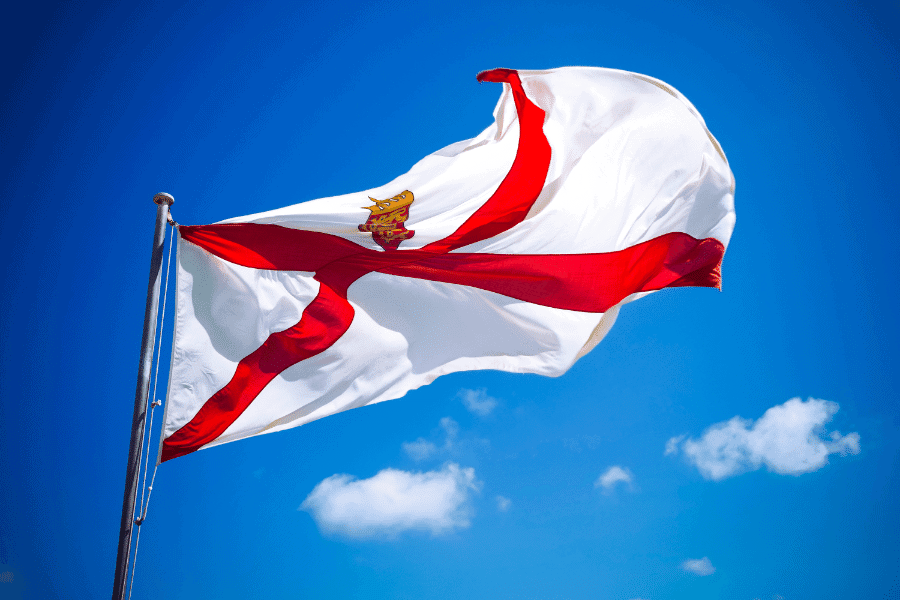

Jersey Residency by Investment: the Ultimate Guide

October 18, 2022

You’d be forgiven for not knowing where or even what Jersey is. And even if you do, you probably have just a vague idea of its location.

This tiny archipelago – part of the so-called Channel Islands – sits off the coast of Normandy, France.

But it is not its location that is of the biggest importance here, even though some might argue that it is indeed the obscure geographic location that makes it a desirable investment immigration destination.

The privacy that Jersey affords its residents, among a plethora of other great benefits, is simply unparalleled.

For decades, Jersey has been a real powerhouse when it comes to offering an extremely high standard of living, global connections, a solid economy, no or low taxes, as well as easy access to the UK and Ireland.

Plus, Jersey is a great alternative to the UK’s Tier 1 visa if you would like to invest in real estate as opposed to building a business.

So, if you’re one of the people who is coming to the realization of just how vital it is to expand your options through a second residence and a passport portfolio, Jersey should be on your radar.

In this article, we’ll tell you what Jersey is like and why you should invest there, what the details are for the required investment to gain residence, and how you can eventually obtain a UK passport through Jersey if you’d like.

Have a read, and if you think you might be interested in taking your Jersey residency by investment further and making it a reality, we can help you with the ins and outs of the application process and your real estate purchase too. Get in touch.

What’s Jersey?

‘The Channel Islands’ is a peculiar concept, both geographically and politically. So, before we tell you why you should consider becoming a resident of Jersey, it’s important to understand its international standing.

The islands consist of two bailiwicks (a.k.a. jurisdictions, not to be confused with bailiffs) – the Bailiwick of Jersey and the Bailiwick of Guernsey, Jersey being the larger of the two.

They are both considered British Crown dependencies, but they are self-governing and neither is officially part of the UK. That said, Jersey does have some privileges that are extended to them for their loyalty to the Crown.

What this means is that Jersey has its own:

• Constitutional government apparatus

• Legislation and taxes

• Currency (which is a version of the GBP; British and Scottish currency also freely circulates in Jersey)

• International identity

But, it also has strong ties with the UK, because:

• The United Kingdom takes care of Jersey’s defense needs

• In terms of immigration and nationality, the United Kingdom treats Jersey as if it were part of the UK

And when it comes to the quality of life in Jersey, the 100,000 island residents have one of the world’s highest standards of living. It’s comparable to the quality of life in the UK, outside of London – Michelin-starred restaurants included.

Jersey’s Gross National Income (GNI) per capita is one of the highest in the world – it’s a place where people flaunt their wealth unapologetically.

Its beautiful coastline with sunny beaches and lots of surfing opportunities, its many top-notch golf courses, as well as agricultural treasures – a unique amalgamation of the British and French cultures – are all the things that Jersey can brag about.

The main language in Jersey is English, although due to its cosmopolitan makeup, many other European languages are spoken too, from French to Spanish.

Jersey is split into 12 parishes, each with access to the sea – you’re never too far away from the Atlantic Ocean and Jersey’s rolling dunes and hidden beach caves when you live in Jersey.

The largest of the parishes and the one with the most people is St Helier, but you don’t have to live ‘in town’ to have access to all of the mod cons.

In fact, people on the entire island have access to one of the world’s fastest broadband connections.

Jersey residents also have access to a modern airport that connects them to the UK and continental Europe, and thus to the entire world.

In a nutshell, Jersey is this tiny but unique part of the world where the quality of life is high and well-balanced. High-net-worth individuals, take notice.

Why Jersey?

And Jersey isn’t all about pleasure. In fact, it has a winning combination of ‘pleasure and business’ factors that make it a great place for the international investor to consider.

Tourism makes up about 25% of Jersey’s GDP, many of the tourists visit for the high-class hotels, resorts, and fine dining restaurants. Agriculture contributes a further 5%, thanks mostly to the Jersey cow and the Jersey Royal New Potato.

However, for years, tiny islands in the ‘middle of nowhere’ have understood just how important it is for them to diversify their income beyond the usual.

Tourism could only take Jersey this far, in other words.

Cue Jersey’s finance industry, namely its banks, trust and fund administration services, accounting, and legal services. Globally, it has an established reputation as trustworthy and private.

It has been in existence for approximately 50 years now, and it provides over half of the island’s GDP. Plus, it accounts for 60% of all taxes collected by the government – it’s the main driver of Jersey’s economy for sure.

Jersey is a leading offshore financial center and even considered a tax haven by some. The Financial Secrecy Index has ranked Jersey 16th in the world as of 2020, but Jersey is fully OECD-compliant and does not feature on the EU list of non-cooperative jurisdictions for tax purposes.

That’s because it has robust oversight by the Jersey Financial Services Commission, an independent organization.

With over 50 banks and nearly 35,000 registered companies, Jersey is an attractive place to invest in because it’s super stable – both in terms of government and life in general.

Jersey is also a zero- or low-tax jurisdiction where there are no capital gains, inheritance, gift, sale, or estate taxes.

And even though some might say the place is boring (and, indeed, most of the foreigners living in Jersey are retirees), the stability and the privacy that the island provides its investors is exactly why so many are keen to invest in Jersey in the first place.

Finally, Jersey is an excellent alternative to the UK Tier-1 visa, which is essentially a residence by investment program, but one that requires a business background.

The Jersey Residency by Investment Program

Technically, Jersey offers what is known as a residence by investment program. But you can also use this residence to work your way towards obtaining a passport if you’d like.

Officially called the High-Value Residency Regime, Jersey’s program offers:

• Investment in real estate. Lower the risk of your investment by putting your money into Jersey real estate.

• No English language requirement. One less requirement to fulfill.

• No business experience. Unlike many other residence by investment programs, Jersey doesn’t require its investors to have an entrepreneurial background.

• To bring your family. You’ll be able to bring your spouse and children under the age of 18 for the same investment sum.

This program allows you to move to Jersey, live and work there full-time, and enjoy the many benefits that a Jersey residency by investment offers its people.

It works the best for those looking for access to the UK and Ireland, as well as UK citizenship for the whole family.

Jersey residency by investment also works for those looking to make a significant investment in Europe or a financial center that’s safe and that’s not subject to the rules and regulations of the UK and the EU.

Another segment of the high-net-worth population that would be smart to make a move on Jersey is the crypto investors. Jersey is a crypto-friendly jurisdiction.

Eligibility

So, what does one have to do to become a high-value resident? There are three aspects to Jersey residency by investment:

- Your personal standing and intended plans. You must be of impeccable personal character and prove to the government that your residency in Jersey will benefit the island in some way, either through business or socially.

- Your ability to purchase real estate valued at £1,750,000 or more. You can also lease or rent a property of this value. You’ll need to fulfill this requirement once your residence application has been approved. This property will need to become your main residence.

- Your ability to pay at least £145,000 per year in tax. Your worldwide income is taxed when you’re a resident of Jersey. Considering the current income tax rates, your annual income should be no less than £725,000 (just over $1 million).

Furthermore, there are the other standard ‘garden variety’ requirements to obtain residence in Jersey. You must be 18 years or older, prove that you have the entire sum of money for the investment in your disposition, and demonstrate that you have enough money to support yourself and your family without drawing on public funds to apply.

Yet, even if you meet all of the aforementioned criteria, no one is guaranteed that they will receive residence in Jersey.

Each application is at the discretion of the government officials and a lot of it is based on subjective criteria such as voluntary work, media coverage of your business or social life, your awards and achievements, cultural interests or skills, and your criminal record (or the lack thereof).

The Step-by-Step Application Process

Only a certain (but undisclosed) number of applicants can obtain Jersey residency each year, so if you’re interested, it’s best not to delay.

The application normally gets processed within two weeks and it costs £5,000 for one person to apply. In other words, if you have a spouse and/or dependents, they will each need to pay £5,000.

But here is the interesting bit: Jersey’s application process is quite different from that of other residence by investment programs. The government officials carry out extensive background checks to make sure that the individual is the right fit for Jersey and vice versa.

Applicants must also submit extensive file portfolios documenting their entire life as well as financial standing, police background checks, and not less than four character references.

Talk about a holistic and qualitative approach.

It’s exactly because of the extensive prep work that very few applicants actually get rejected. Basically, it’s because so few people actually put the entire stack of paperwork together to apply in the first place.

So, what does one do if he wishes to live in Jersey? Here is our step-by-step guide.

Step 1: Apply for Residence in Jersey

If you’d like to apply for the High-Value Residency, these are the documents that you’ll need to gather up and send to the government officials in Jersey:

- A letter of application, written by you personally

- Your business profile, with all supporting documentation

- Your financial profile, with all supporting documentation

- Two personal references

- Two business references

- A copy of your passport

- Your marriage certificate if purchasing the property jointly with a spouse

- A Disclosure Certificate from the relevant Disclosure & Barring Service authority

- A disclosure of your worldwide income to the Jersey government

If you’re approved, you will be issued a Jersey resident card and will be allowed to enter the country.

Step 2: Move to Jersey and Buy Real Estate

Usually within two to four weeks, your investor visa will be approved and you’ll be able to relocate to the island (with your family, if applicable).

The next step will be to actually make a real estate purchase. You are allowed to rent if you wish, but someone with the intention to rent very rarely gets approved to become a resident of Jersey.

So, £1,750,000 is the sum to remember here. Make an investment of at least this size and you’ll be fine to continue with your residency in Jersey.

You’ll also attend an interview with the government officials in which they will ask you where your income comes from and how you can support your tax commitment that you’ve made.

After three years, you’ll be able to renew your residence permit for another two, granted that you have kept the real estate in your possession and continue paying tax every year.

You also may not rent the real estate if you wish to keep your residence status.

Step 3: Get Your Permanent Residence

To be eligible to apply for permanent residence in Jersey, you will have to be a full tax resident on the island. That means paying at least £145,000 in personal taxes every year.

Plus, you’ll need to spend more time in Jersey than anywhere else in the world every year leading up to your permanent residence – at least five years prior to applying.

Also known as the Indefinite Leave to Remain (ILR), your permanent residence status will mean that you don’t need to spend as much time in Jersey anymore if you so choose.

Unlike for the initial residence in Jersey, you will need to demonstrate that you have a sufficient level of the English language and that you have knowledge about life in the UK and Jersey.

You also cannot have any breach of immigration laws to be eligible for permanent residence.

Step 4: Obtain a Jersey Citizenship

After spending 6 years as a resident in Jersey, you’ll become eligible to apply for UK citizenship. In other words, you must maintain your permanent residence status for at least 12 months before applying for citizenship.

You don’t have to claim citizenship if you don’t want to.

However, a Jersey passport can be equated to the UK passport, which allows visa-free travel to over 173 countries in the world.

And that can be a great thing in terms of your passport portfolio, the freedoms of living and doing business that you’ll be afforded with a UK passport, and many other benefits too.

During the year preceding your citizenship application, you can’t be away from Jersey for more than 90 days. And in the five years preceding that, you cannot spend longer than 450 days away from Jersey or the UK to be eligible to apply.

And here’s the good news – once you receive your passport, you won’t have to renounce any other citizenship that you may have on behalf of Jersey. That’s because it has no restrictions on dual citizenship, just like in the United Kingdom.

However, you should always keep in mind that the country of your first citizenship may not support dual citizenship.

Purchasing Real Estate in Jersey

Let’s talk more about what buying real estate in Jersey entails since it’s quite a different and involved process than in other parts of the world.

If you apply and successfully get residence in Jersey, you’ll be expected to relocate there and buy real estate within 90 days.

The minimum value is £1.75 million and although you’d think you would get quite a mansion for that money, the reality is a bit simpler – real estate prices in Jersey are quite high due to lack of supply, but high demand.

But here is the fun bit: ever wanted to go to court in full suit and tie to buy a house? In Jersey, you can.

One truly notable thing about buying property in Jersey is that all property transactions are carried out in public before the Royal Court.

A local lawyer must present the real estate contract to the court. You can give said lawyer power of attorney to represent you in court, so you wouldn’t have to attend.

If that sounds serious, it’s because it is and it takes a while too (but shorter than in the UK).

The proces,s from the acceptance of an offer to the completion of a sale can take up to six weeks, due to the various surveys, searches, and site visits of the property that are usually carried out.

You, as the purchaser, will be liable to pay stamp duty on your property. How much exactly you will pay will depend on the free market value of your house. The maximum rate is 9.5% and must be paid fully before the title gets transferred to you.

The Tax Implications of Jersey Residency

Every international move that you make, especially obtaining residence somewhere, has tax repercussions.

So, before you take such an important step and move to Jersey, you should consider how it’s going to affect your finances.

The good news is that Jersey is quite a favorable environment in terms of tax, especially if you’re a high-net-worth individual. It’s not a no-tax country, but certainly a low-tax one.

As soon as someone becomes a Jersey resident via investment, his worldwide income will be taxed at 20% on the first £725,000 that he makes. Any additional income will be taxed at 1%.

If you’re a high or an ultra-high earner, these tax rates could make all the sense.

So, you’ll be paying tax on your income, as well as goods and services (5% tax rate), but no capital gains (most industries), wealth, inheritance, sales, gift, or estate taxes.

In fact, the government hasn’t raised the income tax of 20% for over 60 years now. That’s because it regularly generates a budget surplus through ‘selling’ its tax advantages to foreigners, as well as other economic activities, albeit to a lesser degree.

It’s clear that Jersey is committed to maintaining its appeal as a jurisdiction where one can optimize his tax rate for many decades to come.

And that’s pretty great if you ask us.

You can further limit your exposure to Jersey’s income tax by setting up trusts located outside of Jersey, although these have to be approved by the Jersey government.

However, you should always keep in mind the minimum amount of tax that you must contribute to Jersey’s economy annually, or you risk losing your residence status.

Jersey Residency by Investment Alternatives

Because Jersey only offers a residence by investment program and no other means of legally living on the island, if the conditions don’t fit you, the only alternative would be to go for a residence in another country.

If it’s Jersey’s price tag that’s too high for you, why don’t you try the Greek Golden Visa? For a bargain price of €250,000, you’d be able to invest in Greek real estate and travel all over the EU visa-free.

Or perhaps it’s the remoteness of Jersey that’s throwing you off? The UK Tier-1 investor visa is a great option if you wish to live in London.

The European residence options are highly varied, so it would be best to get in touch with a trusted financial advisor and see what your investment immigration goals are to get a bespoke plan put together.

The Pros and Cons of Jersey Residency

Just like any other jurisdiction that hands out residence by investment permits, Jersey has its pros and cons.

The Pros of Jersey Residency by Investment

Travel freely in the Common Travel Area. Jersey residents are able to travel within the UK, Ireland, the Island of Man, and the Channel Islands. Plenty of opportunities for hops to London, Dublin, or Edinburgh for the weekend. Plus, the EU is accessible visa-free too.

It’s not an official part of the UK or EU. Why is this a pro? Well, although you have some of the benefits of being a UK resident when you’re living in Jersey, there are no negative implications on your tax status from the UK or the EU. This is great news if you’re looking to live in a place that doesn’t have a tight grip on you in terms of regulation and tax.

Pathway to a British passport. If you’d like to obtain a Jersey passport after six years of residence on the island, it will be as if you have a British passport due to Jersey’s unique relationship with the UK. You will also get access to over 170 countries visa-free, making it one powerful passport.

Top-quality education. Public services on the island of Jersey are truly exceptional, not to mention that Jersey residents and their family members have access to higher education in the UK. The education system in Jersey follows the UK’s national curriculum.

Your entire family can come along. Your spouse and children under the age of 18 can accompany you and become residents of Jersey under the same investment sum.

The residence application is processed fast. Jersey has to be one of the speediest jurisdictions when it comes to processing and approving its residence by investment applications.

High standard of living. Jersey is a place where not just public services, but the quality of life is exceptional. You could be golfing, surfing, or visiting London for a few nights whenever you wish. Imagine doing that after a day of work! The flight is just an hour long.

Global financial center. Jersey is well-known for its stable, private, and excellent financial industry. This is important for investors who might want to establish and run trusts, funds, or simply want the reassurance that the economy of the place where they live is rock-solid.

Doing business in Jersey is easy. Jersey is not only an international financial center but is also home to thousands of companies set up by foreigners. The island’s location, with easy access to the UK and Europe, makes it attractive for entrepreneurs. Plus, the communication services of the island, from the fast internet to the highly efficient courier services, are of high quality too.

The Cons of Jersey Residency by Investment

No access to the Schengen area. Since it’s not part of the EU, Jersey residents and citizens don’t have access to the Schengen zone of free movement. If this is an important thing for you, you better look for another residence by investment program. However, you can still travel to all of the EU countries for up to 90 days visa-free.

A relatively high investment sum. Nearly 2 million British pounds is no small sum to invest just to live on a tiny island. Sure, it’s a financial center and has a really favorable tax regime, but some might think that ‘just a residence’ isn’t worth such a lofty sum of money. You could Malta’s citizenship by investment (in the EU) for much less time and money.

No investment options. Since Jersey truly wants its wealthy investors to reside on the island, the only investment option is real estate that you will later (most likely) live in yourself. There are no other investment options such as stocks or bonds.

Island fever. Jersey is an appealing island full of luxurious restaurants and villas, but it’s so tiny that, inevitably, ‘island fever’ is going to set in at some point. Everyone knows everyone in Jersey and that might not be a desirable aspect of life to many high-net-worth individuals.

Physical residence requirement. Jersey residents are expected to spend at least half the year physically residing on the island, which can be a drag to many Nomad Capitalists searching for absolute freedom in terms of lifestyle.

English langue for permanent residence. Although there is no English requirement to obtain Jersey residence, if you’d like to become a permanent resident or citizen, you’ll need to pass an English exam.

Jersey Residency by Investment – FAQs

Although this article about residence by investment in Jersey is extensive, there are still bound to be questions that you might have.

Or, perhaps you want a quick reference guide to the main facts about the program? Here it is.

Where is Jersey located?

Jersey is an island – the largest of the Channel Islands – and is located just off the coast of Normandy, France. It is located 170km south of the United Kingdom and has maintained its connections with the British Crown for many centuries.

Is Jersey part of the United Kingdom and/or the European Union?

No, Jersey is neither within the UK nor the EU. It has a special self-governed status with long-established ties with both organizations, but no oversight from them. This means that you don’t have to worry about the EU passing down legislation to Jersey in relation to its favorable taxation system, such as has happened with the Malta and Cyprus CBI programs.

Who is the Jersey residency the best for?

People who genuinely want to take up residence and live in Jersey are the best applicants for its residence by investment. Because the ties have to be genuine and you will need to spend more than half of your year in Jersey, it would be best if you like the place. Jersey is also great for those who want quick access to the UK and the entire EU, but don’t want the legislation that comes with residing in either of them.

What’s the income tax rate in Jersey?

As an investor resident, you will be taxed a flat 20% rate on your first £725,000 of worldwide income. Any further income is taxed at a token 1%. It’s interesting to note that Jersey doesn’t have any capital gains, wealth, inheritance, or property taxes.

Which businesses must pay capital gains tax in Jersey?

Although most businesses won’t be charged capital gains tax in Jersey, some industries are subject to a 10% rate. These are companies within the financial services sector and utility businesses.

What’s Jersey’s residence by investment program?

Also called the Jersey golden visa and officially known as the High Value Residency of Jersey, this is a residence by investment program in the independent jurisdiction of Jersey. It’s been running for decades and has attracted many high-net-worth individuals to apply, citing its quality of life, favorable tax environment, and the UK passport that one’s eventually able to collect.

What’s the application process like for Jersey’s residence by investment?

You must submit the application and all of the supporting documents via the post from within your country of residence. The applications usually get approved within 2-4 weeks, but it can take up to 6 weeks in certain instances.

How can I get an extension on my Jersey residency?

Provided that you’ve kept your real estate investment and that you’ve spent more time in Jersey than not, your residence permit will get renewed easily. After 5 years of residing in Jersey, one can get the Indefinite Leave to Remain permit, which equates to permanent residence. English and Jersey history and lifestyle knowledge is required.

How can I apply for a Jersey passport?

Once you’ve been a resident of Jersey for at least 6 years, you’ll be able to apply for a Jersey passport. This equates to a British passport, and you’ll be able to reap all of its benefits fully.

Can I bring my family to Jersey with me under the same investment sum?

If you apply for residency by investment in Jersey, you will be able to bring your closest family members with you to the island, including your spouse and children.

Who is eligible to become a resident of Jersey?

High-value residents are those who are (1) able to contribute at least £145,000 per year in taxes, (2) able to purchase real estate worth at least £1.75 million, and (3) be of excellent financial and social standing that will benefit the island of Jersey in some way.

Who is most likely to be approved for Jersey residency?

Since Jersey residency by investment is quite desirable and the number of approved applications per year is limited, there are some factors that could make your success more likely. Highlight if you’ve done voluntary work, made contributions to charities, gotten official recognition or awards for your professional activities, sports, or other activities, gotten media coverage for any of them too, or have cultural interests or skills that could benefit Jersey.

Is Jersey a tax haven?

While some people consider Jersey to be a tax haven, in reality, it’s a low tax jurisdiction. When it comes to resident investors, they must pay at least 20% of tax on their worldwide income up to £725,000 per year. And while that doesn’t seem particularly low, all of your further income will be taxed at 1% – great news.

What are the corporate tax rates like in Jersey?

Company taxes are either 0% or 10%, depending on the industry. For example, the regulated financial industry and companies within it pay 10% in capital gains tax.

Conclusion

Jersey doesn’t necessarily have the sex appeal that places like Monaco or Malta have. Actually, not many people know of Jersey at all.

And that’s exactly why it should be on the table when you consider your long-term financial plans and your international investment strategies.

Increasing numbers of high-net-worth individuals choose Jersey as a place to live and invest in, simply because Jersey’s reputation, privacy, and integrity are exactly what they are after.

With strong self-regulation, Jersey has successfully avoided external influences when it comes to its financial sector.

Whereas Malta or Cyprus must toe the line that the EU sets about their residence and citizenship by investment programs, Jersey is free to do as it pleases. This has major tax benefits to investors.

Plus, the quality of life that Jersey affords its residents is one of the best. From its chic restaurants and golf courses to visa-free travel to the UK and Ireland and lots of other benefits in between, Jersey is a truly unique proposition.

Want to hear more about Jersey and what it’d be like to live in what some call the best of both – the French and the British – worlds?

We can help you gain residence by investment in Jersey, from applying to purchasing real estate. Let’s talk about how the Nomad Capitalist team can help you go where you’re treated best.

How to Get UAE Citizenship – The Complete Guide

Sovereignty – both national and personal – shapes ambition, secures wealth, and defines status in a shifting global order. For the high-achieving global citizen, acquiring a second or even third passport is more than a lifestyle upgrade; it’s a strategic move in long-term financial and geopolitical positioning. But not all citizenships are created equal – […]

Read more

A Gateway to Central Asia: New Kazakhstan Golden Visa Program for 2025

Central Asia just raised the stakes in the golden visa game. In May 2025, Kazakhstan officially launched a 10-year Golden Visa program in an ambitious move to position the country as a serious contender in the global investor migration space. At a time when other international regions are rolling back their citizenship and residency options, […]

Read more

Top Countries Offering Golden Visas in 2025

Residency is no longer about lifestyle – it’s about leverage In an increasingly unpredictable world, Golden Visas offer something most governments can’t: certainty in exchange for capital. They are more than migration tools; they are strategic safeguards offering residence rights, future citizenship, global mobility, and access to tax-friendly jurisdictions. For investors, entrepreneurs and globally minded […]

Read more