Top 10 Friendly Countries to Invest in Africa

October 22, 2022

I bet Africa will not be the first on your list when you consider investing. It might not even make it to your list of top countries to invest in.

We at Nomad Capitalist are also not as keen on offering African markets to our clients. Why do you ask? Probably because of the same reasons as you do–political instability, civil war, and general lack of trust. Which makes Africa more challenging to market to our wealthy clients as compared to investing in Puerto Rico, Mexico, or Malaysia.

But as a boutique consultancy that keeps an open eye for up-and-coming markets, we believe Africa holds a lot of potential for young, ambitious investors.

We have success stories from clients who have invested their money and experienced high success rates and high returns from their African business investments with investment experts like Investopedia and Africa Business Opportunities Dashboard advising that you have your eyes on the continent.

Emerging markets: why invest in Africa

Africa investment opportunities are not for everyone. But for those who are risk-takers, investors with established businesses, and entrepreneurs looking for a place to park their money or invest, Africa is worth considering.

Here’s a snippet of some pros and cons to consider if Africa’s developing economies are apt for your investment risk appetite.

Advantages of doing business in Africa

One of the advantages of doing business in Africa is high returns.

According to the Overseas Private Investment Corporation (OPIC) and United Nations Conference on Trade and Development (UNCTAD), investing in Africa offers the highest return on foreign direct investment worldwide. But, of course, the high returns compensate investors for the risks involved in investing in Africa.

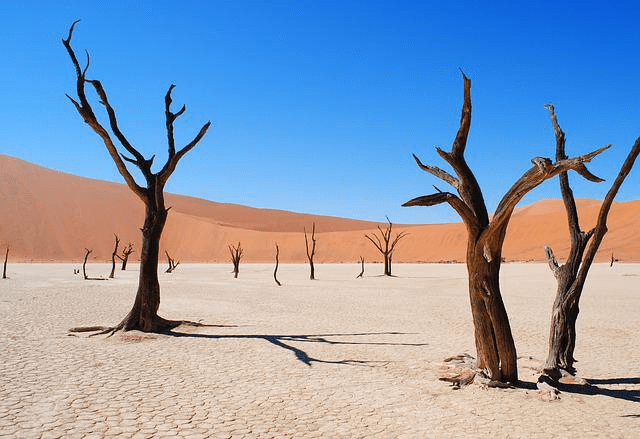

Africa’s extensive natural resources are another reason for investing in Africa.

The northern region of Africa is rich in crude oil reserves. In contrast, the southern part has vital mining industries. Many of these natural resources remain underdeveloped and provide the opportunity for growth.

Another one of the many advantages of doing business in Africa is its large population.

Africa is the fastest-growing continent. Fueling the growth is a young, rapidly urbanizing population. The African people account for an estimated 17 percent of the global population. That’s about 1.4 billion living on the African continent. Thus, there is a considerable potential for growth in the service and consumer goods industries.

Drawbacks of investing in African business

The number one risk why entrepreneurs are apprehensive to invest in Africa is because of its political instability.

Corruption, bureaucracy, and inadequate policies are causes of headaches for potential investors like you.

International investors should also be wary of civil unrest.

Regional conflicts have taken their toll on its people and the African economy. Moreover, civil war can overthrow a regime. And regime changes are an added risk for investors. Not just because of security risks but also from political uncertainties.

Business opportunities in Africa

Despite the added burden of the pandemic, Africa is brimming with investment opportunities. Some business sectors and industries where we see potential and business opportunities are:

- African stock markets (ETF and mutual fund)

- Africa real estate properties

- Africa’s natural resources

- African companies

- African agriculture

Our team believes that expanding your company operations or investing on the ground are the best options to invest in Africa.

Africa business opportunities are in startups, fintech firms, and local SMEs. Existing businesses on the ground with socioeconomic impact are a hit among aggressive investors. You can park your money on boutique funds or make a direct investment.

10 African countries with investment opportunities

If you are warming up to the idea of investing in Africa, then the next question on your mind would probably be, ‘where is the best place to do business in Africa?’

Here are the ten best African countries to start a business.

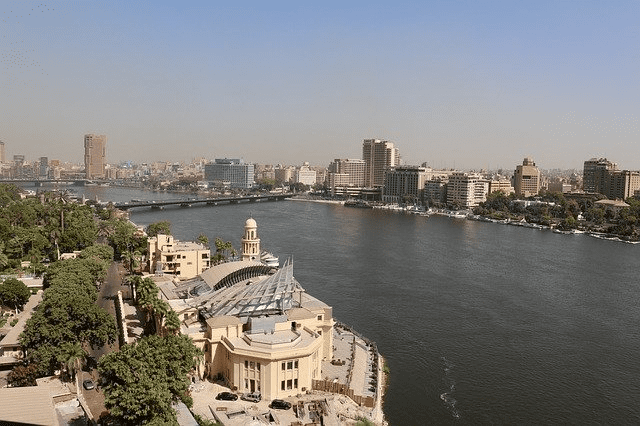

1. Egypt

One of the best places to do business in Africa is Egypt. Though it was one of the hardest hit African countries during the Covid pandemic, it was also one of the first African economies to bounce back. Thanks mainly to the government’s swift implementation of economic measures.

Moreover, Egypt’s geographical proximity to the Middle East and Europe lends it a territorial advantage.

Other potentials of Egypt that private investors should look at are the incredible pool of talent, high population, affordable cost of living, and cheap real estate. There is also a second citizenship possibility for a Tier-C passport.

Economists are optimistic that the GDP will reach a 3.8 percent increase by year-end. Furthermore, Egypt is also expected to expand its economy by 5.20 percent in 2023.

2. Morocco

Another place to invest in Africa is Morocco. This African country enjoys a relatively stable political system that directly translates to its sturdy economy. Better, in fact, than any country in sub-Saharan Africa.

The Moroccan government enjoys closer ties with Europe but also sees the potential for diplomatic relations with other African countries. The country has reintegrated into the African Union and is working towards membership in the Economic Community of West African States (ECOWAS).

Last year, the Moroccan economy experienced a 7 percent increase in GDP. The increase is attributed mainly to the agricultural sector. However, the government expects a slowdown in the economy and forecasts a 3.2 percent economic growth for the next couple of years.

3. South Africa

South Africa is probably the most popular place to invest in Africa. It has received the lion’s share of direct investment in foreign stocks in the whole African continent because of its developed market. Thanks predominantly to its sound economic policies, mature capital market, and availability of financing services. Add to that are the established land infrastructure and ports that facilitate the transport of goods and services.

Businesses in South Africa are marked by a robust manufacturing industry and retail market. Thus retail remains a great business opportunity for expansion. As a result, companies in South Africa remain optimistic despite a lower GDP forecast of 1.3 to 1.8 percent for the next two years.

4. Rwanda

Despite its small size, Rwanda is one of the best countries to invest in Africa and is one of the fastest-growing economies on the African continent.

Rwanda has become one of the African emerging markets, making an impression on private equity firms, venture capitalists, multinational companies, institutional investors, and even local business leaders.

Though this African market has limited expansion opportunities, foreign direct investment continues to pour in because of the sound business environment. In addition, good governance and effective economic policies all add to Rwanda’s desirability for African stocks.

Rwanda’s domestic market is also a gateway for investors looking to enter other east African markets. Trade opportunities to watch out for are in the construction and energy sectors.

This year, African Development Bank forecasts a 6.9 percent increase in GDP for Rwanda, following double-digit growth in the previous quarters.

5. Botswana

Botswana has one of the strongest economies to invest in Africa, with great potential for development.

As the least indebted country in Africa, Botswana has high foreign exchange reserves thanks to the Pula Fund. Pula Fund is the long-term investment portfolio of Botswana from preserving part of the revenues from diamond export. This sovereign fund helped lessen debt exposure by financing the majority of the budget deficit caused by the pandemic.

Botswana is desirable for high-net-worth individuals looking to invest in the region because of the low level of corruption and ease of doing business. It is also a high English-speaking country.

The leading enterprises for big multinationals and investors to consider are food processing, textile, and mining.

Botswana’s economic growth forecast for the next two years is at 4 and 4.20 percent, respectively.

6. Ghana

Ghana is another country to consider if you want to invest in Africa. Ghana has experienced significant shifts over the past years because of its largely commodity-dependent economy. This poses a double-edged sword: it provided a firm footing before the pandemic but was crippled when demand slowed. However, moving forward, Ghana is positioned for significant growth as economies pick up.

Sectors to watch out for gold, cocoa, and oil. The World Bank forecasts a 5 percent GDP increase this year.

7. Mauritius

Mauritius is best known for two things: its tax-friendly environment and its sugar products.

Though the agriculture sector is essential, investors would be happy to note that Mauritius is diversifying its economy. Financial services, textile, exports, and tourism are being developed to lessen the country’s dependence on sugar production. Therefore, an institutional investor should look at the country’s financial sector for opportunities—specifically, cross-border investment activities and banking services.

Mauritius’s projected GDP increase is at a low but steady 1.5 percent.

8. Côte d’Ivoire

One of Africa’s underrated emerging markets, Côte d’Ivoire, has enjoyed a robust and stable economic expansion for the past decade.

The global pandemic interrupted the growth, though the economic forecast remains positive. Domestic demand for consumer goods, services, and exports lead the country’s path to economic recovery.

The government’s thrust on infrastructure projects coupled with a relatively stable political and business sector all add to the economic development in the region.

Investment in infrastructure projects from public and private investment funding continues to drive interest among venture capitalists and private equity firms.

Other sectors to watch out for in Côte d’Ivoire are construction, manufacturing, agriculture, transportation, and energy will drive foreign direct investment.

Côte d’Ivoire’s economy is projected to grow by 6.3 percent this year and a further 6.6 percent increase by 2023.

9. Kenya

If you want to test the waters of the African market, Kenya will be an excellent place to invest.

This East African country is Africa’s economic, commercial, financial, and logistic hub. They are driven primarily by young entrepreneurs in technology–specifically the fintech segment. Moreover, startup enterprises with social impact in mind are a hit among foreign investors.

Multinational companies looking to offshore their business or expand their operations in Africa should consider this African nation.

Kenya’s economic growth forecast is at a robust 5.5 percent and will continue at 5.2 percent till next year.

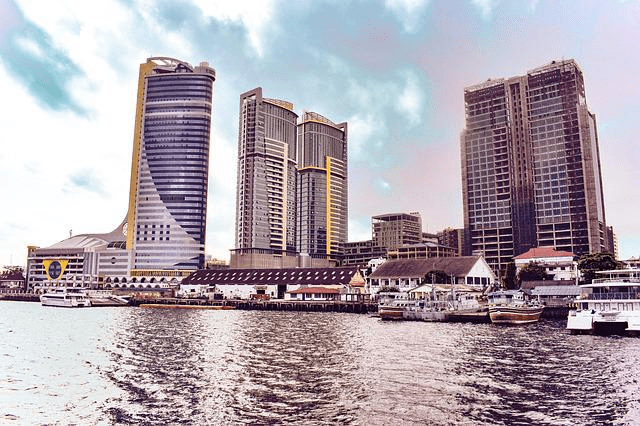

10. Tanzania

Tanzania’s 10th place is attributed mainly to the economic slowdown in the country’s changing business policies. However, government investment in the energy, telecommunications, and finance sectors helps keep the economy afloat.

But as one of Africa’s emerging markets, institutional investors keep a favorable forecast for African investments. Foreign direct investment opportunities in the mining, tourism, and telecommunications sectors remain attractive if you want to invest in Tanzania.

Tanzania’s economic growth is at 4.7 percent for this year and 5.3 percent for the coming year.

Africa Business opportunities

Now that we’ve identified the ten best places to do business in Africa, it is your turn to do your due diligence. As we’ve said, African investment opportunities are not for everyone.

There are many factors at play to consider. First, never invest unless you are familiar with the region’s economic environment. We highly suggest you consult with experts who have done adequate research and have years of experience dealing with high-risk investments.

Talk to our global team of experts with years of experience dealing with high-net-worth and ultra-high-net-worth entrepreneurs who want to go where you’re treated best.

Does Puerto Rico Pay Taxes to the US?

It’s a common question and one that often fuels confusion, debate, and a fair share of misinformation – Do residents of Puerto Rico actually pay US federal taxes? When most people think of US tax obligations, they naturally assume they apply uniformly across all US citizens. But when it comes to Puerto Rico, things are […]

Read more

Zug Canton Taxes: The Ultimate Destination for Wealth Management in Switzerland

Switzerland’s global reputation is built not just on stunning views of Alpine peaks and serene lakes but also on a foundation of exceptional quality of life, world-class infrastructure and investor-friendly tax policies. The results speak for themselves: efficient public transport seamlessly links cities and villages; the standard of living regularly ranks among the highest in […]

Read more

How Smart Investors Use Venture Capital to Build Wealth

Big companies like Google, Amazon, Facebook and Apple all started out as bold ideas backed by venture capital. Decades later, the same firms are household names, as familiar to most people as electricity, the internet, or the telephone. But hindsight is a fickle friend. The truth is, it wasn’t always so obvious they’d succeed. These […]

Read more