What Can You Buy With Bitcoin? 5 Ways to Pay with Crypto

October 24, 2022

Dateline: Kuala Lumpur, Malaysia

So, what can you actually buy with Bitcoin?

Just a few years ago, you couldn’t buy much of anything. In fact, the first-ever crypto purchase was made when one member of a Bitcoin forum offered another user 10,000 Bitcoin to order two Papa John’s pizzas to his home in Jacksonville, Florida.

Keep in mind that this was back in the days when Bitcoin was only worth about 8 cents, so 10,000 Bitcoin only amounted to about $60. Today, that same amount is worth over $60 million.

Ah, how times have changed.

And, as Bitcoin’s value has increased, so have your options for spending it. While you probably can’t use it at the grocery store or gas station, there’s a lot that you can buy with Bitcoin.

Most crypto investors will start by purchasing other major currencies like Litecoin or Ethereum, which are becoming almost as universal as Bitcoin. Then, they may seek out cryptocurrencies with specific attributes, such as Monero’s extensive privacy and security features, or they might hedge their bets by investing in promising new ICOs, which can yield major profits if done wisely.

However, unless you’re a true crypto-anarchist, you’ve probably looked at your virtual wallet and wondered how you can use your Bitcoin and other crypto investments outside of this virtual landscape. Though it may be satisfying to see your virtual wallet grow heavier, you should always be wary of keeping all your eggs in one basket.

Especially when that basket isn’t always the most stable.

As with any other investment, having some kind of diversification is important once you’ve reached a certain level of success. And in the long term, you always want to make sure that your wealth is secure.

Why Should I Invest Outside of the Cryptosphere?

This may be my Protestant, Midwestern upbringing talking, but I’ve always been an advocate of protecting your downside. Personally, I never want to say that I have $10 million in Bitcoin (or any single investment, for that matter). One day I may be on top of the world, but I might lose everything the next day thanks to unforeseen events like a market crash.

Instead, the way I operate is by diversifying as much as I reasonably can. If I do end up having $10 million in Bitcoin, I’m going to liquidate part of it to make sure that – no matter what ends up happening in the cryptosphere – I’ll always have enough money to live a nice life.

Governed by that mindset, all crypto investors will eventually need to diversify – and diversify internationally.

Additionally, even if you’re an ardent crypto-anarchist with the utmost faith in the market, you may want to consider diversifying your investments in light of the inevitable regulation that will come with the mass adoption of cryptocurrency. While the crypto world is fairly libertarian now, regulation will inevitably increase as more people buy into it and invite the government into the crypto realm.

But that will never happen, right?

Unfortunately, it will. As with most new technologies, the government tends to slowly become increasingly involved as more and more people adopt it.

The current state of cryptocurrency reminds me of the days when my father and I first began browsing through the internet in 1994. At the time, the internet was highly libertarian and mostly unregulated, allowing users to do just about anything that their dial-up connections would allow.

However, my father predicted that as the internet gained mass adoption and kept growing, it would become more regulated. As we can see today, that’s clearly the case as the FCC and other regulatory bodies now tightly manage internet traffic in the US and around the world.

My colleagues in the crypto space and I predict that the same thing will happen with cryptocurrency. Currently, the crypto space is still relatively libertarian, and governments haven’t quite grasped how to handle it.

Yet, you can already begin to see regulatory clouds looming over the horizon.

As more people adopt cryptocurrency, you’re going to see higher prices and more oversight, and governments may try to force their way in or even introduce their own cryptocurrencies. The masses will want more regulation – they aren’t crypto-anarchists, and they never will be.

And, of course, governments will be more than happy to oblige.

Given this information, you may want to consider how to secure your wealth so it doesn’t become the victim of excessive taxation or a regulatory crackdown. And, to return to our original question, how you spend your cryptocurrency can have a large impact on the long-term security of your investments.

So, what exactly can you buy with Bitcoin, Ethereum, or other cryptocurrencies?

You can certainly make minor purchases like Bjork songs or games on Microsoft’s app store, but we like to think bigger here at Nomad Capitalist. Our goal is to help like-minded people diversify their lives and keep more of the money they make, so we’re looking for long-term strategies that will secure your wealth while helping you to live the life you want.

Let’s stop thinking of cryptocurrency as a simple payment mechanism and instead look at it as a way to expand your wealth – to create international diversification and build out your portfolio as a global citizen.

Here are five ways to do just that:

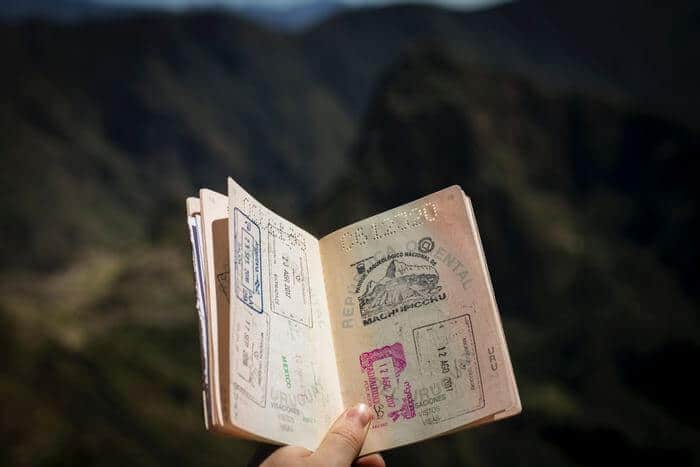

1. Purchase a Second Passport

I’ve always been an advocate for obtaining legitimate second passports. Not only can they help you enhance your freedom but they’re also a great insurance policy against economic or political chaos back home.

The benefits of a second passport are double for crypto investors. A second passport and residency can improve your access to new ICOs and exchanges while protecting you from taxes and government meddling in the crypto space.

Crypto investors looking to purchase a second passport should look no further than Vanuatu, which has one of the most liberal citizenship by investment programs in the world.

Unlike the Caribbean Islands, which have stricter rules to appease thousands of investors and nosy neighbors like the US, Vanuatu isn’t as concerned with diplomatic relations – yet, it has recently become a respectably strong passport.

When I visited a year ago, their citizenship by investment program was fairly complex and offered too many confusing options. However, after I spoke to high-level officials about this problem, Vanuatu has simplified its citizenship by investment program, making obtaining a second passport in Vanuatu surprisingly easy if you have the assets.

You simply have to pay a donation, a local agent fee, and legal fees that add up to around $200,000.

While it’s certainly not the cheapest option, Vanuatu’s citizenship by investment program is easy to navigate, and you won’t need to worry much about taxes or residency requirements once you’ve gotten your new passport. The challenge is that you’ll get an “honorary citizenship”, which isn’t as complete as some other options.

However, you can pay directly in Bitcoin. Most of the time, if you want to pay for second citizenship using your crypto assets, you must first convert it to fiat currency. While this process opens up more (and less expensive) options as far as second citizenships go, it can also be a hassle, so you may decide that it’s worth paying a bit extra to not wrangle with market fluctuations and exchange rates.

Vanuatu is also a highly interesting country in and of itself, and a Vanuatu passport offers visa-free access to the majority of Europe, including Russia, which is a huge boon to anyone looking to avoid the arduous Russian visa process.

As of now, Vanuatu is the only country that has fully embraced crypto as a method of citizenship by investment, but crypto-friendly countries like Antigua and Barbuda have started the process of incorporating it into similar programs.

And, as you’ll learn next, you can also use cryptocurrency to invest in real estate, which offers another path to citizenship in many countries.

2. Invest in Real Estate

Investing in real estate is a consistently reliable path for anyone looking to diversify their international portfolio. Its relative stability complements the inherent volatility in the crypto world, and it can provide a path for economic citizenship in many different countries.

International real estate is also becoming more friendly toward cryptocurrency as a growing number of real estate investors now use it to buy property around the world.

Chinese investors are increasingly using Bitcoin to purchase houses in Silicon Valley, and British Baroness Michelle Mone created the Aston Crypto Plaza in Dubai, a group of luxury apartments that can be bought with cryptocurrency.

This embrace of cryptocurrency in the world of real estate is growing for one simple reason: it just makes sense.

Cryptocurrencies have a number of features that make them attractive for both buyers and sellers in the real estate market. Cryptocurrencies’ direct, peer-to-peer transactions cut out middlemen like banks, and any exchanges are accurately recorded in the blockchain. Ethereum, which is built on smart contracts, even offers the possibility of creating open-source, self-enforced mortgage contracts in the future.

However, while crypto’s real estate potential is slowly being realized, your options when buying property in Bitcoin are still somewhat limited since what you can buy with crypto depends on who will accept it.

Aside from a handful of developments like Aston, the majority of real estate crypto transactions are between two private parties, so finding interesting properties in the country of your choice might take a lot of digging.

Plus, you may still need to convert to fiat to pay certain fees.

Fortunately, an increasing number of agencies are cropping up to help investors looking to buy property with cryptocurrency. I’ve worked with many clients to help them facilitate purchasing property with Bitcoin, and crypto-oriented real estate agencies like the Crypto Realty Group aim to facilitate crypto transactions in the realm of luxury real estate.

If you already have plenty of property, you can also use your digital wallet to pay for renovations. I’ve personally been able to pay for renovations on my homes in crypto-friendly countries, and an increasing number of private contractors are beginning to accept it as payment.

Cryptocurrency is becoming the future of international real estate as agencies and private sellers alike make it easier and easier for buyers to pay in Bitcoin.

3. Buy a Private Island

If a villa in Bali or a mountaintop in Costa Rica just won’t do, you can also buy your own private island with Bitcoin.

The connection between cryptocurrency and private islands seems to have started with Richard Branson, who hosted one of the first major cryptocurrency summits on his private island in 2015. Branson has continued to host these events on an annual basis, inviting major players in the crypto world to discuss ideas and developments in cryptocurrency and fintech.

Whether Richard Branson’s private island has inspired a generation of crypto-anarchists to buy their own with Bitcoin remains unclear, but if you want to take your Bitcoin real estate investments to the next level, you’ll find plenty of private islands that can be bought with cryptocurrency.

Last year, a plot of land on Union Island famously went up for auction at a price of nearly $7 million and the seller would only accept transactions in Bitcoin. Other sellers in places like the Honduran Roatan Islands offer a selection of islands that can be purchased with Bitcoin, Litecoin, or Ethereum.

Given that their current owners likely deal in crypto themselves, finding a private island that you can buy with Bitcoin isn’t terribly difficult.

However, unless you’re absolutely devoted to the idea of owning a slice of solitary paradise, you may want to prioritize other real estate investments. Many private islands are located in countries that aren’t ideal for second passports or other investments, and just getting to your new island will be a hassle in and of itself.

But, as with any purchase, if the benefits outweigh the costs and you have the capital then, by all means, go for it.

Whether you want to prepare for the zombie apocalypse or simply need a vacation spot without hordes of tourists, you can use Bitcoin to buy a private island with relative ease.

4. Convert to Precious Metals

If you’re not quite ready to buy a whole private island, then you may want to invest your cryptocurrency into something that doesn’t involve as much time or money to maintain. Fortunately, converting your cryptocurrency to precious metals doesn’t require a million-dollar upfront investment.

And you won’t need to book a private jet to use it, either.

Some of you may think I’m crazy or old school for suggesting that you use your shiny, new cryptocurrency to buy gold or silver. However, there’s a good reason that people have invested in these assets for centuries: they retain their value.

Unlike stocks or currency, which can be rendered worthless by the whims of government or the market, the value of most precious metals remains stable around the world. This means that even if all of your investments and bank accounts go belly-up, you’ll still have something of value to fall back on.

Precious metals also provide a stable complement to a cryptocurrency portfolio, which is constantly in flux.

Buying precious metals is thus a wise choice for crypto investors looking to diversify. It’s also a relatively easy process since many major brokers will accept your cryptocurrency.

However, this easy buying process can be somewhat deceptive. While it may be tempting to use just any website and buy the coolest looking gold coin you can find, doing so can scam you out of money and land you with a crappy investment.

First-time buyers may lose money if they don’t invest carefully. If you’re just entering the world of precious metals, you should probably read up on how to effectively buy and sell gold to avoid common traps like spread and overpriced collectors’ items, and you should always buy from reputable places.

I personally recommend using Bullion Star, especially if you’re a first-time buyer or you’re using cryptocurrency. I’ve worked with them for over five years and they’ve always been honest, informative, and user-friendly.

Plus, they also accept all major cryptocurrencies, including Bitcoin, Litecoin, and Ethereum.

Keep in mind that you’ll pay a small premium when using cryptocurrency to buy through Bullion Star. Since cryptocurrencies are inherently volatile, most brokers will charge a fee since they need to liquidate it rather quickly, but this small premium will save you the step of exchanging your Bitcoin or Ethereum for fiat currency.

Bullion Star is great for first-timers or users only looking to spend a few grand at a time, but if you’re trying to make a six-figure purchase, then you should consider working with a larger, more private company that doesn’t just allow you to place orders in a shopping cart.

The more private, white-glove firms that I work with offer better pricing as well as services like private vault storage, and they’ll help you personalize your precious metal investments to meet your needs.

Plus, most of them gladly accept Bitcoin and other major cryptocurrencies, too.

5. Pay for Global Citizenship Services

As your assets become more diverse and internationalized, you’ll quickly realize that managing your global investments and obligations is, at best, a chore and, at worst, a nightmare.

If you’re a US citizen, you may find that Uncle Sam can somehow dip his hands into nearly all of your assets (even if you haven’t been stateside in years), and citizens of any country can find themselves in legal or financial trouble if they don’t manage their business dealings properly.

Without outside help, many new international investors can end up overwhelmed and it can take years to get the hang of navigating a massive web of international laws and taxes. You may end up hemorrhaging money in taxes, or you can end up in some sticky legal situations if you deal with the wrong people.

Trust me, I spent years learning the hard way.

Therefore, finding the right help to legally and ethically become a global citizen can help you avoid these pitfalls while enhancing your personal wealth. That’s why Nomad Capitalist has recently decided to start accepting Bitcoin as payment for our services.

Global citizenship services is a broad term, but it generally involves things like setting up companies abroad, assistance with adopting second residencies and passports, and advice on investing in particular industries or countries. While we can’t help with things like making direct payments to governments (since they often prefer that you use your own bank account), we can help you keep track of them or find escrow services to assist you.

We also offer plenty of services that specifically benefit crypto investors like you.

To keep your crypto assets intact and outside of government coffers, I can help you legally create offshore companies to reap tax benefits or find and obtain a second passport in a country that doesn’t charge income tax. If you’re looking to diversify your assets, I can introduce you to opportunities like buying real estate in Georgia or guide you in the process of securely investing in precious metals.

As a crypto investor myself, I understand how becoming a global citizen can benefit you in the crypto sphere and how taking these steps can help you diversify your assets and maintain your wealth in the long run.

Whether you need legal assistance setting up offshore companies or want to make a plan to create an internationally diverse investment portfolio, global citizenship services like Nomad Capitalist are here to help.

Summary

Crypto investors are naturally forward thinking, financially savvy, and internationally minded. We see the regulatory and tax risks of keeping our assets in one place and we also see the benefits of diversifying our assets on multiple levels. Global citizenship services are the key to legally avoiding burdensome taxes and regulations while securing our wealth in the modern world, and now you can even pay for them in Bitcoin.

Does Puerto Rico Pay Taxes to the US?

It’s a common question and one that often fuels confusion, debate, and a fair share of misinformation – Do residents of Puerto Rico actually pay US federal taxes? When most people think of US tax obligations, they naturally assume they apply uniformly across all US citizens. But when it comes to Puerto Rico, things are […]

Read more

Zug Canton Taxes: The Ultimate Destination for Wealth Management in Switzerland

Switzerland’s global reputation is built not just on stunning views of Alpine peaks and serene lakes but also on a foundation of exceptional quality of life, world-class infrastructure and investor-friendly tax policies. The results speak for themselves: efficient public transport seamlessly links cities and villages; the standard of living regularly ranks among the highest in […]

Read more

How Smart Investors Use Venture Capital to Build Wealth

Big companies like Google, Amazon, Facebook and Apple all started out as bold ideas backed by venture capital. Decades later, the same firms are household names, as familiar to most people as electricity, the internet, or the telephone. But hindsight is a fickle friend. The truth is, it wasn’t always so obvious they’d succeed. These […]

Read more