax for non-residents typically isn’t subject to progressive taxation but flat rates, as explained in the following table:

| Income Source | Tax Rate |

| Employment (including self-employment) | 25% (withheld at source) |

| Dividends and interest | 28% |

| Rental income | 25% |

One area where non-residents may encounter progressive taxation is capital gains realized from property sales. Still, non-residents pay tax on only 50% of the gain when selling Portuguese real estate. Assets besides real estate (e.g., shares) are subject to flat-rate taxation, typically at 28%.

You must determine your tax residency each year to ensure your taxes are filed correctly. If you exceed the 12-month threshold of 183 days in a given year, the above rates will not apply, and you will automatically be expected to file tax returns according to the rates for residents.

Non-Habitual Resident (NHR) Tax Regime: A Unique Portugal Tax Benefit for Expats

In 2009, Portugal launched the non-habitual resident (NHR) program that offered major tax breaks to expats and foreign nationals for a 10-year period. The key benefits of the initial program included:

- Tax-free foreign income (rental income, dividends, etc.)

- A 20% tax rate on employment and business income from eligible professions

- A 10% tax rate on income from foreign pensions

Unfortunately, the NHR regime underwent significant changes in 2023, when the Portuguese government announced the Tax Incentive for Scientific Research and Innovation (IFICI) program, commonly referred to as NHR 2.0.

NHR 2.0 retains the 10-year tax benefits, but the eligibility criteria are much stricter. The most notable conditions are as follows:

- You must live and work in Portugal

- You need to work in scientific research, higher education teaching, research and development (R&D), or certain high-level financial or IT jobs

- You may be incentivized if you work in the Azores or Madeira islands

If you qualify, your Portuguese income will be taxed at the favorable flat rate of 20%, and your foreign income is exempt from taxation altogether. Still, your pension and retirement distributions are taxed at normal progressive rates instead of enjoying the 10% flat rate under the initial NHR program.

Those who were already approved for the original NHR program are grandfathered, meaning they can enjoy its benefits for the remainder of their 10-year period. By contrast, anyone who applied from 2024 onward is only eligible for the IFICI program.

Non-Income Taxes for Americans in Portugal

Besides income tax, you need to consider several other categories that may apply to you depending on your relocation circumstances and financial position. The most notable ones are outlined in this table:

| Tax Category | Rates and Details |

| Social Security contributions | Employees are subject to 11% withholdings of their salary (with another 23.75% contributed by the employer). Self-employed individuals typically contribute 21.4% of their income |

| Annual municipal property tax (IMI) | Rates generally range from 0.3% to 0.45% of the property’s value. You can work out your IMI using the official calculator on the Tax and Customs Authority website |

| Additional IMI (AIMI) | A surcharge equivalent to a wealth tax amounting to 0.7%–1.5% of the property’s value in case it exceeds €600,000 (€1.2 million for couples) |

| Property transfer tax (IMT) | Rates range between 0% and 8% depending on the property type and cost. Individuals under 35 who buy their first property are exempt from IMT (as long as the value doesn’t exceed €316,772 and the purchase is made after August 2024) |

| Stamp duty (IS) | Stamp duty at 0.8% of the property purchase price applies. The stamp duty increases to 10% if the property is given as a gift or inheritance to someone other than a close family member |

Portugal doesn’t impose any tax on gifts and inheritance as long as the recipient is your spouse, child, or another direct family member. This is in stark contrast to the U.S. estate tax, which may be up to 40% if the exemption threshold is surpassed.

Tax Advice Portugal: Do I Have To Pay U.S. Taxes if I Live in Portugal?

You must pay U.S. taxes while living in Portugal as long as you are considered a U.S. citizen. Due to citizenship-based taxation, all citizens and Green Card holders are obligated to file an annual U.S. tax return (Form 1040) regardless of their residence.

The only exceptions include standard income thresholds as defined by the IRS. For example, single filers older than 65 at the end of 2025 with income below $14,600 are not obligated to file a tax return.

Relocation to Portugal (or any other country) does not affect your obligations or the exceptions because the U.S. taxes the worldwide income of its citizens. This includes your Portuguese salary, foreign bank interest, and any other taxable income.

All the tax deadlines still apply, though expats can enjoy some benefits. The due dates are as follows:

- April 15: Standard tax deadline

- June 15: Automatic extension granted to expats

- October 15: Available if you fill out Form 4868 to request an extension

Regardless of these extensions, any tax owed is still due by April 15. While you can file later, you should pay the estimated amount by this date to avoid interest.

Although citizenship-based taxation may imply you’ll need to pay a significant amount, there are various provisions that can drastically reduce your obligations.

Do the U.S. and Portugal Have a Foreign Tax Credit System?

The U.S. has a foreign tax credit (FTC) system valid in Portugal, which was established to prevent double taxation. For any taxes paid in Portugal, you get dollar-for-dollar credit against your U.S. tax obligations.

You can leverage FTC in two ways:

- Deduction: Portugal income taxes reduce your taxable income in the U.S.

- Credit: Portugal income taxes reduce your U.S. tax liability

The latter option is typically preferable, especially because you can accrue excess credits and carry them forward up to 10 years for future use. Considering that Portuguese tax rates may be higher than U.S. taxes, FTC may wipe out your U.S. tax obligations altogether.

Note that if Portuguese tax on an item (e.g., your employment income) surpasses the U.S. tax rate, the credit can cover your U.S. tax obligation in full, but you won’t receive a refund for the difference. The most you can expect from credits is to bring your U.S. tax obligations to zero, which is still a major tax benefit if you’re concerned about double taxation.

The U.S. and Portugal have two additional arrangements that optimize your tax position:

- Income tax treaty

- Foreign earned income exclusion (FEIE)

Income Tax Treaty

The U.S. and Portugal have a tax treaty that helps determine which country taxes expats first or exclusively. In theory, a treaty should prevent double taxation by clearly outlining the categories of earnings that each country can tax.

Unfortunately, this isn’t the case here because the U.S.-Portugal treaty contains a “saving clause,” which allows the U.S. to tax its citizens as if the treaty didn’t exist. This is why, unlike expats from other countries, U.S. citizens don’t rely solely on the tax treaty to avoid double taxation but on its relation to domestic laws and frameworks like the FTC.

For example, the tax treaty verifies that income from sources like Portuguese real estate is taxable in Portugal and that the U.S. must give a foreign tax credit for the taxes paid.

Foreign Earned Income Exclusion (FEIE)

FEIE is a highly popular provision among expats that allows U.S. citizens to exclude a considerable amount of earned income from U.S. taxation. The specific amount is indexed annually, with the 2024 exclusion being up to $126,500 per person.

To qualify for FEIE, you must pass either of the following tests:

- Physical presence test: Being physically present outside of the U.S. (not necessarily in Portugal) for at least 330 days within a 12-month period

- Bona fide residence test: Being a bona fide Portugal resident encompasses factors such as length of stay and relocation intentions

The second condition is typically met by default if you relocate to Portugal permanently, as you’ll likely perform activities that the IRS considers for bona fide residence—such as buying/renting a home and acquiring a visa without length-of-stay limitations. If you meet such conditions, you can file Form 2555 to claim FEIE on a portion or the entirety of your income up to the abovementioned limit.

Note that if you do so, you can’t take a foreign tax credit on the same income. You must choose between FTC and FEIE or split your income by excluding a part of it through FEIE and taking tax credits for the remainder.

5 Steps to Filing Taxes in Portugal as an Expat

After working out the amount due, you can file your Portuguese taxes by taking these steps:

- Obtain a NIF: If you haven’t already, obtain a NIF (Tax ID) through the local tax office or via a representative. This step is reserved for recent expats, seeing as you’ll receive a NIF soon after relocating as a part of the immigration process

- Register on the Portal das Finanças: The Portuguese Tax Authority has an online portal where you can register after obtaining a NIF. This is where you’ll submit tax returns, pay your taxes, and complete any related processes

- Collect the necessary documents: Prepare the paperwork necessary for filing taxes, such as income statements, foreign income documentation, and receipts for deductions

- Complete the Modelo 3: The Modelo 3 is used to declare income to tax authorities, so you need to fill out the necessary annexes according to income types (e.g., Annex A for employment or Annex B for self-employment income)

- Pay any tax due: Upon filing your taxes, the Tax Authority will process and issue an assessment (liquidação). After you receive it, you should pay the balance owed by August 31

The tax year in Portugal coincides with the calendar year, and the filing season for personal income tax is April 1 to June 30 of the following year. The deadline is the same for everyone, so make sure not to miss it.

By contrast, you must file U.S. taxes by April 15, unless it falls on a weekend or holiday. While the filing deadlines are close enough, this means you’ll need to set aside a considerable amount of time to make sure you’ve filed both your U.S. and Portuguese taxes correctly.

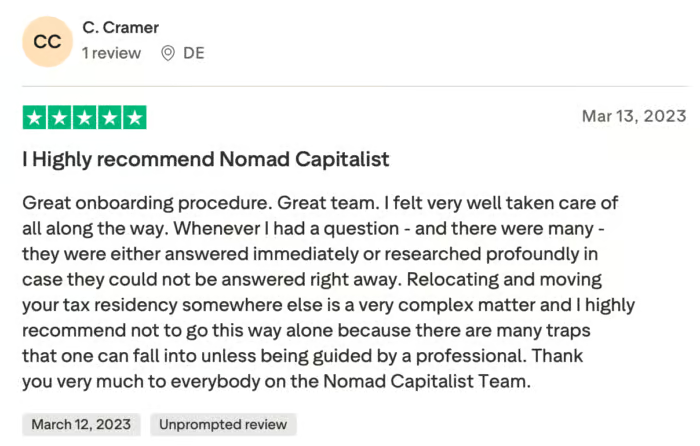

This process can be pretty cumbersome, especially for high-earning individuals whose income might be subject to various special rules. To understand and meet your tax obligations without guesswork, consider enlisting the help of professional advisors from Nomad Capitalist.

Nomad Capitalist: Worry-Free Taxation for Expats

Nomad Capitalist is an advisory firm that supports expats every step of the way during their relocation, including regarding their tax obligations. Our financial experts can help you navigate the intricacies of the U.S. and Portuguese tax systems to ensure:

- A full understanding of your domestic and foreign income’s tax treatment

- Effective prevention of double taxation

- Successful tax planning that helps avoid excessive taxation

This is just one part of what we deliver through our Action Plan—a comprehensive, personalized strategy that analyzes your unique financial position to implement a structured set of steps that meet your relocation goals.

All you need to do is complete a quick application form to determine if we’re a good fit. If so, we will:

- Schedule a private onboarding call to understand the specifics of your relocation

- Develop and present a granular action plan

- Handle the administrative work related to your relocation

- Provide ongoing support for any questions and concerns

Build a custom international plan to legally reduce your taxes, protect your assets, and gain the freedom to live and invest where you’re treated best. Apply for your custom Action Plan today—designed for serious entrepreneurs and investors ready to take action.

✔️ Private onboarding

✔️ Strategy tailored to your goals

✔️ Hands-on implementation

Panama Residency Requirements: A Guide for Investors, Retirees, and Workers

Panama’s immigration system allows investors, retirees, and individuals seeking to live abroad multiple pathways to acquire residency and, over time, pursue Panamanian citizenship. The residency visa system has several attractive options, each with its own set of requirements. In this article, we’ll explore Panama’s residency requirements, discussing topics such as: Benefits of Panama Residency Several […]

Read more

Panama Real Estate Investment: What International Buyers Need To Know

Panama is a popular destination for foreign investors seeking to diversify assets, generate rental income, or acquire a second citizenship in a stable country with a dollar-based market. In this article, we’ll explore the key aspects of a Panama real estate investment. We’ll take a look at the real estate market, examine foreign investors’ rights […]

Read more

Can You Get Panama Citizenship by Investment? Answer and Alternatives

Panama’s status as Latin America’s main financial hub, favorable tax policies for income earned abroad, and an affordable, high-quality lifestyle make it one of the premier destinations for high-net-worth individuals. While the country offers multiple residency-by-investment programs, a common question is whether there’s a direct way to invest and become a citizen. In this article, […]

Read more