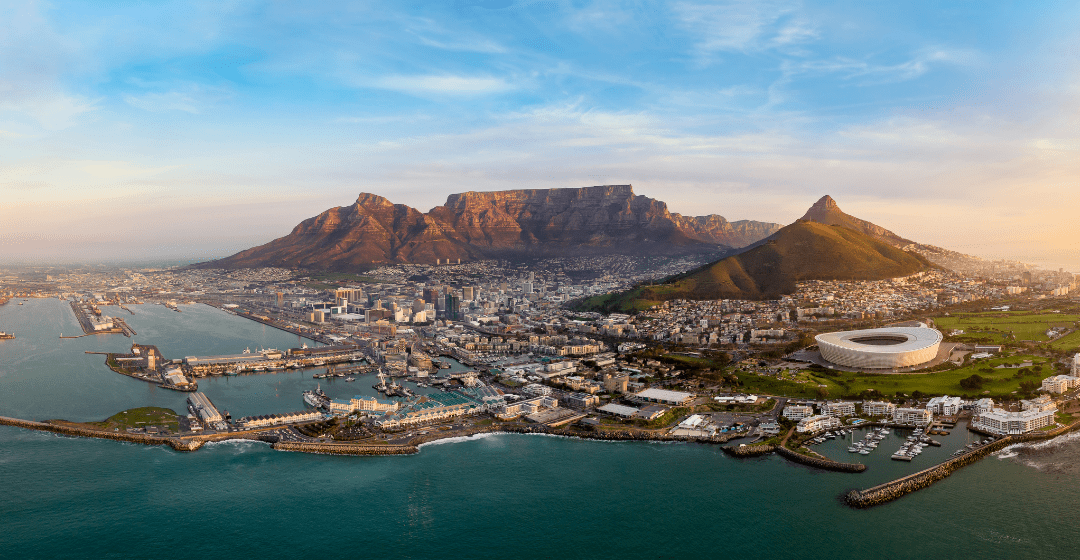

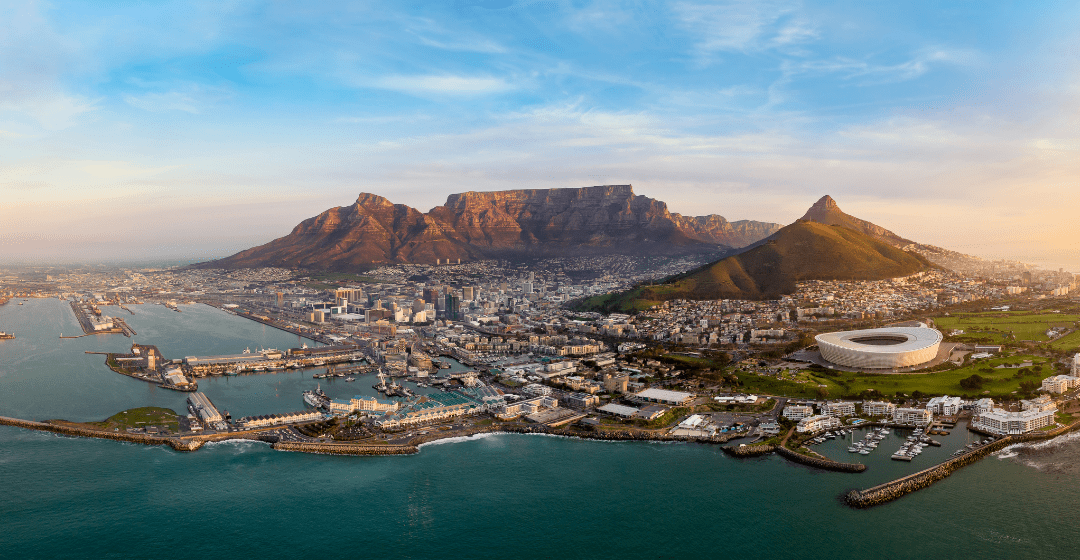

South Africa is a residence‐based tax system. If tax reduction is an objective, you can reduce your tax liability as a non‐resident. Our comprehensive South African tax guide...

Founder of Nomad Capitalist and the world’s most sought-after expert on global citizenship.

What we’re all about

Meet our 95+ global team

We’re here to serve you

Read our testimonials

Get free email updates

Create your own bespoke global citizenship plan

Claim a second passport based on familial connections

Click here to see all our products and services

Discover the world’s best passports to have in an ever-changing world

Explore the citizenship options using our interactive citizenship map

Explore the tax details for countries using our interactive tax map

Click here to see all of our research and interactive tools

Learn from a curated “Who’s Who” of business speakers from around the world, get our latest R&D updates, and rub shoulders with successful people from all corners of the world.

Andrew Henderson wrote the #1 best-selling book that redefines life as a diversified,

global citizen in the 21st century… and how you can join the movement.

South Africa is a residence‐based tax system. If tax reduction is an objective, you can reduce your tax liability as a non‐resident. Our comprehensive South African tax guide...

This article looks at taxes in Germany for non-residents. We will look at how to become tax non-resident in Germany and what the benefits are. We also look at some of the broader...

What do you get when you mix a tax haven with a tropical haven? The Bahamas. With 700 islands, award-winning beaches, and almost no taxes, the Bahamas offers a life that is a...

Like many financially successful people, you may have generational wealth to pass on to your kids. But the tragedy is that not only do you have to pay taxes during your lifetime,...

Dateline: Bogota, Colombia Tax reform in the United States is a dangerous business. Before the highly anticipated “Trump Tax Reform” was finalized in 2017, there was talk of...

You’ve probably heard the expression that ‘the only two things certain in life are death and taxes’. The Internal Revenue Service (IRS) works very hard to make the latter...

When it comes to taxes, US citizens get a raw deal. Not only do they have to pay tax on their worldwide income, but they have to pay it regardless of whether or not they...

This article explores how to take advantage of the provisions in tax treaties to reduce your taxes on foreign-earned income. Say you’re a six- or seven-figure US-based...

Renouncing US citizenship is a life-changing decision that comes with both significant responsibilities and potential rewards. For those considering this bold move,...

For most people who meet the love of their life overseas, taxes are probably the last thing on their minds. But Nomad Capitalists are not most people. You already know...

Subscribe to our Weekly Rundown and stay ahead with instant alerts on key global changes.