Everything You Need to Know about Singapore Savings Bonds

October 17, 2022

Dateline: Singapore

In today’s low-yield environment, investors must constantly decide between “safe haven” assets with practically zero yield, or “riskier” assets that offer a few percent.

Here at Nomad Capitalist, we believe that both can be part of a balanced, global portfolio.

While we’ve discussed simple bank deposits in countries like Georgia and Armenia that can yield up to 10%, today I want to talk about one of the least risky and surprisingly flexible assets on the planet: Singapore Savings Bonds.

Every time I fly to Singapore from my home in Kuala Lumpur, I am reminded just how conservative this place is. While many western financial pundits have complacently come to expect never-ending 12% returns during the last decade’s bull market, Singaporeans are more reserved when it comes to investing.

People here invest more conservatively, yet end up wealthier. Nearly one in five people here is a millionaire, and that’s not just high net worth expats like Jim Rogers.

Before you declare that bonds are dead, understand that Singapore Savings Bonds – also called SSBs – are a bit different than usual bonds. If you live in the West, they also offer well-advised geographic and currency diversification. I’ve recently made SSBs a small addition to my own diversified portfolio.

In this article, we’ll discuss what Singapore Savings Bonds are and what role they could play in your portfolio from the perspective of a global citizen. While investing in Singapore would undoubtedly make sense for Singaporeans, this article will largely focus on the opportunity for banking and investing in Singapore as a foreigner.

What are Singapore Savings Bonds?

Introduced in 2015, Singapore Savings Bonds are a type of Singapore Government Securities that offer ease of opening, lower minimum deposits, and greater flexibility. The government describes them as “specially structured government securities… designed to be accessible and suitable for individual investors.”

In other words, these bonds were created for the small investor, not institutional investors.

Bonds are an investment vehicle in which you lend money to whoever issued the bond. While there are plenty of Singapore corporate bonds, the fact that these are government securities means they’re sold and backed by the Singapore government.

Unlike other types of government bonds, they can only be purchased directly from the issuer – the Singaporean government – and can be sold back in any month before maturity for the same full face value, plus interest.

As they say, “you can always get your investment amount back in full with no capital loss”.

Benefits of Singapore Savings Bonds

I’m sure you’re curious how much you can earn by investing in these government bonds.

The answer? Not a lot, but more than you’ll earn in most western banks.

And unlike most banks, which could fail, SSBs are backed by the Singaporean government which has zero net debt.

That’s right: while Singapore does borrow money (which should be obvious seeing that they’re selling you a bond), their other assets make up for what debt they have.

Unlike the United States and other western countries that rack up trillions in debt like it’s going out of style, this is one of the most stable and reliable governments on earth.

For that reason, investing in Singapore is a great option for anyone seeking asset protection, currency diversification, and internationalization.

1. Interest Rates

So, let’s talk about interest rates; these change monthly, and you can find the most up-to-date rates on the Monetary Authority of Singapore’s website.

When looking at SSBs, you’ll see two interest rates: the ten-year average rate when held to maturity, and the first-year rate. That’s because while SSBs can be sold at any time, the government incentivizes you to hold them to maturity. The longer you save, the higher your return.

The graph below shows the rates for March 2020.

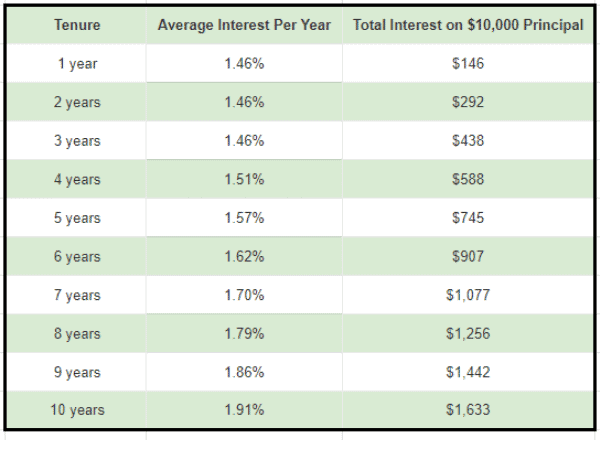

If you were to make a $10,000 investment today, this is how those rates would play out and the amount of interest you would earn over the next ten years:

As you can see, you’ll earn less interest in the first few years, but rates gradually rise until the end to deliver the headline 1.63% rate. The headline rate is merely the average of all ten years’ yields, meaning you’ll get closer to that rate the longer you hold your bonds.

Withdraw your money after year four, for example, and your average yield will be 1.4725%. There’s no lock-in period and you can liquidate any time without penalty by simply selling your bonds back to the government at face value.

These rates aren’t as low as when SSBs were first introduced, but they are certainly lower than the rates from more recent years, which occasionally neared 3%.

That said, interest rates everywhere – including bank term deposits – have collapsed as of late, and SSBs offer more liquidity than a fixed deposit at any Singaporean bank.

Plus, the Government will pay you interest every six months.

Currency Risk

If you’re investing from overseas, you also have to consider the currency risk and reward. The Singapore dollar is an excellent safe-haven currency, but it does have subtle ups and downs like any currency.

Over the last five years, it’s essentially at par with the dollar which makes sense seeing that “the Sing” as it’s called is essentially pegged to a basket of currencies that include the US dollar. In euro terms, the Sing has strengthened over the last decade but slightly declined over the last five years.

While there is currency risk for foreigners, I do think Singapore is a great safe haven for storing cash, and as you’ll see shortly, the Singapore bank account you’ll need to buy SSBs is also a good diversification tool. The Sing dollar is a strong currency, not some backwater country’s funny money.

Who Can Buy Singapore Savings Bonds?

SSBs are one of the more common options for risk-averse Singaporeans to invest their money as rates roughly keep pace with inflation and exceed most banks’ term deposit rates. But as promised, anyone can buy them.

Anyone 18 years or older who has S$500 to invest can apply, whether they’re a Singaporean citizen, Singapore PR, or foreigner.

You’ll need two separate accounts: first, a bank account with one of Singapore’s “Big Three” local banks DBS, OCBC, or UOB; and second, a Singapore CDP account which you can open online with your passport.

Banking in Singapore

The biggest challenge for foreign investors will be opening a bank account. Since accounts at Citibank or HSBC don’t qualify (not that you’d ever want to bank with HSBC anyway), you’re stuck with one of the Big Three. These banks are some of the strongest, most highly-rated banks on earth, but they don’t open accounts for just anyone.

Opening a Singapore bank account with OCBC, DBS, or UOB requires that you actually visit Singapore. As a highly regarded and desirable banking jurisdiction, there is no remote bank account opening available.

While non-residents could once easily open accounts at OCBC with pocket change, those days are over. These days, expect to deposit at least S$50,000 – about US$36,000 – to open an account. Even at those levels, your banker may expect you to have some sort of deeper connection to the island.

Priority banking like DBS Treasures is the most secure option; this gives you access to fixed deposits, Singaporean and pan-Asian mutual funds, and even life insurance, and starts at S$200,000.

How to Buy Singapore Savings Bonds

Once you have your Singapore bank account and CDP account, you’re ready to buy bonds. The minimum investment is S$500, and the maximum you may hold across all SSBs at any time is S$200,000.

The Singapore government releases new bond issues at the start of every month. There is usually a three-week period during which you must apply for the number of bonds you wish to purchase.

To place your bid, simply log on to your online banking account or, if you live in Singapore, use one of the smart ATMs to place your order. There is a S$2 transaction fee per application.

In theory, not all bond orders are filled. While your account will be debited at the time you apply for the SSBs, you’ll need to wait until the end of the application period to be sure you made it in. If there is greater interest than the amount offered, not everyone’s order will be filled, or will only be partially filled.

Bonds are officially issued on the first of the month and interest payments take place every six months thereafter.

How to Redeem Singapore Savings Bonds

With Singapore Savings Bonds, you have two options: hold your bonds to the ten-year maturity or sell them at any other time. Bonds are sold back to the government and not on any secondary market; it is actually not possible to transfer bonds to anyone else.

When you want to redeem, simply login to your online banking or the CDP website and initiate a redemption. You’ll pay another S$2 transaction fee for each order, and you’ll get your investment returned to your Singapore bank account after a “one month notice” period.

There are three possible scenarios for getting your investment back:

1. If you’re redeeming your bonds in one of the two months per year where an interest payment is made, you will receive the initial principal plus a full semi-annual interest payment.

2. If you’re redeeming bonds in a month with no scheduled interest payment, you’ll receive your principal plus pro-rated interest.

3. If you wait until maturity, the S$2 transaction fee will be waived and you’ll automatically receive your principal along with the final semi-annual interest payment in your bank account.

Remember, you can never have more than S$200,000 invested in Singapore Savings Bonds at one time, so plan accordingly.

Pros and Cons of Singapore Savings Bonds

Like any investment, there are advantages and disadvantages to holding Singapore government debt. Your own personal situation and objectives will influence these greatly.

For example, I personally like holding Sing dollars in my portfolio and I am willing to accept the requisite low yield to do so. Since I have enough liquidity in Singaporean banks and elsewhere in the world, owning bonds as a very small part of my portfolio adds another layer of diversification.

Here are the pros of Singapore Savings Bonds:

- You can invest as little as S$500, meaning anyone can invest.

- You get regular interest payments every six months, which provides more regular income than bank deposits which induce you to take interest less frequently.

- You’re not locked into any time period; it’s up to you to determine how long you want to invest, and you can redeem your investment at any time without penalty. What happens with interest rates going forward won’t affect you.

- With a mere one-month notice period, you have high liquidity. SSBs are arguably more liquid than long-term fixed deposits as you won’t suffer a penalty interest rate for redeeming early.

- The Singapore government is among the most reliable on earth and has a AAA credit rating, meaning the chance of default is near zero.

- Your investment is denominated in Singapore dollars, a safe haven currency worth adding to your portfolio as a hedge against your base currency.

- Interest rates, while low, are higher than all but teaser rates at local banks.

Here are the cons of Singapore Savings Bonds:

- Interest rates, while higher than what you’d find in a bank fixed deposit, are not exactly high. You can earn more with a REIT or unit trust (similar to a mutual fund).

- You can only invest S$200,000 at one time, meaning large investors will need to seek other Singapore Government Securities that rely on a secondary market with less flexibility.

- You could suffer a currency loss if the Singapore dollar declines against your base currency

As you might expect, SSBs are an extremely conservative, low-risk/low-reward investment. While many investment experts including Doug Casey have called bonds dead in the water, the unique characteristics of Singapore’s government bonds make them worth considering as part of a balanced international portfolio.

Is Land Investment Safer?

When American humorist and writer Mark Twain said, ’Buy land, they’re not making it anymore,’ he was definitely on to something. Land is finite, and that scarcity gives it lasting appeal. Yet, despite its obvious logic, land remains one of the most misunderstood investments. Many people are put off by its perceived complexity, potential legal […]

Read more

Top Emerging Market Economies for US Investors in 2025

If you’re still parking all your capital in overvalued US real estate or clinging to tech stocks in the S&P 500, you’re playing an old game while rivals are redesigning the board. The world has move on. Smart investors know that the biggest returns aren’t coming from Wall Street anymore – they’re coming from below-the-radar […]

Read more

Monaco Real Estate Guide: Market Trends and Opportunities

When it comes to luxury real estate, nowhere does things quite like Monaco. This tiny but ultra-exclusive principality isn’t just a place to live – it’s a global symbol of wealth, prestige and financial freedom. In 2025, Monaco remains the world’s most expensive real estate market, with average property prices soaring beyond €51,000 per square metre […]

Read more