When Diversifying Investments, Timing is Everything

October 24, 2022

Guest author, Peter St. Onge, Ph.D. is a former hedge-fund manager, Mises Institute Fellow, and an Assistant Professor at Fengjia University College of Business. He blogs at Profitsofchaos.com

A fundamental problem in diversifying your investments is that rich countries move in relative lock-step; leaving you with a clutch of colorful but exciting-in-a-bad way poor countries to choose from. So should you skip diversification altogether? Not at all. Just pay attention to the timing.

First up, some data on the last crisis. 2008 is a useful test-case for two reasons: First, fresh is good in comparing crises, since financial and economic relationships change. Second, and this is the kicker, is that our economic overlords are busily building a clone of 2008. Loose money and bailout moral hazard are the key ingredients of 2008 and, if anything, both have gotten worse.

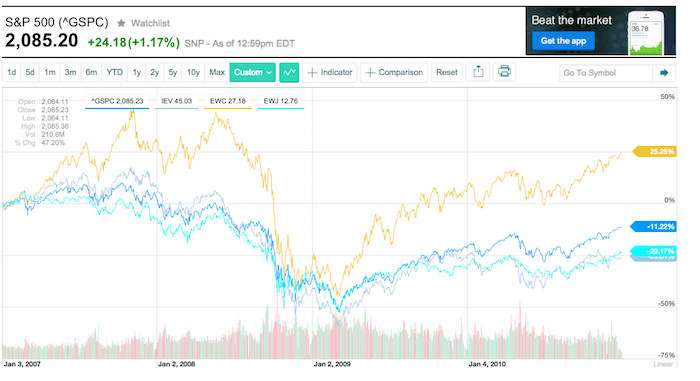

Here we have a chart of the S&P 500 compared to ETF proxies for Europe (IEV), Canada (EWC) and Japan (EWJ). It’s easy to see the outlier Canada, which was coming off a boom in materials exports to China.

Japan and Europe, for their part, almost precisely mirrored US returns. In fact, a US investor would’ve been better off just keeping all their money at home; they’d have lost a bit more going into the crash, gained a bit more on the recovery, and netted a 4% lower return over the period.

This is fairly ironic, since the crisis was, after all, Made in the USA. If the actual source of the crisis can’t even beat diversification, when would it work?

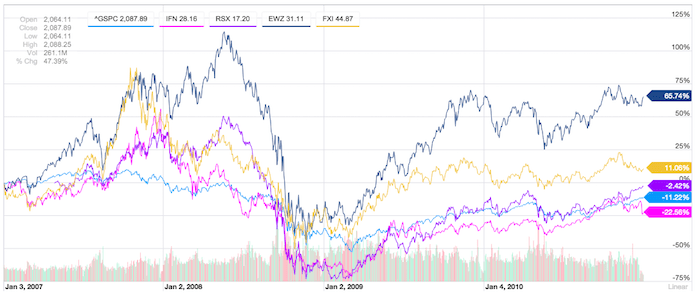

Next up, let’s look at the famous BRIC economies — Brazil, Russia, India, China. These guys, we’re told, are taking over the world. And you can’t get further away from US shores without breaching the stratosphere. Perfect growth-plus-diversification play, right?

Or not.

The BRICs did even worse. Again, using ETF proxies for Brazil (EWZ), Russia (RSX), India (IFN) and China (FXI), they dropped 70% going into the crash versus 53% for the S&P. They recovered faster as well: 117% versus 52%. Meaning they netted a loss of 36% from October 2007 to end-2010, versus a loss of only 28% for the S&P.

Taken together, don’t even bother diversifying before the crisis starts. Even if the US is the source. Instead, ride the “flight to quality” going into a crisis.

Now, this doesn’t mean never diversify. On the contrary, look at those recoveries — both Europe and especially the BRICs beat the US hands-down on the recovery. Measuring from the trough to end-2010 the US went up by 52%, the rich trio by 57%, and the BRICs by an astounding 117%. The worst BRIC-crasher, Russia, lost 77% going in and gained a shocking 169% in just a year and 8 months coming out.

The bottom line is that the real crisis diversification play is to keep your powder dry until there’s blood in the streets. When it’s flowing nice and thick, that’s when to cash in your US stocks, your Swiss bonds and gold coins, and go shopping abroad.

So how to invest this today? First off, know that a recession is coming. As sure as the seasons — well, as sure as Central Bank manipulation of money supply. Having said that, this lazy boom of ours has a ways to go. Meaning it’s too early to start speculating on post-bust plays. So, for now, sit tight with reduced but positive market exposure — in line with your risk appetite — and wait for that buying opportunity they call a crash to pick up those unloved assets when nobody else will.

Is Land Investment Safer?

When American humorist and writer Mark Twain said, ’Buy land, they’re not making it anymore,’ he was definitely on to something. Land is finite, and that scarcity gives it lasting appeal. Yet, despite its obvious logic, land remains one of the most misunderstood investments. Many people are put off by its perceived complexity, potential legal […]

Read more

Top Emerging Market Economies for US Investors in 2025

If you’re still parking all your capital in overvalued US real estate or clinging to tech stocks in the S&P 500, you’re playing an old game while rivals are redesigning the board. The world has move on. Smart investors know that the biggest returns aren’t coming from Wall Street anymore – they’re coming from below-the-radar […]

Read more

Monaco Real Estate Guide: Market Trends and Opportunities

When it comes to luxury real estate, nowhere does things quite like Monaco. This tiny but ultra-exclusive principality isn’t just a place to live – it’s a global symbol of wealth, prestige and financial freedom. In 2025, Monaco remains the world’s most expensive real estate market, with average property prices soaring beyond €51,000 per square metre […]

Read more