The Cheapest Place to Buy Gold

January 15, 2024

Gold remains the ultimate safeguard for preserving wealth. By understanding what the best gold coins, bullion bars, and sellers are, you have the opportunity to purchase these valuable assets at reasonable premiums.

These precious metals not only help preserve wealth in times of inflation and instability but also offer a universally recognized store of value.

In worst-case scenarios that are becoming more common, gold can serve as an alternative form of currency. As the US and most other Western societies move toward de-dollarization, relying on fiat currency is unreliable.

On the other hand, gold has held its value for thousands of years. For a more in-depth look at why gold is an ideal asset for a well-rounded portfolio, check out our Ultimate Guide to Gold Coins and our 10 Tips for Buying Gold in 2024.

Here we will discuss the cheapest places to buy and store your gold.

Become a Nomad Capitalist client, and we will work as the architects and general contractors of your holistic offshore strategy, helping you diversify your assets, including precious metals.

The Price of Gold

Gold is priced in US dollars per ounce, not actually a regular ounce, but rather a Roman troy ounce, which is slightly heavier than the standard ounce.

Gold products such as bullion bars and coins are generally shown in the metric system, so grams, kilograms, or ounces.

You can find gold bars and coins in a variety of sizes and weights, which are often ranging from one ounce, one gram, 5 grams, 10 grams, 20 grams, 50 grams, 100 grams, and also 100 ounces.

As mentioned, prices are usually in US dollars but can also be found in other currencies like Singapore dollars, British pounds, Hong Kong dollars, Australian dollars, and some other major currencies.

So, if you are coming from or moving to a non-USD-denominated jurisdiction, this offers you the opportunity to get exposure to the gold market but also the forex markets.

What Influences Gold Price

Similar to other commodities, the price of precious metals is predominantly influenced by supply and demand. However, the unique dynamics of the precious metals market have led to discrepancies between the “paper” price of gold and the “physical” price.

Sometimes, there could be a period of time when the demand is very high for physical gold, but the prices will continue to go down because of the big financial institutions trading in paper gold.

These paper gold financial products don’t actually exist in the market as a physical asset and often depress the price of gold.

The primary reference for the price of gold is the “spot price,” which is predominantly derived from the leading commodity exchanges in London and Chicago.

Gold futures contracts allow sellers and buyers to agree on trading a specific quantity of gold at a predetermined price in the future. Miners historically utilized these contracts to secure gold prices.

These contracts are actively traded among various stakeholders such as miners, traders, speculators, banks, hedge and gold mutual funds, and pension funds. The continuous trading activity surrounding these contracts contributes to the volatility of gold prices.

We want to stress the point, however, that these contracts don’t result in the physical delivery of gold.

For high-net-worth individuals looking to protect themselves, hedge against inflation, and create a Plan B, we recommend instead buying physical gold.

Although gold is very much insulated, it is still, of course, impacted by geopolitics, environmental, and cultural events, for example, in our article Why Indians Buy Gold, we delve deeper into the cultural impact on gold markets, including yearly celebrations such as Diwali.

Gold is suited for investors concerned with geopolitical and financial uncertainties. A precious metal that is preferred when things get unstable, whether it’s war or the decoupling between China and the US.

From an environmental point of view, the entire gold industry is now more transparent and focused on sustainability. This has, however, the knock-on effect of higher prices.

Other elements also determine the price of physical gold, including minting, transportation, and storage costs, and costs depend on the style of gold and what form it takes. For example, coins typically have a higher premium compared to bars.

The best deals on gold coins can be scored from large gold retailers specializing in selling gold, with many offering discounts. Verifying that the website you choose offers insurance on the gold is vitally important.

The Cheapest Place to Buy Gold 2023

Asian markets are some of the cheapest in the world, with Singapore and Hong Kong leading the way.

Hong Kong

Hong Kong has some of the world’s most competitive premiums on gold coins, making it the cheapest place to buy gold.

Many highly recognized financial institutions offer a range of choices when acquiring gold bullion bars, coins, and other related products.

Conduct thorough research to compare prices to ensure you secure a fair price and purchase gold from trustworthy sources.

Hong Kong, an influential financial center in Asia, stands out as an ideal destination for buying gold.

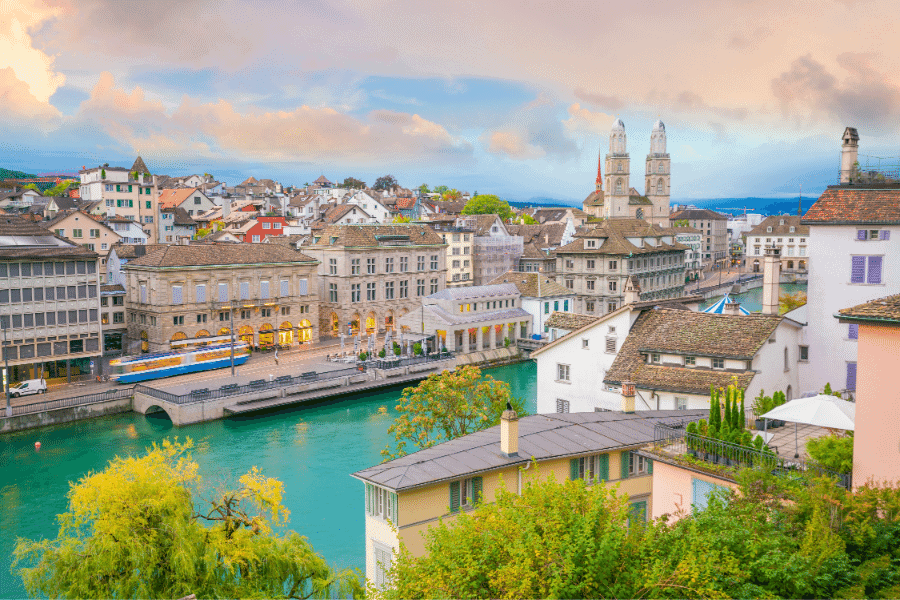

Switzerland

Some of the better rates are found with online retailers based in Switzerland.

Generally, countries that offer the most reliable and secure banking options are considered the ideal places to buy and store gold. In Switzerland, you have the option to buy gold through a variety of channels, such as Swiss banks, dealers, or jewelers.

However, it is essential to conduct thorough research and make comparisons regarding gold prices in order to secure the best prices.

India

Emerging markets like India also offer opportunities to buy gold at competitive rates. India is the second-largest gold market in the world after China.

Indians predominantly buy gold in the form of jewelry, which is offered in a wide range of weights and prices to cater to all budgets.

Gold coins and bars are also sought after and easily obtainable from various outlets nationwide. Gold jewelry costs are subject to fluctuations based on factors such as weight, purity, and the particular dealer.

Singapore

Although Singapore is not as cheap as Hong Kong or other jurisdictions, we have included it in our list because of the offshore and diversification benefits it offers.

The constant innovation in Singapore makes gold-related transactions more convenient and cost-effective.

For example, one notable innovation in Singapore’s gold storage industry is the introduction of gold-backed debit cards.

You can sell gold and receive the funds on a card, usable in numerous currencies worldwide, which eliminates the need to transfer gold funds from a gold account back into the traditional banking system.

You can start by purchasing just a small amount of gold, such as a single silver coin, and open an account. BullionStar, for instance, allows storage with as little as USD$20. As Europe faces increasing volatility, Singapore emerges as the new gold investment and storage center.

Buy Gold Bars

It all comes down to premiums. The lower premium of pure gold bullion bars makes them more affordable than buying gold coins.

Also, larger gold bars often offer better deals and lower premiums. With pure bullion bars, the value is derived solely from the bullion content rather than the rarity or collectability that affects the price of coins.

The cheapest gold bars include:

- Asahi 1 oz Gold Bar in Assay – $2,014.92

- Argor Heraeus 1 oz Gold Bar – $2,018.10

- 1 oz Gold Bullion Bar – Perth Mint – $2,019.54

From a pure professional investment point of view, it is often recommended to buy bars. In today’s market, it costs around $6,000 US dollars per 100-gram gold bar.

Buy Gold Coins

Because there are mining, production, and transportation costs, gold coins are sold at a higher premium than the spot price of gold bars.

The premium is also higher for coins because it costs more to make them as they are smaller and have particular designs, usually a simple of the country they are from, such as the maple leaves or kangaroos.

The cheapest gold coins include:

- Krugerrand 1 oz Gold Coin – $2,018.63

- 1 Oz Gold Maple Leaf – $2,019.10

- 1 oz Canadian Gold Maple Leaf Coin – $2,036.09

These particular gold coins are accepted worldwide. This global recognition means that these coins can easily be sold or used anywhere in the world.

Always stick to London Bullion Market Association products for whatever precious metal you decide on. This association monitors all the global players in the gold industry, from refiners to vaults to shipping companies.

For an up-to-date and more extensive breakdown of gold and silver prices, click here.

Universally Recognized Mints

To make a beneficial investment in gold, it is crucial to consider purchasing universally recognized gold, regardless of whether it comes from Hong Kong or any other jurisdiction offering the best prices.

To identify the best physical gold deals, conduct a search for each country with the lowest purchase price on universally recognized gold, including:

- Canadian Maple Leaf

- Austrian Philharmonics

- South African Krugerrand

- Gold Australian Kangaroo

The Cheapest is Not The Best

A word of warning, the cheapest is not always the best option. Instead, we recommend especially high-net-worth individuals go to dealers with higher transaction values. You get better pricing and high-quality service when you go to specialized gold companies that deal primarily with a larger volume.

For example, gold dealers like J. Rotbart & Co. don’t need to get margins like retail sellers, with clients buying very small fractional deals so that they can offer better deals to clients.

You should not judge gold by whether it’s cheap or not cheap. You need security and an excellent relationship manager that will take care of your interest in the long term.

Work with Professionals in Precious Metals

To find the best prices on gold from different countries, you can, of course, visit the many online retailers. However, for high-net-worth individuals, it is better to look to reliable precious metals firms that provide a full suite of services, including verifiable documentation confirming the value of your gold investments.

When you become a Nomad Capitalist client, we help you build a suite of experts and execute plans, whether starting off small or going all the way, diversifying and protecting your wealth, reducing taxes, and creating a global Plan B. Nomad Capitalists can help.

We work along with gold experts who provide a full suite of services for high-net-worth individuals who would like to diversify their portfolio by investing in precious physical metals, including gold, silver, platinum, and palladium, and providing the entire solution, from sourcing precious metals from the best refineries in the world to handling transportation.

Why Buy Gold

Gold serves as a counter-currency, an asset held when confidence in paper currency issued by central banks and the government is lacking.

Also, physical precious metals cannot be manipulated by the Federal Reserve. Precious metals have stood the test of time, maintaining their value for thousands of years.

Many choose to buy and store gold due to the countless uncertainties in today’s world, as it offers stability and security. Gold, on average, appreciates 10% per annum, a unique asset that you can be sure will be around in 100 years.

Gold has an inverse correlation to the market, meaning when other assets are dropping, gold will usually do very well, as seen in 2020.

The sustainability of the US dollar-based system relies on trust and confidence. Paper currencies rise and fall, experiencing devaluation. The Federal Reserve cannot manipulate physical precious metals. With the likely introduction of CBDCs, the reality is that paper currencies will inevitably lose value over the long term.

Best Places to Store Your Gold

If your goal for investing in gold is as a hedge against inflation and insurance for your assets, it is only worthwhile if you use a suitable storage facility or jurisdiction.

You may want to keep some of your precious metals nearby for emergencies or as a backup source of currency. Consider storing a minimal amount of your gold metals in a home safe to protect them from threats like fire and theft.

However, we agree with our gold experts who advise against storing your gold in your home or a traditional banking facility.

There is no insurance in those bank vaults, and they also leave you open to interference from the government.

The best place to store your gold is with private vaulting facilities, which come with many advantages, including full insurance coverage, top-of-the-range security, and the potential to turn your gold purchase into a professional investment.

When you want to invest in gold, you go to professionals; when you want to store your gold, go to a professional company with great vaults.

Choose a reputable jurisdiction with transparent and competitive prices and trustworthy storage facilities that allow high-net-worth individuals to diversify by investing in precious physical metals, including gold, silver, platinum, and palladium.

If you’re interested in starting small with offshore gold storage, visit our partners in Singapore, where you can buy and store in their private vault.

Would you like to learn more before investing in gold? For more insights and actionable tips on asset protection, building freedom overseas, and tax reduction, sign up for our Weekly Rundown newsletter and subscribe to the Nomad Capitalist YouTube channel.

FAQs

Physical gold, such as coins and bars, provides direct exposure to the precious metal. However, it can be expensive due to dealer commissions, sales tax, storage costs, and security considerations.

Gold futures, ETFs, and mutual funds that track gold offer a more cost-effective and liquid option. They can be purchased like shares on a stock exchange, eliminating the need for markups, storage costs, and security risks associated with physical gold.

However, investors will incur expense ratios and commissions for buying and selling gold futures and ETFs.

Based on past trends, the optimal periods for buying gold would be during January, March, and early April. The value of gold and silver tends to taper off during the spring and summer and surges again in autumn.

Buying gold online can be safe, provided you are sure you are dealing with a trustworthy company. To safeguard yourself against scammers, conducting thorough research on online retailers before buying a gold product is essential.

Reputable dealers adhere to gold compliance standards and provide insurance coverage for the full value of their shipments.

Does Puerto Rico Pay Taxes to the US?

It’s a common question and one that often fuels confusion, debate, and a fair share of misinformation – Do residents of Puerto Rico actually pay US federal taxes? When most people think of US tax obligations, they naturally assume they apply uniformly across all US citizens. But when it comes to Puerto Rico, things are […]

Read more

Zug Canton Taxes: The Ultimate Destination for Wealth Management in Switzerland

Switzerland’s global reputation is built not just on stunning views of Alpine peaks and serene lakes but also on a foundation of exceptional quality of life, world-class infrastructure and investor-friendly tax policies. The results speak for themselves: efficient public transport seamlessly links cities and villages; the standard of living regularly ranks among the highest in […]

Read more

How Smart Investors Use Venture Capital to Build Wealth

Big companies like Google, Amazon, Facebook and Apple all started out as bold ideas backed by venture capital. Decades later, the same firms are household names, as familiar to most people as electricity, the internet, or the telephone. But hindsight is a fickle friend. The truth is, it wasn’t always so obvious they’d succeed. These […]

Read more