Are you interested in numismatics? Certainly, a fascinating field that encompasses history and economics, but is it a good investment or a viable asset protection option?

Here we will discuss what exactly these coins are, why you shouldn’t buy numismatics, and what better options are available.

At Nomad Capitalist, we’ve helped 1,500+ clients fill the gaps in their portfolios. Become a client today, and we will create a holistic strategy to take you offshore, helping you choose the right precious metal storage facility and jurisdiction.

What is Numismatics?

Numismatics refers to the study or collection of various forms of currency, which includes coins, tokens, paper money, medals, and related items.

People who specialize in this field, usually collectors, are known as numismatists. These coin-collecting enthusiasts examine the physical characteristics, production, and historical background of different types of currency, including collectible coins.

Numismatics is not the same as an academic historical and economic study of money. Rather it focuses on the physical characteristics of payment methods rather than their use and role in an economy.

Value of Numismatics

Instead of using these coins at face value, collectors remove them from circulation so that they can collect or invest in them. Numismatics no longer circulate in the markets and have ceased to serve as money in an economic sense.

For this reason, numismatic coins can be sold for much more than their actual worth or the value of the material or precious metal they are made of. For example, some 20th-century silver coins worth 25 cents can be traded for tens of thousands of dollars each. Each numismatic value is based on its rarity, demand, and quality. This is what attracts some to the field as an investment opportunity.

Why Avoid Numismatics

As you may have already deduced, numismatics coins can be incredibly valuable, so why do we advise not to buy numismatics?

It’s a hobby, not an investment

The very nature of numismatics makes it a collectors’ game, not an investors’ game.

Coin collectors spend years understanding the nuances of these rare and ancient coins and the various subcategories, including scripophily, notaphily, and exonumia. For example, notaphily, as the name suggests, is the study of paper money.

Professional numismatists, or coin graders, in the US study extensively and need to pass exams to receive a diploma from the American Numismatic Association. In other words, numismatics is not something you pick up overnight. So, while it’s a super interesting hobby for high net worth individuals looking to explore new ways to build wealth, there are far more advisable (and accessible) precious metal investment options.

Volatile Market

As with most markets, it’s all about supply and demand. The nature of numismatics can make it volatile with significant market fluctuations. If there is an increase in the demand for a specific coin or a series of coins, prices can skyrocket, but these prices may later plummet if the popularity weakens.

Numismatic coin prices vary greatly, and these old coins can be sold for up to four times the price of a standard ounce of gold. But if you don’t have a deep understanding of the field and know exactly what you’re buying, you could easily lose a lot of money.

Coin markets to avoid

If you are new to the precious metals world, a word of caution, marketplaces to be avoided include eBay and online retailers.

Investing in rare coins can be more complex compared to buying other assets. Be aware of the possibility of counterfeit or doctored coins that have been modified to conceal defects and misrepresent their condition and value.

Also, avoid online retailers and other companies that sell cheesy novelty gold coin rounds with the image of characters of Elon Musk or Joe Biden.

If you are not an expert, it’s best stay away from the numismatics markets.

What Precious Metals Should I Buy?

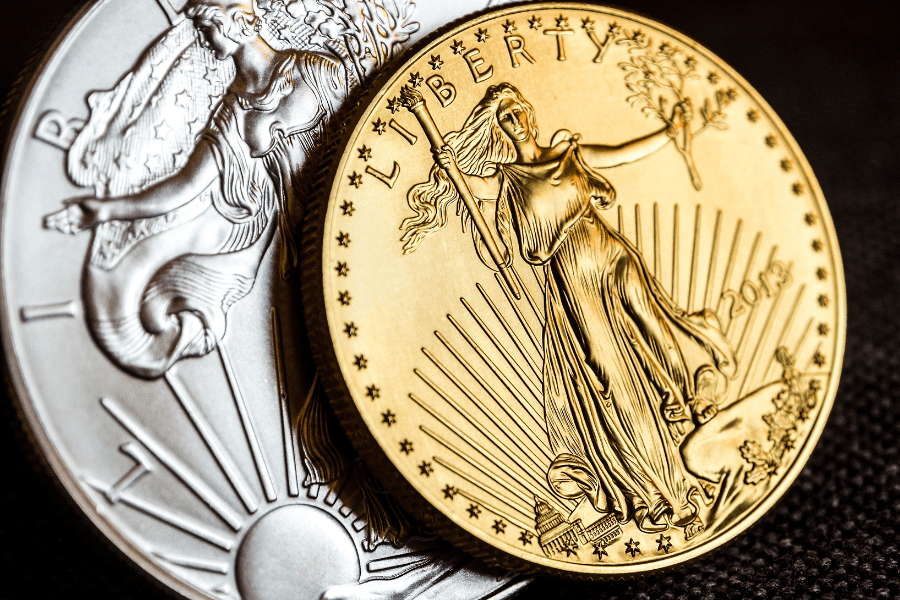

When included as part of a diverse portfolio, precious metals such as gold and silver act as a sort of insurance policy, offering safety and security.

According to precious metals expert Joshua Rotbart, founder of J Rotbart and Co., one of our trusted partners with offices in Hong Kong and Singapore:

“When things get unstable gold will perform well. Gold actually has inverse correlation to the US dollar. So of course, when the US dollar is weakening gold will perform better. So it’s very much a barometer for what’s happening in the financial market and in geopolitics.”

Another recent example of this was during the 2020 pandemic period. While other assets, like real estate, dropped in value, gold went up 20%, and silver prices went up 45%.

If things go wrong, our insurance will cover us, right? So that’s how we look at precious metals.

In other words, having real, physical gold in your portfolio is a tried and trusted way to protect your wealth during periods of economic and political instability, whereas collectible coins… not so much.

Offshore Your Precious Metals

At Nomad Capitalist, we recommend that if you invest in precious metals, you move at least a portion offshore to realize the full asset protection this asset class offers you.

Diversifying and offshoring your precious metals gives you insurance and extra asset protection.

Popular jurisdictions for offshore gold storage are neutral, established, and economically stable, with good logistics, and include Singapore, Switzerland, and Liechtenstein. (Singapore being our preference.)

Whichever location you choose to offshore to, we always recommend using private expert vaulting facilities, such as the oneJ.Rotbart & Co offers.

Most of them will offer you insurance coverage as part of the service, adds further peace of mind. By using this method of offshore storage, you can turn your purchase of gold into a professional investment.

For more actionable tips on asset protection, building freedom overseas, tax reduction, and more, sign up for our Weekly Rundown newsletter or subscribe to our Nomad Capitalist YouTube channel to get our latest videos.

FAQs

The largest coin collection in the United States and one of the world’s biggest is the National Numismatic Collection, held by The Smithsonian Collection. This impressive collection has 1.6 million objects. The most valuable coin is estimated to be the 1849 $20 gold coin, the first Double Eagle. Experts speculate that if this coin were to be auctioned today, it could easily reach a price in the multi-million dollar range.

Numismatic gold can be defined as a category of gold coins that possess a higher worth compared to the market price of gold. As with all numismatic coins, gold is elevated by its rarity, age, and various other characteristics.