Antigua and Barbuda Digital Nomad Visa Guide

November 25, 2024

If you’re new to the digital nomad visa world, we won’t judge if you can’t spot Antigua and Barbuda on the map.

After all, it’s not even 1% of the size of the US and it’s not as well-known.

However, this British Commonwealth nation is pretty famous among wealthy investors, digital nomads and beach-hungry travellers – and for good reason.

Ever since Antigua and Barbuda gained independence in 1981, it’s worked hard to establish itself as a top tourist destination in the Caribbean, famous for its award-winning beaches, coral reefs and luxury resorts.

Adding even more attraction to its allure is the nation’s various long-term visa and residency and citizenship programs, which include the digital nomad visa for remote workers.

If that sounds like something you’d be interested in, here’s everything you need to know about the Antigua and Barbuda digital nomad visa (also called the Nomad Digital Residence Program): you’ll find details on the application procedure, benefits, tax considerations along with a few alternative options to help those in search of their next nomadic destination.

If that doesn’t sound like a good fit for you, check out our citizenship-by-investment guide for this tropical paradise.

Benefits of the Antigua and Barbuda Digital Nomad Visa

For digital nomads, the Antigua and Barbuda digital nomad visa is an opportunity to experience what the Caribbean has to offer without having to spend fortunes on residency.

You won’t be limited to accessing the country for only a few months a year, either. Aside from that, it comes with a few of the following top-tier benefits.

Tax Incentives

With no inheritance, wealth, dividends, interest, capital gains or personal income tax levied, Antigua and Barbuda comes pretty close to the classic interpretation of a tax haven.

Citizens and residents of Antigua and Barbuda don’t have to pay any of the abovementioned taxes.

Successful applicants and their dependents under the Nomad Digital Residence Program also don’t have to pay income tax during their stay on the island.

While Antigua doesn’t have personal taxes, it does have corporate taxes. So, if you intend to stay in Antigua and work for your own offshore company, you need to make sure not to trigger permanent establishment rules.

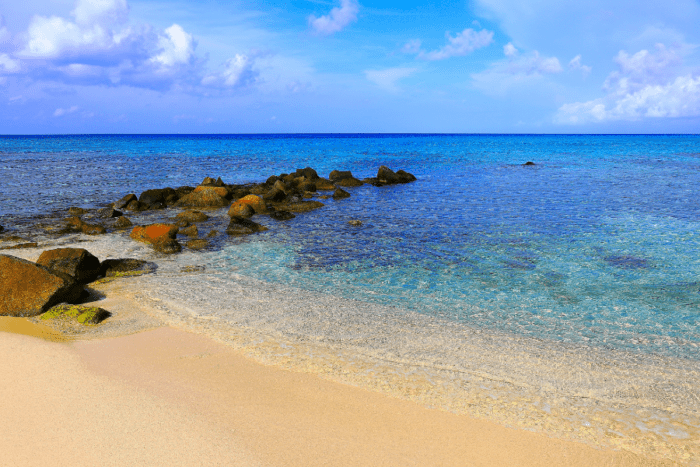

Exotic Destination

The twin island nation of Antigua and Barbuda is world-renowned for its pink beaches, high-end resorts, water sports activities and welcoming people.

The country is no stranger to tourists and their lifestyles. St John, the capital of Antigua and Barbuda, is entirely accustomed to foreigners and offers tons of activities for them.

Whether you want to sip a fruity drink by the beach or indulge in water sports, the island offers some of the best locations.

One of the Best Digital Nomad Destinations

Antigua and Barbuda has everything you need as a digital nomad. It has a thriving digital nomad community, fast internet, co-working spaces and an atmosphere that’ll make you feel your best so that you can work your best.

In addition to being an excellent tourist destination, Antigua and Barbuda is also marketing itself as an efficient offshore financial services hub with many international banks and other financial institutions.

So, you’ll get to work from Antigua and Barbuda and never have to worry about mediocre banking or related issues.

Antigua and Barbuda Digital Nomad Visa Background

On June 30, 2020, assessing the rise of the remote work model, Barbados introduced its Welcome Stamp program, the first digital nomad visa of its kind in the Caribbean region.

Soon after, Bermuda and other countries in the region, including Antigua and Barbuda, joined the bandwagon.

Today, many Caribbean countries offer their version of a digital nomad visa. However, Antigua and Barbuda’s visa provides the most extended stay, i.e., two years.

The only other Caribbean country with a two-year digital nomad visa is the Cayman Islands.

In October 2020, Antigua and Barbuda launched its long-stay remote-work visa called the Nomad Digital Residence Program (NDR Visa).

The Nomad Digital Residence Program offers eligible foreigners who can work remotely and their families a special-resident authorization valid for up to two years from the first instance.

How to Apply for the Antigua and Barbuda Digital Nomad Visa

The Nomad Digital Residence Program’s visa application process is entirely online and straightforward.

Below, you’ll find all the required documents, eligibility criteria and other information you’d need to apply for the NDR visa.

Eligibility Criteria for the Digital Nomad Visa in Antigua and Barbuda

According to the official site of the Nomad Digital Residence Program, to be eligible for the NDR visa, you must:

- Be 18 years or older

- Be employed outside of Antigua and Barbuda and can work remotely

- Make a minimum annual income of US$50,000 (USD) for each of the two years you intend to stay in Antigua and Barbuda

- Have a clean criminal record

- Satisfy entry visa requirements (if applicable).

Required Documents for Antigua and Barbuda’s Digital Nomad Visa Program

If you meet those requirements, then your next step will be to gather the following documents.

Applicant’s Documents

- Two passport-size photos

- Colour copy of your passport bio-page

- Birth certificate

- Proof of employment

- Proof of funds

- Police certificate of character

- Medical insurance, inclusive of travel insurance.

Dependents’ Documents

- Passport bio page

- Birth certificate

- Standard passport-size photo

- Proof of medical insurance

- Marriage certificate

- Notarised letter of relationship (not needed for married couples)

- Police certificate of character for all dependents aged eighteen or above

- Proof of Guardianship (if applicable).

Fees for Antigua and Barbuda Digital Nomad Visa

In addition to the documents, you must pay a non-refundable fee to get the NDR visa. The rates are mentioned below:

- Single applicant – US$1,500

- Couple (applicant + spouse/partner) – US$2,000

- Family (applicant + up to three dependents) – US$3,000

- Each additional dependent (in addition to the first three dependents) – US$650.

You can expect to receive an approval or rejection via email within a short period of submitting your application.ation.

Other Digital Nomad Visas Programs to Consider

Digital nomad visas aren’t exclusive to the Caribbean region. In fact, the first official digital nomad visa was issued by Estonia, which allowed remote workers to stay in the country for up to one year. Germany is another European country with a famous digital nomad visa.

In North America, Costa Rica and Mexico have digital nomad visas urging location-independent workers to work from their shores.

Many countries in Asia, Africa and Latin America also offer remote work visas for different durations. Some are even free, like Mauritius’ Premium Visa, which also requires no proof of income.

It’s definitely an exciting time to be a digital nomad or a location-independent professional, with so many countries competing to bag your contributions to the economy.

If we go back a few years, remote-work visa options were scarce, and the quality was mediocre. The increase in options has resulted in each country upping its game to attract the biggest numbers.

Antigua and Barbuda Digital Nomad Visa: FAQs

The Antigua and Barbuda digital nomad visa lets you soak up the sun and island life for up to two years, which is plenty of time to explore its many pristine beaches.

To qualify, you’ll need to prove you have a consistent monthly income of at least US$50,000 per year. While this might be a lot higher than most countries, you have to keep in mind that they need to know that you’ll be able to look after yourself and that they are not as well-developed as many other countries.

Like most digital nomad visas, this one also allows you to bring your spouse and any dependents along for the adventure. Just be sure to include them in your application.

The visa application fee is US$1,500 for a single applicant, US$2,000 for a couple , and US$3,000 for a family. If you bring more than three dependents, you’ll have to pay an extra US$650 for each one.

It depends on what you think ‘easy’ is. For example, as long as you apply from within Spain, the Spanish digital nomad visa is done entirely online, and you only need to show proof of a monthly income of €2646.

Antigua and Barbuda does have tax advantages for certain individuals and businesses, but it’s not technically classified as a tax haven in the traditional sense. While they don’t tax worldwide income, capital gains, inheritance or wealth, they do have taxes on things like property, sales and certain business activities within the country.

Should You Consider the Antigua and Barbuda Digital Nomad Visa Program?

Antigua and Barbuda’s two-year Nomad Digital Residence program is an excellent option for people who want to live in an exotic tropical location with the best beaches, literally one beach for each day of the year, and a friendly tax regime.

The best part about living in Antigua and Barbuda is that if by the end of your two-year NDR visa tenure, you come to love the country and want to become a citizen, you have an economic citizenship option.

Ready for a new start somewhere bright and sunny? We can help.

At Nomad Capitalist, we help high-net-worth entrepreneurs and investors to move offshore and ‘go where they’re treated best’.

If you’re dreaming of life of high temperatures and low taxes, reach out and we’ll help make that Caribbean dream of yours a reality.

Is Grenada Safe for Visitors, Residents and Families?

Evaluating a nation for tourism, relocation or investment begins with a single, non-negotiable factor – safety. Security, from both a personal and financial point of view, is the foundation upon which all other considerations rest. And while it’s easy to assume that stability is a given in the developed world, recent challenges in countries like […]

Read more

Is Antigua Safe for Tourists, Families and New Residents?

Security is a cornerstone of any serious investment migration strategy. For high-net-worth individuals (HWNIs) and globally mobile families, it ranks alongside tax efficiency, political stability, and quality of life as a key driver in deciding where to live, invest or acquire a second passport. Too often, safety is assumed to align with economic development. Countries […]

Read more

Is St Kitts and Nevis Safe? Tips for Tourists and Residents

Safety is a non-negotiable factor for anyone considering whether a country is right for travel, relocation or investment. Overlooking such a vital consideration carries serious consequences, and the stark truth is that assumptions based on a country’s global image often fall short of reality. Cases in point include the following countries: The takeaway is clear: […]

Read more