What Is The Best Country For Real Estate Investing?

October 24, 2022

Dateline: Tbilisi, Georgia

It seems that everyone wants to know which country is “the best” for real estate investing these days. While I get this question on a regular basis, the answer isn’t as simple as it seems.

As I look around my beloved Georgia where I’m currently involved in numerous real estate ventures, I wouldn’t exactly say that it’s “the best.”

In fact, I wouldn’t tell you that ANY country is “the best.”

To do so would not only be untrue but a disservice to you.

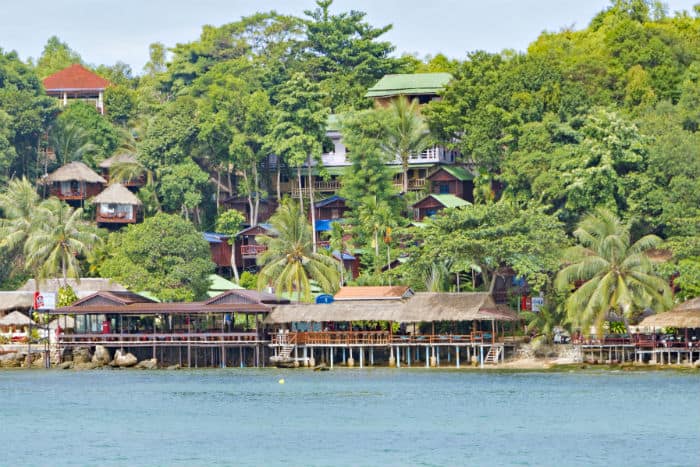

I have real estate properties in locations around the world from the United States to Georgia to Cambodia to Montenegro and beyond, but I wouldn’t say that any one of these countries is definitively better than the other.

Just because these countries were good choices for me, doesn’t mean that they’ll be good choices for you.

Through years of personal experience in emerging, frontier and developing markets worldwide, and with extensive legwork and millions of my own money spent on travel, research, professional help and insight into foreign markets, I’ve developed a formula that best fits my needs and personal requirements for real estate investing.

But in everything I do, I am always aiming to help my readers at Nomad Capitalist as well. So, today, I’m here to answer the question: “What is the best country for real estate?”

My answer may not be what you expect. I won’t be naming countries because there is no universal answer. Instead, I want to answer your question with another question – seven of them to be specific.

There are seven essential questions that you should be asking yourself about your personal preferences and situation in regards to real estate investing. If you can answer them honestly, you’ll know the answer to a much more important question: What is the best country for real estate investing for me?

I realize that some casual web surfers don’t like the idea of being asked these questions. We’re used to getting the answers now. “Just tell me the best offshore bank!” or “Why so many questions?!” are not unheard of complaints. However, you wouldn’t go to the doctor, tell him your head hurt, and demand a prescription on the spot. In medicine as in foreign real estate investing, diagnosis should come before prescription.

My success in numerous property markets around the world has depended on this formula. Here are the questions that you should consider:

1. Who Are You and What Do You Want?

This question isn’t meant to be asked in the existential sense, but rather in a way that explains what you’re trying to do. What are you looking to achieve by investing in real estate in a foreign country?

Hardcore investors, new investors, Chinese criminals with hot money; they are all different kinds of people with different real estate needs.

Real estate offers more than just a way to make money or hide illegal cash, but not every country will give you what you want, so examining your needs will help you narrow down your list of options.

Maybe you’re trying to keep a chunk of money safe through offshore investing. Perhaps you’re trying to find a foreign real estate market that will earn you big profits.

Or maybe you just want to be prepared in case of an emergency in your country. You may not be under any pressure or facing any emergencies at the moment, but you still want to get your money out of the bank or out of the country.

For instance, when the Indian government made it illegal to remove gold and cash from the country, many Indian citizens decided to melt down their gold down, turn it into jewelry, and wear it out of the country. They lost a percentage of their value but they figured it was better than losing everything. They knew they needed to invest their gold outside of their country to keep it safe.

Real estate is a great way to have a backup outside the country should things change at home.

All of these are fine reasons to invest in foreign real estate and can begin to guide you in the direction of one country or another. So, before you even start looking for the best country for your real estate investments, figure out who you are as an investor and what you want to achieve with your investments.

2. Where Do You Want To Be?

The most important thing to think about when asking, “What is the best country for real estate for me?” is figuring out where you want to be. What is at stake for you?

I had a guy call me and say that he had $250,000 to invest and is adding to it every month. It’s sitting in the bank making 3% while he wants it to make 10-15%.

Plenty of people have done this, including me.

It’s important to ask yourself how much you are losing every year by not getting where you want to be.

For him, at $250,000, the difference of 12% is $30,000 a year. Every year. He’s adding money to that too, so that’s a 12% difference of any money that he puts in.

Over ten years, he would lose $300,000! You would be losing that difference every year. It’s costing you a lot of money so it’s worth getting some help from someone who asks the right questions, rather than merely selling you the same thing they sell everyone else.

3. Yield or Appreciation?

Those looking for real estate investments in foreign countries should decide what is more important to them: yield or appreciation.

You may be a traditional investor who is looking for a property that will appreciate. Or, if you are looking for cash flow, it might not matter to you whether or not the value of your property will go up in value.

For example, there are cities in the Rust Belt of the US, where you can earn 20%, 30%, and even 40% yield. In fact, I recently took $50,000 of my money and invested it in property there because it’s earning 41% gross yield and 29% net yield.

I know a lot about this Midwestern area of the US as it’s where I’m from. Since I wanted some good cash flow at a good tax rate, I chose to invest there.

While I doubt the property will go up significantly in value, it’s nice to be able to put in $50,000 and get a convenient little check from the property in return each month.

However, I also have properties in Montenegro, Cambodia, Malaysia, and Georgia that I believe will go up in value. Some have already gone up. In one case, I already got an offer for 20% over what I paid for the property.

While you can have both yield and appreciation, be clear with yourself on what you want. I recently read the book The One Thing, which talks about being focused on one thing at a time in order to receive the most benefits and results. Focus on one thing when it comes to yield and appreciation and you will make out better in the long run.

When I bought real estate in the Rust Belt, I wasn’t focusing on appreciation, although I did try to buy under market so I got some instant equity.

On the other hand, the property I bought in Georgia is right in the center of the city but it’s a total dump. Since it’s on the city’s renovation list, I figured it would be a good move to wait it out. Once the city renovates it, based on historical trends in the market, it should be worth four times what I paid for it.

In this case, I actually got rid of the tenants instead of collecting rent because it would be too much of a hassle. I would rather let it sit like money in the bank and appreciate.

Think about your end financial goal and base your buying location off of that.

4. What Are Your Concerns?

Investing your money is bound to cause some concerns. Before deciding what country to buy real estate in, you need to be honest with yourself about the worries you have.

Are you concerned that the US real estate market is a bubble? How about the Chinese real estate market? Could that be a bubble too?

Perhaps you are concerned about frontier markets and the rule of law. And, what happens if a dictator goes crazy and disrupts your investment?

Cambodia is a frontier market and I am happy to be invested in it. I believe that it’s a phenomenal opportunity. However, my father, who grew up while bombs were being dropped on Cambodia, does not feel the same.

A solid investor himself, he just isn’t sure about investing in Cambodian real estate.

By figuring out your concerns, you can eliminate the things that you don’t want, giving you a great starting point. If you don’t want frontier markets, cross Cambodia off the list. If emerging markets make you nervous, cross off Georgia. It’s that simple. Better to eliminate than deal with the stress of a decision you will second guess.

If you are looking for a ton of appreciation and your risk tolerance is higher, developing markets may be a good route towards making a profit.

Similar to when you’re hiring people, if you get one hundred resumes, you should first figure out which ones to toss in the trash to make the process easier.

5. What’s Your Learning Curve?

How much do you know about real estate and how much do you want to be involved in your property?

While Georgia is a beautiful place where you can get appreciation AND cash flow, there aren’t many property managers in the country.

I’ve had success in Georgia from all corners, but I made sure to educate myself in the market before jumping in and I have since spent a lot of time involved in my investments.

Sure, you can buy new expat properties and have an expat agent rent it out for you for $1,000 a month. Your appreciation and cash flow numbers may go down a little, but it can be done.

However, anything under six figures won’t have a property manager in Georgia. Knowing this, I am constantly getting involved.

I’m always meeting with lawyers and new people to find out how I can invest in these kinds of markets and make it easier for myself. I’m willing to fly to these destinations, take people out to dinner to talk things over, and do a whole lot of work.

What I’ve found is that investing in Georgia, like most countries, is not the same as investing in the US. If you want to buy real estate at a US level and quality, you better go to a developed country that is similar to the US.

One of the reasons you can earn 22% in these countries compared to developed real estate markets is because you have to do more work.

But, I’m not the only one who has found success in these markets. My friend Reid Kirchenabauer has done very well in the emerging markets that target boutique investors.

Not being aware of what’s going on in foreign markets is what leads to downfalls. Most of the turnkey investments that you see at offshore conferences are garbage and the people running them have admitted to fudging some numbers.

I know guys who have conferences and tell people 30% when, in reality, it’s 14%.

People believe it and don’t realize until later that these things aren’t worth what they thought they would be. There aren’t a lot of options to be too hands-off unless you know what you are doing. And, knowing what you’re doing involves getting someone to help you or going somewhere and figuring it out yourself.

6. How Much Money Do You Have?

This is a big one. You need to know how much money you’re working with to decide which country is best for you. If you don’t have millions, you may not want to invest in a New York City penthouse.

I once went to Cyprus for New Year’s Eve and met up with some European friends who were telling me about their friend who moved to Amsterdam. They said that he bought a flat for 11,000 euros a meter. This price is pretty standard as even small accommodations can cost $300,000 to $400,000 there.

For an investment that’s going to be your home, it’s no big deal. People pay that much in the low-cost real estate market of the US. Dallas, for example, is one of the cheapest big cities where you can buy real estate in the world and you can get a palace for not much more than that.

If you’re talking about investing, you might not want to put that much in. Instead of spending a million in Amsterdam, I would rather come to Cambodia or Georgia and help a guy build a small building and double his money in two years who can then kick me some profits.

I have people who call me with $50,000 to invest. With that amount, they can either be in dumpy markets of the US or looking at frontier markets like Georgia and Cambodia.

Even then, they need to be on their game or else they’ll buy some overpriced crap.

Case in point, when talking to Reid recently, I found out that he’s buying stuff for one fourth to one fifth the price of new constructions. It’s then being sold to the Chinese who are paying too much. If you want to be in the know, drive around town like a local would and figure it out yourself.

7. Do You Want Additional Flags and Passports?

One vital need you must assess is whether or not you want to utilize your real estate investments to get a second passport or plant other flags.

For example, countries like Turkey offer a second passport to foreign investors who invest $1 million in real estate there. If you are the kind of person who is looking for fast dual citizenship, Turkey may be the best country for you for real estate investing.

If, on the other hand, you are looking for a way to obtain a second residence within the European Union, the best country for you could be one of the many EU countries that offer “Golden Visas” to real estate investors.

Or, if you are looking to plant banking flags, buying property in countries like Malaysia gives you the right to open a bank account there. Without owning real estate in Kuala Lumpur or elsewhere, you’d have a hard time opening a bank account.

There are numerous different ways to use your real estate investments to give you a leg up in your efforts to build a passport portfolio and plant other important business and banking flags around the world. It serves to be strategic so that you can plant more flags at the same time you are diversifying your assets.

So, what’s the best country for real estate? Well, the answer is different for everyone. But for me, the answer is a small, welcoming country that doesn’t make things too hard. If you want help finding the right market for you, feel free to reach out.

Is Land Investment Safer?

When American humorist and writer Mark Twain said, ’Buy land, they’re not making it anymore,’ he was definitely on to something. Land is finite, and that scarcity gives it lasting appeal. Yet, despite its obvious logic, land remains one of the most misunderstood investments. Many people are put off by its perceived complexity, potential legal […]

Read more

Top Emerging Market Economies for US Investors in 2025

If you’re still parking all your capital in overvalued US real estate or clinging to tech stocks in the S&P 500, you’re playing an old game while rivals are redesigning the board. The world has move on. Smart investors know that the biggest returns aren’t coming from Wall Street anymore – they’re coming from below-the-radar […]

Read more

Capital Gains Tax on Real Estate in the United States

For most people, buying a home is the single largest financial commitment they’ll ever make – and often, one of the most stressful. Yet, for many US citizens, home ownership remains a cornerstone of the American Dream. Whether it’s about financial security, independence or building generational wealth, millions strive to get on the first rung […]

Read more