Peter Schiff Predictions for 2023

February 13, 2024

In this article, we will explore the predictions of economist Peter Schiff. Schiff is an expert in international exchanges, business, precious metal investments, and economic performance. His economic views are generally conservative, and he advocates for fiscal responsibility.

In recent interviews, the financial expert warns against rising mortgage rates and stock market instability. Schiff predicted the coming year would bring further economic instability and one of its worst recessions. Peter Schiff draws his economic view from expertise regarding growth, stagnation, and inflation. The upcoming year has the potential to alter consumer behavior, affect long-term investments, and see the continued fall of the U.S. dollar. At Nomad Capitalist we help our clients safeguard against economic uncertainty by helping them move offshore, legally reduce their taxes and diversify their investments.

What Does Economist Peter Schiff Predict For The Economy In 2023?

Economist Peter Schiff often voices his concerns about an economic downturn and increased consumer prices. However, his estimates for 2023 and the proceeding years are bleak compared to previous years.

2023 is becoming a dangerous year for the stock market, the U.S. dollar, and business growth. Many economists estimate that the U.S. dollar may see one of its worst years on record.

This stress is compounded by falling asset prices, further exacerbating market volatility. Peter Schiff argues that these pressures can increase the probability of a massive financial crisis soon.

According to his predictions, 2023 will be a year of falling market performance and a more significant inflation problem. This will likely cause consumer caution, business stagnation, and a decreased trust in the U.S. Federal Reserve.

Schiff Predicts Consumer Prices Will Continue To Rise

The rising national debt is causing rising inflation across the board. The average consumer continues to see prices and interest rates rising due to an ever-increasing national debt.

When national debt increases, it decreases the overall value of the dollar. Since businesses lose profits, they must tighten their belts with spending, which means reduced employee pay.

This unfortunate vicious cycle results in consumers decreasing expenditures, which means less money circulation in the economy. Schiff is not optimistic about the potential for decreased consumer prices because the debt already exceeds 30 trillion and is set to continue rising.

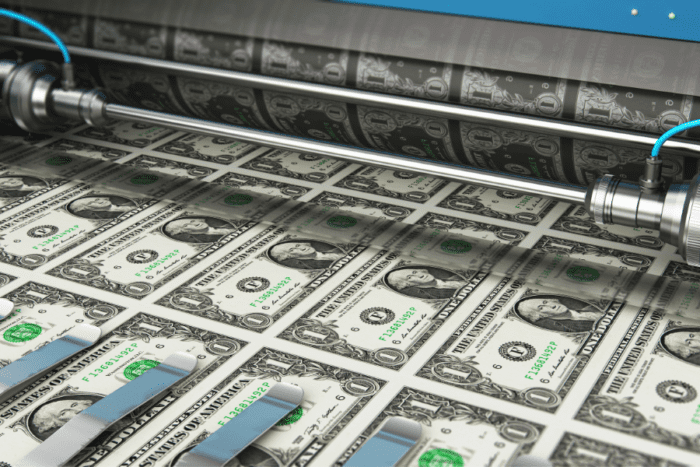

The US Dollar Will Continue to Fall in 2023

The U.S. dollar is not expected to make a recovery this year. Peter Schiff predicts the little gains the dollar had in the last two quarters of 2022 will be lost this year within the next quarter. This could be better, considering how much the dollar decreased the previous year compared to the last decade.

The U.S. dollar index is a comparative system for weighing the overall health of the dollar against other currencies. While the dollar does not appear as weak as it did during the Great Recession, it has steadily fallen since 2020.

In a recent interview with KITO TV, Schiff contended that this would not reverse. He argues that the dollar will drop significantly this year compared to the past few years because of the ever-rising national debt.

The federal reserve is unwilling to let the dollar fold under the burden of this debt. The federal reserve’s recent actions set to increase the national interest rates from 4.5 to 4.75%. This may not seem significant, but it’s a 16-year high.

In short, the dollar is crashing; it will worsen unless the government drastically cuts spending. Even if the government manages to curb debt, it’s so high that it will take a long time for the dollar to recover.

As the dollar falls, the stock market responds accordingly. Peter Schiff predicts the U.S. dollar index may worsen in response to the failing stock market. Essentially, these elements only increase the probability of a severe recession.

We Will Continue Seeing Falling Asset Prices

Peter Schiff argued in a recent article that the global economy would likely suffer one of its worst years this year. This is especially true for western economies since nations like China may actually take advantage of the weak U.S. dollar.

Competition with other nations may increase the burden on the stock market as it struggles to recover from 2020. This means the U.S. economy will not likely be the main performer on the world’s economic stage going forward.

High mortgage rates and falling real estate prices have asset prices falling across the board. The Federal Reserve and people such as Schiff have repeatedly warned the government to curb spending.

However, as Schiff predicted, increasing inflation has hit most U.S. savings and investment accounts. Assets such as homes, cars, and stocks no longer carry the value they once held and are not likely to provide the security they did in the past.

The Economy Will Continue Moving Toward Recession

Many economists see a severe recession on the horizon. In fact, as Schiff contended several times, the U.S. government is biased in its assessment of the state of the economy. The government’s interests lie in defending the economy’s performance and stability.

Schiff claims that the inflation threat is caused by reckless spending and unsustainable tax policy. This high inflation problem decreases the value of most assets in the U.S.

The S&P down, falling real estate prices, and crude oil prices estimated to drop throughout 2023 may cause more serious economic downturns. Such stock market instability drives investors away to more secure investments elsewhere.

What Are The Primary Drivers Behind The Economic Decline In 2023?

The economic struggles throughout 2022 had numerous causes, but some of the main causes are related to fiscal policies. The high inflation problem, the stock market suffering, and the value of the dollar crashing are likely to lead to a massive financial crisis.

Economist Peter Schiff’s predictions for 2023 include more inflation, rising taxes, and further business loss.

Similar to the inflation issues experienced in 2008, these economic troubles will likely lead to another recession. While the 2008 recession was primarily caused by poor mortgage lending, rising taxes, and debt caused by the current economic downturn.

More Americans carry balances on their credit cards month by month. Most Americans say they wonder whether they’ll be able to pay rent and put food on the table. While the results of these recessions may seem similar, their causes appear to be driven by slightly different factors.

During times of economic instability, most wise investors choose to protect their assets against inflation. This may include moving their money to an offshore account or investing in up-and-coming strong world currencies.

What Does Schiff Recommend For Investors in 2023?

Peter Schiff primarily recommends cutting down on debt and investing in precious metals. He predicts the economy will become significantly worse throughout 2023 and into 2024.

While inflation can significantly impact the value of currencies, it doesn’t impact precious metals as much. The OECD estimates that western economies in Europe and North America will continue to sharply decline in 2023 because of the Russia-Ukraine conflict.

According to the report, this could see inflation in the west topping 9% while Asian economies are likely to see 3% growth in 2023.

With little chance of this conflict ending at any time in the near future, the conflict will cause further global economic issues. Since the U.S. economy relies on the international economy, the ongoing conflict will exacerbate economic issues.

Conclusion

Economist Peter Schiff’s predictions can be daunting and upsetting. No one wants to see the economy hindered and their profits lost.In times of economic uncertainty, diversifying your investments and moving assets offshore creates a secure plan B. At Nomad Capitalist, we provide our clients with personalized services, including asset protection and safe offshore banking opportunities. Apply today to get started.

Does Puerto Rico Pay Taxes to the US?

It’s a common question and one that often fuels confusion, debate, and a fair share of misinformation – Do residents of Puerto Rico actually pay US federal taxes? When most people think of US tax obligations, they naturally assume they apply uniformly across all US citizens. But when it comes to Puerto Rico, things are […]

Read more

Zug Canton Taxes: The Ultimate Destination for Wealth Management in Switzerland

Switzerland’s global reputation is built not just on stunning views of Alpine peaks and serene lakes but also on a foundation of exceptional quality of life, world-class infrastructure and investor-friendly tax policies. The results speak for themselves: efficient public transport seamlessly links cities and villages; the standard of living regularly ranks among the highest in […]

Read more

How Smart Investors Use Venture Capital to Build Wealth

Big companies like Google, Amazon, Facebook and Apple all started out as bold ideas backed by venture capital. Decades later, the same firms are household names, as familiar to most people as electricity, the internet, or the telephone. But hindsight is a fickle friend. The truth is, it wasn’t always so obvious they’d succeed. These […]

Read more