The Tax Rebate System for Malta Companies

October 31, 2024

Nomad Capitalist founder Andrew Henderson likes to tell us that his wise and aged grandmother liked nothing better than to pour cold water on any exciting (and potentially good) news by barking out the warning: ‘If something ‘sounds too good to be true, it probably is’.

Things have moved on in the world and while the advent of technology has outpaced many warnings of doom and gloom, they haven’t all been relegated to the dustbin of history just yet.

In fact, when it comes to international business taxes, granny’s warning is as good a yardstick to measure promises of tax-free idylls as any other, especially if you are looking into the tax rebate system in Malta for you or your company.

At the very least, the warning should act as a reminder to entrepreneurs to acquaint themselves with what’s on offer in any new venture or location and what legal avenues are open to reduce or even eliminate corporate taxes.

The quid pro quo of tax-free countries is that they are usually in far-flung places where company incorporation rules can be challenging to understand, and the hassle and expense negate any potential benefit.

You see, in exchange for a sizeable investment or job creation, a whole gamut of jurisdictions, primarily in the Caribbean and the Middle East, offer a range of incentives such as zero tax for companies to go there.

Some of these offers would have had granny spinning in her grave – they really are ‘too good to be true’, coming as they do from countries that are blacklisted and laden down by some heavy-duty, negative, reputational baggage.

These tax havens will work for some, but the choices begin to diminish if you’re a business owner or investor who wants to live in Europe. That is, unless you are familiar with the tax rebate system in Malta.

That’s right. Step forward and take a bow, Malta.

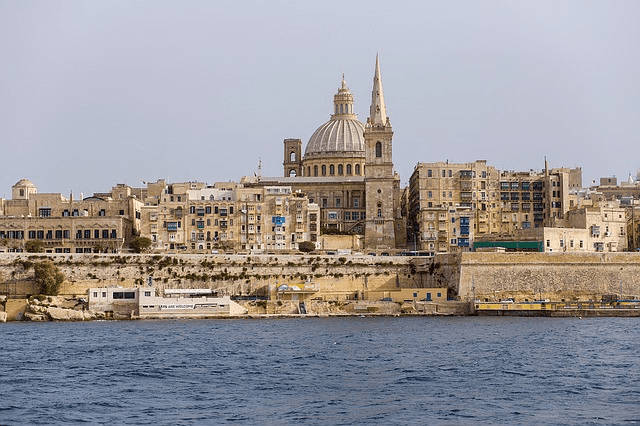

Anyone wishing to establish a European base should carefully consider this Mediterranean island, which offers the lowest effective corporate tax rates in the European Union (EU).

There are conditions attached to securing its surprisingly low rate, and achieving it requires proper planning, but that’s why Nomad Capitalist exists – to help clients with this kind of heavy business.

To begin with, it’s essential to understand the basics of Malta’s tax incentives for companies, its advantages and the practical issues around it. In this comprehensive analysis, we’ll take a close look at Malta’s taxation system.

Malta’s Basis of Taxation

Malta’s tax system is based on the dual concepts of residence and domicile.

Anyone who’s an official resident or intends to remain there permanently through domicile pays income tax on their worldwide income and certain capital gains.

Those ordinarily resident but not domiciled are taxed only on Malta-sourced income and foreign income remitted to Malta. Non-residents pay tax solely on Malta-based income, while married partners of resident and domiciled individuals face worldwide taxation.

However, there are other scenarios to weigh up and understanding Malta’s tax incentives and implications is crucial, particularly when considering residency and domicile status.

Consider the following:

- Maltese resident with tax residence elsewhere:

- Considered non-domiciled in Malta

- Taxed on Malta-sourced income and any foreign income that is remitted to Malta

- Foreign-sourced capital gains are not taxed, even if remitted to Malta

- Tax non-resident of Malta:

- If you do not reside in Malta for tax purposes (tax non-resident), you are taxed only on income sourced from Malta

- No tax on foreign income, regardless of whether it is remitted to Malta or not

- Tax resident of Malta but non-domiciled:

- As a tax resident but non-domiciled in Malta, you are taxed on income sourced from Malta and any foreign income remitted to Malta

- Like the first case, foreign-sourced capital gains are not taxed, regardless of remittance

Moving to corporate taxes in Malta, the following is the case:

- For a corporation, domicile means the company is registered in Malta.

- If the company is incorporated outside Malta, it’s still resident there if it’s managed and controlled in Malta or, in other words, has a permanent establishment there.

- Foreign companies operating through branch offices in Malta are only taxed on the income generated in Malta. In this case, foreign-sourced income not remitted to Malta will not be taxed in Malta.

The corporate tax rate in Malta is 35%, making it, in theory, a high-tax country. However, this rate is drastically reduced under the Malta tax rebate system after dividends are distributed among shareholders.

While the 35% is uniformly applied, the future distribution of dividends to Maltese shareholders can be offset against income tax.

This means that non-resident shareholders are also entitled to a refund of most of this tax. Depending on the type and source of income, those refunds can be as high as 6/7ths of the tax paid, effectively reducing the total tax burden to as low as 5%.

How does that work?

Shareholders receiving dividends are entitled to a tax credit equal to the tax originating from the profits from which the dividends are paid, preventing double taxation.

Because remember, double taxation treaties in Malta with various countries worldwide prevent you from being taxed more than once on the same income.

Put another way, under what’s known as an imputation tax system, the dividends paid by a Maltese company do not trigger any further tax since they include a tax credit identical to the tax paid by the company upon the distribution of profits.

So, shareholders are eligible for a refund of the income tax paid by the Maltese company when dividends are distributed. The tax paid is thus reduced to 5%.

How the Malta Tax Rebate Works

In literal terms, ‘imputation’ means assigning a value to something by inference from the value it contributes.

So, the Maltese tax system credits shareholders with the underlying tax on corporate profits attached to dividends they receive. This avoids them being taxed twice under its double taxation rules.

When a company registered in Malta distributes its profits (a company resident in Malta or a non-resident company with a branch in Malta), its shareholders may claim a refund of the tax charge of the distributing company. This extends to foreign companies by offering unilateral relief on the taxes paid on the profits out of which dividends are paid.

Relief is therefore available to individuals and companies for the dividends received from a foreign company and the tax paid by any subsidiaries in which the company holds at least 10% of the voting rights.

The most common tax refund is 6/7ths of 35% paid on the taxable profits, or 30%, leaving you with an effective 5% tax rate.

One drawback of the rebate system is that the 35% tax must be paid upfront and in full, so you must have the funds ready to pay. The refund to shareholders is usually granted between two and four months after the underlying company pays the tax.

Ultimate beneficial owners typically use a two-company structure comprising a Maltese holding company and a Maltese subsidiary. This arrangement is designed to optimise tax efficiency.

What to Know About Malta’s Participation Exemption

Under what’s known as the participation exemption, dividends received by the holding company from the subsidiary and potential capital gains on the sale of sales are exempt from taxation.

Moreover, this structure allows for the possibility of receiving refunds on a portion of the tax paid by the subsidiary, thereby optimising the overall tax impact.

You then have the option to retain the funds in the Malta Holding company, re-inject the funds in the Malta subsidiary, or distribute the funds as dividends to ultimate beneficial owners as required.

The company does not receive the eventual refund; instead, the shareholders do, so there cannot be a set-off between the tax payment due and the refund due as these legally relate to different persons.

The refund is available against those profits which have been declared as dividends (i.e., not on the retained earnings).

So, for the refund to be applied, you must make a dividend declaration (i.e., declare a profit distributable to the shareholders but not necessarily physically paid out). So, the actual money can be left in the company’s account, where it can fund activity and will be seen as a shareholder loan to the company.

The refund will be received in an account designated by the shareholder, and then he can transfer it back to the company.

Potential Tax Changes

Recently, it has been suggested that Malta could move away from the imputation and adopt a tax system more in line with what the European Union is doing on the continent.

Speculation has grown that these measures could include Malta lowering its corporate tax rate from 35% to 25%.

What we do know is that Malta has decided not to implement any part of the OECD Pillar Two Initiative in 2024, which includes the Income Inclusion Rule, Undertaxed Profits Rule and a qualified domestic top-up tax.

Instead, Malta will continue to monitor global tax developments and focus on maintaining its appeal to foreign investors.

The existing tax system will remain in place, with ongoing work on grants and tax credits that align with EU and OECD rules, ensuring minimal disruption to the current fiscal environment.

Regardless of how this affects future tax rebate systems, it doesn’t negate the fact that to compete on the international stage, this small island economy, with limited resources, will still need to create tax incentives that compensate businesses for being there.

The Tax Rebate System for Malta Companies – FAQs

Total tax exemption in Malta is possible for shipping companies under the tonnage tax system, provided they meet specific conditions. This exemption includes income from shipping activities and profits from the sale of qualifying vessels.

Malta’s tax refund system allows companies to claim refunds on tax paid by shareholders, effectively reducing the corporate tax burden. The refund percentages vary based on the type of income and applicable tax rules but can lower the effective tax rate to as low as 5%.

Malta offers tax incentives like the tonnage tax exemption for shipping companies, reduced tax rates for certain manufacturing activities, and various grants and tax credits for companies investing in research, development and innovation.

Malta has double taxation treaties with at least 70 countries, including the United States, United Kingdom, Germany, France and Italy.

In Malta, certain financial services, real estate transactions, and exports are exempt from VAT. Additionally, small businesses with annual turnover below specific thresholds may qualify for VAT exemption.

Should You Take Advantage of the Tax Refund System in Malta?

Malta’s imputation tax system applies to residents and non-residents who can claim a refund of the underlying tax paid by companies operating there.

This has made it a popular choice for people who, say, moved to Portugal under its Non-Habitual Residence scheme because Malta is not a blacklisted country.

Maltese companies are usually recommended when somebody wants to live in Europe – that’s to do with the EU’s lengthy list of blacklisted jurisdictions.

For example, if you opt to live in Italy, Spain or Portugal – as many people do if they establish a company in a blacklisted jurisdiction such as the British Virgin Islands – you will be punitively taxed at a higher rate.

Not so in Malta, where you will be taxed at standard rates and, because of its favourable system, you can expect to get 30% back.

Of course, a Maltese company is also suitable for people who want to live nomadically and put Nomad Capitalist’s trifecta system to work by building bases in different countries where you need to spend more time to be considered a tax resident.

Malta is one of the most business-friendly jurisdictions in the world, and there are substantial tax benefits to setting up a company there.

It offers a versatile corporate structure for establishing various business entities. In many ways, it’s an ideal place to streamline the establishment of a tax-friendly offshore presence.

Non-resident companies enjoy many benefits as resident Maltese companies, such as reduced taxes and access to other EU countries and markets.

You will need to plan this carefully, however.

That’s where Nomad Capitalist comes in.

We help seven- and eight-figure entrepreneurs and investors create a bespoke strategy using our uniquely successful methods. We’ll help you keep more money, create new wealth faster, and be protected from whatever happens in just three steps. Become a client today.

Does Puerto Rico Pay Taxes to the US?

It’s a common question and one that often fuels confusion, debate, and a fair share of misinformation – Do residents of Puerto Rico actually pay US federal taxes? When most people think of US tax obligations, they naturally assume they apply uniformly across all US citizens. But when it comes to Puerto Rico, things are […]

Read more

Zug Canton Taxes: The Ultimate Destination for Wealth Management in Switzerland

Switzerland’s global reputation is built not just on stunning views of Alpine peaks and serene lakes but also on a foundation of exceptional quality of life, world-class infrastructure and investor-friendly tax policies. The results speak for themselves: efficient public transport seamlessly links cities and villages; the standard of living regularly ranks among the highest in […]

Read more

How Smart Investors Use Venture Capital to Build Wealth

Big companies like Google, Amazon, Facebook and Apple all started out as bold ideas backed by venture capital. Decades later, the same firms are household names, as familiar to most people as electricity, the internet, or the telephone. But hindsight is a fickle friend. The truth is, it wasn’t always so obvious they’d succeed. These […]

Read more