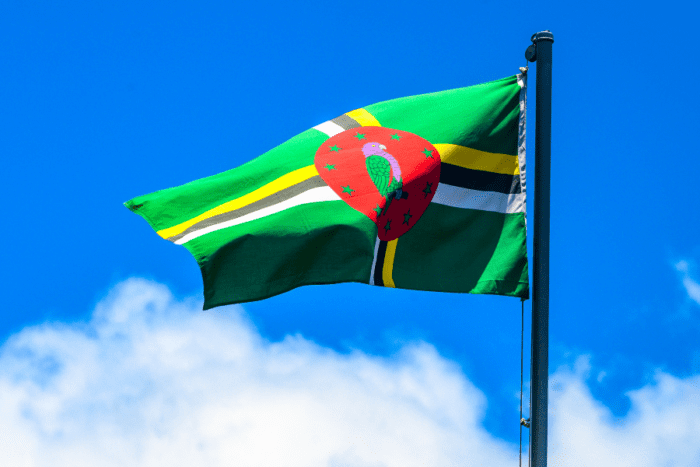

Banking in Dominica: The Ultimate Guide

December 27, 2024

With its lush mountains, verdant rainforests and white sand beaches, Dominica is more than a tranquil vacation spot – it’s also an attractive base for offshore banking.

Of all the Caribbean countries, Dominica is an island that has seen sizable growth as a financial centre.

This is partly due to the launch of its citizenship-by-investment program, which allows foreigners to become Dominican citizens by investing as little as US$200,000 in the country’s economy.

Due to its growth, Dominica continues to catch the eye of those in search of offshore banking solutions to help diversify their assets.

Benefits of Banking in Dominica

With its fast-emerging financial industry, if you’re considering opening an offshore bank, Dominica is well worth a look.

After all, there are plenty of excellent benefits for those who choose a Caribbean island as their offshore banking location.

For starters, a Dominican bank account can be a valuable asset for those engaged in global commerce by opening doors to new investment opportunities in a dynamic economic zone.

In terms of ease of doing business, Dominica’s official language is English, which makes banking-related processes simple to navigate for Westerners. Dominican banks also give you access to a network of correspondent banks worldwide, enabling efficient cross-border transactions and investment opportunities.

Furthermore, Dominica offers a tax-neutral environment that can be advantageous for tax planning purposes. However, it’s crucial to seek professional guidance to ensure compliance with relevant international and domestic tax regulations.

Dominica vigorously enforces its confidentiality laws to protect the privacy of the individual clients and companies that bank in the country.

Who Should Bank in Dominica?

Unlike in the Cayman Islands, the regulatory Financial Services Unit (FSU) doesn’t require you to prove a connection to Dominica to open a bank account. Non-residents are welcome to open both personal and corporate accounts.

If you are planning to live there, you are better served by having a local account in East Caribbean dollars, which is pegged to the US dollar at an exchange rate of US$1 to EC$2.70.

Those investing in Dominican real estate can also benefit from opening a local bank account.

How to Open a Bank Account in Dominica

While the process of opening an offshore bank account in Dominica is similar to opening an account elsewhere, it’s essential to familiarise yourself with the specific requirements of the bank you choose.

If you make a personal visit, we suggest you dress accordingly, as the suit remains the uniform of business in this part of the world.

In a similar vein, Dominican banks expect clear and concise communication throughout the application process.

One of the first things a Dominican bank will ask for is your banking history. Your chosen bank will stipulate a minimum of three years’ proof of holding an account with another bank.

If you don’t have a banking history, they’ll request a credit reference: this is a letter from a business associate, friend or lender confirming your solvency, and again, the relationship should span more than three years.

Then, you’ll need to supply certified documents that illustrate the source of your funds. This could be a rental agreement establishing your income from rental properties or a reference from your employer confirming your salary.

You’ll also be required to prove your identity and where you come from. To verify your identity, you’ll need to present a driver’s license or passport. For proof of residence, you’ll need to supply an up-to-date utility bill less than three months old.

In terms of cost, there is an initial minimum deposit of at least US$5,000 and, typically, you will also have to pay a non-refundable fee to open a bank account in Dominica and any ongoing maintenance charges.

Depending on the type of account, the deposit amount can increase to between US$20,000 and US$50,000.

Top Banks in Dominica

Dominica has over 15 banks, including a development bank and an indigenous bank.

When choosing a bank, it’s advisable to consider factors such as the bank’s reputation, financial stability and range of services. An online presence can also be an indicator of a bank’s accessibility and commitment to modern banking practices.

The following are some of the leading banks in Dominica:

EQIBank

Launched in 2015, EQIBank is a global offshore bank with a physical presence in Roseau, Dominica’s capital city. It serves clients in over 180 countries.

Ferz Global Bank

Another offshore bank with a Roseau zip code, Ferz Global Bank offers a range of personal and business accounts, including credit cards and private banking services.

National Bank of Dominica Ltd.

The National Bank of Dominica (NBD) operates four branches on the island, a wide network of ATMs, plus mobile banking and insurance services. The Eastern Caribbean Central Bank (ECCB) has recognised the group for its outstanding performance.

Dominica Agricultural Industrial & Development Bank

A subsidiary of The National Development Bank (NBD), the Dominica Agricultural Industrial & Development Bank (AID) provides loans for start-ups and energy-efficient and development-related funding.

CIBC FirstCaribbean International Bank

CIBC FirstCaribbean International Bank has a Canadian origin but has Bahaman headquarters.

This offshore bank offers a variety of financial products across the English-speaking Caribbean, including corporate and investment banking services, investment portfolio customisation and management and premium personal and business accounts.

Banking in Dominica: FAQs

Dominica banks typically require proof of identity (passport, driver’s license), proof of residence (utility bill) and banking history. Some banks may also request a credit reference or proof of your source of funds.

Costs vary depending on the bank and account type. Expect a non-refundable opening fee and a minimum initial deposit, which can range from US$100 to US$50,000 for certain account types.

Dominica banks provide a variety of accounts to suit your needs, including personal and business accounts, savings accounts and even specialised accounts for investments or offshore banking.

Yes, Dominica is a politically and economically stable country with a well-regulated banking sector. Dominica banks adhere to international standards, assuring the safety of your funds.

Yes, Dominica welcomes non-residents to open bank accounts, both personal and corporate. The Financial Services Unit (FSU) in Dominica doesn’t require you to prove a connection to the country to open an account.

NBD Dominica provides convenient online and mobile banking, competitive interest rates and a variety of financial products, including loans, mortgages and credit cards. They also offer personalised customer service and financial advice for local and foreign investors.

Yes, Dominica banks offer business bank accounts to its customers.

Choose the Best Offshore Bank for Your Assets

A few years ago, most people didn’t even know where Dominica was but, today, the country is emerging as a beacon of offshore banking stability and opportunity.

Confidentiality, stability and a commitment to international standards are the pillars on which savvy investors can protect their wealth.

But, as any Nomad Capitalist knows, true financial freedom requires more than secure banking.

It demands a holistic strategy, a carefully composed mix of global citizenship, tax optimisation and investment diversification – a plan that transcends borders and helps you to live and work on your own terms.

Perhaps you envision establishing a second residence in a welcoming jurisdiction or maybe you’re exploring the possibilities of dual citizenship?

Perhaps you’re seeking to structure your investments in a way that minimises your tax burden while maximising your returns?

Whatever goal you’re after, achieving it can be complex – but it doesn’t have to be.

At Nomad Capitalist, we’ve helped countless customers and their families access a life of greater freedom and prosperity.

We understand the nuances of international finance, and we’re passionate about helping our clients achieve their unique vision of success.

If you’re ready to unlock the full potential of your wealth and embrace a life of global opportunity, we’d like to help you go where you’re treated best.

Does Puerto Rico Pay Taxes to the US?

It’s a common question and one that often fuels confusion, debate, and a fair share of misinformation – Do residents of Puerto Rico actually pay US federal taxes? When most people think of US tax obligations, they naturally assume they apply uniformly across all US citizens. But when it comes to Puerto Rico, things are […]

Read more

Zug Canton Taxes: The Ultimate Destination for Wealth Management in Switzerland

Switzerland’s global reputation is built not just on stunning views of Alpine peaks and serene lakes but also on a foundation of exceptional quality of life, world-class infrastructure and investor-friendly tax policies. The results speak for themselves: efficient public transport seamlessly links cities and villages; the standard of living regularly ranks among the highest in […]

Read more

How Smart Investors Use Venture Capital to Build Wealth

Big companies like Google, Amazon, Facebook and Apple all started out as bold ideas backed by venture capital. Decades later, the same firms are household names, as familiar to most people as electricity, the internet, or the telephone. But hindsight is a fickle friend. The truth is, it wasn’t always so obvious they’d succeed. These […]

Read more