Investing in Myanmar: The Ultimate Guide

November 22, 2023

I have been interested in Myanmar as an investment frontier for some time, but it was not until recently that I reached out to experts working and investing in the country to learn more about Myanmar, its economy and the opportunities available for investment and business there.

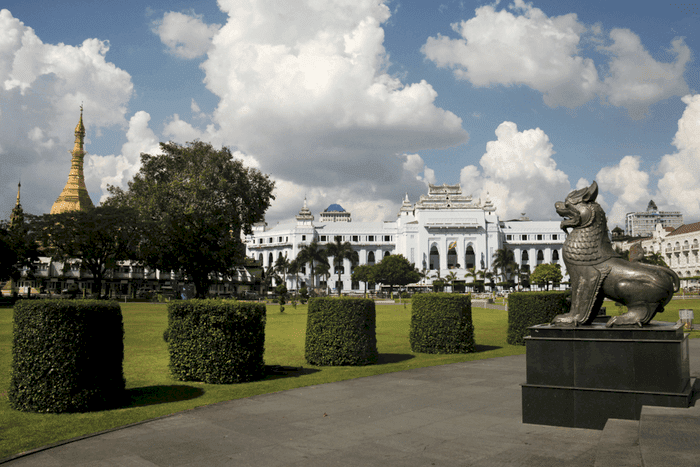

Myanmar, also known as Burma, has experienced its share of political instability in past decades. With peace restored less than a decade ago, Myanmar now proves to be one of the largest unexplored “gold mines” in Asia today.

The guest post below discusses everything from investment laws to tax incentives and from investment vehicles to investment sectors.

There is a lot to discuss about Myanmar. As the “the last untapped economy,” it is a great high risk/high reward investment opportunity. So, let’s jump into the experts’ opinions.

Myanmar: The Last Untapped Economy

Myanmar is a unique corner of Southeast Asia bordering China, Thailand, Laos, India and Bangladesh. It became independent from Great Britain in 1948, but just twelve years later fell under a military dictatorship that lasted from 1964 to 2011.

In the 1990 elections, the National League for Democracy – headed by Nobel Peace Prize winner Aung San Suu Kyi – won 81% of the seats in the Burmese parliament, but the Military Junta refused to hand over power and Aung San Suu Kyi remained under house arrest for almost 15 of the next 21 years.

The dictatorship finally came to an end when Buddhist monks carried out massive protests that came to be known as the “Saffron Revolution.” The Military Junta officially disbanded on March 30, 2011, with the inauguration of the new government.

Aung San Suu Kyi has served as State Counsellor (similar to a Prime Minister) since 2012.

Due to the decades of isolation and sixty years of military rule, Myanmar is one of the poorest nations in Southeast Asia and the world. As the country has opened both politically and economically, Myanmar has become the scene of a geo-strategic struggle between China and the West.

Myanmar’s valuable natural resources include everything from its fertile lands to its mineral resources. China views the country as an outlet for its surplus production and growing population.

The US, on the other hand, is the centerpiece of the Look East policy that is focused on strengthening the ties between the West and Southeast Asian countries to counteract Beijing’s influence in the area.

And, as far as western investors are concerned, Myanmar represents one of the last untapped economies. Large companies like Coca-Cola and General Electric have already opened offices in the country.

Myanmar Investment Laws

One of the main purposes of any fiscal policy is to provide investors with a transparent and rule-based approach to legal and regulatory frameworks; a clear and well understood legal system where no one can be surprised.

This is not yet the case in Myanmar.

Despite the fact that both old colonial laws and those recently created have focused on foreign investment and providing basic rules to govern which industries are open to foreign investment and how companies should operate once they have entered the market, the current investment policies are unclear and outdated.

For example, the last law on income taxes dates back to 1974.

However, there has been some solid progress, the most notable being the promulgation of the new Foreign Investment Law on 2 November 2012 (“FIL”) and the more recent Notification No. 49 of August 2014 which liberalized more investment sectors (“FI Notification”).

As Myanmar works to open its economy to foreign investment, success will depend on the government’s ability to draft and issue new laws that will make this process of change easier.

Entry barriers for foreign investors in many of the still-restricted sectors are expected to ease in the coming years, particularly as ASEAN countries approach the agreed date of a single economic community.

The government has already opened the banking sector to foreign banks, albeit on a limited basis to provide capital and services to foreign companies. The insurance sector is expected to open up, as well.

The Securities Market Law was adopted in July 2013, which created the framework for the establishment of a stock exchange, a fundamental market for international companies considering investing in Myanmar.

This was followed by the Regulation of the SEC in early 2015, under which an international tender was held for the first brokers and securities companies to be licensed under the new law.

The telecommunications sector is another success story, with the granting of two national licenses for mobile networks and services to Ooredoo and Telenor, following the enactment of the Telecommunications Act modernized in 2013.

It is to be hoped that this model of partnership between Myanmar enterprises with foreign capital and know-how will be replicated in all sectors of Myanmar industries and services to bring the country to its once prominent position in Southeast Asia in terms of trade and wealth.

However, no foreign investment company can do business in Myanmar if it has not obtained both a “Permit to Operate” and a “Certificate of Incorporation.

The “Permit to Operate” is a business license that must be obtained before a foreign company can provide services or engage in activities such as manufacturing or construction.

The “Certificate of Incorporation” is the foundation of a company’s legal existence and good reputation in the country. Foreign investors who obtain such documentation will be eligible for the benefits granted to a company formed under the Foreign Investment Law (FIL Companies).

It should be noted that the subsidiary companies must obtain a commercial permit and a certificate of incorporation, in addition to the certificate of registration in the case of being a branch of a foreign company.

Tax Incentives and Benefits

Myanmar tax policy provides foreign companies with an income tax exemption following the start of commercial operations in the country – seven years for businesses in the Free Zone and five years for businesses in the Promotion Zone.

It also reduces the income tax rate by 50% during the second five year-period for businesses in both the Free Zone and Promotion Zone. Then, for the following three years, any profit that is reinvested within a year in the company as a reserve fund will be protected as well.

There are also attractive exemptions from customs duties and other taxes for the first five years for the importation of equipment, instruments, raw materials, machinery, and other types of imported goods that are required for the company.

Investment Vehicles

There are several types of investment vehicles that would allow a foreign investor to enter Myanmar’s market. In some cases, a foreigner may be able to establish a 100% foreign-owned company. In others, they will be required to set up a branch or enter into an agreement with a citizen, company or state entity of Myanmar.

These types of entities are permitted under the Foreign Investment Law and the Commercial Companies Law, although the Foreign Investment Law imposes limitations on the use of certain investment vehicles in various sectors.

In practice, the foreign investor applying for a permit must form a subsidiary. Distinctions in terms of potential liability between a subsidiary and a branch are not clearly specified in Myanmar legislation. The only advantage of choosing to open a branch over a subsidiary is that a subsidiary can carry out onshore activities.

There are two types of limited liability companies in Myanmar, namely the private and public limited company. Currently, foreign public companies are not available in Myanmar.

A joint venture is allowed for any project, but there are certain business sectors that require a partnership with a Myanmar citizen or company.

In general, stock indices will be decided by “mutual agreement” of the parties; however, there are rules to establish participation ratios between foreign and local investors in specific sectors.

In some cases, a public-private joint venture or other similar system is required, such as the construction contracts of Operate Transfer in partnership with the government.

Foreign investors may also appoint a trade representative or enter into an agency agreement with a local citizen or a company that is 100% owned by Myanmar for activities such as import, export, trade and retail distribution.

In factories, foreign investors restrict their capital to a maximum of 80% compared to 20% local capital. This relationship does not apply to banned or restricted commercial sectors.

The role of the state agency that administers the Foreign Investment Law is to coordinate with various ministries and organizations to facilitate foreign investment in Myanmar by assessing the proposals of foreign companies with criteria of quality and integrity.

Investment Areas

Myanmar intends to revive and promote manufacturing via the Foreign Investment Law. On the one hand, the law contains measures of excessive protectionism that may discourage investment of foreign capital. On the other hand, certain industries are open to foreigners based on joint strategic partnerships with a local party.

Any 100% foreign-owned company investment must obtain prior approval from the relevant ministry overseeing the sector in which the manufacturing will take place.

It is unlikely that a foreign investment permit will be granted if the proposal does not coincide with at least one of the following areas:

- The exploitation of mineral resources and other natural resources sufficient to satisfy domestic demand and export surplus.

- Support to capital-intensive

- Creation of jobs for people in line with the progress and expansion of

- Develop human resources, basic infrastructures such as banking and financial activities, modern highways, interstate highways and national production of electric and other sources of energy.

- Develop high-tech industries, including modern information technology.

- Develop communication networks, educational systems and transport so that citizens can compete at an international level.

Generally, an investor will need an investment permit for the sectors and businesses specified in the Foreign Investment Law, the Foreign Investment Rules and in the Notifications.

Joint Venture with a Local Partner Investment Areas

enter into an agreement with a citizen, company or state entity of Myanmar.

The following are sectors for which the participation coefficients in a joint venture with a local partner are determined by mutual agreement between the parties:

Biodiversity is protected so that the production and distribution of hybrid seeds as well as production and propagation of high yield seeds and local seeds will be under state control.

Manufacturing and Domestic Marketing extends to the preservation, manufacture, canning and domestic marketing of food products, except milk and its derivatives. Specific sectors include:

- Cereal-based products such as biscuits, wafers, and noodles

- Confectionery such as sweets, cocoa, and chocolate.

- Malt liquors, malt and non-aerated products.

- The distillation, mixing, rectification, bottling and marketing all kinds of liquors, alcohol, alcoholic beverages and non-alcoholic beverages.

- Water, as far as the manufacture and marketing of purified ice. The manufacture of purified products and purified drinking water.

- Plastic products, rubber and rubber products and packaging.

- Processing of hides, skins and hides of all kinds, except synthetic leather, and their manufacture and marketing in the domestic market, including standing and handbags.

- The manufacture and marketing of all kinds of paper, raw materials for paper, all kinds of products made by paper, paperboard including carbon paper, waxed paper, toilet paper.

- Chemicals based on natural resources available in the country (excluding oil and gas products), as well as the manufacture and marketing of solid, liquid, gaseous and aerosol fuels (acetylene, gasoline, propane, hair, perfumes, deodorants, insect sprays).

- Cosmetics, including oxidants (Oxygen, Hydrogen Peroxide) and tablets (Acetone, Argon, Hydrogen, Nitrogen, Acetylene).

- Corrosive chemicals (sulfuric acid, nitric acid), industrial chemical gases including compresses, liquids and solids and pharmaceutical raw materials.

Electricity at small and medium scale.

Real Estate: This applies to companies that develop, sell and lease residential apartments and condominiums, office buildings and shops, as well as golf courses and international resorts. It also applies to the development, sale and leasing of residential apartments in areas related to industrial areas and the development of affordable housing for the less privileged classes.

Air Transportation, including domestic air transport services and international air transport services.

Prohibited and Restricted Investment Areas

Under the Foreign Investment Rules, there are specific activities that are reserved exclusively for Myanmar citizens and entities, including those for production and services, agricultural cultivation, livestock and fisheries. Other restricted and/or prohibited industries include:

- The manufacture of weapons and ammunition for national defense.

- Management and conservation of natural forests.

- Prospecting, exploration and production of jade and other precious stones.

- The exploitation of minerals on medium and small scale, including gold in veneration and water.

- The administration of the Electrical System, as well as the inspection of electrical works.

- Air navigation services, for piloting.

- Printing and broadcasting services jointly without the approval of the Union Government, in addition to imparting national ethnic languages including myanmasa or Burmese.

Mining Sector

One of the main reasons for optimism when it comes to mining in Myanmar is the country’s abundance of natural resources. Mining is the third largest industry contributing to the country’s GDP behind oil, gas and energy.

Myanmar also has a large amount of undeclared jewelry, precious stones and charcoal, so it has great opportunities for foreign investors with technical resources and know-how.

Under the Foreign Investment Law and the applicable Foreign Investment Rules and the Notification MIC 49/2014 issued pursuant thereto, several prescriptions are made.

Generally, the exploration and production of jade and other precious stones, the production of small and medium-scale minerals, and the exploitation of minerals such as gold in the riverside ring and the waterway are prohibited, while medium and large scale endeavors are authorized with the approval of the Ministry of Mines.

Where foreign investors are allowed to operate, they must be subject to rigorous timelines for each phase.

Mining policy has been quite rigorous and excessively bureaucratic. To obtain a mining concession from the government requires the execution of a Shared Production Contract (PSC) with the Ministry of Mines.

There is a total ban on the export of raw coal, ore and gold to ensure that it is processed in Myanmar.

And, lastly, there is a requirement that a new contract be required to move between operational phases (for example, from exploration to site development to production), in addition to a rigorous assessment of the environmental impact according to the current legislation.

It is expected that legal reform in this area aims to expand foreign investment in the sector and, at the same time, to incorporate international standards.

Retail sector

Retail trade is restricted to locals under Notification MIC 1/2013. The notification states that under no circumstances would small retail trade be allowed at that time.

However, with government authorization, foreign investment in supermarkets, department stores and shopping centers would be permitted when they are not located near local businesses.

The Notice further indicates that the sale of local products would be favorable and if it is done through a joint venture with a local partner, which must have not less than 40% of the capital.

It was anticipated that all retail trade, except automobiles and motorcycles, would be open to foreign investment in 2015, with a minimum investment of USD 3 million.

In fact, the newer MIC Notification 49/2014, which replaced MIC Notification 1/2013, does not restrict retail. However, in practice, foreigners are still not allowed to participate in trade, and for all intents and purposes, retail sale is still closed to foreign investment.

Telecommunications

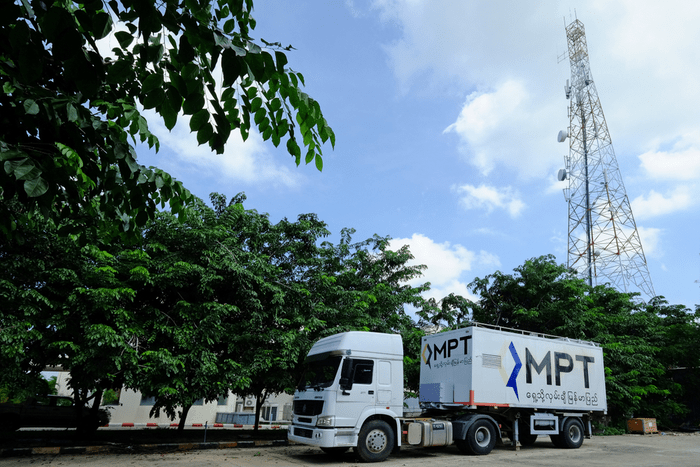

The most important development in the Myanmar business world in 2013 was the holding of an international tender for two national telecom licenses to be issued to foreign telecommunication companies.

The winning bids were for Norwegian Telenor and Qatar’s Ooredoo, leaving many other bidders disappointed but determined to share the immense potential of Myanmar in this area.

Both operators are competing in a healthy way to build their networks in a market with clear rules, based on the rigorous goals set by the government.

A surprise result of the open market is the resurgence of the state-owned MPT (Myanmar Posts and Telecommunications), which held a telecommunications monopoly until October 2014, when the new Operators launched their services.

MPT responded to the competition by partnering with Japanese firms KDDI and Sumitomo and has doubled its subscriber base to more than 11 million reported customers, while Ooredoo has close to 5 million and Telenor 10 million.

Such vigorous competition is expected to benefit consumers.

Two results that consumers experienced since the start of the new operators’ businesses were the expansion of the mobile network and the considerable drop in the price of a SIM card.

The Telecommunications Act of 2013 added clarity to a previously opaque sector. The draft regulations have also been published for consultation with interested parties.

This law will meet future expectations in terms of licenses and other areas, but remains below international best practices in key aspects, such as regulation of the sector, which remains in the hands of the Ministry of Communications and Information Technologies, which owns MPT.

Questions remain about future development under this structure.

Myanmar has no anti-competition legislation and relies on the 1872 Contracts Act and the country’s constitution. However, both the new law and the draft regulation address this issue in a way that potential investors in the sector consider a positive.

Electric Sector

Myanmar has an abundance of natural gas, coal, carbon-neutral biomass and great potential for hydropower.

However, despite its large amount of energy-generating resources, less than 30% of Myanmar’s population has access to electricity. The country has approximately 3,500 MW of available electricity, of which 76 percent comes from hydropower and the rest is produced by coal and gas plants.

Myanmar’s electricity sector attracted more investment than any other sector. According to DICA, starting in 2015, nearly US $20 billion of foreign investment in the electricity sector was approved by MIC.

At the same time, there are several challenges related to the electric power sector that also offer opportunities for foreign investors:

- Insufficient firm generating capacity.

- Significant inefficiency of gas and coal plants.

- Transmission installations with poor voltage regulation and significant line losses.

- The absence of reflective cost rates.

The new Myanmar Electricity Law was enacted on October 27, 2014. It replaced the old Electricity Act of 1984 and established the new Electricity Regulatory Commission (ERC), which determines the electricity rates.

The Asian Development Bank provided technical assistance to the new law to reflect current international standards.

In practice, foreigners can invest in electric power projects of up to 30MW only as joint ventures with locals and in hydroelectric and coal projects as joint ventures with the government in construction, operation and transfer projects.

The national government has the power to grant electricity business permits to local and foreign investors for power projects with a generation capacity of more than 30MW and all other energy projects connected to the national grid.

Regional governments can approve and manage energy projects of up to 30MW connected to their regional and state networks.

The national government fixes the tariffs for the national electricity grid. Regional governments determine tariffs for energy in their respective regions and states.

Oil & Gas industry

It is speculated that Myanmar’s oil and natural gas fields are mature and have potential reserves of natural resources. Crude reserves are believed to be minimal but natural gas production could be substantial.

The little gas exploration that has been done so far has been a great success for foreign investors. In October 2013, Myanmar awarded 18 oil and gas blocks onshore and in March 2014 it awarded 20 offshore oil and gas blocks, 10 of which are deep-water blocks and another 10 are shallow water blocks.

Under the terms of the tender, a local partner will be required to assist foreign investors in all deep-water blocks, even though it is recognized that local firms are unlikely to have the necessary expertise.

Of the 16 blocks on land, 13 will be carried out under the terms of a PSC with the Ministry of Gas and Electric Power, whether the foreign investor has a local partner or not.

The remaining three blocks are improved oil recovery blocks. The model is considered relatively standard and, in some cases, even more beneficial than the terms used in other oil-rich countries. The most outstanding provisions are:

- Creation of recovery of up to 50 percent of the available oil per year with the ability to transfer any unrecovered oil costs to the following years.

- A signature bonus payable to the State.

- Production bonds payable to the State for reaching certain levels of production.

- 5 percent of royalties payable to the State.

While exploration for oil and gas begins in the vast onshore and offshore blocks, there will be a definite opportunity for all investors.

In the short term, investors in the oil and gas industry are likely to be in high demand given the immense exploration task that will confront the winners of the two bidding tenders.

Once a discovery is made, there will probably be an opportunity in the middle of the market as well as the potential for farms of other operators.

Finally, downstream specialists will be needed to refine, purify and process the discoveries.

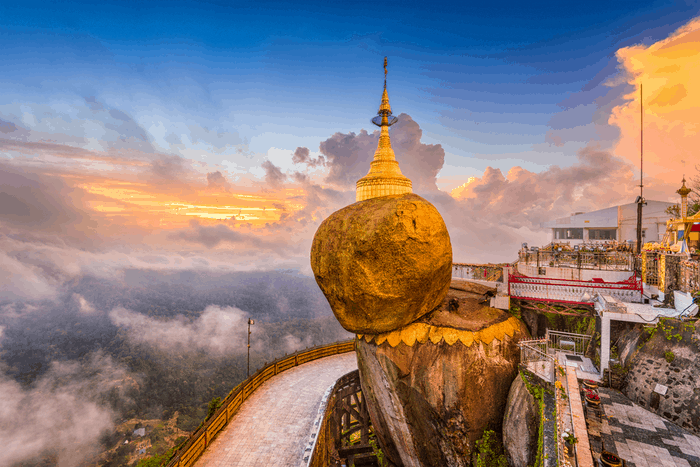

The Golden Rock that hangs from a “Buddha Hair”

Physicists and geologists surely have their own theory to explain the unstable balance of Myanmar’s Golden Rock. The huge golden boulder is located 1,100 meters above sea level and sits atop Mount Kyaikto where the hand of man has not influenced its fragile balance.

The size, and especially the placement of the golden rock is a whim of nature produced by volcanic phenomenon that defies gravity from the very edge of a precipice.

For the majority of the Burmese people who have made the place one of their main pilgrimage destinations, the most convincing explanation of such a phenomenon is that this Golden Rock hangs from a Buddha’s hair.

The same could be said of Myanmar’s fragile economy.

The mix of customary law with new laws of abbreviated approach, proper to civil law, has been further complicated by the liberal application of the “policies and practices” of recent decades, which are not detailed in legal norms and regulations and are often not published.

The result is a legal landscape that requires patience and, most importantly, an in-depth understanding of colonial laws, the practices of former military governments, and recent laws aimed at foreign investment.

With careful legal and fiscal structuring and an appetite for danger, foreign investment may exist in Myanmar on the basis of the principle of “high risk / high reward” for the first engines.

Certainly, it is not too late to take advantage and move quickly in various sectors of this market. GDP per capita in 2018 was estimated at USD 1,571 and the annual GDP growth rate has been as high as 13.84% in past years, although it is currently hovering around 7%.

Myanmar is in a highly strategic location, sharing borders with China and India, as well as Thailand, Laos and Bangladesh. Positive conditions suggest that, as long as the political environment remains stable, economic growth will persist.

Because of its strategic geographical location, natural resources, fertile land and role as an outlet for China’s surplus production, Myanmar is a great choice for Western investors who like the high risk/high performance ratio and are ready to capitalize on the Look East strategy to increase western ties with Southeast Asian countries and counter Beijing’s influence in the area.

Is Land Investment Safer?

When American humorist and writer Mark Twain said, ’Buy land, they’re not making it anymore,’ he was definitely on to something. Land is finite, and that scarcity gives it lasting appeal. Yet, despite its obvious logic, land remains one of the most misunderstood investments. Many people are put off by its perceived complexity, potential legal […]

Read more

Top Emerging Market Economies for US Investors in 2025

If you’re still parking all your capital in overvalued US real estate or clinging to tech stocks in the S&P 500, you’re playing an old game while rivals are redesigning the board. The world has move on. Smart investors know that the biggest returns aren’t coming from Wall Street anymore – they’re coming from below-the-radar […]

Read more

Monaco Real Estate Guide: Market Trends and Opportunities

When it comes to luxury real estate, nowhere does things quite like Monaco. This tiny but ultra-exclusive principality isn’t just a place to live – it’s a global symbol of wealth, prestige and financial freedom. In 2025, Monaco remains the world’s most expensive real estate market, with average property prices soaring beyond €51,000 per square metre […]

Read more